Four stocks with strong IP and Technology, that are well positioned in the age of disruption

Companies: PRSM, KWS, SOG, THRU

We've seen and felt significant disruption in almost all walks of life in the past two decades. The Internet has facilitated considerable social and economic change and development. In Western countries, change is happening in the form of widespread disruption of traditional business models and the adoption of new technologies and processes.

Phenomena like the Internet of Things (IoT), 5th generation networks (5G), automation, robotics, augmented reality and virtual reality (AR & VR), artificial intelligence (AI), and machine learning are on the horizon, and some are already here. These developments will dramatically disrupt companies, sectors, and whole industries.

In this age of change, it's vital that private investors are aware of the trends that are heading our way because institutional investors and VCs certainly are. By being conscious of these trends, investors can position themselves and their portfolios to avoid stocks swimming against the tide of change, and to benefit from those companies that are well placed to capitalise on future innovation.

When it goes wrong (or right)

One of the best examples of an industry in flux and the impact on investors is the UK property market. It was a market traditionally dominated by a few big players like Countrywide, Connells Group, Savills etc., but it has seen huge disruption in the last 4-5 years, firstly by online marketplace platforms Rightmove and Zoopla, and more recently by the online/up-front-fee model pushed by emoov, Purplebricks, and easyProperty.

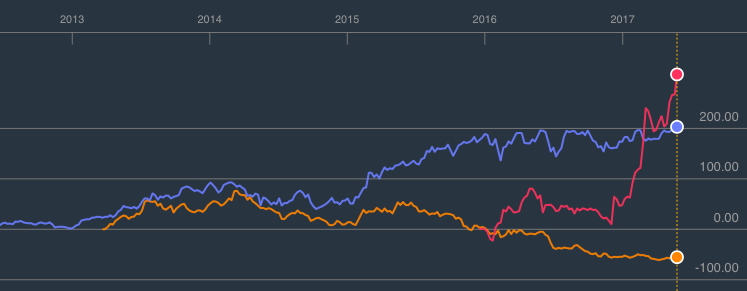

The chart below from Bloomberg shows the decline of Countrywide (UK's largest estate agency in orange) since 2013, which has lost 55% of its value. Contrast that to the rise of Rightmove (blue) which has increased 200%, and of Purplebricks (red) which has had an astonishing c.300% increase in the past 15 months.

It is also worth noting that Countrywide was one of the companies behind Rightmove, so had a stake in it - this hasn't been enough to prevent a long two-year decline

Future Proofing your Portfolio (Small & Mid Caps)

One of the reasons for this blog has been the rapid rise in Blue Prism shares since its IPO last year, and the recent bull-run that's received a lot of attention from AIM investors. The company, which automates backend processes and counts a growing number of Blue-chips amongst its clients, enjoyed a meteoric 365% rise from its IPO in March up to December 2016. Since the turn of the year it has looked pretty flat but recently began to rally again, jumping another 84% since April on the back of positive trading information.

Much of the hype that surrounds Blue Prism, which is explored in more detail further down, is its tech. PRSM is an RPA specialist, which is short for Robotic Process Automation. The company is a future proof stock in terms of its technology and will benefit as increased automation hits the white-collar workspace.

In order to manage your portfolio for future changes it is important to appreciate not just how the top layer of companies in a sector can deal with technological change, but the second order effects, such as the impact on the supply chain. An example of this is the effect that increased adoption of electric vehicles will have on large sections of the automotive supply chain. Many of these companies will fail to adapt.

It's also important that investors avoid falling into the trap of stocks that might be profitable and well run now, but are not well positioned for future disruption and are unable/unwilling to reposition themselves to take advantage.

Below are four stocks, all from very different industries, that we think are Future Proof. Bear in mind, that this doesn't mean they are great companies financially, great investments at current valuations, nor that competition won't beat them, but that they are strategically positioned to benefit from the tailwinds of ongoing technological innovation.

1) Blue Prism

Founded: 2001

Headquarters: London

Key People: CTO David Moss and CEO Alastair Bathgate

Market Cap: £562.6m

1 Year Share Price: +545.4%

P/E: N/A

Broker Views:

Whitman Howard: BUY | TP: 946p

"We are positive on the impact of software bots on productivity, and therefore long term GDP. We are buyers of Blue Prism, one of the clear world leaders in this emerging high growth space."

What is Blue Prism?

Blue Prism is a UK software company that makes enterprise Robotic Process Automation software for large/blue-chip organisations. It helps them eliminate low-return, high-risk, manual data entry and processing work by using software to automate it.

The Tech (Robotic Process Automation)

RPA (Robotic Process Automation) is essentially an automated clerical process technology that helps organisations by providing a digital workforce of bots (also known as AI workers) that follow rules and processes and interact with systems in the same way that humans do.

It is a low-risk, non-invasive technology, that can extend the life of legacy systems. It also improves productivity and frees up human resources to do more value-add tasks (which helps staff retention).

Blue Prism enables this, but in a way that is supposedly far more efficient. It’s also "secure, consistent, reliable and scalable." PRSM's software complements traditional IT solutions such as BPM (Business Process Management) and front office productivity tools.

With an estimated 200 million jobs at risk of automation, including many white collar jobs, Blue Prism's technology is on the right side of progress and in my opinion is most certainly a future proof stock.

Addressable Market

According to Ernst and Young, the RPA services market will grow to nearly $19bn by 2020. EY also says that adoption of RPA is increasing, with 14% of its customers already using it, 28% in the proof-of-concept stage, 19% actively considering it, and 31% considering it soon.

Other Players

Blue Prism certainly has a fair bit of competition in the marketplace, with Robotic Process Automation offerings from Automation Anywhere, BlackLine, Datamatics, EdgeVerve, HelpSystems, Kofax, NICE, Pegasystems, and Verint.

However, it also has already established an impressive list of clients, including the NHS, Telefonica (O2), The Cooperative, London School of Economics, Ernst and Young, Enovation,

Blue Prism secures new customers primarily through its partner network that includes Accenture, Capgemini, Cognizant, Deloitte, EY, HPE, IBM, KPMG, PwC, and Tech Mahindra.

Valuation

PRSM's share price has flown up in the past year, and as it's still years away from making a profit, it has a negative P/E. Current market cap is £550+ putting it on a substantial 27x 2017E revenue, and with revenue growth of just 25% expected between 2017 and 2018, this stock is not for the value investor.

Whitman Howard recently wrote that it believed the stock was in the early stages of a multi-year growth cycle, and that it expected further upgrades to numbers in future:

"Blue Prism shares have done very well and with a forward sales multiple of 20X, are certainly discounting substantial growth. However we believe we are in the early stage of a multi-year growth cycle and expect further upgrades to numbers. This is supported by the company reinvesting heavily in the business. To that end we expect increased headcount in key areas such as R&D and sales and have adjusted up our salesman driven numbers. We now have a 946p PT and retain a BUY rating."

2) Keywords Studios (KWS)

Founded: 1998

Headquarters: Dublin

Key People: CEO Andrew Day

Market Cap: £460m

1 Year Share Price: +148.4%

P/E: 37x (2017E)

Broker Views:

"Keywords has acquired Strongbox Ltd... This is another acquisition that we view positively, seeing that Strongbox has both a quality client and resources base in what is a high growth market and furthermore has been bought for a valuation (1.1x sales) in line with previous acquisitions. We increase FY17E and FY18E EPS by 2.3% and 4.6%, respectively."

What is Keywords Studios

For those of you that are active investors in the FTSE AIM market or saw Rob's recent piece, KWS will be a familiar name. The company is a provider of technology and creative services to the gaming industry, and it has 14 offices worldwide and 1,500 employees.

Its business model is based upon acquiring niche providers of services in a fragmented global gaming industry in order to secure new relationships and cross-sell services under one company.

Future Proof?

KWS is a provider of services to the major global game developers, an industry that is at the forefront of technological development (VR for example). It is likely that KWS's services are future proof, with its market expected to enjoy ongoing structural growth, and assuming it can continue to acquire leading businesses.

Keyword Studios provides a range of services under one group banner and continues to expand its offering providing further diversification and protection from industry change.

Currently, these services include: translation, testing, audio, customer care and art production, and the company tries to build relationships with gaming producers throughout the lifecycle of a game from concept to live operations support.

Addressable Market

Massive. There are an estimated 2.2bn gamers around the world who will generate nearly $110bn in revenues this year alone. The market is expected to continue to grow as games increase in complexity, with richer environments, greater connectivity and collaboration of users, and new technologies such as VR and AR become the norm.

This all helps protect KWS and gives it future proof status, as it supplies services to a highly technical and developing market.

Little competition in a fragmented market

Keywords has a 15% market share in a highly fragmented market, meaning it is in a dominant position. It has 21 of the top 25 revenue-grossing gaming companies as clients and in mobile provides services to 7 of the top 10 companies.

Valuation

The shares trade at a premium after a 300%+ rise over the last year and a half. As with lots growth companies at the moment, it’s hard to know whether today’s price has got ahead of itself or if in future it will look like a bargain.

It's even more difficult when the company is on the hunt for acquisitions a lot of the time (it made 3 in May!) which are often earnings enhancing. But on its current P/E of 37x earnings, investors are indeed baking in a lot of growth, so KWS will need to make sure it delivers if its rise is to continue.

KWS is clearly a high-quality company. It has a strong Balance Sheet, a clear strategic direction, a fragmented market to grow into, and a structurally growing customer base that is supportive of its business model.

3) Digital Barriers (DGB)

Founded: 2009

Headquarters: UK

Key people: CEO Zak Doffman CEO

Market Cap: £45.6m

1 Year Share Price: -49.1%

P/E: N/A

What is Digital Barriers

Digital Barriers produces covert and remote video recording and streaming products for the surveillance, security and safety markets. It also provides analysis of secure videos and related intelligence. Its video streaming tech has zero-latency over wireless and cell networks, requires less network bandwidth than standard technology, and can operate in some pretty tough environments.

The Tech

Without getting too geeky, DGB's tech is pretty impressive. ThruVis uses electromagnetic waves to detect different weapons based on their unique "spectral fingerprints" meaning different materials (or types of weapon) can be detected in big crowds of people. 1,000 people per hour with a 100% detection rate to be exact.

Future Proof?

The threats to national and domestic security from terrorism and cyber warfare have increased markedly in the past 15 years, often crossing borders and jurisdictions, exploiting vulnerabilities in electronic and physical security systems, and impacting both public and private sectors. This is why Cyber-Security companies are also a good bet.

Technology like this provides Digital Barriers with something of an economic moat helping to put it in the future proof category. However, it is worth saying that the company needs to prove it can successfully roll-out these products consistently.

Addressable Market

Western politicians have been stepping up calls to bolster border security amid increasing threats. This, coupled with Trump's demand for NATO members to up their spend on security and the increasing need to protect public means it is a growing industry.

Digital Barriers has products that could be of significant value to security agencies, both private and public. Its clients include many US and International government agencies, as well as airports and shopping centres.

Valuation

Digital Barriers has attractive intellectual property after several acquisitions, but the company has a troubling balance sheet, a track record of profit warnings, and has trouble keeping down costs. Cash flow is worrying, and while the revenue stays at current levels and contract wins get pushed to the right the business will continue to need fresh capital injections.

The fantastic IP that can let security services scan around 1000 people per minute coupled with increasing security spend in the US and Europe means this company is most definitely future proof. That doesn't mean it can necessarily stay afloat though.

4) StatPro (SOG)

Founded: 1994

Headquarters: Boston

Key People: CEO Justin Wheatley

Market Cap: £82.2m

1 Year Share Price: +40%

P/E: 25.7x 2017E

Broker Views:

N+1 Singer: BUY | TP: 193p

What does StatPro do?

StatPro Group is a software provider specialising in asset management portfolio analysis and asset pricing. It’s primary product, StatPro Revolution, is a portfolio analytics platform that helps fund managers assess performance, attribution, contribution, and risk, etc.

The Tech

StatPro Revolution is the company’s primary product. It is a cloud-based portfolio analytics tool on a SaaS model, meaning it’s scalable and importantly more profitable.

Its technology isn’t especially glamourous, but it is future proof. Users can access their portfolio performance measurement, attribution, contribution, allocation, risk, and compliance analytics in one online platform.

Its transitioned to the cloud quite recently, and the move has accelerated revenue growth and has led to brokers raising their target prices, and margins have enhanced.

Addressable Market

It’s hard to estimate the size of the addressable market for StatPro, but in terms of the UK asset management industry, it employees 90,000 people in the UK and there is nearly £7trn under management.

Other Players

It has some big competitors in the space, with SimCorp, Misys, eFront, and Calastone among those offering a similar service. What sets SOG apart is its lower price point and the cloud-based nature of its offering.

More than 250 major asset managers worldwide use StatPro, and the list is growing. There are some impressive names on that list, including AXA, Artemis, BNP Paribas, Barclays, Blackrock, Deutsche Bank, F&C Investments, Fidelity, GAM, JP Morgan, Lombard, M&G, Nordea,

Valuation

StatPro is currently trading on a P/E ratio 25x 2017E earnings, which is a fair bit higher than the sector average of 19x, but this falls to 17x earnings in 2018 as the company is expected to make its return to profit after falling into a loss last year.

So far this year it has enjoyed a 40% increase after it beat expectations in its final results for the year to 31 December, and reported sizeable revenue, EBITDA, and underlying EPS growth. This was primarily due to currency tailwinds, but its shift to the cloud-based model has facilitated significant revenue growth.

-----

Sectors

Finally, here are some sectors that we feel either offer investors some protection from disruption or are well positioned to benefit from technological innovation.

Tech - Future Proof

Obviously, disruption in the most disruptive of industries is always likely. But this is the place to be if you're looking for stocks for the future.

There are a variety of sub-sectors within tech that you should consider, including cyber-security companies, software-as-a-service firms, and those who are pioneering new technologies like artificial intelligence and machine learning. Tech companies are future proof if they are scalable, innovative, unique, and well-financed.

Utilities - Future Proof

Provided Mr Corbyn doesn't win the election and nationalise the energy industry, it is likely these slow moving giants will remain protected from future disruption. They are often on very long-term contracts that guarantee profits.

In future, it appears the energy industry will face increased pressure to raise supply with the coming of car automation and an increasingly interconnected world, but it is likely that new technological innovations like advancements in solar will help.

Online (not Tech) - Mixed Bag

Be careful when looking at "Tech" companies. Some companies are just online companies. These can become redundant if the sector they service becomes obsolete and they don't adapt.

For example, many people think we won't own cars by 2030 as automated fleets will make the ownership of vehicles extravagant. In a market where nobody owns a car, why would you need second-hand car sales websites like Autotrader?

High-street retailers

With economics fundamentally against them, physical retailers will always struggle to compete against the online competition. Also, the UK's ecommerce market is the most active in the World, with more goods purchased per person than any other country, and this figure is rising.

Physical retail stocks, while mostly not at risk of complete redundance, will increasingly lose against the likes of Boohoo, Amazon, Asos, Gear4Music, etc.

Car Industry Supply Chain / Services - Wrong side of progress

I'd be wary of any company that relies on the combustion-based engine car industry for its business. With electrical and automated vehicles the future, businesses that produce parts specifically for this industry could struggle to adapt to the new supply chain in the coming decades. One UK example here would be Castings.

Oil & Gas - Long-term decline

With 50% of global oil demand coming from cars and trucks, the threat to the Oil industry of electrification of vehicles is huge.

-----

As always, please do your own research and do not buy anything based solely on any information in this blog. Nothing here is meant to be advice, and I do not make any recommendations.

.png)