The demand for lithium is set to grow 10x over the next decade, opening the door to opportunities for investors.

Companies: BCN, EMH, KOD, SAV, 0R0X

Demand for lithium is growing

Lithium mining and lithium stocks have had a significant buzz surrounding them recently, and for good reason. It seems the long-forecasted spike in demand for lithium has well and truly dawned as our thirst for portable technology and greener, lithium-ion powered vehicles continues to grow.

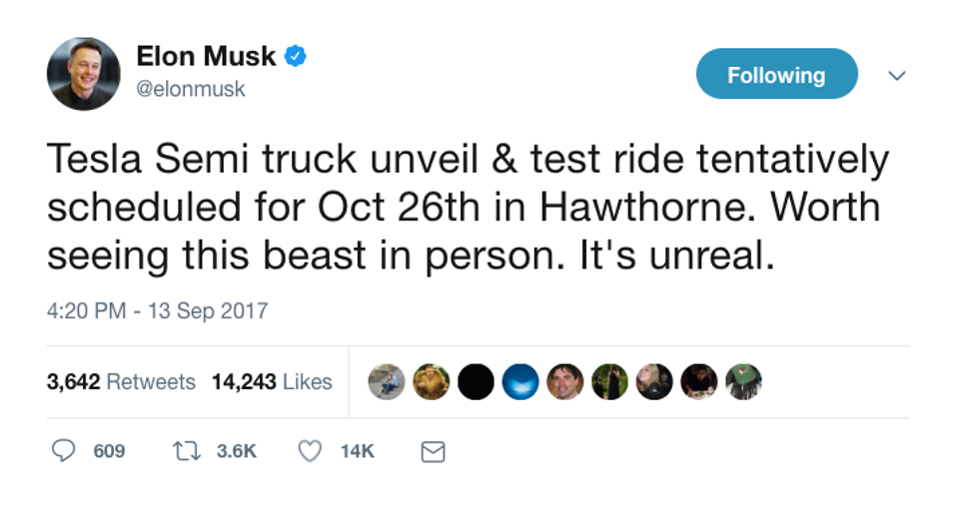

The demand for lithium has grown significantly over the past few years as lithium-ion batteries become the norm in a wide range of products across all facets of life - there is every chance you are reading this on a phone or laptop powered by a Li-ion battery. They are used in a plethora of devices - everything from pacemakers, hearing aids, watches, laptops, smartphones, as well as in homes and cars.

This increase in demand for lithium to help power our lives is expected to grow exponentially over the coming years, as we become evermore wireless and as our vehicles become powered by Li-ion batteries.

Our thirst for petrol cars is dying

The driving force behind the sharp spike in demand for lithium is the increase in production of Hybrid and Electric cars, brought on by the world's first mass-produced Hybrid, the infamous Toyota Prius. Often labelled as "boring", companies like Tesla and more recently Porsche, are making electric cars "cool" and bringing them closer to the everyday norm.

Porsche's Mission E. Image: Electrek

The UK Government announced in July it would ban the sale of new petrol and diesel vehicles by 2040, citing poor air quality as the driving force behind the change. A bit of a farce, really, as its already evident that nobody will be buying petrol or diesel cars anywhere near 2040.

Chinese vice minister of industry and information technology, Xin Guobin, also announced just two weeks ago that the Chinese government is developing a long-term plan for the country to become petrol and diesel car-free. This will have a resounding effect on the car industry, for which China is the largest market.

The two countries are following in the footsteps of France, who want to be carbon-neutral by 2050 and has also set 2040 as its deadline to become an electric or alternative fuel vehicle-only society.

These announcements are just some of examples of how the notion of a world driven by lithium batteries has become politicised, rather than an environmentalist's utopian fantasy.

The impact of Tesla

There's no denying I am a huge fan of Elon Musk (how could you not be?) for a number of reasons. Not just for his entrepreneurial psyche and stamina, but also for putting all his time, effort and money (lots of it) into innovations that have not only made him swathes of cash but will also change the way we live forever. Of course, there were people pioneering the use of Li-ion batteries in vehicles before Elon, but he has certainly made the notion of a world free of petrol and diesel powered vehicles a near-future reality.

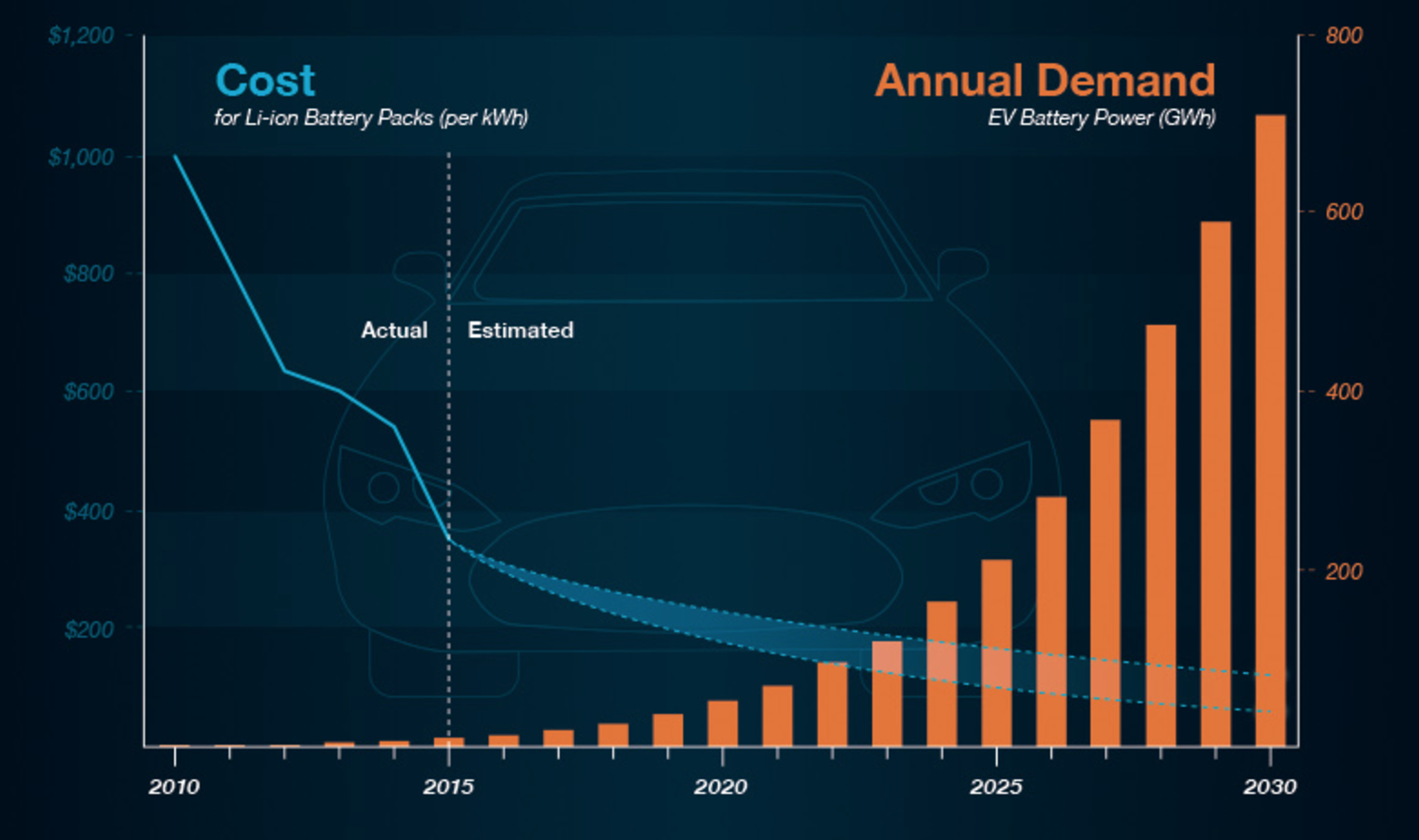

Not only is Telsa now mass producing cars, it also announced in April 2017 it would soon be unveiling its new lithium battery-powered Semi truck, the aptly named Tesla Semi. After a couple of delays, the Tesla Semi is now set to be unveiled at the Company's California headquarters on October 26. Not much is known about the Tesla Semi, other than Musk referring to it as a 'beast' on Twitter recently.

Image: Twitter

Image: Twitter

Tesla alone plans to produce 500,000 vehicles per year by 2018, which itself would require all of the world's current supply of lithium-ion batteries. China has also set ambitious targets for domestic Electric Vehicle (EV) development and deployment, aiming to have 5 million EVs on the road by 2020.

To build its batteries in the future, Tesla has built its Gigafactory in Nevada, which according to the website...

"The factory’s planned annual battery production capacity is 35 gigawatt-hours (GWh), with one GWh being the equivalent of generating (or consuming) 1 billion watts for one hour. This is nearly as much as the entire world’s current battery production combined."

Current forecasts predict the global market for Li-ion batteries in passenger vehicles will grow from $3.2 billion in 2013 to over $24 billion by 2023.

This is not to mention Tesla's home battery, the Powerwall, which harnesses the sun by storing its energy in Lithium battery packs, used to power the home at night. Even other household names are launching their own versions, including Ikea and Nissan.

Tesla Semi concept. Image: Teslarati

What exactly is lithium?

Lithium is simply a chemical element (Li) that is a soft, silvery metal. So soft in fact, it can easily be cut with a kitchen knife. Lithium is the lightest metal and the lightest solid element. Nature's lightest metal is also one of the most chemically reactive, making it a key ingredient in powering the latest technology.

Lithium for mining purposes is found throughout the world in rock deposits, and in parts of South America including Chile, Bolivia and Argentina in brine deposits. It is these brine deposits where the majority of saleable lithium currently comes from - a topic we will delve into a little further down.

What is lithium used for?

Lithium and its compounds have a plethora of uses and applications, including, but not limited to, heat-resistant glass and ceramics, lithium grease lubricants, and as a treatment for mental health issues including bipolar, used to stabilise mood swings caused by the disorder (remember the Nirvana song?).

However, its use in lightweight, rechargeable Li-ion batteries for the cars of today and the future is why the demand for the element has grown and will continue to grow in the future.

Li-ion batteries became the norm for a number of reasons, but mainly due to the fact they pack a lot of power into a very small space. Not only this, they also have fast recharge times and a large number of recharge cycles before they die. And, of course, this technology is only getting better. For a useful explanation of how a Li-ion battery works, check out this video (Lithium-ion batteries: How do they work?)

Image: Visual Capitalist

Increased demand = increased supply

UK Broker finnCap recently published a report for its latest quarterly mining sector note, called Tailings, which delves into the issue of supply and demand of lithium on the mining industry, and the opportunities the increased demand opens up for investors.

According to the note, the global transition from petrol to Li-ion, battery-powered vehicles is expected to...

"Drive demand for lithium from the present 37,000 tonnes per year to more than 400,000 tonnes per year by 2025."

And as it stands, there is no shortage of lithium in geological terms.

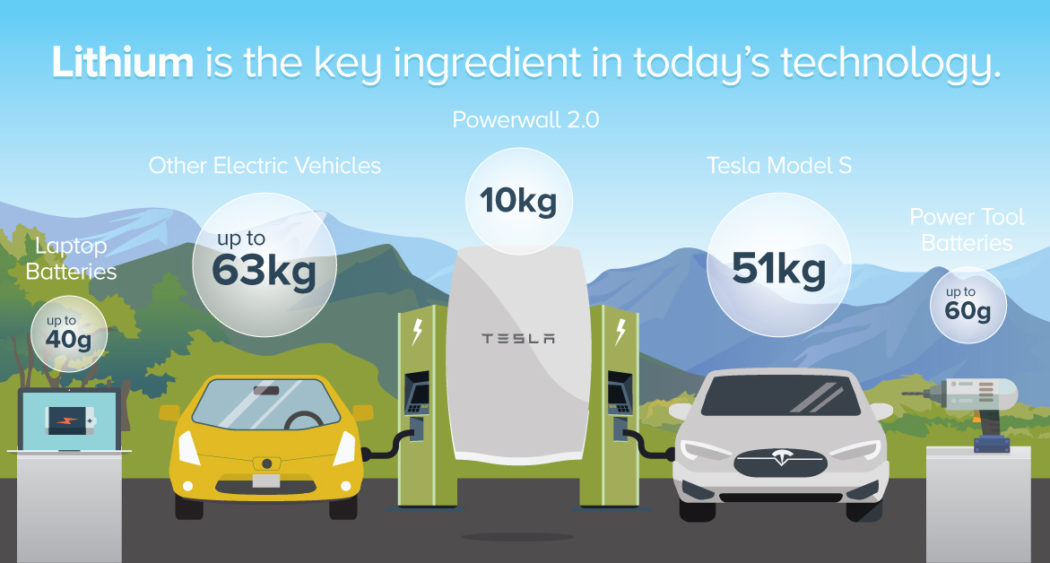

Approximately one-third of the total price of an electric vehicle is currently the battery itself. So, of course, as the price for these batteries decreases the demand for them will increase, as seen in the graph below:

Image: Bloomberg New Energy Finance

Here in the UK, several investors recently pledged £1m to mining company Cornish Lithium to help drill holes to find lithium sources in the region. High levels of lithium were identified in the water in Cornish mines in the 19th Century, but there was no market for it at the time.

Despite the abundance of lithium, there is, however, some ignorance surrounding which forms of lithium are currently viable for mining companies. The question is, can mining companies keep up with the incredible rise in demand?

With the predicted 400,000 tonnes forecast to be needed by 2025, and lithium currently coming from brine deposits, the answer is no. The concentration process mining from brine is slow, hence there is a significant lag before new plant becomes productive.

finnCap's Tailings mining sector note stated:

"Hard-rock sources of lithium are far more widely distributed geographically

though so far have seen only limited commercial exploitation. Until now, this has simply been because the brine operations are more profitable. However, the significant increase in demand, in particular for lithium carbonate for battery manufacture, means that much of the near-term increase in supply will have to come from hard-rock sources."

How is lithium currently mined?

Today's lithium mining paradigm is complex yet very simple.

Current lithium mining practices focus around mining the mineral from brine deposits mainly located in South America and to some degree, China and Tibet. But, as demand continues to grow, the much more geographically-spread rock deposits will have to exploited to keep up with demand.

Brine deposits are simply underground reservoirs which contain a high concentration of dissolved salts, e.g lithium, sodium, and potassium. These are generally found below the surface of dried lakebeds, known as salars, like this one in Chile's Atacama Desert:

Soquimich mine, Chile. Image: Scientist

Despite brine deposits containing a far less concentration of lithium in its natural state, it has been a more profitable method of mining lithium due to its simplicity - the brine is pumped to the surface from below ground where it evaporates for up to 21 months, exposing the lithium.

When it comes to hard-rock lithium mining, there are currently only three significant mines in operation, all in Australia, with two more currently under construction and more planned in several other countries.

At present, these mines only target spodumene, a mineral containing 3.73% maximum lithium content. Compare this to the most commonly mined iron ore containing c. 70% iron and the most commonly mined copper ore containing c. 35%. Other minerals containing lithium have an even small percentage of lithium concentration e.g. jadarite with a maximum 3.1% Li and petalite with a maximum 2.3% Li.

As you can see, these are small percentages when compared to other commonly mined chemical elements, contributing to the cost factor of mining lithium this way.

However, it's these other minerals containing lithium which will have to be exploited in order for the imminent sharp spike in demand to be met.

As finnCap put it:

"These mineral deposits can only become commercial when a suitable process route has been identified and tested at a commercial scale that will enable the direct production of lithium carbonate or a similar battery feedstock. They also need higher lithium prices in order to be viable – they are fundamentally less attractive minerals in economic terms."

According to finnCap, Rio Tinto has so far spent US$90m on its Jadar prospect is Serbia, in which the majority has gone into test work to "establish a process route that can recover the contained lithium and turn it into useful intermediate products."

So far, a process route has been developed at the small pilot plant scale but is yet to be scaled up.

It seems the supply and demand equation for lithium is set to go through much the same stages as the oil industry has over the last decade.

In the oil industry, the original sources of oil in simple, conventional oil fields such as across the Middle East, and the shallow water fields, such as the North Sea, was insufficient to meet the demands of a growing global economy. Prices rose significantly over the last 15 years as the rise in oil demand had to be met by higher and higher marginal cost sources of oil, eg oil sands, US shale, deepwater oil fields etc.

As an aside, the higher prices eventually spurred technological innovation, driving costs down in US shale to such an extent that a glut ensued and oil prices have since collapsed. Now looking ahead, with the advent of electric vehicles mass adoption, it seems unlikely oil prices will recover.

Back to the lithium market, as demand grows exponentially in the coming years, we could well see a similar set of events play out as Miners chase supply up the cost scale until they can innovate and reduce those costs.

What does this all mean for investors?

It's obvious the anticipated spike in demand for lithium has well and truly dawned. Once upon a time, simply tapping into a brine deposit and letting it dry in the desert was enough to meet demand. In today's world, however, this time-consuming practice won't suffice. Companies will need to develop more complex and feasible process routes that can utilise the vast amount of lithium-bearing rock to capitalise on the demand hike.

In order for mining companies to capitalise, they will have to viably find ways to produce commercial-grade lithium from hard-rock mineral deposits that aren't currently being exploited. These minerals include petalite, jadarite, pegmatite, lepidolite, zinnwaldite and hectorite.

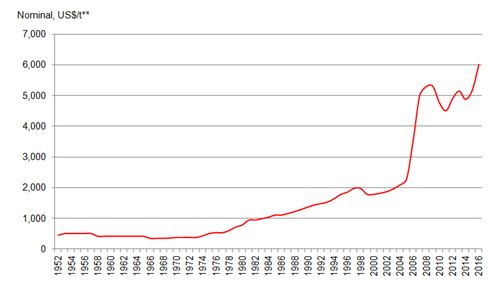

As seen in the graph below, the price of lithium first spiked around 2007, and again in 2015...

Lithium price growth chart in US$/t. Image: Wealth Daily

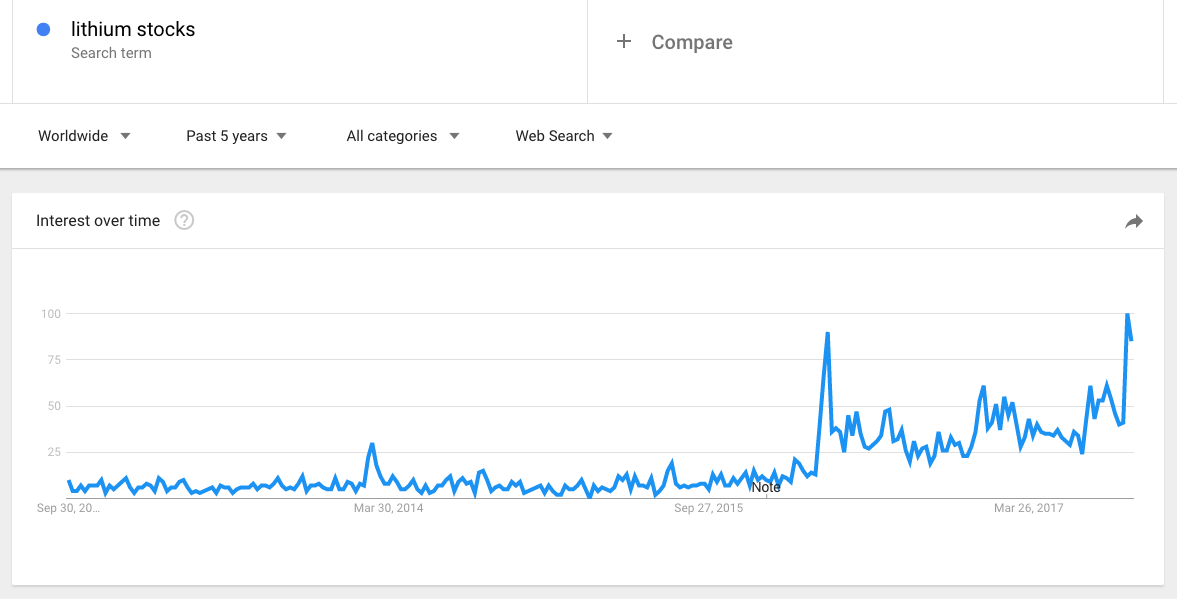

As a result, the number of searches for 'lithium stocks' also spiked in 2015, as seen in this chart from Google Trends...

Image: Google Trends

As the price continues to grow, so will the opportunities for mining companies and investors alike.

AIM-listed stocks with exposure to lithium

Bacanora Minerals (BCN)

Founded: 2008

Headquarters: Calgary, Canada

Key people: CEO Peter Secker

Market Cap: £107m

1 Year Share Price: -9%

P/E: N/A

What is Bacanora Minerals?

Bacanora Minerals is an AIM and TSX (Toronto Stock Exchange) listed lithium development company from Canada with a focus on Mexico. Their flagship mine, the Sonora site, is capable of "producing up to 35,000 tonnes per annum of battery grade Li2CO3 [lithium carbonate]."

The Group has also spent CAD$17m on exploration and development of a pilot mine in Hermosillo, Mexico, which has produced "high-quality lithium carbonate during ongoing test work conducted over 24 months."

Valuation

BCN has ridden the waves of a number of ebbs and flows since its admission to trading in July 2014. Opening at 86p, it fell not long after to its lowest price of 35p, rising to a peak of 100p in June 2016. As of today, the Group trades at c. 80p with a market cap of £103m

None of the Group's prospects has bared fruit (yet), with net losses swelling 10x in the five years to 2016 as BCN explores and develops its three Mexican sites, Sonora, Hermosillo, and the Magdalena site. They also have a 50% stake in the Zinnwald lithium site in Germany, with the other 50% held by SolarWorld.

European Metal Holdings (EMH)

Founded: 2011

Headquarters: Perth, Australia

Key people: CEO Keith Coughlan

Market Cap: £120m

1 Year Share Price: +34%

P/E: N/A

What is European Metals Holdings?

European Metals holdings is an Australian (ASX) and AIM-listed company headquartered in Perth, Australia. The Group's flagship prospect is a lithium and tin site at Cinovec in the Czech Republic, on the border with Germany (the same region as Bacanora's Zinnwald site).

This small area of central Europe straddling the border of Germany and Czechia is home to Europe's largest lithium deposit, the World's fourth-largest non-brine deposit, and "one of the largest undeveloped tin resources in the World".

The Cinovec area is a favourable location for a mine with its central location and good infrastructure networks close by. It also has the potential to be "the lowest cost hard rock operation globally" according to the EMH website.

Valuation

EMH share prices grew rapidly since its December 2015 IPO on the AIM market, with an opening price of 10p growing to an all-time high of 82p in April 2017. At the time of writing EMH was trading at c. 47p with a market cap of £115m.

Savannah Resources (SAV)

Founded: 1957

Headquarters: London

Key people: CEO David Archer

Market Cap: £32m

1 Year Share Price: +15%

P/E: N/A

What is Savannah Resources?

Savannah Resources is a multi-commodity company listed on the AIM market, with early-stage operations of heavy mineral mining in Africa, and at Lithium sites in Portugal and Finland. The Group is also awaiting a license to mine copper in Oman.

The Group owns a 75% stake in the Mina do Barroso site in northern Portugal, which has been granted a 30-year mining license. According to Savannah, it has the potential to become the first lithium producing mine in Europe. Early rock chip testing has found spodumene with 3.12% lithium concentrate, with development decision expected by the end of 2018.

Valuation

SAV currently trades at c. 6p, well below its all-time high of 20p per share in 2011. Like other companies detailed here, the Group is at an early stage and has operated at a loss of c. £2m per annum in the five years to 2016, with this figure forecast to be roughly the same in FY17 and FY18.

Kodal Minerals (KOD)

Founded: 2010

Headquarters: London

Key people: CEO Bernard Aylward

Market Cap: £17m

1 Year Share Price: +65%

P/E: N/A

What is Kodal Minerals?

Kodal Minerals is an AIM-listed mining company whose operations focus on lithium and gold exploration projects in West Africa. The Group has stated that lithium is its priority. Kodal has two lithium mining projects, both in the southern region of Mali. At its Bougouni Project, rock-chip sampling began in September 2016, with these studies identifying zones of pegmatite mineralisation, with a lithium concentrate of c. 2%. Subsequently, an 18 drill hole programme began in November 2016.

The Group also has a 90% stake in the Diendio Project, also in southern Mali. Previous exploration at the site uncovered lithium-bearing pegmatites, however, the drilling and sampling was targeting gold at the time.

Kodal has said "it will undertake detailed reconnaissance mapping to follow up known pegmatites and identify undiscovered pegmatite outcrops within the project."

Valuation

KOD saw its share price spike in January 2017, growing 400% in a month to reach an all-time high of 0.5p per share. At the time of writing (September 2017) the share price was 0.26p per share.

The bottom line

It's simple, really.

As the demand for lithium grows, so will its price and therefore the number of mining companies actively looking for and mining lithium carbonate.

As mining companies discover new regions where lithium exists, as well as develop processes to feasibly mine lithium-bearing minerals that are currently uneconomical, the door will be wide open for investors.