On a Parity PEG basis, there seems to be reasonable potential here for a conservative 100% or so upside

Companies: PCF Group plc

PCF Group, ticker PCF, offers retail savings products as well as retail and SME lending services. At the time of writing it has a Market Cap of £79m.

The following provides an analysis and view of this company based on…

- Data obtained from Stockopedia

- Data obtained from the most recent Broker note from Research Tree

- The Parity PEG Price Report produced by Briefed Up

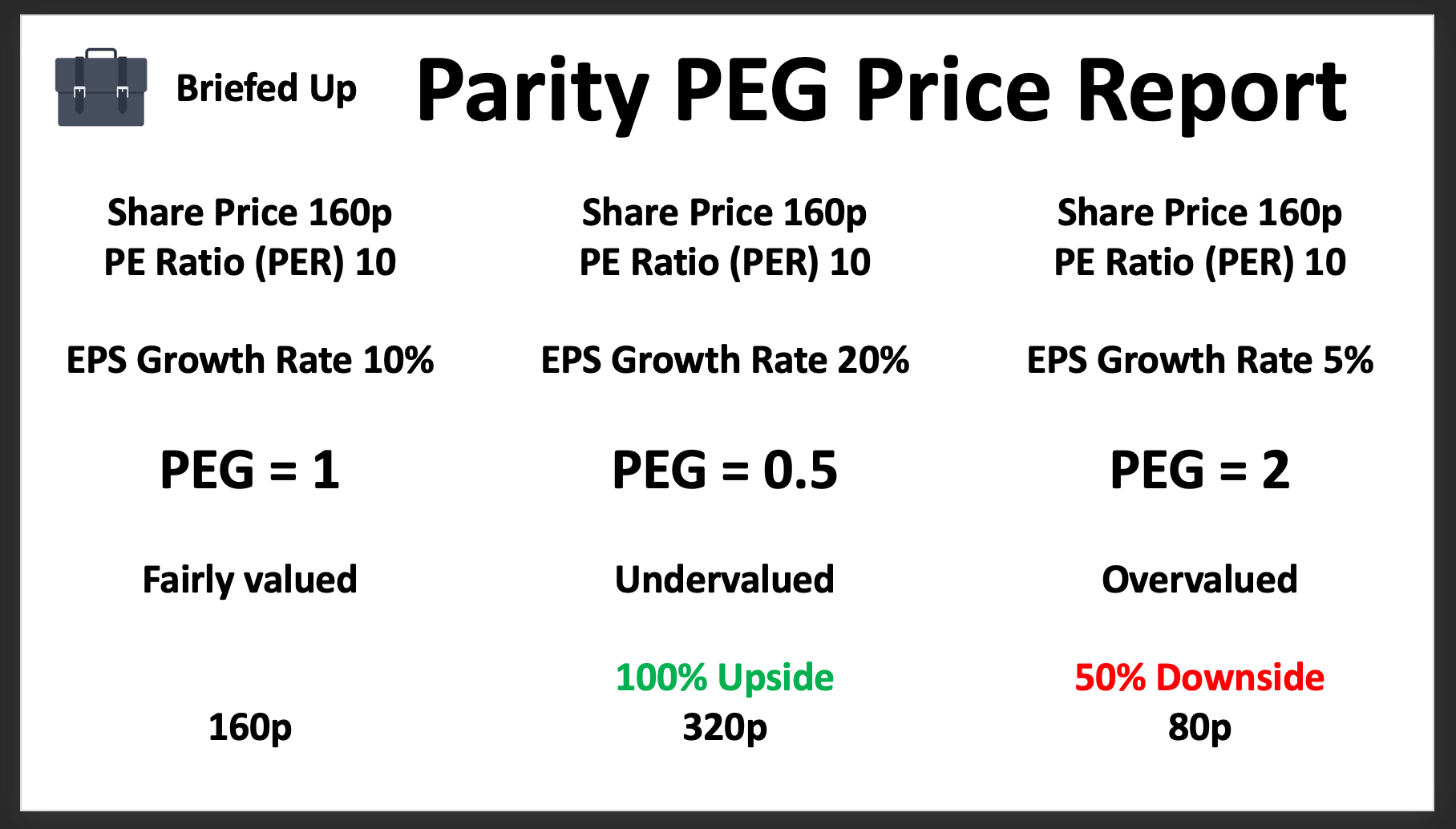

The primary focus of the Parity PEG Price Report is the PEG Ratio, the PEG. The objective is to identify a 1 and 2 year fair value price based on the PEG and the forecast EPS growth.

The PEG was made popular by Peter Lynch. It is calculated by dividing the PE Ratio, the PER, by the EPS Growth Rate.

A PEG of 1 indicates a stock is fairly valued, a PEG below 1 indicates a stock is under valued and a PEG above 1 indicates a stock is overvalued.

Thus, a stock with a PER of 10 and an EPS Growth Rate of 10% would have a PEG of 1 and would be considered fair value.

A stock with a PER of 10 and an EPS Growth Rate of 20% would have a PEG of 0.5 and would be considered undervalued with 100% Upside – Where the PEG would then be at parity.

A stock with a PER of 10 and an EPS Growth Rate of 5% would have a PEG of 2 and would be considered overvalued with 50% Downside - Where the PEG would then be at parity.

Onto the analysis and view…

I finally decided to overlook the HUGE Net Debt here, which seems acceptable enough for a lender. I bought in on 24th May at 33.8p. This is about 10% above the recent placing price of 30p (back in February this year).

There’s a reasonably clear Downtrend here which I don’t particularly like buying into, down almost 30% from the high 12 months ago. However, I am hopeful the 30p placing price will provide support. Any fall to the 25p level would probably see me looking for an exit.

According to the most recent Broker note from Stockdale on 27th March there’s a small yield (just over 1%) and, according to Stockopedia, that yield looks to be well covered (around 7 times).

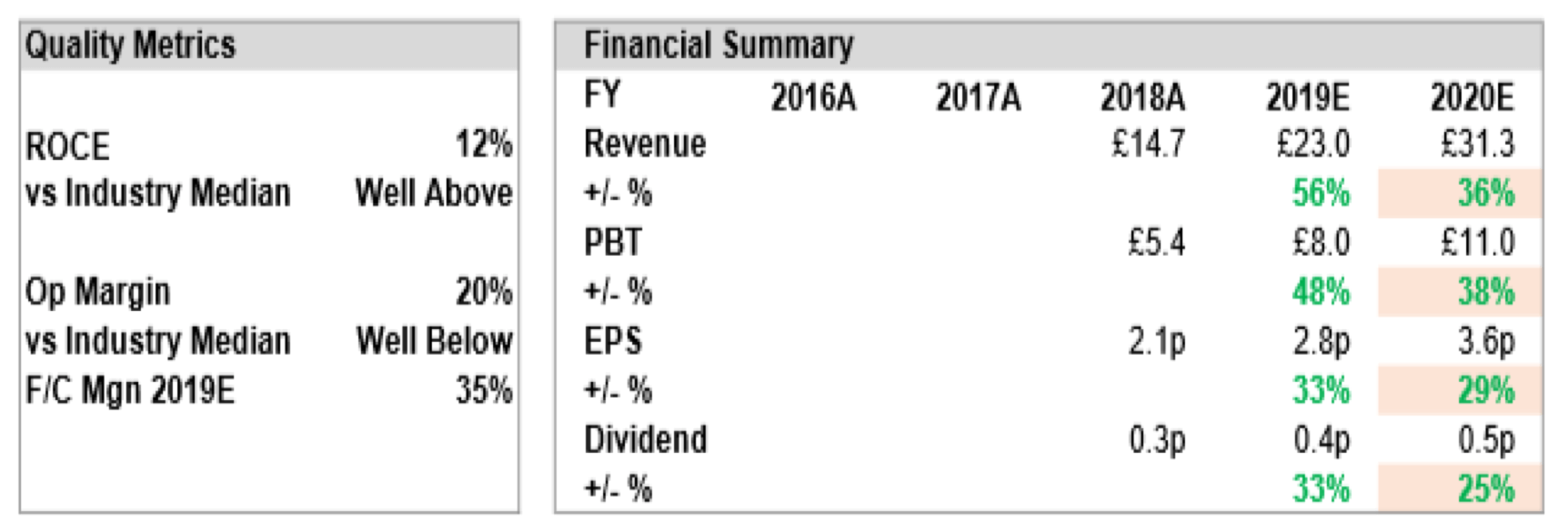

The Quality Metrics

Both the ROCE and Operating Margin figures are taken from Stockopedia. And, according to Stockopedia the ROCE is well above the Industry Median.

The Operating Margin is well below the Industry Median but at 20% it seems healthy enough.

The Forecast Margin for 2019E, calculated from the 2019E Revenue and PBT forecasts in the Financial Summary, indicates an improvement to 35%.

The Financial Summary

All figures here are taken from the most recent Broker note from Stockdale on 27th March.

Revenue is forecast to increase by 30%+ in both 2019E and 2020E and PBT is pretty much in-line with this growth. EPS is forecast to grow by 30% or so in both years, as is the Dividend.

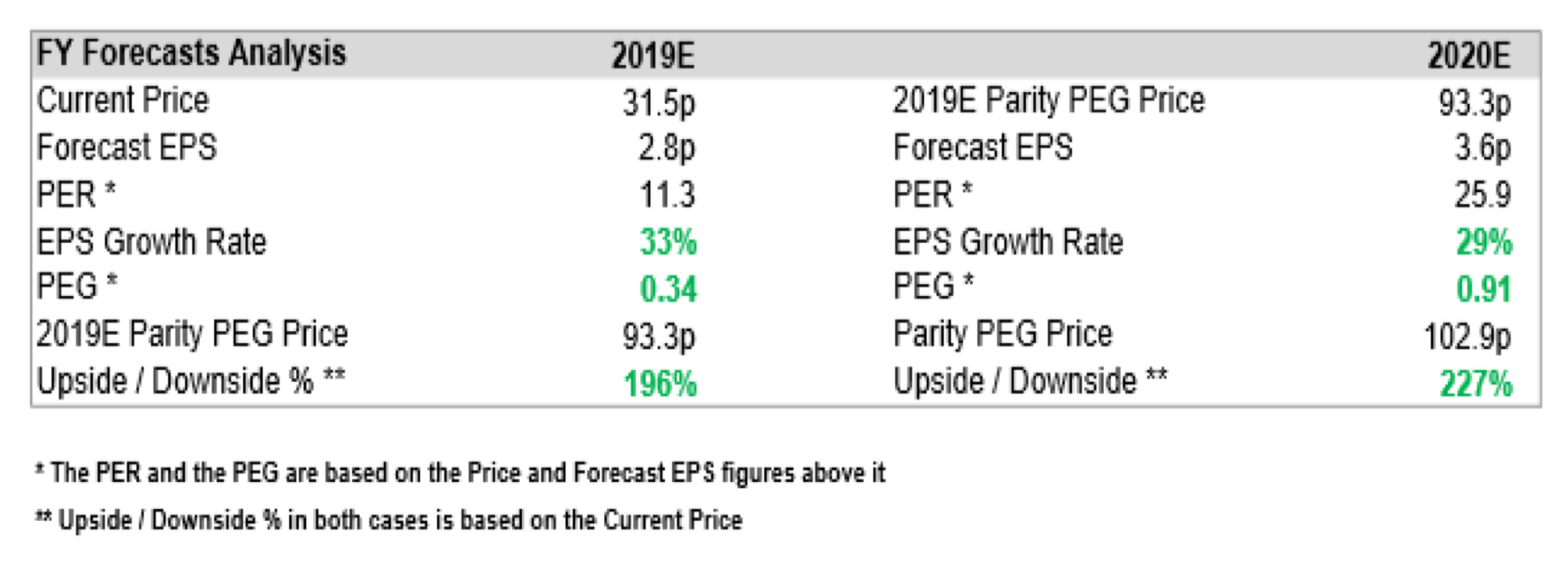

Forecasts And PEG Analysis

Looking at 2019E there’s a forecast PER of 11.3 and EPS growth of 33%. This translates to a PEG of 0.34 and a potential upside of almost 200% from the current price level (on a Parity PEG basis).

Looking to 2020E there’s a forecast PER of 25.9 and EPS growth of 29%. This translates to a higher PEG of 0.91 and a potential upside of over 200% from the current price level (again, on a Parity PEG basis).

These estimates are probably a little over optimistic as the Industry Median PEG here is 0.7. However, even taking this into account, on a Parity PEG basis, there still seems to be potential here for a 100% upside over 2 years.

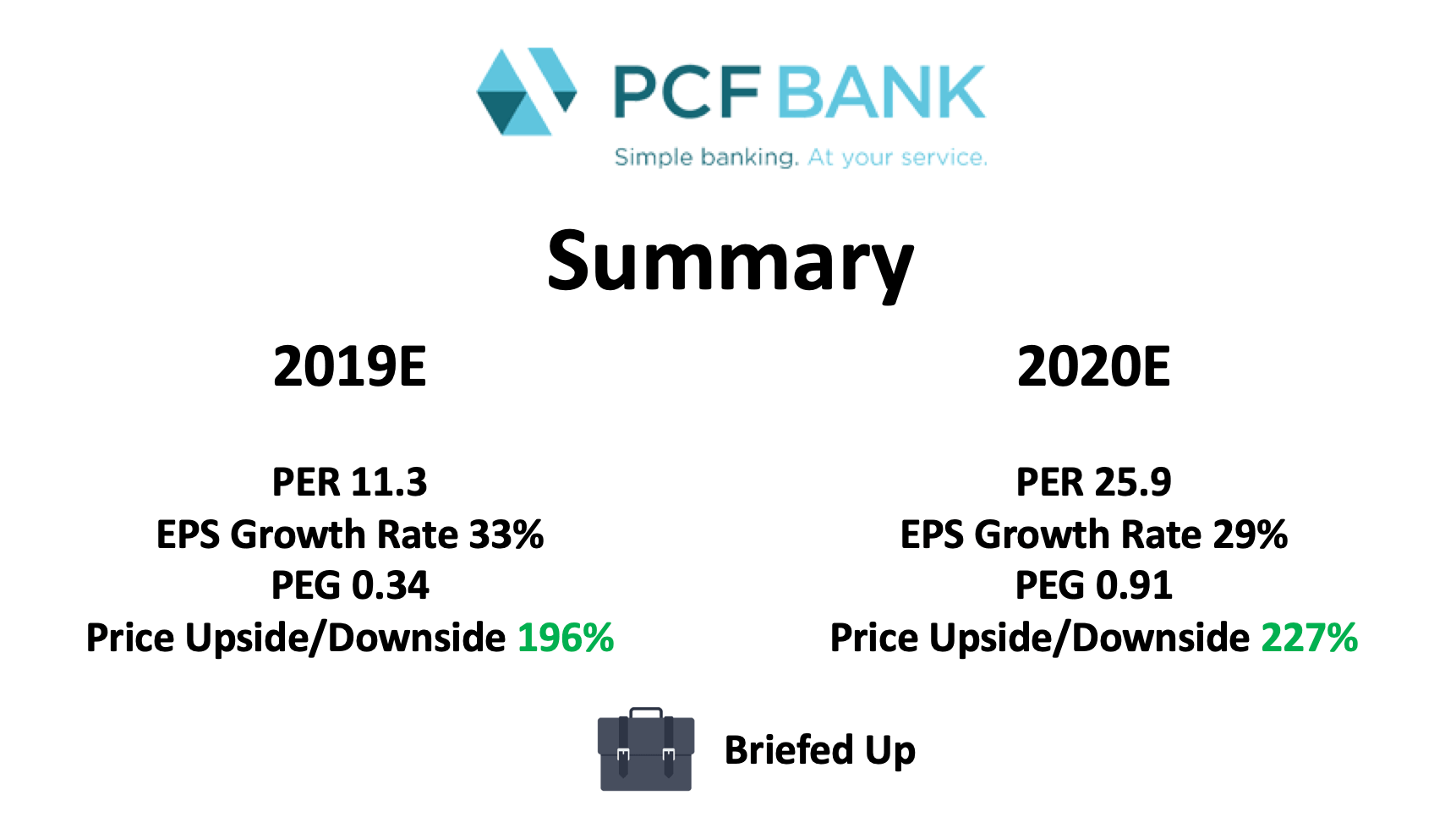

To, summarise…

On a Parity PEG basis, there seems to be reasonable potential here for a conservative 100% or so upside on a 1 and 2 Year view. Even taking into account the Net Debt (which seems acceptable enough for a lender) and Industry Median PEG of 0.7.

This analysis and this view is of course no recommendation to Buy or Sell shares in PCF Group and does not cover any risks associated with investing in this company or any other company.

Hope it helps!

You can see many more reports on our website https://briefedup.com/.

Please Note: These reports are purely my opinions at that point in time on stocks I may or may not have a position in. I do not and will not ever give any advice. As always, do your own research.