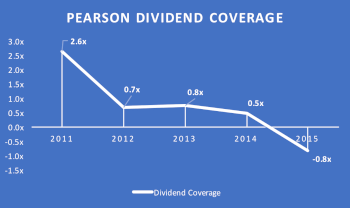

Troubled education publisher says 2017 dividend will have to be cut after US sales decline

Companies: Pearson PLC

Shares in British education publisher Pearson slumped a whopping 20% in early trading on Wednesday, after the London-based firm cut its profit outlook and said it would have to reset its 2017 dividend due to a worrying decline in its U.S business.

The FTSE 100 firm, founded in 1844, said it expected to deliver operating profit in line with guidance for FY16, but said 2017 would be challenging and in 2018 it would not hit its operating profit goal.

"We expect to deliver operating profit in line with guidance for 2016, despite a further unprecedented decline in Q4 2016 in our North American higher education courseware business. Our 2016 restructuring program has been delivered in full and the financial benefits are a little higher than planned."

The company has had several profit warnings in recent years and narrowly achieved its 2016 forecasts after a successful restructuring programme delivered significant cost savings and offset the decline in revenue.

"We expect to report adjusted operating profit and adjusted earnings per share of approximately £630m and 57p...

We have continued to manage discretionary cost tightly and are accruing around £55m less than originally planned for our 2016 staff incentive programme, enabling us to report within the guidance range we had previously set."

In regulatory news published on Wednesday, Pearson's management said it was accelerating its transition to digital in higher education as print continues to decline.

North America revenues fell 30% during Q4, leading to a hefty 18% decline for the full-year. 2% of the decline was due to lower enrollment in community colleges, but the lion's share was due to inventory correction reflecting the need to accelerate the transition to digital.

North America will no doubt be a challenging market for the group for the next few years.

Broker Panmure Gordon said the update was "surprisingly weak" as it moved its rating from Buy to Hold:

"... capitulating on long-standing market concerns regarding North American higher education courseware, accelerating its restructuring programme and rebasing profit and dividend guidance from FY17E onwards. We move from Buy to Hold, with an initial view is that the shares could fall towards the 600-700p level."

Pearson Chairman Sidney Taurel said he and the Board were confident of the firm's digital transition plan but acknowledged the current difficulties in trading conditions:

"We are facing difficult trading conditions in our largest business as we transition to digital, but as a Board, we are confident that the plan announced today will allow the company to navigate these conditions and build on its leading position in higher education."

While CEO John Fallon stressed the education sector as a whole was going through "unprecedented" change and volatility:

"We have already taken significant steps on restructuring, reducing our cost base by £375m last year. However our higher education business declined further and faster than expected in 2016. So we are taking more radical action to accelerate our shift to digital models, and to keep reshaping our business."

Pearson shares opened down 20% before sliding a further 5% in early trading on Wednesday.