An extract from Northland's AIM Journal

Companies: ASC, HUR, PLUS, SOU

There has been an improvement in the overall liquidity of AIM companies in recent months following the EU referendum, helped by a recovery in resources.

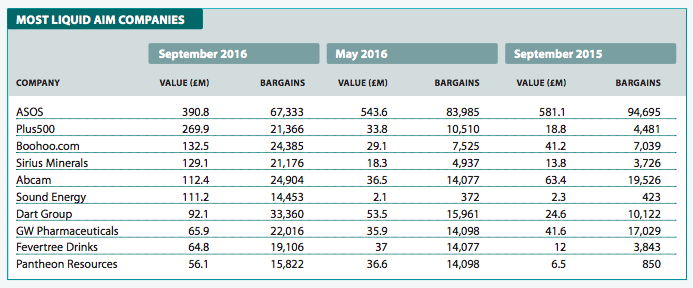

September was the best month for some time in terms of the liquidity of trading in AIM shares. There were more than 627,000 trades worth a total of greater than £3.3bn. On both counts, this is more than one-fifth higher than the previous highs for a single month in 2016, or even in 2015.

The level of trading is well above that in May, the last full month before the EU referendum, and one year ago.

Move over ASOS

When writing about AIM liquidity, online fashion retailer ASOS always dominates. This is less true this September. It is not unusual for ASOS to account for around a quarter of the value of trades and the number of trades. In September, ASOS accounted for 11.7% of trades by value and 10.7% by number. That is around half the levels one year before or in May 2016.

"...trading is becoming more spread out across a wider range of AIM companies, which is a good thing."

This suggests that trading is becoming more spread out across a wider range of AIM companies, which is a good thing. Whether this will last or is just a blip is still to be seen.

Plus500

Trading in derivatives trader Plus500 has soared but that is no surprise because its business feeds on uncertainty and volatility. It should be remembered, though, that existing shareholders placed just over £100m of shares at the end of September, which will have boosted the figure for the month. Trading volumes still show a strong increase even excluding the placing.

Mining and Oil and Gas

In recent months, the two sectors that are worth significantly more in value terms as a percentage of AIM are mining and oil and gas. They account for 13.8% of AIM, up from 11.9% in May. There is also increased trading in resources companies. They accounted for 13% of the value of AIM trades in May, rising to 22.5% in September. There has been a recovery in the price of oil and other commodities this year and that has made some investors give the resources sector a look.

This improved trading has been helped by the strong performance of the likes of Sound Energy. In September 2015, there were 423 trades in Sound shares and fewer in May 2016. In September 2016, there were 14,453 trades worth a total of £111.2m. The good news continues to flow, with the latest drilling showing that gas flows from the Tendrara discovery in Morocco are better than expected. Both small investors and institutions have been buying shares in Sound. The inclusion of Sound in the FTSE AIM 50 index will have raised its profile further.

UK-focused oil and gas explorer Hurricane Energy, although it is outside of the top ten in terms of trading volumes, is similar to Sound. Trading volumes of £35.7m are more than seven times the level they were in May. This also indicates increased interest on the back of positive news. Hurricane has been able to raise £70m to finance the development of its Lancaster field and to drill two exploration wells while rig rates continue to be low. Much has been made of the falling number of companies on AIM but these improvements in trading volumes are more siginifcant.