Unit economics key, but so is Management ability, market forces & growth constraints

Companies: CRAW, DPP, FOXT, FUL, GYM, CAKE, RTN, RBG

Afternoon all

As mentioned last week, I thought I’d spend some time in this piece putting down my thoughts on a business strategy I have a lot of affection for, namely roll-outs.

Investing in companies that have a proven/successful offering, and are in the process of rolling their product out to new markets, can be an absolute joy when it works.

For example, the cash flow generated from a new restaurant pays back the initial investment, and can then be used to invest in new restaurants. As the number expands, central costs are spread across more restaurants expanding margins, the roll-out rate can accelerate, the market places an increasing PE multiple on the valuation, and a beautiful, virtuous circle ensues.

However, when market forces and competitive pressures go against a business, or operational changes affect the "USP", margins suffer, expansion slows and PE multiples take a painful haircut. It pays to go through the following analysis process to help avoid the bad ones and spot the opportunities.

Well-known examples of roll-outs

Classic examples of success stories include Pizza Express, Dominos, Gym Group, Card Factory, Patisserie Valerie, Smart Metering Systems, and many more.

However, there are certainly examples of where it’s gone a bit wrong, the most recent example being Crawshaw, but also Tesco in the US, Foxtons and Restaurant Group.

Some interesting stocks are early in the journey of their roll-outs, including Fulham Shore, DP Poland, and Revolution Bars (after re-listing in 2015).

Below I go into some detail of how I think about these companies, what’s important and how best to assess the opportunities and risks. It’s the process I go through, and it captures all the main factors.

To summarise, roll-outs are all about:

- Return on Invested Capital for each new unit,

- Constraints and ability of Management to execute the roll-out, and

- The market size which dictates how many units ultimately can be opened.

Unit economics are key

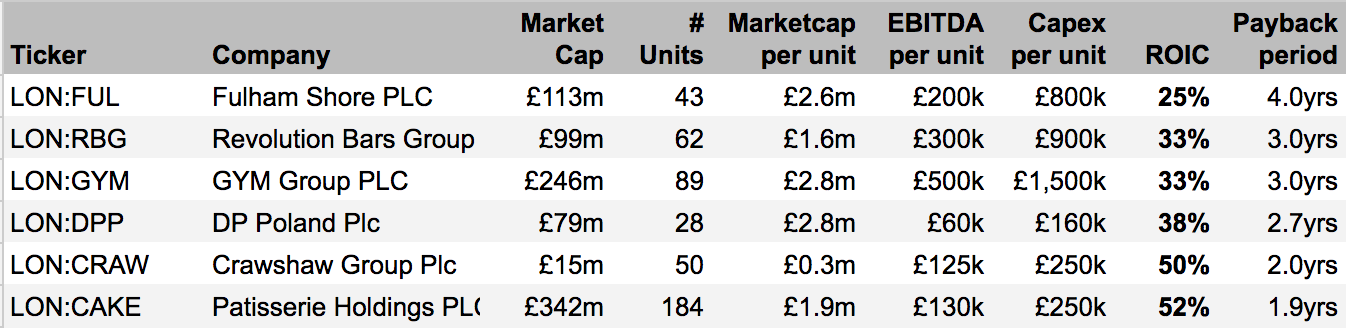

When trying to get a feel for the scale of the opportunity you need to assess the company economics in unit terms. Hence for Fulham Shore units mean Franco Manca restaurants, for DP Poland its pizza takeaways, and for Patisserie Valerie its cafes.

I want to get an idea of how much cash each unit will generate per annum and how much it costs to get the unit up and running.

To do this, I look at capex incurred and unit additions over a number of years to smooth out timing differences and arrive at a reasonable estimate for capex per unit. I then do the same for EBITDA (or NOPAT) to get a broad idea of earnings or cash generation per unit.

Once I have those numbers I can calculate the Return on Invested Capital for each new store/restaurant/bar/cafe etc. This is critical because the higher the ROIC, the faster the payback period, and so the quicker the company can recycle that capital into new units. Typically, a healthy roll-out model should repay capex within 2-4 years.

Below is a table showing some rough numbers I’ve pulled together for some well-known, and not so well-known, roll-out stocks.

I'm happy with most of these numbers but have less confidence in the accuracy of my Fulham Shore estimates. There is currently no broker coverage to which I can verify my numbers. FUL is relatively young and has no investor presentation on the website, so I've had to rely on my dodgy accounting. FUL's Capex per unit in the table of £800k looks a little high to me so I may well have undercooked its ROIC.

I would prefer to use net operating profit after tax (NOPAT) to calculate ROIC because it better reflects the actual earnings generation per unit. However, for comparative purposes and ease, I'm using EBITDA in the above table. Also, EBITDA is relevant as it’s representative of FCF (aside from maintenance capex).

The six companies above show a range of ROICs from 25% at Fulham Shore up to an impressive 50% at Patisserie Valerie and Crawshaw. However, that doesn’t tell the whole story. As many of you will know, Crawshaw shares were hit hard in September last year as LFL sales fell nearly 5% following new price initiatives which were unpopular with customers. Shares fell 60% at the time and are now down 77%. Ouch!

If a company changes its format, raises prices, or cuts back on quality in the hope of expanding margins, in my experience, this usually ends badly. Customers spot the change quickly and the “edge” or differentiation the company offered before suddenly disappears.

Falling LFLs will lead to a double whammy as the downgraded earnings results in less capital for future roll-outs resulting in a lower and slower expansion, but the market also applies a de-rated multiple to the company’s earnings.

How big is the addressable market?

Once I’ve got a feel for the unit economics of the business, I need to build up a view of how big the market opportunity is.

For Fulham Shore, it is primarily building out a pizza business and currently has 43 restaurants (including some non-pizza Greek ones). Pizza Express is the perfect example of a mature roll-out in the same space, and it has 430 restaurants. This gives me an idea of the addressable market.

For Revolution Bars, there are about 1,000 town centres in England and 70 cities across the UK. The same stat applies to Patisserie Valerie, Crawshaw and Gym Group.

Looking at DP Poland, there are five cities with populations greater than 500k people and over 50 cities with populations more than 75k.

I’m not saying these are exhaustive, but they are the sort of stats I consider when building up an idea of to what extent a roll-out could expand.

Is the product differentiated? Is there an “edge”?

To successfully roll out a concept and maintain ROIC levels, the offering has to, in some way, be better than what’s already available.

Franco Manca (Fulham Shore) offers fantastic pizzas at very affordable prices, in modern and welcoming restaurants. DP Poland is taking a proven business model with a well-integrated online offering that is demonstrably popular with customers in the UK and applying it to an under-saturated market. Patisserie Valerie has created a successful and scalable cafe concept by focussing on quality and atmosphere. Gym Group offers a low-cost, stripped down, 24/7 gym that is undercutting the competition.

How ambitious are Management?

Each of the companies mentioned above has stated objectives about how many stores/bars/cafes/gyms they plan to open and over what period.

Revolution Bars plans to expand from 62 units to 140. Crawshaw wants to expand its Butchers offering from 50 units to 200. The Gym Group plans to open 15-20 new gyms per year. Patisserie Valerie plans to open 20 new cafes each year.

Are these reasonable targets? What does that roll-out rate mean in relation to when the business might reach saturation point? Can that level of capex be covered by organic cash flow, and if not, then how much debt is needed to fund the growth? Most importantly, will the company require another equity raise to fund plans, and what might the dilution impact be to my investment?

How experienced are Management?

This is the most important consideration. The unit economics and the market size are relatively easy to model. However, as always, success or failure will primarily come down to whether the team can execute on its plans.

One of the reasons Fulham Shore is interesting for me is the team is clearly first class. David Page oversaw much of the Pizza Express growth as CEO and Chairman. He founded the Clapham House Group, owner of GBK and Bombay Bicycle Club. He and his team clearly know how to roll out a winning concept.

Patisserie Valerie has Luke Johnson, also of Pizza Express and Strada fame, as its Chairman. Mr Johnson seems to have been involved in most of the successful restaurant chains in the UK over the last 25 years.

Reaching a sensible valuation

Once I’ve built up a picture of the unit economics, roll-out plans and Management experience, I can project the rate of roll-out and therefore to what level future group earnings could grow.

After that, it's a simple multiples-based valuation using EV/EBITDA or PE, and a discount back to a valuation in today's money.

So far I have valued the success case. I now need to apply some risking or a healthy safety margin to give myself some breathing room should things not go to plan.

Finally, I compare that valuation with the current share price, consider the intangible factors like Management and the competitive environment, then I take a view.

What can go wrong?

I mentioned Crawshaw further up, but this is an example of great unit economics, but changes to the offering as the company tried to move upmarket and run fewer promotions backfired. Also, there were some "aggressive meat promotions" from the big supermarkets. LFL sales dropped nearly 5% which feeds into reduced ROIC, the roll-out rate and the valuation of the future business.

Foxtons is another good example of a roll-out story with great unit economics but without the supportive market backdrop. Stamp duty and economic uncertainty slowing down transactions in London materially, impacting profitability, cash generation and ultimate perceptions of valuation.

Restaurant Group worked well for years, but it started over-charging for its products and then faced unhelpful market forces as a combination of food inflation and living wage hikes have hit margins.

All of these are good examples of companies looking attractive on paper but running into issues that impact the unit economics, the ROIC, the rate of rollout and the ultimate valuation. Some of these are internal issues like regrettable Management choices; others are external headwinds and market forces. That's why it is important to run through the above steps to make sure you're comfortable with all the main factors that contribute to a roll-outs performance.

-----

To read a brief outline of how I think about stocks, and what I aim to achieve in this blog, please check out my first blog where I set out my stall.

Recent blogs:

- 23 Jan 17 - Why Pearson was an obvious value trap, and is Jackpotjoy worth a closer look?

- 30 Jan 17 - How MiFID II could hurt Small and Mid-caps

- 16 Jan 17 - How sustainable are current dividends

- 8 Jan 17 - Implications of Trumponomics for equities

- 18 Dec 16 - Millennials - Becoming the most important demographic

- 12 Dec 16 - CFDs - Tough week but worth a closer look

- 5 Dec 16 - Pension deficit dogs starting to look interesting

- 28 Nov 16 - Setting out my stall...plus my thoughts on bond proxies

Please Note: To be clear, I do not and will not ever give any advice. I will rarely mention individual stocks but when I do these will not be recommendations, instead just my thoughts at that point in time.