Growth stock G4M delivered very strong interims, with a whopping 73% revenue growth

Companies: Gear4music (Holdings) PLC

The rapidly growing online musical retailer Gear4music (AIM: G4M) delivered a strong set of Interims this morning. Revenue grew a whopping 73% across the business with robust +44% sales growth in the core UK business and spectacular +169% growth in Europe. These headline figures were announced in last month's trading update but they bear repeating.

As a result of the strong organic sales revenue, G4M has swung from a loss before tax of £217k in 2015, to a profit of £966k in 2016. Margins are understandably thin as Management are pursuing an aggressive growth strategy and seeking to undercut established high street retailers. The H1 2016 gross margin is 26.6% and EBITDA of £1.34m gives an EBITDA margin of 6.2%.

Panmure published a very positive note this morning following the results:

"We raise our FY17 PBT and FY18 PBT by 21% and 6% respectively to £2m and £2.9m. The strong momentum continues which, combined with the virtuous circle of strategic re-investment into the e- commerce platform, the product range, and new capability/capacity, points to further scope for our upgraded but still conservatively framed estimates to be surpassed ... G4M is starting to unequivocally display many of the characteristics of its peer group (e.g. 3 year FY16-FY19e sales CAGR of +40%, leader in its chosen niche due to an attractive consumer proposition and highly defensible business model, profitable, well-funded and cash-generative)."

The main drivers of the strong organic growth in the business are a combination of "rising website traffic and improved conversion rates". This is a clear sign that the website investment is paying off and G4M have announced it is bringing the development team in-house for a total consideration of £1.5m, as it gears up for further growth.

"...our software development team will be brought in-house and ... expanded even faster to ensure we continue to build a market leading e-commerce platform"

An interesting point made in the statement is that the strong European revenue growth achieved by G4M predates the currency tailwinds brought by Brexit. Therefore we would expect to see further benefits in the FY results early next year as the lower sterling makes G4M more competitive for the full period. This is supported by the outlook statement where Management confirm H2 should deliver ahead of expectations:

"...given the strength of first half performance coupled with continuing momentum heading into the important Christmas period, the Board considers the Group well placed to deliver results for the full year ahead of its previous expectations."

As the above table shows, website visitors were a healthy 5.58m, up 26% on H1 2015, but the expansion came via improved conversion rates rising 59bps to 2.38%, combined with an 8.6% boost in average order value.

"The Group served 141,000 customers in the period, up 60% on last year. Numbers of 'new customers' increased by 60% whilst 'repeat customers' improved by 59%. Active customers increased by 45%, and the number of people on our email subscriber database rose 84% to 601,011."

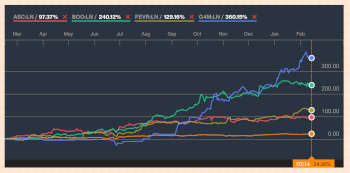

The shares opened down 2% in early trading but have more than doubled since June.

_m.jpg)

.png)