UK online battle already won. US presents both a huge opportunity and some risk.

Companies: Purplebricks Group Plc

Good evening,

The Naked Fund Manager is taking a week off to sample the gluhwein and slopes of the Austrian Alps. Instead of not publishing anything, he has given me leave to put my thoughts down on Purplebricks and its planned expansion into the US, announced last week.

Full disclosure: I am a Purplebricks shareholder and below are my thoughts about the company and the risks and opportunities in the States. It is not advice and is just my opinion.

Battle for UK online presence already won

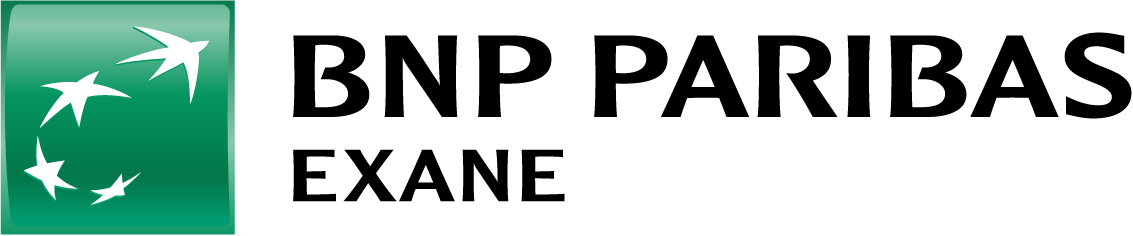

Comparing the number of visitors to the leading websites in the sector shows the size of the task facing PURP’s online competitors.

The graph shows just what an uphill struggle there is for competitors of Purplebricks. Monthly visitors for PURP is c.750,000 visitors according to Similar Web, a colossal level when compared to the usual suspects that are its direct online competitors, namely: emoov.com, housesimple.com and Yopa.co.uk.

Hatched.com has the lowest traffic of the platforms in the above graph. It was bought by Connells in November 2015, but there does not appear to have been much acceleration in operations since.

As an aside, if you haven’t yet heard of www.similarweb.com, then I would highly recommend it. The numbers are not exact, and there are larger differentials when looking at less-visited websites. However, it is a great tool for comparison purposes. Another service is www.alexa.com, but most digital marketers will tell you they find similarweb more useful.

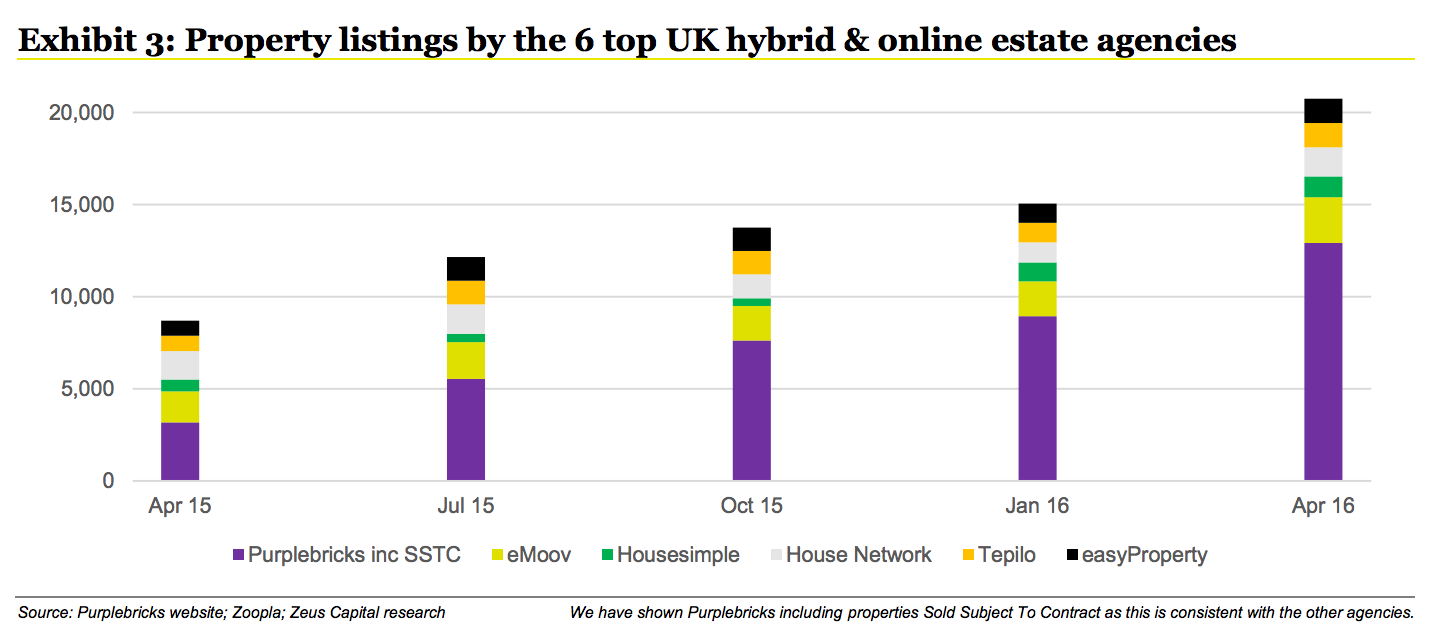

Another graph that shows the rate of change achieved by Purplebricks comes from a great note published by Zeus analysts last year (see below).

Deep wallets required to match PURP’s marketing budget

PURP’s marketing spend over 2016 was £13m and over H1 2017 it spent £7m. It is poised to swing to profitability for FY 2017:

- For online competitors to make any inroads into its market share (illustrated by the graph above), they will need to spend at least this much, generating heavy upfront losses.

- For typical estate agencies, it is a tough ask to compete with the far lower cost base of an online business like Purplebricks. Foxtons made £10.5m of PBT in its last reported Interims. Countrywide, the UK’s biggest estate agent, reported £22m of PBT in its last Interims. Matching PURP’s marketing spend would be a big hit to margins, and chasing the lower end of the market would cannibalise their established higher margin business.

Competition from Rightmove or Zoopla doesn’t quite stack up

One source of competition that could arise is from the online giants Rightmove and Zoopla. The issue with this is the fact that Rightmove’s and Zoopla’s business models are complimentary for typical estate agents. If they start to compete with estate agents, their access to the inventory of houses and flats for sale could quickly evaporate as agents move their listings to rival platforms.

If Rightmove proceeds on this basis, Zoopla is big enough to quickly take over the mantle of the primary platform in the UK. If both enter the market, then Onthemarket.com is further back concerning its offering but could make up the ground. In short, moving into competition with the established estate agents could risk the dominant market share Rightmove and, to a lesser extent, Zoopla has online with their information consolidator models.

The counter to this is that the balance of power has now shifted and is in the hands of the online platforms. It is now critical for an estate agency to be present on Rightmove if they are to be effective for their customers.

US expansion brings enormous opportunity...as well as some risk

The announcement of a state-by-state expansion into the US combined with a £50m fundraise shows the scale of ambition at Purplebricks. The US market is highly fragmented and enormous.

Here are some industry stats:

- In 2015 there were 5.8 million real estate transactions in the US with an aggregate value of $1.6 trillion.

- US Realtors are a highly fragmented industry, mostly dominated by local agents with c.2 million licensed professionals according to the Association of Real Estate License Law Office.

- Over 65% of sellers and over 40% of buyers found their Agent through either word of mouth or prior use, according to the National Association of Realtors.

- The Listing and Buying Agents use online marketplaces called Multiple Listing Services (MLS’s) to list real estate and find buyers. It appears there are between 800 and 1,000 regional MLS’s currently, but this number is falling as many are consolidating.

Zillow and Realtor are biggest information consolidators

Similar to Rightmove, Zillow and Realtor.com act as information consolidators for Agents and monetize through advertisements:

- Zillow is the largest online player with a number of customer-facing websites, primarily www.zillow.com and www.trulia.com platform. These two sites respectively generate over 170 million and 55 million visits per month according to Similarweb. Zillow sources its data from around 400 regional MLS’s. It also has an algorithm like Zoopla that allows people to get a “Zestimate” value of their house, although the mixed reviews suggest it is a bit like marmite and contains some estimates materially wide of the mark.

- Realtor.com is another big online player with 59 million monthly visits. It has connections with over 800 MLS’s.

There are hundreds of other consolidators across the US, including Google and Yahoo, and here is a snapshot of some of the main ones.

Newer online disruptors also gaining traction

Online platforms are already looking to disrupt the US real estate industry. As mentioned in the Purplebricks announcement, commission fees in the US can be 7%, far higher than the 1.5-1.8% that is the average in the UK:

- www.redfin.com offers its services for 1.5% commission. It generates 26 million visits per month

- OpenListings and UpNest are two other examples of online disruptors that are much smaller, generating c.200k and c.100k visits per month respectively.

Who gets the 7% commission and how is it split

Here’s a quick overview of the US Realtor model. There are Brokerages, who are the larger business, and there are Agents, who work as part of the Brokerage but can be thought of almost like self-employed contractors. The Agents pay a fee for desk space, membership of the local MLS, etc.

Splitting the commission:

- The Listing Brokerage and the Brokerage that represents the Buyer typically share the commission pot 50%:50%.

- The Agents within each Brokerage then get a share of that commission. Junior Agents might get a 50:50 split with the Brokerage. Senior Agents can get up to 90% of the fee.

- A Brokerage can both list the seller and source the buyer. In this case, it keeps the full commission and shares it with its Agent

- Therefore for a $500,000 house, the total fee could be c.$35,000. If there are separate Brokerages and Agents, then each of the four parties might get c.$8,750. If there is just one Brokerage and Agent, then the share could be $17,500 each assuming a 50:50 split.

Opportunity and risk for Purplebricks

After spending some time looking into the US market, it does indeed seem highly fragmented. Furthermore, it appears reasonable to expect that Purplebricks can plug into data feeds from the various MLS’s to start its state-by-state expansion.

The argument that the local knowledge held by the local realtor leads to an optimised sale price, justifying higher commission rates, appears to hold sway at the moment. This argument has been steadily eroded in the UK over the years as platforms like Rightmove, and now Purplebricks, have, in my view, started to commoditize estate agents and challenge the status quo.

While the preponderance of individual Realtors represents an opportunity, it also implies a cultural preference for the personal touch. As detailed in the stats above, there is a high number of buyers and sellers that rely primarily on word of mouth. This preference may lead to a slower take-up in the US compared to the UK.

However, there are many examples of a rapid change in customer habits when a disruptive service provides a big increase in consumer surplus, e.g., Just Eat, Rightmove, Uber, Deliveroo and many more.

One surprise for me in last week’s announcement was the decision to launch in the US with an offering that was not looking to undercut the current market. Redfin.com is clearly gaining traction with its 1.5% commission offering, and given PURP’s expertise, it seems like an obvious way to gain market share quickly.

However, perhaps the reason for not competing on price is an acknowledgement that it will struggle to attract talent if it reduces the commission attainable by good agents.

Purplebricks said in its recent announcement:

“The Company will look to attract some of the most experienced real estate agents in the US property industry who want to run their own businesses”

A problem with this is that most real estate agents, including the most experienced ones, already run their own businesses.

Management intends to market and advertise the offering rigorously leading to an increase in the number of listings flowing to Purplebricks:

“a sustained marketing and advertising campaign is intended to drive listing appointments to the LPEs”

For the expansion into the US to succeed, it is crucial that this marketing is successful.

Overall

The timing of this bold expansion into the US seems ideal. There is a fair amount of risk involved because PURP is looking to change customer habits and drive listings through it's platform rather than those listings being sourced by well known local Agents.

The success of companies like Redfin suggest this is not an impossible task, and PURP’s plan to steadily expand state by state mitigates the risk of an unsuccessful marketing campaign. If it succeeds, the opportunity is enormous. In the meantime, I look forward to more detail from Management at its next update.