Shares in CMC rose 5% as drop in profits was better than initially feared

Companies: CMC Markets Plc

AIM-listed spread betting firm CMC Markets enjoyed a 5% bump in share price this morning following better than feared FY results, with a 5% fall in revenue and 9% drop in pre-tax profits.

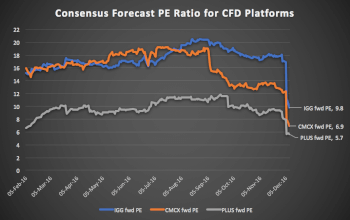

The firm said the lower revenues and profits were due to lower levels of volatility in the markets, which translates into less activity from spread betters, an industry-wide trend also reflected in recent updates from IG Group and Plus500.

The 5% jump came because investors had anticipated greater declines.

Total revenues hit £160.8m, while PBT came in at just under £50m. Despite the lower volatility, the firm added 5% to its active client numbers, with 60,082 in total during the period.

CMC says it will pay a final dividend of 5.95p a share, broadly in line with last year's FY dividend of 8.93p, giving a yield of about 6%.

CEO Peter Cruddas said the year had been disappointing that reduced activity had impacted revenue for much of the year, but added that he was happy with his team and the platform.

"We have continued to make excellent headway with our five strategic initiatives in 2017 and signed the biggest institutional transaction in our history, our partnership with ANZ Bank. Clearly regulatory change is likely to have some impact on the business but we believe we are well positioned to benefit from market share gains in the medium to long term, with our ability to adapt our leading proprietary technology and focus on client service and regulatory compliance supported by our financial strength."