Millennials are "Digital natives" with high expectations who account for 25% of the UK

Companies: ASC, BOO, HL/, JE/, OCDO, PURP, RMV

Morning all,

Unless I get inspired by the Christmas Turkey, this will be my last piece before the New Year. I have to say I'm greatly enjoying writing the column and find it helps me take a step back from the coal face and think about the bigger and longer-term themes, so I hope people are finding it interesting. The Research Tree team tell me it's well received, and so I shall continue...

This week I will be writing about Millennials and why they are so important. Tied into this is the changing landscape for retail-facing businesses with a brief comment on some of the rising stars.

My plan for Christmas? To think more about what makes Millennials tick

I've always thought of myself as a bit of a "techie" and I like to keep up with the latest trends. However, my recent hire of a bright, 25yr old chap has confirmed to me that his (and his generation's) fluency with technology is at an entirely different level to that of my generation. Ready access to the internet, immersion in social media, and a plurality of smartphones and tablets make twentysomethings true digital natives. As Pew Research says, Millennials are:

"Digital natives in a land of digital immigrants."

Why care about Millennials? Because their demands are shaping our future businesses

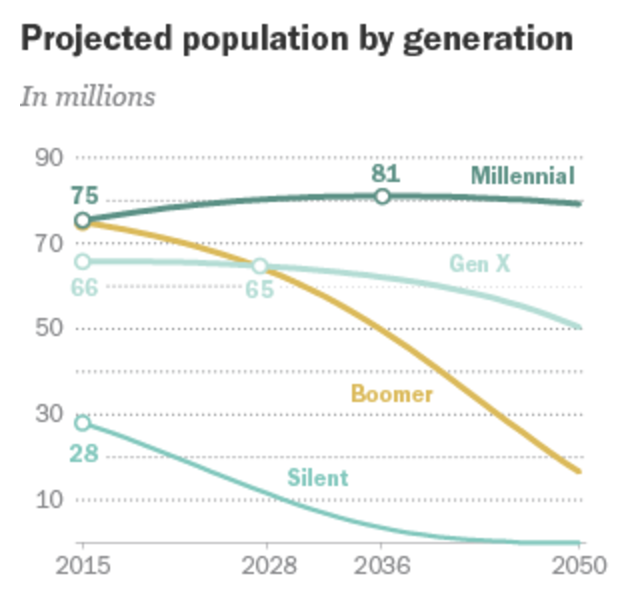

An interesting thing happened in 2016. Millennials became the biggest demographic in the US, overtaking the Baby Boomers. Closer to home, in the UK, the Boomers were passed by the Millennials in 2015.

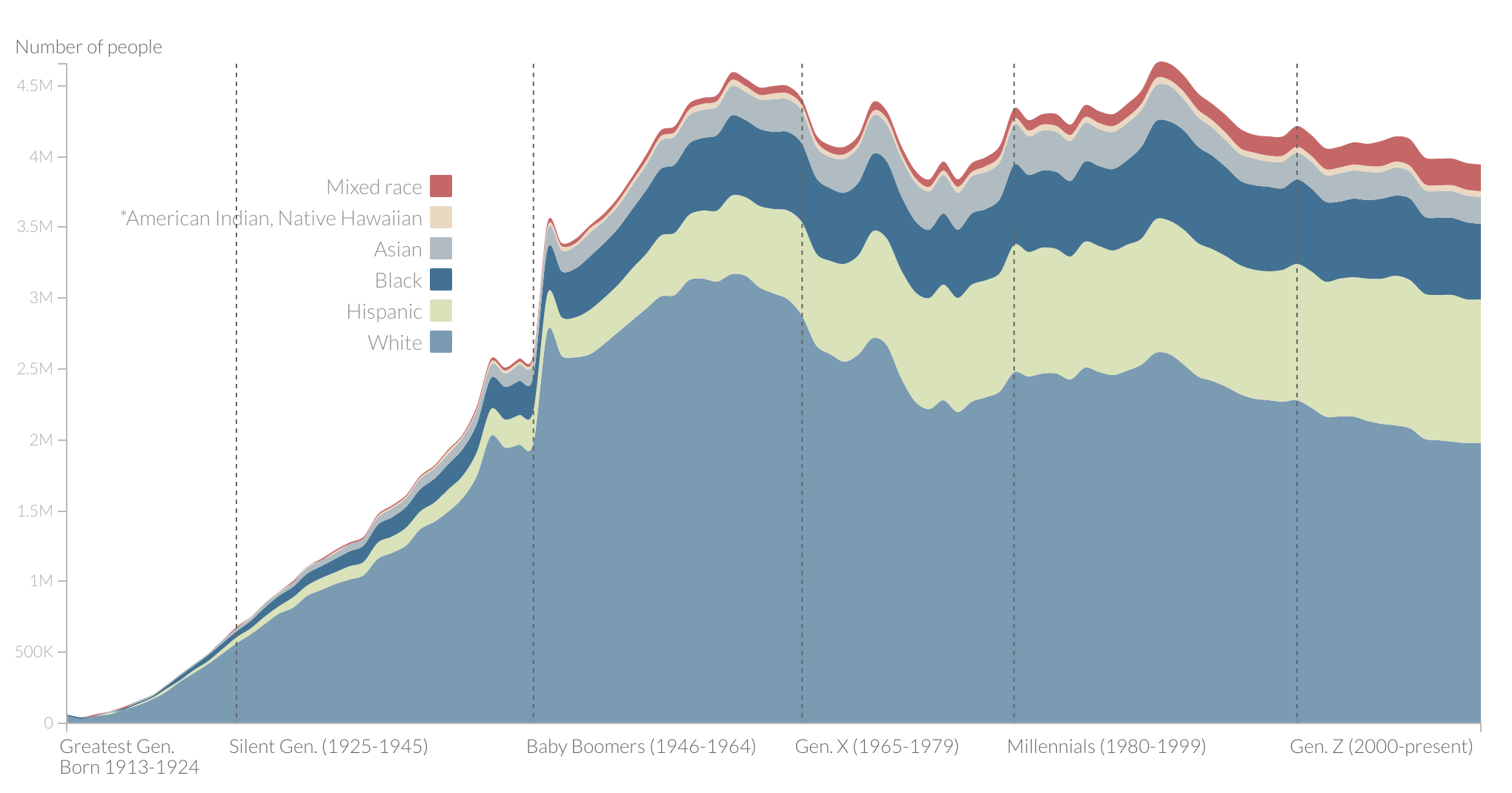

CNN have a great graph showing the US demographic, which I have borrowed below.

As you can see from the chart, the Silent Generation are those born up to 1945, the "Boomers" are those born from mid-40's to mid-60's, "Gen X" are the generation born from 1965 to 1980, and Millennials are from 1980 to 2000. Gen X has always been the smaller generation sandwiched between the post-war Boomers and the Millennials. This is a result of lower birth rates during that period.

Pew Research put out an interesting article on this back in April, including the graph below which forecasts how the US demographics will shift over the next ten years.

Some facts showing why Millennials are important:

Millennials are the #1 workforce demographic in the US,

They spend $1.3tn annually in direct consumer spending,

$40tn of wealth will pass from Boomers to US Millennials in the "Great Transfer" over the next 20 years,

In the UK, Millennials account for 25% of the population and will hit 17 million by 2019

And why Millennials are demanding:

70% of young people agree they are “impatient” [Youth Trends Report 2016],

The vast majority see themselves as "on the cutting edge of technology" [Telefonica study],

80% reported owning a smartphone and 45% a tablet [Telefonica study],

Driving change across almost every sector

If you look at every sector that sells directly to retail customers, the level of creative disruption is high and rising:

The Sharing Economy has seen AirBnB change the way we think about holidays, and has taken significant market share away from the hotel sector,

Uber is redefining not just the taxi industry but car ownership and urban transport,

Clothes retailing has been taken over by the online experience of platforms like Amazon, Asos, Boohoo, and many established high street companies that have built strong online positions,

Platforms like Just Eat now dominate food delivery,

Ocado has driven change in the supermarket sector, altering the way many people buy groceries today,

Share Trading is primarily executed through a small number of online platforms like Hargreaves Lansdowne, TD Direct, and Barclays, at the cost of the traditional "stockbroker",

Fund Managers are losing market share to robo-advisors like Nutmeg and Wealthfront,

Rightmove has revolutionised the Estate Agent sector which now faces an existential threat from the PurpleBricks business model,

The Broadcasting giants are under tremendous pressure from the rise of Netflix and Amazon Prime streaming services.

Providers of media content have also been wrong-footed as these same streaming giants now heavily invest in their own content to keep their customers satisfied,

Banks are facing disruption from Fintech such as Monzo, the challenger banks, and funding platforms like Zopa,

And the list goes on and on…

The conclusion is clear

Millennials are already the biggest demographic, and they will continue to grow market share as the Boomers succumb to the inevitable. The common theme through all of these changes is the user experience that is now demanded by Millennials. As a group, they are far more “tech-savvy” and far less willing to put up with slow or poor service than older generations. A joined-up, engaging online presence is mandatory.

Established companies that can adapt and invest to make sure they stay relevant and engaging to consumers will thrive. Corporations that rest on their laurels and their market share will go the way of Blockbusters, Woolworths and BHS.

Spotting The Next Asos

For the above reasons, businesses with a strong online presence and a high focus on great user experience are well placed for the future. That's why I love scalable platform companies.

The prospect of finding the next Asos, Boohoo or Just Eat is what gets me up in the mornings. This is a subject for its very own article, but in the mean time I would point out the Next Asos theme Research Tree has created in its Themes section (click here). Personally, I would tweak the filters slightly, but it's an interesting starting point. It throws up some quality prospects that are worthy of attention, including G4M and UTW (although it does also include some questionable entries...).

Merry Christmas all!

NFM

-----

To read a brief outline of how I think about stocks, and what I aim to achieve in this blog, please check out my first blog where I set out my stall.

Please Note: To be clear, I do not and will not ever give any advice. I will rarely mention individual stocks but when I do these will not be recommendations, instead just my thoughts at that point in time.

_m.jpg)