Online supermarket's margin pressures do not look likely to subside any time soon

Companies: Ocado Group PLC

Ocado (LSE: OCDO) put out a trading statement today confirming that over the 12 weeks to August 7th, it achieved the best volume growth performance in over five years, whilst also flagging that margin pressures remain and do not look to be going anywhere anytime soon.

In the brief announcement Ocado announced topline figures showing good revenue growth of over 15%, even better order volume growth of 19%, but with a slightly pared average order size of £108 (down 3.4%):

The Group had cash of £48.1m on August 7th, down from the £52m reported at the Half-Year results, and external debt of £86.5m.

Despite the robust growth, Ocado also highlights that ongoing margin pressures inherent in this industry:

"As the market remains very competitive, we are seeing sustained and continuing margin pressure and there is nothing to suggest that this will change in the short term."

Despite the margin pressure, Management struck a confident tone reiterating it expects to grow ahead of its competitors and "substantially ahead of the market overall" given its focus on customer experience and its proprietary technology.

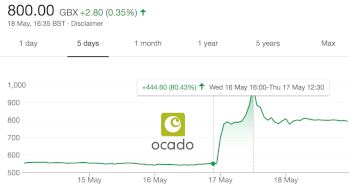

The market has focussed rightly on the margin pressure this morning rather than the top line growth, with shares off 7.5% in early trading. The share price has bounced over 40% since the Brexit vote.

Tim Steiner, Ocado's Chief Executive Officer, commented:

"As the market remains very competitive, we are seeing sustained and continuing margin pressure and there is nothing to suggest that this will change in the short term. However Ocado's combination of choice, competitive pricing, and industry-leading service has contributed to an increase in average orders by nearly 19%, our best volume performance in more than five years."