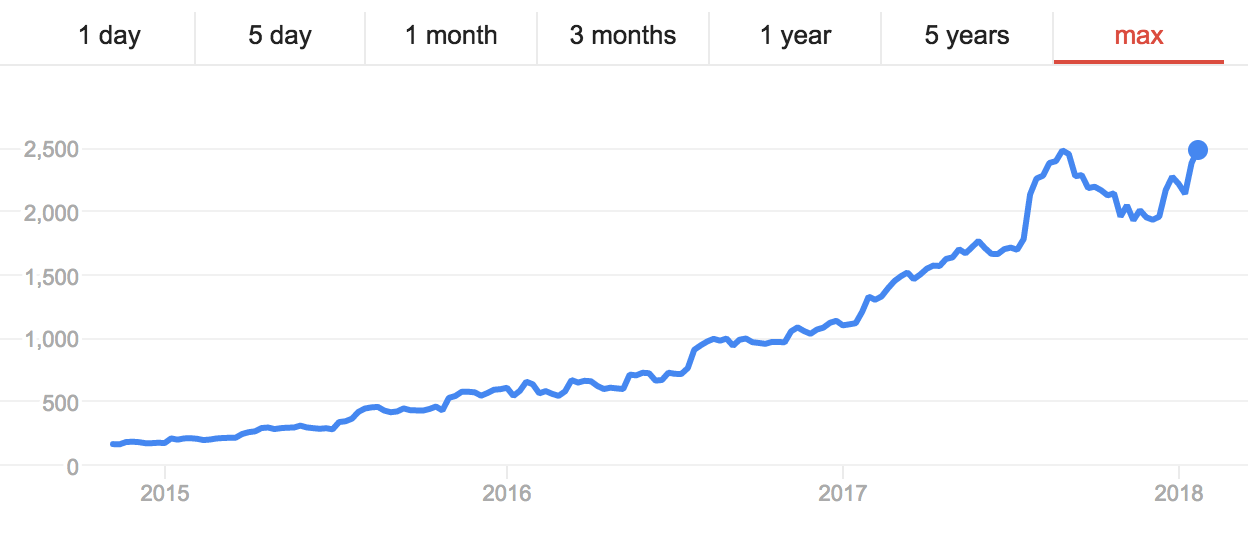

The stock continues to go from strength-to-strength, continuing its incredible rally since IPO into 2018.

Companies: Fevertree Drinks PLC

Fevertree Drinks' (LON: FEVR) has seen its shares jump this morning off the back of the Group's trading update, highlighting its continued market domination in the UK and abroad.

The premium carbonated mixers company has reported a period of "very strong growth" with Revenues for the full-year expected to be approx. £169m, up 66% from FY16. H2 17 Revenues are also up 58% on H2 16.

In the UK, Revenues are expected to be c. 96% ahead of 2016, boosted by a "particularly notable" Christmas period. In Europe, full-year Revenue has grown 42% while in the USA Revenues are up 39%, helped along by the opening of its first stateside office.

Rest of the World sales also jumped by a healthy 57% in FY17.

As a result of the numbers, Management said it now expects "the outcome for the full year will be comfortably ahead of market expectations".

Commenting on today's announcement, Tim Warrillow, Co-founder and CEO of Fever-Tree said:

"While we have seen strong growth across all regions, our performance in the UK over the Christmas period was once again exceptional. Our growing range of mixers and formats are appealing not only to our loyal customers but also bringing consumers back to the category and importantly attracting a new younger audience.

There is clear evidence that the same trends of premiumisation and mixability that we've previously highlighted are accelerating and we are increasingly excited by the global opportunity this presents particularly as we transition to our own operations in the US."

Shares were up as much as 8% in early trading on Wednesday but have since settled at +2%.

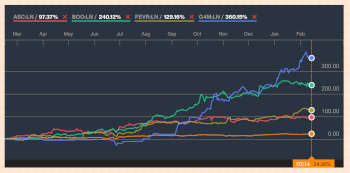

The stock has performed incredibly well not only in 2017 but ever since its IPO in 2014, growing over 1,400% in just over three years. In 2017 alone its share price doubled.

According to data on Stockopedia, FEVR has a Revenue CAGR of 53% for the 7 years to 2018, an impressive Net Profit CAGR of 64% for the same period, and an average operating margin of 24%. At its last Interims, it had a cash balance of £46m.