Check out what's been trending on Research Tree this week

Companies: APP, ENTU, FPM, FLOW, GSK, RKT, RTHM, RKH

With a snowy weekend on the cards (perfect for reading), here is our weekly digest covering some of the most popular research on UK equities published this week.

In the markets: It was a busy week for Plus500, who announced a robust set of results and a move into South Africa. Boohoo confirmed its move into the US with the $20m acquisition of Nasty Gal, and as you can see below Reckitts confirmed its $17bn deal for Mead Johnson.

Bad advertising…Big agencies and Google in the firing line?

Rhythmone Plc (RTHM) | N+1 Singer, 9 February

"The Times is running a major investigative story suggesting that major brands are "unwittingly funding Islamic extremists, white supremacists and pornographers by advertising on their websites". This is not the first time that the issue of online media budget spend processes resulting in brands being advertised alongside inappropriate media has come up..."

Operations update; Delek downside protection

Faroe Petroleum Plc (FPM) | Panmure Gordon & Co, 10 February

"Faroe updated on its FY16 performance, which was in line with previous guidance. The main incremental highlight was a good reserves replacement performance, excluding the direct impact of the DONG acquisition, which we calculate at 114% underlying. For FY17 production guidance of 12-15kboed looks on the light side at the low end of the range, reflecting..."

Trading in line but dividend cut in FY17

Entu Ltd (ENTU) | Zeus Capital, 7 February

"Entu has announced that EBITDA from continuing operations will be within the range of its previous guidance of £2.5m to £2.9m at £2.6m to £2.7m. This is in line with ZC forecast of £2.7m in FY16. The FY16 outcome, combined with the fact that revenue for the first three months of FY17 are also in line, is reassuring considering the issues the business has faced during the year. FY17 forecasts..."

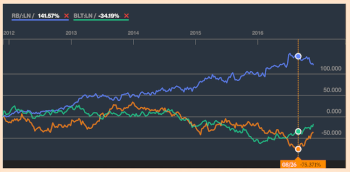

$17bn For Mead Johnson Confirmed – +1% OSG in Q4

Reckitt Benckiser Group Plc (RB/) | Whitman Howard, 10 February

"Reckitt Benckiser (RB/ LN, BUY, T/P 9000p) released their full year results this morning beating on both EPS and revenue. Sales for the full year increased 11.5% to £9,891m beating consensus forecast of £9,863m. EPS was at the top end of the range at 302p (vs 296p)..."

Glaxosmithkline (GSK) | Beaufort Securities, 10 February

"GlaxoSmithKline PLC (GSK.L) reported robust FY-16 results, with its Q4 especially benefitting from strong growth in new US$ related products and GSK's cost base being predominantly in the UK. Overall, full year organic revenue growth was 6%, delivering some 12% earnings growth. The key risk to GSK's earnings this..."

Flowgroup Plc (FLOW) | Equity Development, 8 February

"In November Flowgroup kicked-off a strategic review of its mCHP boiler following the UK government's shock decision to slash Feed-in-tariffs (FiT) - compounded by sterling's devaluation vs the $/€, leading to a 17% increase in manufacturing costs...."

Rockhopper Exploration (RKH) | Edison, 9 February

"The operational update from Rockhopper (RKH) contains no significant news, but does draw a line on the rig litigation (now settled) and provides further detail on the drilling activity in Egypt in 2017. Two wells will be drilled in H117, an exploration well followed by a development well, which will target a reservoir..."

Product innovation continues with Mastercard

Park Group (PKG) | Edison, 10 February

"Park's approval as a licensed Mastercard issuer will support further new product initiatives and is a useful third-party vote of confidence in the robustness and security of Park's systems. However, Park is a story of continual innovation and transformation, driven by e-commerce investment, aimed at better..."