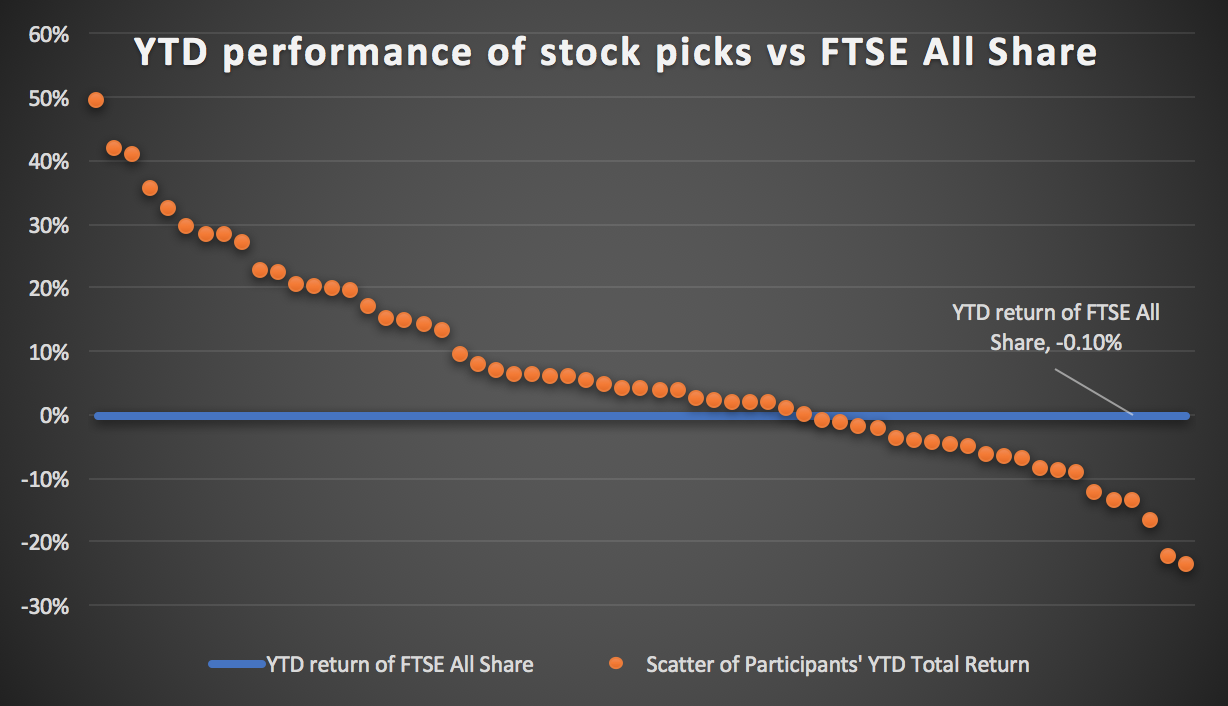

Whilst it's only early days, our users are already comfortably beating the market

Companies: BNN, IOM, IQE, LSF, MCRO, SPE, TRAK

As explained below, here are some of Research Tree user's top picks in Tech/Software, Telecoms and Semiconductor sectors for 2017.

At the tail-end of 2016, we asked our core users for their stock picks for 2017 and their associated rationales. We had a fantastic response, and after receiving some excellent insights from a group of very clued-up investors, we decided to share some in a series of articles.

As you can see, the picks as a group are significantly outperforming the FTSE All Share which is currently flat year-to-date, although it is admittedly still early days.

Our users are mostly Sophisticated or High Net Worth private investors, but we also have a growing number of professional investors and commentators.

We thought it would be a good idea to share some of their views and rationales. However, we got so many quality responses that we have had to split them broadly into sector groupings.

Below is a quick run through some of the picks in the Tech/Software, Telecoms and Semiconductor sectors.

Tech/Software

Tech stocks are an important part of any growth investor's portfolio. There are two key factors to look at when considering investing in growing tech companies: scalability and margins.

Tech companies that are truly scalable see their margins improve over time as legacy costs are paid off and as acquisition costs decline with increasing brand recognition/popularity. Many of these stocks achieve growth and margins that are simply impossible for brick and mortar firms, hence their often sky-high valuations.

When we asked our users who they thought would do well this year we got some interesting insights on Microfocus, BNN Technologies, Sopheon, Iomart, and Trakm8.

Microfocus was in the press a fair bit last year after its acquisition of HP's Enterprise division and, not surprisingly, was a pick for several of our users (and our CEO Rob!). One private investor said he believed it was in a good place to weather whatever 2017 could throw at it, as the firm is "insulated against currency risks" and other factors that could affect more consumer-sensitive stocks.

Our CEO Rob, who also chose MCRO for one of his picks, said:

"What Mr Loosemore and his team have achieved at MicoFocus is highly impressive. I would back them to bring margins at HP Enterprise towards those of MicroFocus. Currently HPE has 20% EBITDA margins compared to MicroFocus margins of 46%. Indeed, MCRO bought HPE for 11.4x EBITDA. Bringing the margins fully in line would increase EBITDA from the new addition from $660m to $1.3bn which would drive significant earnings accretion. I’m not expecting MicroFocus to bring HPE completely in line with its established profitability, but if they achieve half that job then the acquisition was an absolute bargain."

Purplebricks is a high profile growth stock looking to disrupt the estate agency market. This is another of our CEO's picks and here's Rob's rationale

"To disclose I own shares in PURP.

This is a classic example of a growth company where the multiples look crazy. However, in early December PURP announced it had crossed the EBITDA threshold, with profitabillity in H1 '17 and more revenue in H1 than the previous 12 months.

The size of the opportunity vs the current market cap is enormous. PURP only account for less than 3% of UK transactions and the opportunity in Australia is also significant. Estate agencies have been charging too high a fee for the service they provide in my view for a long time, and a platform offering like PURP could reshape the landscape.

The bull case is not that it takes over the market, like a Just Eat. That is too optimistic in my view. But in the process of reshaping the industry it is a reasonable position to assume PURP wins a decent market share. That would put it on a multiple of current valuations.

The upfront nature of the payments should mean PURP has a semi-negative working capital business model allowing organic investment of cash flow. It is marketing heavily and its competitors will find it hard to compete, especially given incumbent estate agencies are in effect marketing to maintain market share but erode margin."

BNN Technologies is a transactional database specialist which is currently in the process of dual-listing on the NASDAQ. One investor told us why he thinks it is a "blue sky" pick with "massive" potential:

"... [BNN has] pivoted away from a reliance on the (currently suspended) Chinese lottery into a deal with Xinhua news agency (government mouthpiece) in China to take a small commission on transactions going through the Xinhua app, ranging from utility bills to mobile top ups and parking fines."

Stockbroker Hybridan is also optimistic about BNN, saying in December that its entry to the fast-growing Chinese digital ad market was "significant", with further contracts and agreements expected before year-end. Hybridan also said the Nasdaq process is well advanced and the firm is investing heavily in R&D.

Sopheon is an Enterprise Innovation Management software specialist whose share price has increased more than 400% in the past 12 months. One of our users says he has held Sopheon since mid-2016 (nice work!), explaining his pick as being "very cheap" for a software company with a great product (Sopheon has a market cap of just £25m):

"I saw it spike earlier in the year and didn’t buy but after the results (in June I think) and a wave of big director buys, I thought it looked good. The interims were very strong and I hope that the second half of the year will see further contract wins. Even at the current level I think it could be very cheap for a software company where the product really seems to be getting traction."

According to broker finnCap, Sopheon has seen a resurgence of momentum in the second half 2016, showing the opportunity for profitable growth.

Another of our users chose Cloud hosting Saas company Iomart as his safe pick for 2017. He told us the firm had consistently delivered good earnings growth and excellent cash generation:

"The dividend has the capacity to keep growing at 25% plus alongside earnings and the prospective P/E looks reasonable compared to its equivalents."

Iomart is up c.40% in the past 12 months but has remained relatively flat for 2017 so far.

The final tech stock is Trakm8 Holdings, a small-cap fleet management specialist who saw its share price tumble 50% in November after a hefty profit warning. According to one of Trakm8's investors, the firm is now in turnaround mode and announced a restructure in December that he believes "will bring the company back alive." He also believes the firm is an attractive acquisition target going forward.

Telecoms

The Telecoms sector looks like it's in for an action packed 2017, with 5G, the IoT, regulatory reform, security, and M&As featuring heavily. We received just one Telecoms pick from our users, Laird Plc.

Laird Plc is a high-tech telecoms company that provides systems, components and solutions to "protect electronics from electromagnetic interference and heat" whilst enabling connectivity in mission-critical wireless applications and antenna systems. Serious stuff.

"The company announced just before Christmas that it would be rebuilding its balance sheet with a rights issue in Q1 2017. Some may read this is as a veiled "for sale" sign for the company and therefore a speculative play. Only yesterday Alphaville reported that it could be an obvious Apple consolation play. Watch this space."

Semiconductors

Semiconductor specialist IQE manufacturers epitaxial wafers (whatever they are) for a wide range of technology applications for wireless, optoelectronic, electronic and solar devices. It has been on a bit of a streak with EPS growth averaging c.12% over the last 4 years, and are trading on around 13x forecast earnings.

"I chose IQE because the business is growing strongly and on a modest rating. I have held it since August or so. Given the forex change, it could also make an attractive takeover target."

IQE stocks increased 100% in 2016, and have had a fairly decent start to 2017.

-----

Read our users' picks across the other sectors here:

- Construction, Support Services, and Financial Services stocks for 2017

- Energy, Pharma, BioTech, and Publishing stocks for 2017

- Bars & Eateries, Household Goods, and Clothing Retailer stocks for 2017

Please Note: This article is not intended to be advice or a recommendation to buy, sell or hold any investment mentioned, nor is it a research recommendation. Investors should form their own view in relation to any potential investment.