M&A closes gap between fundamental value and what "Mr Market" currently discounts

Companies: CHT, KHC, LVD, ULVR

Evening all

This week I'm writing about the impact of M&A on equity markets. I started writing this when Buffet's Kraft bid for Unilever was still in play. While that deal has been retracted, the impact on valuations in the market has not, and I think this will be an increasing trend for UK equities over the next 12 months. We are seeing examples of post-Brexit M&A across the market cap scale. The upshot, in my view, is a supportive environment for company valuations in the near-term.

UK-listed companies do not exist in a vacuum. In $ or € terms they have become significantly better value since the Brexit vote, and I believe over the last six months we have only begun to see the effect of this on the M&A market.

Sterling slump to drive more inbound M&A

There are a lot of high quality, cash generative companies listed in the UK. These businesses have global footprints, strong balance sheets, and attractive growth potential, irrespective of our decision to leave the EU. When we see a lurch down in sterling such as the one we saw last year, the sterling-denominated value of these companies mathematically goes up.

However, M&A activity from foreign players doesn’t just underpin share prices; it can drive a sustained rise in valuations beyond merely offsetting FX moves and translational benefits. The drop in sterling has suddenly put a lot of companies “in play”. When that happens, M&A activity increases, closing the gap between fundamental value and the price Mr Market is currently putting on a company.

Plenty of capital available

US companies, especially in the Tech sector, have mountainous levels of cash sitting outside of America. This source of capital is another reason to be optimistic about M&A activity. Some of these cash piles could start moving back to the States if Trump carries out his plan of offering a tax amnesty, but it’s not yet clear what Trump’s plans are in this respect, how much impact it would have, and what the timeline might be.

$-revenue/£-cost-base companies should see margin expansion

Another factor that provides a nice tailwind for certain companies is the margin enhancement for business with global revenues and UK operating costs. Granted, this doesn’t benefit all companies, but it is beneficial for those with a high proportion of revenues outside the UK but costs based within the UK and denominated in Sterling. These companies should see margin expansion as the sterling move has made them inherently more efficient.

Still too early to assess Brexit impact on M&A

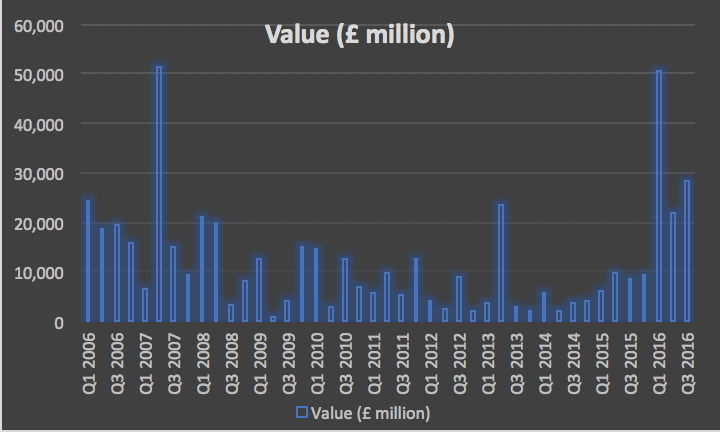

The below graph shows the latest ONS data on Mergers and Acquisitions. It currently only includes one quarter, Q3 2016, following the referendum, so we can’t draw any firm conclusions yet. Data for Q4 2016 should arrive in the next month or so. It’s a little early to conclude decisively that there will be a big increase in activity.

The lifecycle of a deal takes many months, and we are only half a year on from the sterling slump. I would expect activity to increase in 2017, and this should lead to a realisation of the actual value of these companies rather than the, often, much lower value discounted in the markets.

But recent activity certainly catalysed by Sterling drop

Anecdotally many of the recent deals and opening bids have been catalysed by the drop in sterling.

Recent examples of foreign-to-UK M&A

Last week saw the proposed gargantuan merger of Kraft-Heinz and Unilever. The ever-sage Warren Buffett, whose Berkshire Hathaway vehicle owns roughly a quarter of Kraft, had his fingerprints all over this deal. I would imagine Unilever is a company that has been on his radar for many years, especially following his Kraft Heinz merger in 2015. The sterling slump is clearly the catalyst, but for a company as global as Unilever, the GBP FX rate was not going to inform the final valuation paid, were a deal to have been done. As it happens, Kraft retracted its offer over the weekend.

Unilever is a core holding of many large UK and European funds with a reasonable c. 3% yield, a multi-decade track record of paying a dividend and a ten-year dividend growth rate of over 6%. These core shareholders and Unilever Management appear to have sent a clear message to Kraft, precipitating its swift retraction.

A minor skip down the market cap scale, and more into my universe, was the recent battle over Lavendon. This was another example of a Brexit-catalysed acquisition, but the to and fro between Dutch group TVH and the ultimate winner, French group Loxam, resulted in a much fairer value being reached, a value that was far above the undisturbed share price. The market cap before the first bid from TVH was too low at around £230m (125p/shr) By the end of the bidding process it had risen to c.£460m (i.e., 270p/shr).

A slightly more infuriating recent example was Constellation Healthcare Technologies where the CEO, who also happened to be the major shareholder, took advantage of the sterling drop to take his company private. The price he managed to do it at was a steal in my view, but given his large holding, there was little minority shareholders could do. That company is set for strong growth over the next few years, the fruits of which we now can't enjoy. I expect we will see a re-listing perhaps on the Nasdaq in a few years time at a much higher price...

To conclude

I believe we are in the foothills of a material rise in M&A activity coming from abroad, and I expect corporate financiers are running their rule over lots of UK companies which offer complimentary assets and synergies for their clients. Brexit is the catalyst, and the increased activity should lead to an increase in the valuations discounted in the markets.

The upside for investors is a nice bump in performance that year, but the downside is the reduction of quality companies in which we can invest.

-----

To read a brief outline of how I think about stocks, and what I aim to achieve in this blog, please check out my first blog where I set out my stall.

Recent blogs:

- 14 Feb 17 - Anatomy of a growth company

- 6 Feb 17 - Roll-outs: the Good, the Bad and the Ugly

- 30 Jan 17 - How MiFID II could hurt Small and Mid-caps

- 23 Jan 17 - Why Pearson was an obvious value trap, and is Jackpotjoy worth a closer look?

- 16 Jan 17 - How sustainable are current dividends

- 8 Jan 17 - Implications of Trumponomics for equities

- 18 Dec 16 - Millennials - Becoming the most important demographic

- 12 Dec 16 - CFDs - Tough week but worth a closer look

- 5 Dec 16 - Pension deficit dogs starting to look interesting

- 28 Nov 16 - Setting out my stall...plus my thoughts on bond proxies

Please Note: To be clear, I do not and will not ever give any advice. I will rarely mention individual stocks but when I do these will not be recommendations, instead just my thoughts at that point in time.