Rhino is in a position to generate significant free cashflow to service this 5.5% coupon

Companies: Rhino Rugby Bonds Plc

Rhino’s second series of 5-year bonds offers exposure to a private company with an enticing set of characteristics, combining significant growth potential with proven ability to deliver over a 40-year history.

Having spent several years shifting its business model away from capital-intensive production towards closely controlled licensing, and then investing heavily in increasing exposure at the top level of international rugby, Rhino is in a position to generate significant free cashflow to service this 5.5% coupon and offer attractive growth potential, further strengthening debt serviceability ratios.

Listing

Private Company

Issue Details

- Up to £7.5m

- Target: £0.53m

- 5.5% Initial Yield

- 6-monthly Coupon

- 1st Coupon 31/03/21

- Maturing 30/09/25

- Non-Transferable

Further Details

The Business: A global leader in sporting equipment

Trading since 1988, and having been subject to an MBI by the current management team in 2006, Rhino provides training equipment, balls, and teamwear to various sports leagues and teams around the world – with a strong focus on rugby. Rhino has, for example, now been the official supplier of training equipment and pitch kits to the Rugby World Cup for three cups in a row: in New Zealand (2011), England (2015), and Japan (2019), and 5 in total. This has been part of a concerted and successful effort to raise the profile of the Rhino brand.

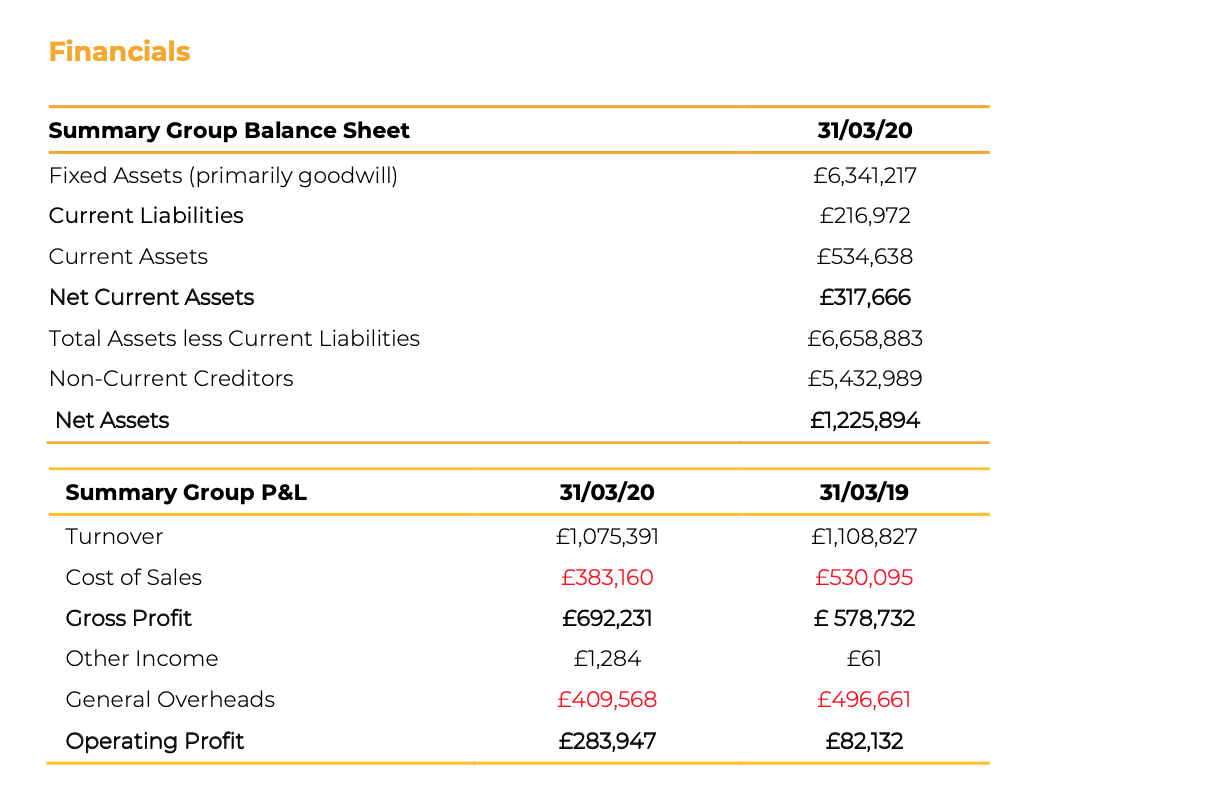

The Financials: A long and strong track record

Already high gross margins should expand as the mix continues to shift towards the licensing business: margins and growth are both higher in licensing than in owned- production.

Additionally, the balance sheet looks strong. The only coupon-paying debt is the 7.5% Series 1 bond, which will be repaid using the 5.5% Series 2 bonds. Assuming a raise, as targeted, of around £0.53m, debt serviceability ratios look strong, with a 10.8x operating profit to cash interest multiple, suggesting that the business has ample headroom to service this debt.

The Instrument: A strong yield for the next 5 years

Having successfully serviced its first bond, the £502,000 7.5% Series 1, before Rhino had progressed far down the road to internationalisation and licensing, servicing the new 5.5%s should prove easy. Any expansion of the total indebtedness resulting from excess demand for the Series 2 issue will be applied to working capital to fund profitable growth, preserving or improving the debt serviceability outlook in the medium and long term.

Further Details

Background

Trading since 1988, and having been subject to an MBI by the current management team in 2006, Rhino provides training equipment, balls, and teamwear to various sports leagues and teams around the world – with a strong focus on rugby. Rhino has, for example, now been the official supplier of training equipment and pitch kits to the Rugby World Cup for three tournaments in a row (5 in total), in New Zealand (2011), England (2015), and Japan (2019). This has been part of a concerted and successful effort to raise the profile of the Rhino brand in these product categories, and within rugby generally.

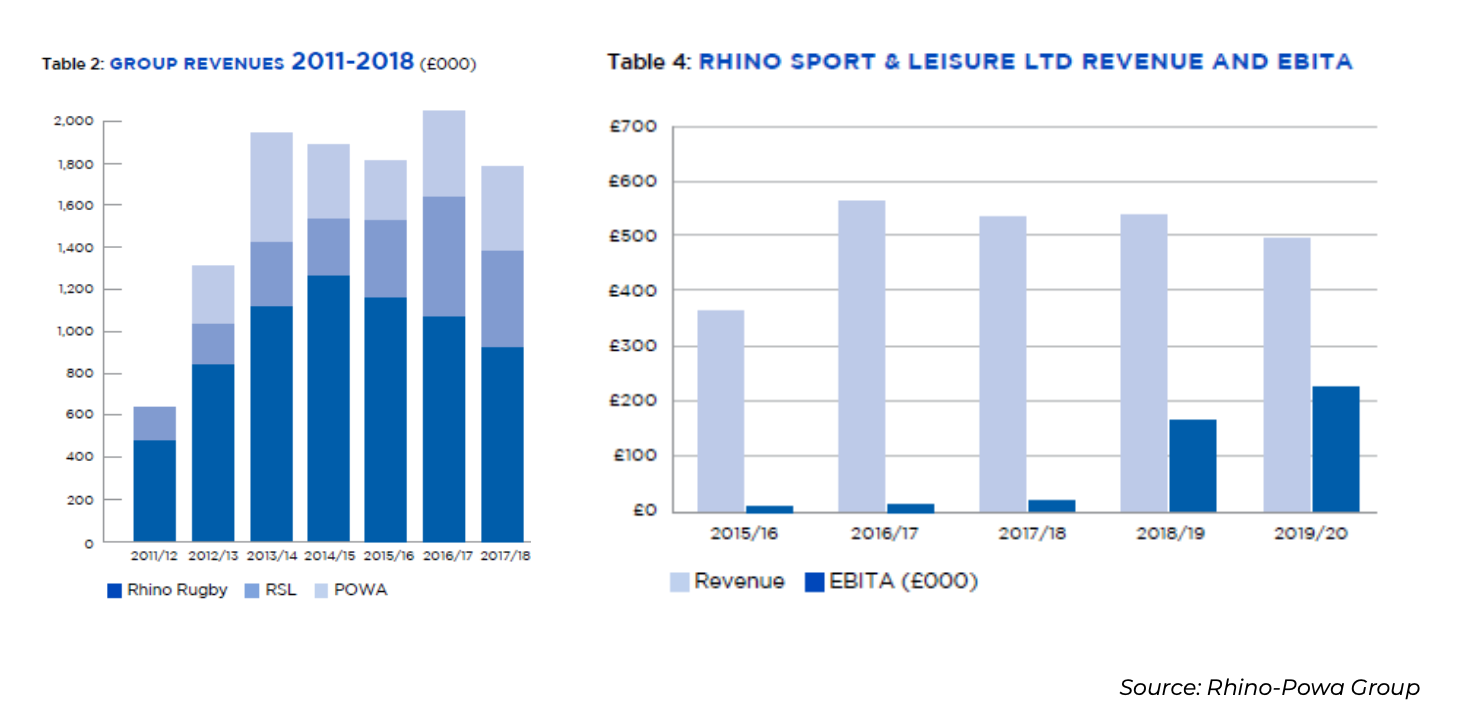

Since the MBI in 2006, Rhino’s history can be summarised into three phases: firstly there was a period of steady state trading to 2010, with operating margins consistently in the 5-10% range. In 2007 management signed the first teamwear licence, but unfortunately the Global Financial Crisis hit soon afterwards and limited the positive impact. However, 2009-2010 saw the beginning of meaningful revenues from licensing.

This second phase was part of a push for licensing growth both internationally and across its product ranges between 2010 and 2017. These licences typically last for 3-10 years and Rhino is paid around 10% of sales. Between 85% and 90% of revenue is now achieved through licences.

In 2012 Rhino acquired Powa Products, a long-standing (friendly) New Zealand rival and supplier of rugby training equipment, including to the New Zealand national teams and squads and the 2011 Rugby World Cup. This significantly increased revenue overnight and led to the dual branding of the group. In 2019 Powa won and successfully delivered the contract to supply all technical training and pitch kits to the Rugby World Cup in Japan; no mean feat.

Rhino-Powa continues to develop and sell its own products where its technical expertise and reputation are required – primarily in scrummaging machines and contact suits, which both need to evolve alongside game trends and rules. In particular the Powa subsidiary works closely with world leading coaches to develop new scrummaging machines to help players and teams train in line with the latest engagement protocols.

Between 2010-2018 revenue more than doubled. After this point revenue doesn’t tell the whole story though, because in April 2018 c.£750k-£1m of annual revenues were licensed out to Rhino Global Ltd. The result of this switch from own-sales to royalty income is lower revenue but the same or higher profit. In very simplified terms instead of generating sales, subtracting costs, and recording the resulting profit, Rhino-Powa group is paid an income roughly equivalent to this profit, directly by the licensee. As such margins increase significantly, as illustrated in the two charts below:

The third phase, from 2018 onwards, involves the push for growth through active brand management. Rhino has supported the licensees through marketing spend, predominantly on Official Supplier deals - see the appendices for a list of major leagues and tournaments sponsored. This focus on licensees and profitability through efficient brand management is what we expect to provide the majority of growth: the need for scrum machines is relatively constant, as despite taking a knocking they last for a long time! Any moves into new markets or new categories is likely to be pursued with licensing partners, rather than through direct entry.

In recent years Rhino has spent over £1.5m on sponsorship deals, which have been a major component of its marketing strategy. Now it’s entering more of a ‘steady state’ era in terms of sponsorship costs, and is looking to capitalise on the brand recognition achieved to date.

Segments

The key segments include Balls, Technical & Training Equipment, and Clothing - which includes teamwear and more casual ‘athleisurewear’.

Balls

Rugby balls are increasingly commoditised, so those that achieve the most screen time tend to sell best. Rhino has taken on market leader Gilbert by providing top quality balls, ensuring that they are used in televised professional leagues. Rhino is “Official Supplier of match balls to the Rugby Europe and Asia Rugby units of World Rugby – 78 of the nations in membership now play international matches under their jurisdiction with the Rhino Vortex Elite ball.” It has also, under 6-year deals, been the match ball in the PRO12 professional rugby union league and the European Super League in rugby league, and the training and supporters’ ball for 3 British & Irish Lions tours. Rhino is also currently the Official Match Ball for Major League Rugby in the USA and Global Rapid Rugby in Asia/Oceania; both professional leagues.

As Rhino CEO Reg Clark says “The ball is the one thing always in camera shot on TV” so this spend has proven worthwhile. Rhino is now firmly positioned as the challenger brand to Gilbert, the traditional market leader in top of the range match balls. The volume market for lower grade balls is dominated by suppliers such as Sports Direct and the brands they choose to favour in this category.

Next, Rhino will use this hard-won recognition and credibility to better penetrate the ‘grass roots’ club rugby market to gain higher volumes and market share. This is a well proven model, sponsoring international and national matches to gain a ‘halo effect’ and using that to sell to more ‘grass roots’ leagues and teams. As such we expect Balls to be a significant growth category for Rhino.

Technical and Training Equipment

Rhino’s world leading position in scrum machines, having invented them in the 1980s, appears unassailable at present. Its presence in other technical training and contact equipment is underpinned by its reputation for proven, high quality products that are the culmination of 40 years of development.

Development is carried out in conjunction with leading coaches, particularly in New Zealand where Powa is based, which has the advantage of keeping its products at the cutting edge and ensuring that R&D expenditure is properly targeted to provide the best outcomes.

Key competitors include Predator in the UK, Silver Fern in New Zealand, and Scrummaster in Canada. However, all three of these have lost market share to Rhino in recent years.

In this segment Rhino, largely through Powa in New Zealand, designs, manufactures, and sells its own equipment. It therefore achieves lower margins than the licensing side of the business but retains more control.

The outlook here remains solid, but this is a relatively low growth (12.5% growth in 2019 vs. c.19% for licensing) business and as such will likely constitute a shrinking part of the sales mix, albeit whilst still growing sales year on year in absolute terms. As a result of both the growth and margin differentials between this segment and the licensing side, the shift in mix is likely to provide a tailwind for group margins.

Teamwear/Athleisurewear

This is a competitive market at a professional level, and in the past Rhino has supplied big names including the Barbarians, Northampton, Gloucester, the Scarlets, and Edinburgh. However, Rhino has now eschewed this traditional route to carve a successful niche in universities through multi-sport deals: it currently has contracts with 30 universities across the UK.

The move into athleisurewear has produced mixed results so far, but it remains a key part of the growth strategy. Clearly competition here is tough, with key players in the high-end space including Nike, Adidas, Puma, Under Armour, and Canterbury, in addition to recent success stories such as Gymshark.

Rhino has worked with experienced industry professional Jason Marchant to provide athleisurewear and fashionwear since 2010 and continues to do so. However, some other contracts have proven less successful, including a recent contract with the master licensee in Japan, the massive Itochu Corporation. We believe it underinvested in marketing and product in the run up to the 2019 World Cup, which should have allowed a quick and easy ramp up in sales. Instead this vital sales window was largely missed and one of the benefits of having been a supplier to the Japan Rugby World Cup was lost. However, management installs minimum performance levels in contracts whenever possible.

Rhino has also recently moved into associated products such as boots (both rugby and football) and mouthguards – again under licence agreements.

Conclusion

The main drivers of growth are likely to be balls and teamwear/athleisurewear. The former looks to us to be very low risk and the conditions are in place for strong growth potential to be realised now that the hard branding work has been done and the focus is turned to higher volume grass roots rugby.

Athleisurewear is not without risks, but the reward for good execution here could be significant – if Rhino could cross over into the mainstream like Under Armour, the possibilities are endless. Whilst not there yet, it has generated a strong brand in the premium rugby sector, which should help it to realise this potential.

About the Series 2 Bond Issue

- Up to £7.5m, minimum raise of £525,000.

- 5.5% Initial Yield

- 6-monthly Coupon

- 1st Coupon 31/03/21

- Maturing 30/09/25

- Non-Transferable

The first portion of the proceeds will be used to repay Series 1 bonds, of which £502,000 of 7.5% September 2020 bonds are outstanding. These bonds have established Rhino’s credibility on the bond market, having been fully serviced since their issue in 2015. Indeed, a large proportion of the Series 1 bondholders (representing £130,000 par value at time of writing) have agreed to roll over their holdings, and more are expected to follow.

The next portion of any cash raised beyond that required to repay the existing loans will be focused on PR and brand awareness, with any significant excess being put towards the push into athleisurewear. However, please note that management does not intend to raise more debt than is immediately serviceable from current operations unless under exceptional circumstances.

The non-current creditors are primarily directors’ loans which have no fixed repayment date and accrue a 5% non-cash interest charge, so I exclude them from my calculations. The only cash interest payable at present relates to the £502,000 of 7.5% Series 1 bonds, which will be repaid by the 5.5% Series 2 bonds.

A £525,000 raise, enough to repay all Series 1 bonds, at a 5.5% coupon would imply a 10.8x operating profit to interest multiple in 2020: extremely safe in our view. Even in 2019, which saw gross margin fall due to significant stock clearances, and the licensing business represented a smaller proportion of sales, operating profit would have been 3x interest. This company has ample headroom to service this debt.

If we assume a £1m raise, with the excess proceeds going to fund increased PR and brand awareness, the interest serviceability remains comfortable at 5.7x 2020 and 1.6x the unusually low 2019. And note that increased PR spend doesn’t exist in isolation: it tends to correspond with increased revenue (indeed that’s its main purpose!), so under these circumstances we would expect normalised (for COVID-19 impact) operating profit to be ahead of 2020 to increase the coverage multiple compared to historic levels anyway.

COVID-19

Clearly given that many 2020 fixtures have been postponed, COVID-19 will have a significant impact on rugby and any rugby-exposed businesses. We therefore expect Rhino’s royalty income to drop in 2020, though the extent of this will depend on whether the postponed fixtures, due to resume in autumn, do go ahead or whether the appearance of any ‘second wave’ of the disease causes full cancellation. Clearly if fixtures are cancelled there will still be the requirement for training equipment, and associated marketing spend will drop to partially offset the fall in revenue.

Rhino is a low overhead business, and the shift towards the licensing model (which now comprises 85%-90% of revenue) means that revenues can drop off significantly before the cost base becomes a problem.

Furthermore, during the crisis Rhino has been putting its assets and networks to good use, selling face masks manufactured by one of its connected textiles factories in Laos. Masks have been sold to the Welsh Rugby Union, Richmond Rugby Club, Oxford University Rugby Club, and many others.

The other opportunity to arise has been in home exercise equipment, where Rhino is significantly exposed. Management hasn’t released any numbers but has confirmed they have benefitted from this boom in consumption.

Business Risks

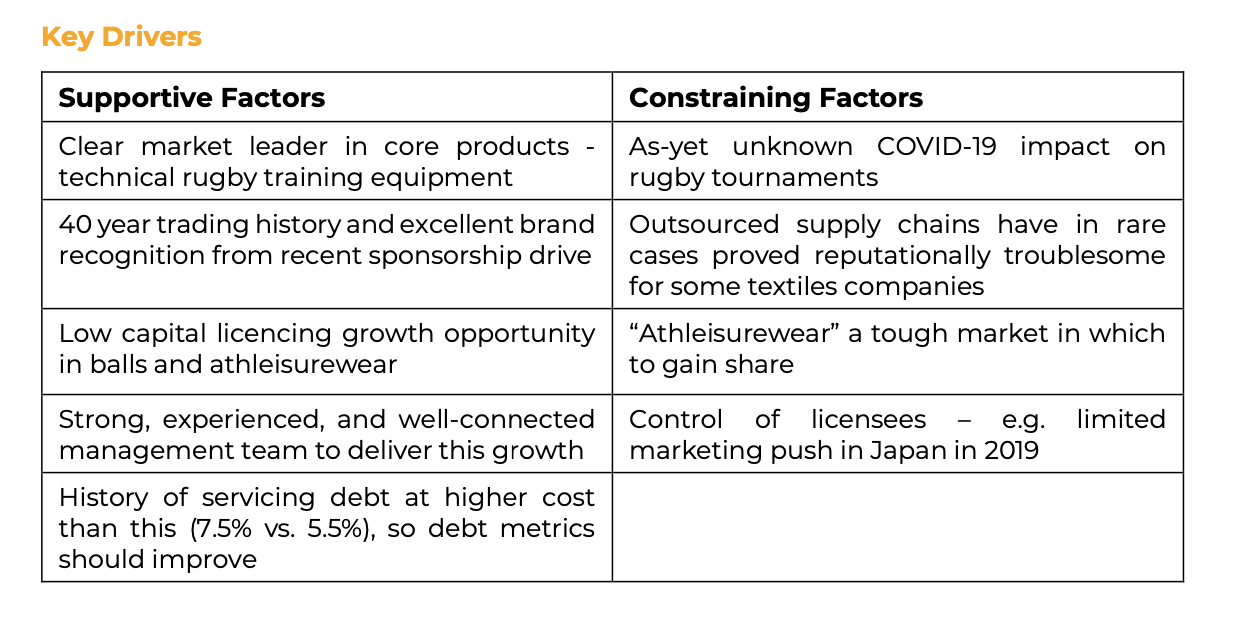

The key risks include:

- Child labour concerns remain in the broader industry: balls and apparel are produced in emerging economies, which appear to be at higher risk of such scandals. Discovery of such problems in Rhino’s supply chain could damage its brand image and cause dissociations and falling sales. However, Rhino is an ethical business and is extremely careful in its supplier management – for example in India Rhino only works with one carefully-vetted partner. Further, all suppliers used by brand licensees are approved by head office.

- Within the Athleisurewear growth drive, licensees have in the past failed to deliver. Management is aware of this and wherever Rhino has the ability to add minimum performance terms, it does. This is not always possible with large international licensees though.

- Clearly we do not have any idea of the scope of the COVID-19 fallout, but so far the recovery looks to be on track so unless a severe “second wave” curtails the delayed rugby season, we don’t see a significant long term impact.

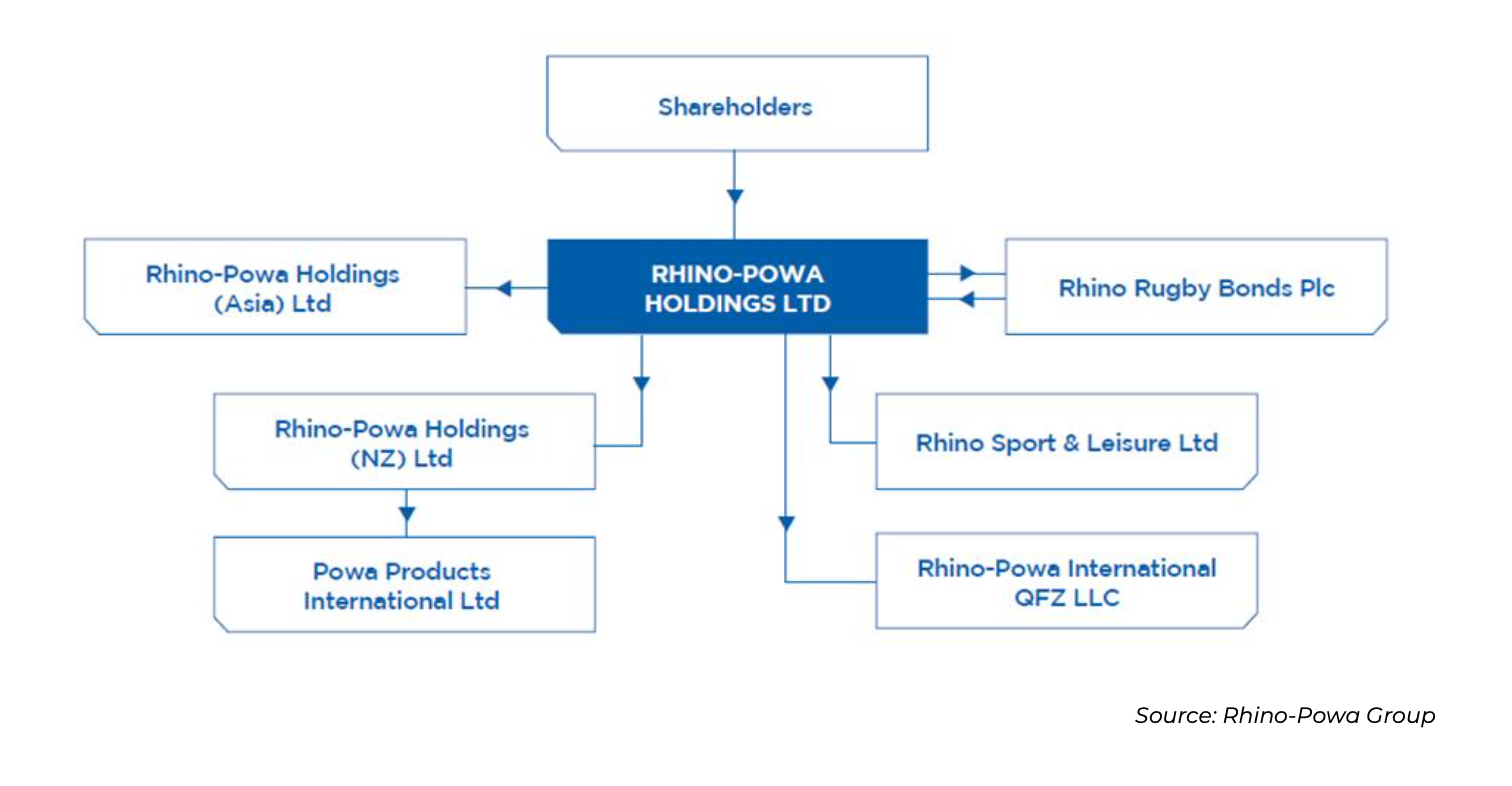

Corporate Structure

The group structure is illustrated below, with the Series 2 instruments being issued by Rhine Rugby Bonds Plc, and guaranteed by Rhino-Powa Holdings Ltd, the parent company – the same structure as for the Series 1 bonds:

Appendices

Management

Reg Clark, CEO, first invested in Rhino in 1988 having worked to incorporate the business and launch a BES (roughly the equivalent of the current EIS scheme) equity issue. He has always lived for rugby, having won two rugby Blues at Oxford and played for West Hartlepool, London Irish, the HAC, and Richmond, and captained the London Stock Exchange team, before founding the Kew Occasionals club. No less accomplished in business, he spent 3 years with Kobe Steel in Japan before working with Yamaichi Securities, Swiss Bank Corporation, and JP Morgan. He then re-joined Kobe Steel in London for 10 years, latterly as European Finance Director, before becoming an adviser and investor in the SME sector. In that role he led an MBI of Rhino in late 2006 and has been group CEO since then.

Marcus Rule, Chair, invested and took on this role in 2017. Having played rugby for Oxford University he embarked on a City career as a trader before moving into IT consultancy with Cap Gemini. He subsequently founded Rule Financial which he sold to the German firm GFT in 2014. He is also a director of Phi Partners and Vantage Point and is a serial investor in the SME sector. He also played rugby for the London Stock Exchange and the Kew Occasionals.

Nick Bray, Group FD, has been a Director since the MBI in 2006 when he helped Reg Clark bring together the investors to effect the transaction. Nick’s has spent 20 years working in corporate finance for KMPG and NM Rothschild & Sons. More recently Nick has focused on managing and advising SMEs.

Further Details

Contact Analyst

Oliver Juggins

+44 20 7397 2933

Oliver.Juggins@capitalaccessgroup.co.uk

Disclaimer:

This document is a marketing communication which is designed to educate and inform professional investors about the subject Group. The subject Group pays Capital Access Group a fixed annual fee to cover the costs of research production and distribution, and the research has not been prepared in accordance with regulatory requirements designed to promote the independence of investment research. Capital Access Group does not make recommendations. Any comments in this report regarding the valuation of a financial security are based on comparisons with similar securities; they are not forecasts of a likely share price. This document is not an offer to buy or sell, or a solicitation of an offer to buy or sell, the securities mentioned.

Capital Access Group does not buy or sell shares, nor does it conduct corporate finance transactions, nor does it undertake investment business either in the UK or elsewhere. Capital Access Group is not regulated by the Financial Conduct Authority (FCA). Neither Capital Access Group nor the analyst responsible for this research owns shares or other securities issued by the Group analysed in this research note, nor do they have a position in any derivative contract based on those securities.

This research is provided for the use of the professional investment community, market counterparties and sophisticated and high net worth investors as defined in the rules of the regulatory bodies. It is not intended for retail investors. Any such individual who comes into possession of this research should consult an authorised professional adviser.

The information contained in this document has been compiled from sources believed to be reliable, but no guarantee whatsoever is given that the information is complete or accurate, or that it is fit for a particular purpose. This document was issued by Capital Access Group without legal responsibility, and is subject to change or withdrawal without notice. By reading this document, you confirm that you have read and understand the above, and that you shall not hold Capital Access Group or any of its members and connected companies liable for any loss that you may sustain should you decide to buy or sell any of the mentioned securities."