An idealistic manifesto, funded by wishful thinking, would have damaging consequences

Companies: BBY, COST, MGNS

Afternoon all,

In a slight departure from the norm, and given that the General Election can be by far the biggest factor affecting share prices, I thought I’d go through some of the key proposals in the Labour Manifesto.

The brief summary would be that there are some good policies in the Labour Manifesto, but they are overwhelmed by a pile of patently bad ones. The impact, should these be enacted, would be a reduced level of investment in the economy by small and medium-sized business. Less investment would slow revenue growth, at a time when minimum wage changes would raise costs and most likely reduce employment.

The worst thing about the Labour Manifesto is the way it attempts to mislead the electorate that this level of spending can be funded by hefty increases in income tax of high earners and corporates. The reality is this will not remotely cover the spending plans and will damage the economy in the process. The results would simply be either significant increases in borrowing or a wholesale climb down in ambition.

Taxation

Policy: The 45p income tax threshold down to £80k (from £150k) and new 50p tax over £123k.

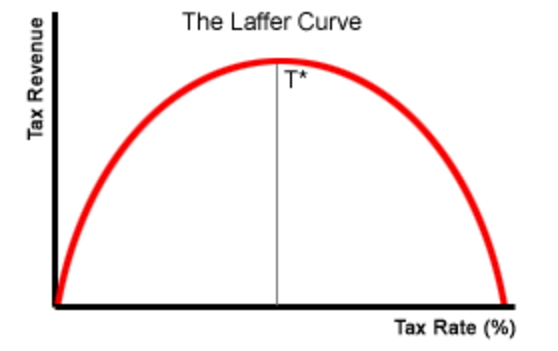

Such a terrible policy that will reduce long-term tax revenue for the Government. One impact would be to drive more workers out of employment and into self-employment, resulting in an evaporation in Employers NI, less income tax, and lower Employee NI. The rise of the gig economy is already impacting tax revenues by removing Employers NI. Further up the pay scale companies and high earners will find ways to move earnings outside of the UK tax system. Either way, we will be sliding the wrong way down the Laffer Curve (see below).

Policy: Raising £19.4billion by raising corporation tax to 26 per cent - a rise of more than a third.

This is another terrible policy that will bring in nothing like the c.£20bn of funds. It is a simplification to say that companies are footloose and will just move their corporate earnings offshore. However, many can and will, resulting in a substantially reduced level of taxable profits within the UK. Also, many other companies are too small to have the global footprint that allows transfer pricing. These companies will have to pay the higher corporate tax rates.

Even the IFS agrees that Labour’s numbers don’t remotely stack up

Paul Johnson published the Institute of Fiscal Studies’ view of both manifestos. His conclusion implies the Labour party are either being hopelessly optimistic or deliberately misleading:

“Labour have a set of policies intended to raise £49bn per year from the “rich” and, overwhelmingly, from companies... But the £49bn calculation includes some factual mistakes with regard to part of their tax avoidance package, optimistic assumptions and unspecified tax increases. Their proposals could be expected to raise at most £40bn in the short run, and less in the long run.”

What is the impact of this?

Higher tax rates lead to less free cash flow to the firm. Reduced cash generation will result in a lower level of ongoing investment by those companies. This means less employment, less capital investment and less revenue growth.

The reason why corporate tax rates should be lower

In an economy, economic value is generated and shared between companies and workers. Governments extract tax revenue from both of these groups in order to fund the pooled services required by society (e.g., health, infrastructure, education, security and benefits).

In the UK, like many other economies, our government extracts more of the value from the workers than from the corporates. This may seem like a cruel way of operating, but for those that live in the real world, it makes perfect sense.

Companies create jobs, and so it makes far more sense, especially in a globally mobile world, to attract business to our economy by offering attractive tax rates. This allows the company to invest more in its growth, create more jobs here in the UK than there would otherwise be, and crucially employ more people. This is one of the primary reasons job creation has been so high in the UK and unemployment so low.

As a side point, it is the reason we have needed such elevated levels of immigration and has been a great boon for our economy. Going forwards, my hope is that Brexit doesn’t necessarily reduce immigration, but instead focus it on areas of need. Nurses, doctors, engineers, tech, etc.

But...higher taxes on corporates may make sense in the future

The intriguing situation the near future brings is a world where automation may well reduce employment levels. In this case, more economic value will be captured by corporates, and therefore corporates will need to carry more of the tax burden for governments. However, we are certainly not there yet!

Rail

Policy: Railways nationalised and fares to be capped.

Capping fares will reduce the level of capital available to invest in the rail network. The lower investment will result in ageing and overcrowded trains. Underinvestment will also lead to a degraded quality of signalling equipment and other vital infrastructure, increasing the instances of breakdowns. The rate of cancelled and delayed trains will increase. More commuters will drive as they increasingly will be unable to rely on rail, putting more strain on roads and increasing pollution.

Policy: HS2 will be completed and will link with a "Crossrail of the North".

Finally a good policy! This would be long overdue in my opinion and is good policy. One of the key issues holding back growth and prosperity in the North of England is a modern, fast rail network to connect the various satellite towns to the business hubs, such as Manchester. The result of this is a long list of towns that are economically cut off, much like islands.

People were unable to live in these economically isolated towns and easily commute to decent jobs in Manchester, Leeds or Liverpool. House prices stagnated as the towns were less desirable places to live. This pushed workers to move out of these areas, precipitating a brain drain and further pushing down house prices. A negative spiral therefore ensued.

The value of a decent rail network is not just the ticket revenue, but the rejuvenation of these towns as workers can now move to them, attracted by the cheaper housing and quick commute. The brain drain reverses, schools improve, house prices rise, and a virtuous cycle kicks in.

Companies to benefit from a “Crossrail of the North.”

The publically listed businesses that could profit from this sort of infrastructure project are:

- Balfour Beatty,

- Costain,

- Morgan Sindall,

- Vinci (French), and

- Ferrovial (Spanish).

Energy

Policy: Energy market partially brought back into public ownership.

Maybe I’m missing something, but I fail to see why Energy companies are so often cast as the villain by politicians. Theresa May is as guilty as Corbyn now and Ed Miliband a few years ago in this regard. These companies make low single digit margins. Looking at Centrica and SSE over the last five years they’ve achieved a net profit margin of 1.6% and 2.2% respectively. These are hardly supernormal profits.

Furthermore, it is incredibly easy to switch if you don’t like how much you’re paying. The real culprit in all this is our capacity for inertia meaning many of us just don’t bother to take five minutes to switch. We use First Utility, and they provide excellent service.

Policy: Ban fracking

This is an interesting one, and another policy I think is short-sighted.

The environmentalists are plain wrong when it comes to the pollution of drinking water or increased traffic concerns. If fracking can be made to work in the UK, it would be a fantastic source of energy for our power stations, and gas, as fossil fuels go, is relatively green.

Furthermore, we will need as much power generation and security as possible in the coming years as the economy switches to electric vehicles. This has to come from a balance of sources including nuclear, solar and gas, but probably less so from wind. With the North Sea drying up, we should be looking for fracked gas to replace this energy source.

However, fascinatingly solar is also now playing an increasingly important part. Last Friday (26th May) around midday, 24% of UK power generation came from solar panels. The average share of UK power generation in 2016 was around 3.5%, up from effectively zero back in 2010. The word revolution is an understatement.

The progress in solar has been astounding, with prices for panels dropping over 75% since 2008. There are challenges to overcome, such as storage and grid management, but the future does appear to point towards a partial disaggregation of power generation and mass adoption of solar.

Why fracking has had a profound impact on the global economy

Fracking in the US has turned the energy world upside down. Opec plus Russia are scrambling to keep up and are trying to regain control of the market. However, the game is already up. Recent events show how powerless these producing countries are.

Global oil prices used to have a swing producer in the form of Saudi Arabia. Everyone else produced as much as they could with total production of around 90 million barrels per day. The Saudis would set the global oil price by adjusting their production around the 10 million barrels per day level.

While the BRIC countries were growing at incredible rates in the noughties, Opec enjoyed the elevated oil prices their demand brought. Unfortunately for Opec, those very same oil prices created the environment where shale oil and gas could evolve to become economic and the shale boom was born. US production rose from 5 million barrels per day in 2008 to 9 million barrels per day currently and shale took over the crown as the global swing producer.

Now we live in a world where Opec have failed to push shale out of the market back in 2014 by ramping up production to tank the oil price. Instead, Opec is now trying to cut production to get the prices back up so that the various governments can increase their tax revenues again. The problem is that rising prices now quickly lead to an increase in shale production.

The bad/good news doesn’t stop there. The next decade will be defined by the roll-out of Electric Vehicles across the globe. I know it seems far-fetched to many but this is really happening. Around 50% of oil production is used to power cars and trucks. Even if the move to electric vehicles is slower than expected, this is still a huge reduction in demand for oil products going forward. In the future, we will look back on the $100+ per barrel days as pure supply-demand economics and I doubt it is something we will see again in our lifetime, barring World War 3 of course.

Higher education

Policy: Tuition fees abolished and maintenance grants reintroduced for university students.

Yet another terrible policy. If Labour manages to do the unlikely on June 8th, I imagine this might end up a similar millstone around their neck as it was for the Lib Dems during the Coalition. I find little more irritating than when a political party blatantly panders to a demographic by deliberately misleading them.

The glaring truth ignored by Labour’s inner circle when drawing up this proposal is that English universities have been performing very well since tuition fees increased, while underfunded Scottish universities have been slipping down the rankings. According to the league tables, there is only one Scottish university in the top 20, St Andrews. Edinburgh is now back in 23rd and Glasgow, Heriot-Watt and Dundee are next, around the 30th mark.

The other disappointing side-effect of free university tuition in Scotland has been the pillaging of school education budgets, impacting the quality of secondary education.

Free university tuition, as demonstrated in Scotland, is bad policy that affects education across the system. Whereas the changes made in England aligned the payer of the education with the person that benefits from it. That is unquestionably a fairer system.

Health

Policy: Scrap NHS pay cap.

Good policy! As mentioned below, the pay cap has led to a surge in doctors and nurses quitting the day job and working through an agency where they can earn two to three times their usual pay. This has created more holes in ward rotas and hence more demand for agency workers, raising their wages even further. It has also impacted the continuity of care.

Raise salaries and the incentive to move to agency work reduces, wards need less agency staff, costs for each ward go down and quality of care rises.

Policy: Over £30 billion extra NHS funding through increased income tax for top 5 percent earners.

In short, additional NHS funding is required and an extra £6bn a year is a good start. My scepticism kicks in, however, when Labour believes it will be able to get the funds by raising taxes on the top earners.

Dealing in facts rather than slogans, the level of spending on healthcare in the UK has been rising towards that of France and Germany over the last few years. We used to spend 8.5% of GDP back in 2010 compared to c.11% in France and Germany. That’s a 2.5% difference.

By 2015, we spent 9.8% of GDP versus the unchanged level in Germany and France of c.11%. Both Labour and Conservative are pledging more funds, which are sorely needed, but we are now approaching the spending levels of our neighbours across the Channel.

Our spending is still far below the level spent in the US, which is an incredible 17%. Although I would far prefer our system to that of the US, where citizens lack the safety net of proper free healthcare, and far too much of that 17% goes into outsized profit margins of pharma companies, health insurance providers and doctor’s wages.

So if funding is no longer significantly below that of our European neighbours, but the level of care is still not good enough then what’s driving this underperformance?

The two primary culprits are poor efficiency and the social care impact

The austerity cuts have led to local councils underfunding social care at a time when the number of over 85-year-old has ballooned. It is regrettable that Theresa May u-turned so quickly last week. Her proposals were a fair way to deal with this issue, and the proposal was a rare example of politicians being honest with the electorate.

The other issue facing the NHS is its woeful level of efficiency. When you ask those within the NHS, the same themes always get raised, including inefficiency, poor policy choices, mismanagement, resistance to change.

Here are some of the typical issues:

- Holding back or freezing nursing and doctors wage levels is a clear example of mismanagement, whereby more staff are driven to agency work which ends up costing each ward 2-3x a normal worker and lacks continuity of care.

- The long extinct Fax Machine is incredibly still a major form of communication within and between hospitals.

- Prescriptions, GP referrals and appointment bookings are still largely communicated through the post, allowing postal errors and delays to add to NHS costs.

- There is not enough centralised data across the NHS, e.g. one hospital not knowing if safeguarding concerns or infection status had been flagged at another hospital.

- Promotion within the NHS is based far more on tenure than merit.

- Senior management is resistant to change, even if it clearly would improve processes.

Before you shout at me “what do you know, you’ve never worked in the NHS”, these are not my views but those of front-line nurses and doctors to whom I have spoken. There were many more points I left out.

Workers' rights

Policy: Zero hours contracts outlawed.

Another populist policy that doesn’t stand up to reality. Our workforce is evolving at a rapid pace and many workers like the flexibility zero hours contracts offer them. There are well-publicised examples of the structure being abused, but the answer is not a knee-jerk ban, but to structure the controls and incentives to reduce bad behaviour from a minority of employers.

The call to “outlaw” these contracts shows a lack of understanding as to how our economy and the world is changing. Governments do not have the power to reverse the constant evolution of the labour market, but what they can do is legislate to ensure fairness is preserved.

Policy: Four new public holidays to mark patron saints' days.

Each Bank Holiday costs the economy £2.3bn, according to The Centre for Economics and Business Research. This was their assertion back in 2012. So an additional four days of Bank Holidays will probably reduce economic output by around £10bn if the research boffins are correct. Not to mention the low productivity the following day as everyone endures their St Patrick’s Day hangovers.

Overall

There are certainly problems with the Tory Manifesto. Energy caps is one example. Another is reducing immigration to the tens of thousands, although I imagine 99,999 will be their target rather than 10,000.

Furthermore, the flakiness of Theresa May in the face of opposition is also a worry. The proposals for social care, and the self-employed NI changes of a few months ago, are both examples of good, fair policy, and a tough dose of reality that we all need. But both were shelved or amended within days at the first whiff of opposition.

Whereas, as discussed above, there are some good policies buried in the Labour Manifesto. The problem is they are hidden amongst a litany of terrible proposals that would greatly damage the economy:

Minimum/Living Wage proposals would reduce employment.

Higher tax rates at the top end would drive more workers into self-employed structures, removing them entirely from Employer’s NI.

Higher corporate tax rates will drive large corporates simply to move their profits offshore, and small-to-medium corporates will get hit resulting in less free cash flow.

Reduced cash available for reinvestment, as we all know, results in less investment, lower revenue growth, impaired job creation and squeezed corporate profits, which then get taxed even more.

What’s worse is the whole edifice is built upon a funding plan that doesn’t stack up in the real world.

I hope the electorate can look at the facts on June 8th and if they don’t vote for the best candidate, then vote for the least worse.

-----

To read a brief outline of how I think about stocks, and what I aim to achieve in this blog, please check out my first blog where I set out my stall.

Recent blogs:

- 30 May 17 - THE NAKED FUND MANAGER - China shows Western Tech Giants might be stifling innovation

- 8 May 17 - The Naked Fund Manager: Why corporate chiefs are better leaders than politicians

- 2 May 17 - Why the best businesses have great cash conversion

- 10 Apr 17 - Platforms are taking over the world

- 3 Apr 17 - Bingo player Jackpotjoy offers interesting upside...and risk

- 27 Mar 17 - What Banks and Brokers can learn from Amazon

- 20 Mar 17 - Why understanding behavioural finance is just as important as stock picking

- 14 Mar 17 - What to make of Challenger Banks

- 6 Mar 17 - CFD platforms still worth a look

- 27 Feb 17 - Purplebricks US expansion: How big is the opportunity?

- 20 Feb 17 - M&A - One reason why I’m still bullish on UK equities

- 14 Feb 17 - Anatomy of a growth company

- 6 Feb 17 - Roll-outs: the Good, the Bad and the Ugly

- 30 Jan 17 - How MiFID II could hurt Small and Mid-caps

- 23 Jan 17 - Why Pearson was an obvious value trap, and is Jackpotjoy worth a closer look?

- 16 Jan 17 - How sustainable are current dividends

- 8 Jan 17 - Implications of Trumponomics for equities

- 18 Dec 16 - Millennials - Becoming the most important demographic

- 12 Dec 16 - CFDs - Tough week but worth a closer look

- 5 Dec 16 - Pension deficit dogs starting to look interesting

- 28 Nov 16 - Setting out my stall...plus my thoughts on bond proxies

Please Note: To be clear, I do not and will not ever give any advice. I will rarely mention individual stocks but when I do these will not be recommendations, instead just my thoughts at that point in time.