Panmure Gordon raises PBT estimates by 20%

Companies: Gear4music (Holdings) PLC

One of last year's biggest AIM-listed risers, Gear4music Holdings, has kicked off 2017 by telling investors it expects full-year profits to be ahead of expectations when published later this year.

On Friday morning, CEO Andrew Wass said that due to the strong performance from its own-brand products and a controlled cost-base, the Group believed it would post profits even higher than its most recent increased expectations at the half-year stage.

Broker Panmure Gordon welcomed the "very strong" trading update by raising its forecasts for the Group's PBT by 20%:

"Today’s very strong trading statement shows continued excellent sales momentum (+55% for Sept-Dec) and a boosted gross margin, attesting to G4M’s delivery against its stated strategic objective to grow European market share and marginrich Own-label offering. This prompts us to raise our FY17 PBT estimates by +20% (following on from the +21% increase in October 2016).

Panmure says the company's ethos of investing in infrastructure ahead of its future growth means operational gearing will come through further as the international business grows over the medium-term:

G4M’s unwavering investment philosophy is, in our view, absolutely the right one but it constrains the short-term profit upside potential, hence why, despite the continued strong sales growth momentum and gross margin stability envisaged in FY18 and FY19, we think it prudent for now not to change our FY18-FY19 PBT forecasts.

To reflect our confidence in G4M’s future prospects we raise out TP to 600p (from 400p)."

Edison also put out a note, saying Friday's Christmas trading statement showed the group was continuing to take share in its niche markets, generating revenue growth far above the level of general consumer demand:

"We expect the company to over-achieve our margin expectation, and upgrade our FY17e earnings per share forecast by 20%, although we expect margins to normalise in FY18. While the share price has risen by a factor of four since we initiated in May 2016, it still stands at a discount to larger UK pure-play e-tail peers."

The UK's largest musical instrument retailer saw UK sales increase 29%, and ROW sales increase 129%. There was a 55% increase in total like-for-like sales and 63% growth in sales of its own-brand products.

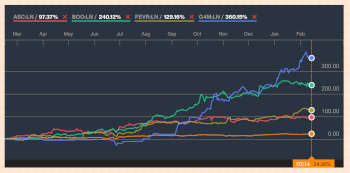

G4M's share price has risen 244% in just 1 year and is up 12% since 30 December, the company trades at a P/E multiple of 49.39.

_m.jpg)

.png)