Growth shares need a big market, a USP and scalability. When they work they're a beautiful thing.

Companies: ASC, BLTG, DEBS, 0QS9, FEVR, G4M, JE/

Afternoon all

Thanks for all the positive feedback after last week’s piece on roll-outs. The Research Tree team told me there were a lot of nice messages coming via email, twitter and website comments.

It occurred to me that the communication is only one-way at the moment and it might be better for all if there was a feedback process. The team tell me that a comments section is coming soon, but in the meantime, if you email nfm@research-tree.com I will endeavour to cover any subjects of interest in future blogs.

Today I will be following last week’s format to address the anatomy of a high growth company. Four examples that immediately spring to mind are the stock market darlings Asos, Boohoo, Fever Tree and Just Eat. All four are excellent examples of truly scalable, low capital business models. Below I break down what characteristics these companies share and the financial metrics and qualitative factors I think are important in identifying quality growth companies.

I also look at eDreams as an example of a growth company that come unstuck when market forces, technological changes and competitive pressures erode margins, growth and barriers to entry.

Examples of newer growth stocks that are earlier in their journey include Blancco Technology and Gear4Music.

Big addressable market + Clear USP + Scalability

As I expand upon further down, valuation is not the first thing I consider when looking at a growth stock. The most important factors are to assess the size of the ultimate opportunity, namely that:

- There is a big market to grow into,

- The business has a unique selling point (USP) or clear benefit that gives it the edge required to win the battle for market share, and

- The business model is readily scalable

Below is a quick overview of how these three factors play a part in the growth of recent well-known success stories.

Needs a big addressable market

Asos operates in men's and women's fashion, primarily young adults, which is a huge global market. When it started in 2000 online retail was in its infancy. Asos had a clear USP in that it was capital-lite with no stores to manage and the website acting as its “shop window”, allowing it to move faster than high street peers, manage inventory more efficiently and scale the business far more quickly.

The Group have built a very customer-friendly platform and was ahead of its online and high street peers in how it engaged with its target market.

Boohoo, another online fashion retailer targeting the youth, took online customer care, engagement and rapid inventory management to a new level, providing cutting edge designs at affordable prices.

Last year, analysts at Liberum estimated the UK online clothing market size at nearly £7bn, growing to almost £10bn by 2018. Consensus expectations are for Boohoo to increase revenues from £200m in 2016 to £290m in 2017. Management is on track at the moment with H1 2017 revenues of £130m. Analysts are also baking in growth to £400m in 2018. That’s 45% growth over 2017 and 37% in 2018, but would still only put Boohoo on a 4% market share.

Boohoo is another example of a company with a big addressable market, a clear USP and a scalable business model, which it now hopes to expand across the pond with its $20m Nasty Gal acquisition.

Company must have clear USP

Fever Tree offered a high-end product into a market dominated by a slumbering giant in Schweppes who had a monopoly due to a lack of decent alternatives.

Schweppes was charging a lot for their product, and bars and restaurants wanted another option, as well as to raise the quality of their offering. Spirits producers likewise benefitted from the “premium” offering up-rating of their product, as well as the marketing push from Fever Tree. Consumers were happy to pay a small premium for higher quality, especially as it was consistent with the market’s move to a preference for higher-end spirits.

There were natural barriers to entry there is insufficient fridge space or desire for a third mixer option. Schweppes was managed country-by-country, and so was slow to respond. The simple marketing campaign slogan of “if three-quarters of your drink is the mixer - make sure you drink the best” had a powerful impact.

The business model is highly scalable with production outsourced. To grow supply to meet the ever-growing demand, Fever Tree just needed to increase its orders from suppliers. Growth was, therefore, driven by going from bar to bar and making deals.

Business model must be scalable

Just Eat acts an aggregator platform for delivery restaurants, providing user-friendly, online ordering system for customers, and a broad platform for restaurants to market their offering. Just Eat IPO’d in April 2014 and has been on an acquisition spree to expand into new countries or take out its main rivals in markets it already dominates.

The market again is huge and appears for now to be a winner takes all market where reaching critical mass is key. The statistic often put out there is that over 50% of UK food ordering is still done on the phone, direct to restaurants, so the likes of Just Eat here, and GrubHub in the US see the market growth opportunity as significant, both through international expansions and growth within each country.

Regarding scalability, the model is very capital-light, and cash generative as Just Eat effectively just acts as a middleman, taking a commission. Just Eat benefitted from early mover advantage, and now its “edge” is its market dominance. As an example, last year it bought its closest UK competitor (a 10th its size) for 10x sales.

How can we assess scalability?

The issue with roll-out companies (as much as I love them) is they can’t achieve rapid growth because they are constrained by both capital and Management time as the companies need to find new sites etc. High growth companies have no such constraints to growth.

Many of the factors that a critical in assessing a growth company are slightly more intangible, e.g., USP or “edge”, barriers to entry, constraints to growth, etc. However, some good financial metrics are important to consider when assessing the business model of a growth stock.

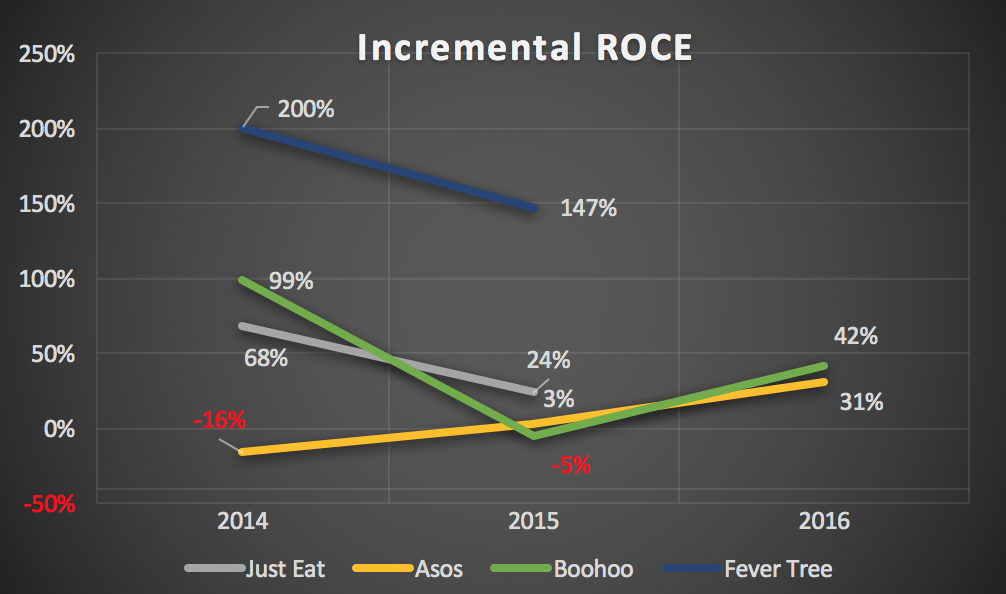

Incremental Return on Capital Employed

I like to look at Incremental ROCE as a useful measure to determine how good a company is each year at growing earnings off its capital base. I take the incremental change in EBIT each year and compare with the additional deployment of capital, i.e., the increase in Fixed Assets (less goodwill) and any increase in Working Capital.

Many of the better high growth stocks have negative working capital, and this can sometimes mean capital employed actually reduces while growth accelerates. To strip out this effect in the below graph I only include increases in fixed assets or working capital.

As you can see from the chart, all four have robust incremental ROCE. The blip Asos experienced in 2014 is understandable as it struggled that year with a warehouse fire in Barnsley, but has recovered well.

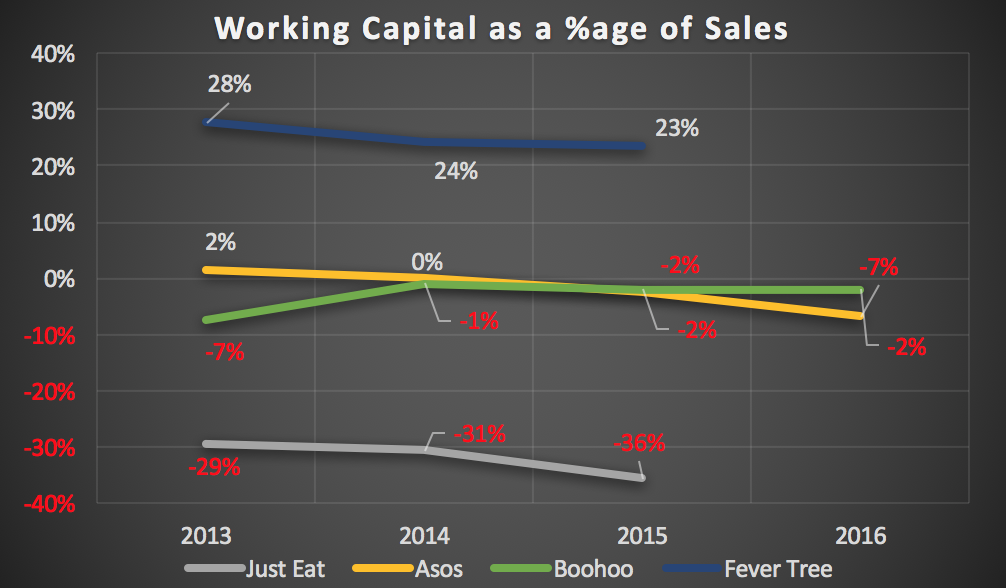

Working Capital over Sales

Another useful metric to consider is how much working capital is required to fund the business, which I illustrate by looking at Working Capital as a percentage of Sales. The lower the number, the better, and the perfect situation is when the business has a negative working capital position (see Boohoo in 2013 as an example below). This is where the company manages to make the product, complete the sale and receive the cash before it has to pay its suppliers.

Another important metric to look at is FCF generation. Obviously, a high FCF yield is desirable, and it is another indication that the business is in a healthy position to reinvest for growth. As you can see from the chart, working capital for most of these companies is either very low or negative.

Just Eat is an excellent example of a beautiful negative working capital business model, with cash received up front from the customers but only paid to the restaurants every couple of weeks. A small or negative Working Capital to Sales means less capital required to grow the business.

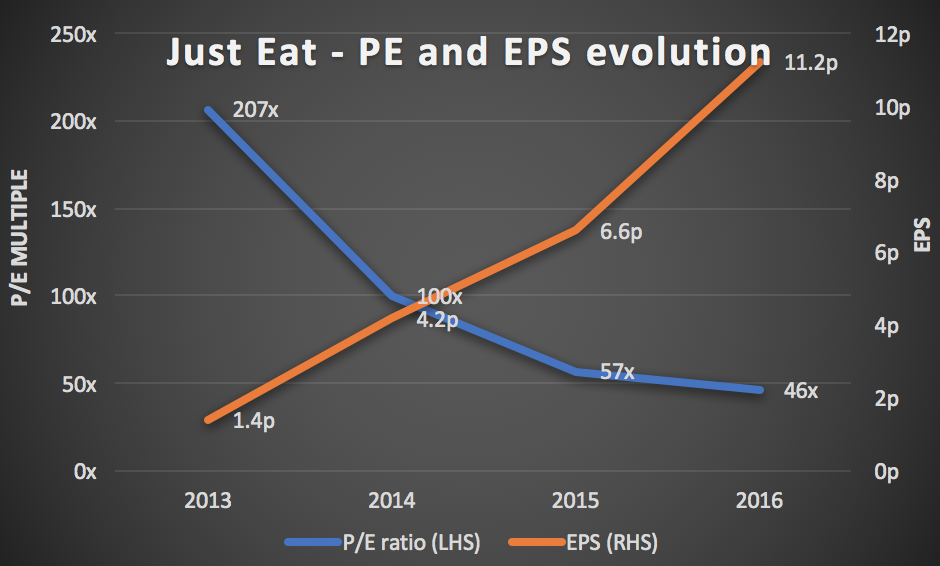

Valuation important but not 1st priority

It might be a difficult task, and I know I find it hard to brush over, but valuation shouldn’t be the first thing you look at when assessing high growth stocks. Otherwise, you’ll never invest in them.

Below I’ve plotted what the PE multiple (based on reported EPS) looked like shortly after Just Eat published FY Results, each year since IPO, (I’ve used consensus for 2016).

Just Eat is currently trading on 92x reported earnings, Asos is on 124x, Fever Tree 85x, and Boohoo 84x. These are hefty multiples to stomach and are baking in a lot of future growth. They may well be priced for success, and any misstep could see a horrible price correction, as explained below. On the other hand, we might look back on these companies in five years time and see today’s valuation as an absolute bargain.

To arrive at a valuation of the future opportunity I look at a range of top-down scenarios as to what the ultimate market size, market share and long-term profit margin might be. Once I have a rough idea of the scale of the opportunity I bring that back to a valuation in today’s money (building in a healthy safety margin as always). If the upside compared to the current share price is meaningful, taking into account execution risk, then it will likely make it into my fund.

G4M & BLTG examples of earlier-stage growth shares

Blancco is, by some margin, the market leader in data erasure services. It is 7x the size of its nearest competitor according to Equity Development and has been around and growing nicely for some years. However, there are long-awaited regulatory changes now just around the corner that should be a boon for the sector.

The new EU data protection law is coming into effect in May 2018. Aside from the regulatory tailwind, the data erasure market is a growing and Blancco has grown revenues 50% pa over the last two years.

To get comfortable with whether or not the shares offer an attractive opportunity, you need to build an impression of how big the market could get, and over what timescale. You will need to gauge competitive threats and barriers to entry to ascertain how wide Blancco’s moat is. Finally, this should allow you to build a picture of Blancco’s future earnings and therefore value.

Based on the latest Trading Update and broker forecasts, 2016 revenues look like they will come in around £23m, 50% up on 2015. Brokers brave enough to forecast to 2020 are estimating growth to take revenues to over £50m which considering current organic growth and regulatory tailwinds doesn’t seem too far-fetched. Applying a 25% margin to this, and a reasonable multiple can easily get you to an attractive premium over the current market cap.

These assumptions may well prove hopelessly wrong, to the good or bad, so that’s why you then need to build in a safety buffer. Whatever your view of the company, it, and the industry it leads, faces a fascinating 24 months.

Gear4Music is an excellent little growth company in a niche market as an online retailer of musical instruments. It’s been growing very well in the UK over the last few years and has started making big inroads into Europe. The shares have risen 350% over the last six months as its operational delivery has put it on people’s radar. The market cap stands now at £126m.

The business model is highly scalable with a high-quality online experience and Regional Distribution Centres providing an inventory and margin advantage versus smaller shops. Another barrier to entry and margin accretion source is its own range of instruments it has developed.

The long-term market size is something that is less clear to me at this time, but the successful expansion into Europe shows the opportunity there is sizeable. Margins are underwhelming with a PBT margin of c.5% in 1H17. However, the business has swung from losses in 2015, to flat for FY 2016, and is now moving into profit. The operational leverage inherent in this business model should expand those margins nicely as top line grows.

Growth stocks are painful when things go wrong

A good example of how investing in growth stocks can be a painful experience at times is French travel aggregator eDreams. This web-based travel and flights aggregator was experiencing soaring growth (apologies for the pun) leading up to and shortly after its April 2014 IPO.

However, by the June 2014 Q2 Results, some competitive and market forces had thrown a giant spanner in the works. Changes to Google’s algorithm suddenly made their paid search keywords unprofitable, where before they were highly profitable. On top of this, an affiliate partner site that had driven a lot of traffic to eDreams stopped some of the ways it drove traffic to eDreams.

The problem was that the company had IPO’d with ambitious growth targets. The prior year it had grown bookings by 12%, revenue margin by 15% and earnings by 51%. The network and scale benefits were seemingly kicking in nicely, but then everything went into reverse. To maintain topline growth, Management decided to increase marketing spend on more expensive keywords in Google, which reduced margins and bid these expensive keywords to even higher levels.

eDreams didn't have the USP or barriers to entry and competition was always going to be fierce given even half its ROCE would have been attractive.

The virtuous circle on the way up that resulted in a premium-rated IPO led to a vicious spiral on the way down. Shares fell heavily after the Q2 2014 results and had fallen 80% by the end of 2014.

-----

To read a brief outline of how I think about stocks, and what I aim to achieve in this blog, please check out my first blog where I set out my stall.

Recent blogs:

- 6 Feb 17 - Roll-outs: the Good, the Bad and the Ugly

- 30 Jan 17 - How MiFID II could hurt Small and Mid-caps

- 23 Jan 17 - Why Pearson was an obvious value trap, and is Jackpotjoy worth a closer look?

- 16 Jan 17 - How sustainable are current dividends

- 8 Jan 17 - Implications of Trumponomics for equities

- 18 Dec 16 - Millennials - Becoming the most important demographic

- 12 Dec 16 - CFDs - Tough week but worth a closer look

- 5 Dec 16 - Pension deficit dogs starting to look interesting

- 28 Nov 16 - Setting out my stall...plus my thoughts on bond proxies

Please Note: To be clear, I do not and will not ever give any advice. I will rarely mention individual stocks but when I do these will not be recommendations, instead just my thoughts at that point in time.

.png)