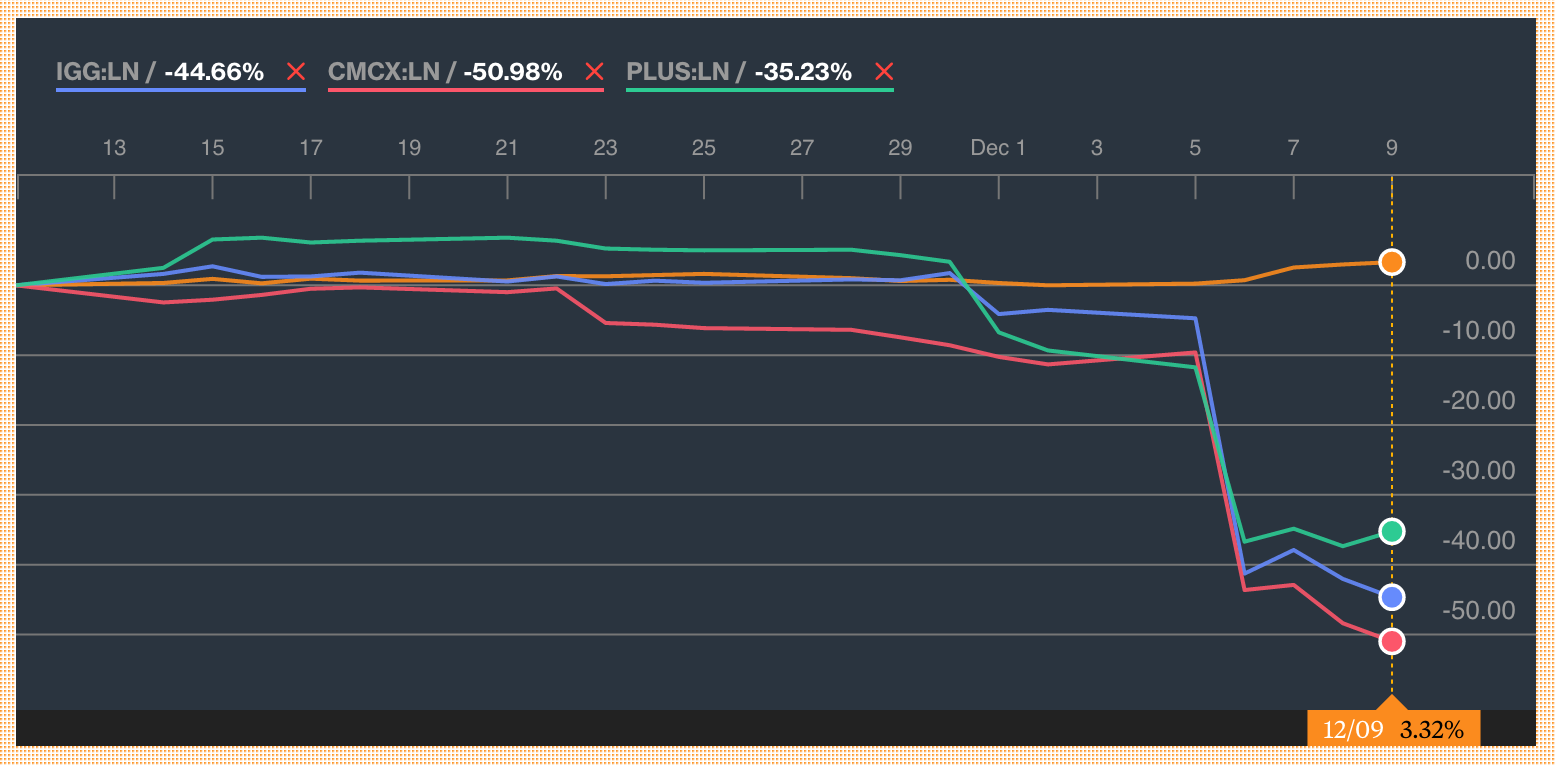

IG's Japan comparison complicated and therefore slightly misleading.

Companies: CMCX, IGG, PLUS

Afternoon all

After a pretty eventful week, the subject of today's blog has to be the bombshell the FCA dropped on the CFD market. Full disclosure, I'm a holder of shares in both PLUS and IG.

If you look at the chart above, PLUS was already trading at a significant discount to its peers, due to last year's trouble with the FCA, trading at around 10-12x forecast earnings. CMC had decoupled from IG back in September after its profit warning and was on a PE of about 13x. IG was sailing serenely on 18-20x earnings.

Now they trade on 5.7x for PLUS, 6.9x for CMC and 9.8x for IGG. The obvious point is that broker earnings forecasts have probably not fully adjusted yet. If I take a 25% bite out of all three, then PE ratios go to 13x for IGG, 9x for CMCX, and 7.5x for PLUS. Are these multiples justified?

What happened

It started November 30th with the publication from the Cyprus regulatory body, CYSEC, of a series of Q&A's on the CFD industry. Plus 500 took a 10% hit as something like 70% of its sales are reported there, and it later put out an announcement saying it didn't believe there would be a material impact on the business from the "topics covered".

On Tuesday (6th Dec) the FCA announced even harsher regulations with leverage caps, greater risk warnings, and marketing restrictions. The three main players IG, CMC and Plus 500 all took heavy hits over the next few days with share prices slumping 27% for PLUS, and over 40% for IG and CMC.

Finally, on Thursday (8th Dec) BaFin put out its set of proposed regulations which were far less severe with no leverage caps but far more focus on clients not being able to lose more than their initial deposits. PLUS already do this on all their accounts and announced the changes "will have no effect on its business". CMC and IG are both bigger players in Germany and both already offer this on accounts. Neither would quantify its impact at this time but both welcomed the news.

What's next

It would be foolish not to expect further announcements from other regulators and Australia is an obvious next candidate. The question is whether these are already in the share prices or not.

In my view, the FCA likes to be seen as the most stringent when it comes to other regulations, and so one argument is that the most onerous conditions are already out there. In that vein, the BaFin announcement was welcome as it is certainly less severe. Many analysts across the city were already looking at their models with the assumption of FCA leverage caps across Europe. If other countries adopt BaFin more than FCA-type limitations, then the revenue impact should be reduced.

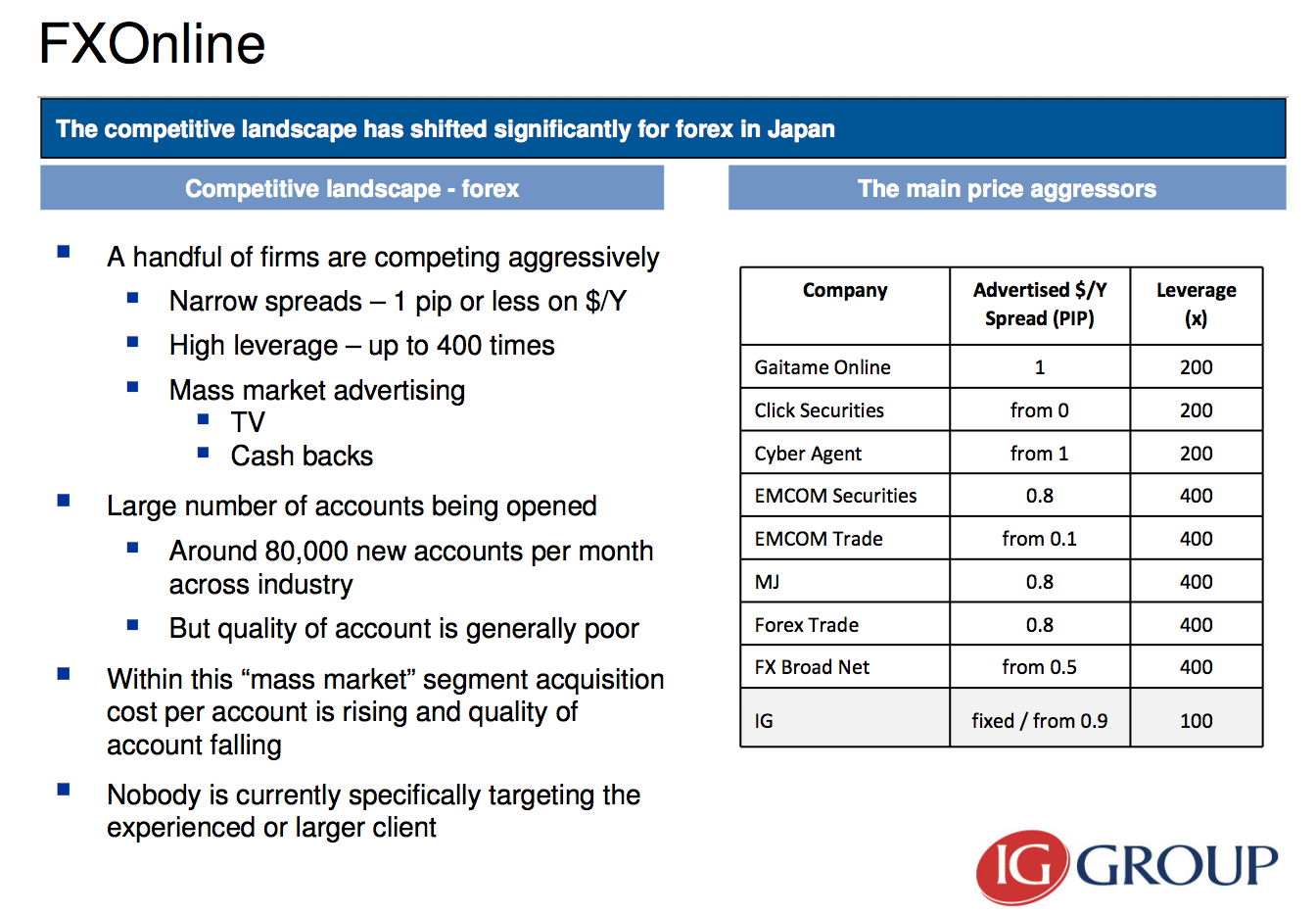

Why the Japan comparison is complicated...and misleading

When events cause dislocations in the market, the immediate reaction is to look for similar situations in the past to gauge the impact this time round. This is critical but can sometimes lead to comparing apples with pears.

On the morning of the announcement, I received a lot of incoming emails highlighting IG's experience in Japan as a comparator. IG acquired Japanese CFD platform "FX Online" in 2008. The Japanese regulators then put a 50x leverage cap on trades in 2010 and a 25x cap in 2011. Revenues fell 25% each time from £28m in 2009, to £21m in 2010, and then £16m in 2012.

However, there were other significant factors that drove this fall in revenue than just the change in regulation. I would never pretend to speak for IG, but I would hazard that, in hindsight, Management would concede this wasn't its best acquisition.

Japan was a hugely competitive market. In IG's words from its 2009 Results presentation "A handful of firms are competing aggressively". The below slide shows the huge leverage and incredibly narrow spreads that IG was fighting against.

Furthermore, IG moved its acquired customers from the FXOnline platform, to which they were accustomed, to its PureDeal platform which I gather generated a lot of additional churn.

The regulatory changes came at a time when IG was still integrating its Japanese acquisition, and there may well have been the cultural friction you would expect from a European company taking over a Japanese one.

Finally, I'm told the impact on the Japanese market in aggregate from the regulatory change was actually closer to 10%, followed by a recovery over the next few years.

An interesting point on regulatory arbitrage

A few analysts have also highlighted an interesting point on regulatory arbitrage, in particular at Citi and Liberum. The announcements so far from all the regulators have only been consultation papers. If a regime like BaFin proved to be sufficiently less onerous than the FCA, there could be a migration to that regime.

Personally, I would expect a partial converging of regulations across Europe for this market, and I am not convinced the benefits would outweigh the costs of such a move for the big platforms, but it is an interesting point.

There is also an argument that the FCA won't want to push traders overseas. An example of this is the gambling industry where land-based gaming keeps getting bashed by the regulators but online platforms have experienced a much more stable environment. Regulators know that being overly harsh will just drive gambling customers offshore.

Longer-term implications

Longer term I think these changes will be good for the industry and the key platforms that operate in it. The leverage caps and limited loss accounts should mean a lot of offshore "bucket shops" who have been competing aggressively to win market share will leave the market. The remaining platforms should experience less customer churn, spreads could well widen, and there may be less need to spend a fortune on marketing. As an example, IG group has doubled its marketing spend in the last two years from just over £30m in 2014 to around £65m this year or edging towards 14% of revenues...

Another point worth noting is the benefits of the 80:20 rule. Having spoken to the Management at most of the major platforms a number of times over the years, the composition of revenues has often been described as being 80% of revenues coming from 20% of customers. One large platform has gone as far as calling it a 90:10 rule.

A big portion of this "20%" (or "10%") of clients will be eligible to be classified as professional investors. They are inherently sticky with respect to churn and therefore lifetime value. Both the FCA's and BaFin's proposals appear to exclude these clients from the new limitations and leverage caps. This would not, therefore, impact those revenues. In fact, the overwhelming message from all regulators is that they want to protect the unsophisticated retail investor from taking excessive risks and risking excessive losses, and rightly so in my view. The proposals, therefore, will impact the lower quality, higher churn, and hence higher cost revenues.

-----

To read a brief outline of how I think about stocks, and what I aim to achieve in this blog, please check out my first blog where I set out my stall.

Please Note: To be clear, I do not and will not ever give any advice. I will rarely mention individual stocks but when I do these will not be recommendations, instead just my thoughts at that point in time.