CMC pondering move to Germany and IG encouraging clients to protest to FCA

Companies: CMCX, IGG, PLUS

In a surprise announcement last week, the UK's Financial Conduct Authority announced that it intended to increase regulations on CFD providers based in the UK. The move immediately sent shares in the three largest spread betting providers plummetting, as future earnings were cast in doubt.

As investors and analysts continue to digest the news to reassess their forecasts and positions, it appears CFD providers have started to fight back, with news released this morning by Skynews suggesting CMC Markets is considering relocating its operations and 300 jobs to Germany.

CMC, which was founded by prominent Tory donor and leave campaigner Peter Cruddas, is considering the move in direct response to the proposal, which many observers say is Draconian. The company is the market leader for CFDs in Germany, and the German regulator BaFin announced considerably more lenient proposals for the CFD industry in an announcement last week.

The threat of relocation is likely to concern the Treasury who won't want to push traders (and tax revenues) overseas, as has been the case in the gambling industry where land-based gaming continues to get bashed by regulators, whilst online platforms are not.

In another twist, IG Group CEO Peter Hetherington, who has openly criticised the FCA's surprise announcement, has emailed IG clients saying they should complain to the regulator about the proposals, which in some cases would lead to clients requiring to up their deposits 10 times in order to continue trading.

CFD providers will be in discussions with the FCA during the consultation period which lasts until March, and no changes will be made until later in 2017, but clearly two of the big three have already started to make their positions known.

Plus500 has yet to reveal it's position, but the Israeli company is in a slightly different position to IG and CMC due to its relatively smaller exposure to the UK market.

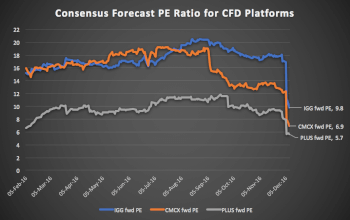

CMC, IG, and Plus500's share prices have fluctuated considerably in the past week, but all three continue to trade at more than a 40% discount to their pre-announcement prices. All three providers opened more than 3% up on Wednesday, with PLUS up 6% at one point.