Looking Ahead At The Next Week

Companies: IRON, JDW, KRS, LUCE, KETL, TIME, TRCS, UAI

Company news, such as Interim results, Final results, AGM statements and Trading Updates, are all recognised by active investors as being spurs that generate interest and dealing activity.

This column highlights some company news that will be announced in the week ahead.

Check out any of the companies mentioned by using the Research-Tree Companies Research link.

Monday 18th January

Interims: None declared

Finals: None declared

Trading Updates: Devro (DVO), The Gym Group (GYM),

AGMs: Craven House Capital (CRV), Keras Resources (KRS) General Meeting,

Research Tree Comment:

The AIM listed manganese ore and phosphate mining company Keras Resources (KRS) on this day is holding a General Meeting to approve its recent Placing of 400m new shares @ 0.11p each, needed as additional working capital. SP Angel reckoned that ‘Keras looks significantly undervalued assuming it will receive a mining license for Nayéga. The team shipped a bulk sample to a manganese alloy processor last year proving the quality and suitability of the ore for alloying.’ The broker also goes on to state that ‘Keras continue to press ahead with developing cash flow and production in Utah and in Togo. We are hopeful the new administration in Togo will come through with the mining license for Nayéga and production will start soon after.’

Tuesday 19th January

Interims: Time Finance (TIME), U and I Grp (UAI),

Finals: None declared

Trading Updates: Cairn Energy (CNE),

AGMs: Flutter Entertainment (FLTR), Tracsis (TRCS),

Research Tree Comment:

Times are changing, especially for 1pm. The latter company has recently rebranded itself as Time Finance (TIME) and the restructuring that is underway looks very interesting. Cenkos Securities reckon that the alternative finance group is all set for a good time over 2021. Rating its shares as a Buy @ 24p the broker suggests that ‘the shares still have plenty more to go as its catches up with the improving trading momentum.’

The software and computer services group Tracsis (TRCS) ‘has weathered the storm better than expected, with organic and acquired growth prospects as strong as ever’ stated finnCap in its latest comment on the group. Ahead of this day’s AGM it has reiterated its Target of 900p for the group’s shares.

The interim results to end September last from the U and I Group (UAI) will cover a period of lower rent collections. This specialist developer is due to announce on this day. After last September’s AGM Liberum concluded the group was making positive progress benefitting from a good momentum in residential sales and that its shares were pricing in too much negativity.

Wednesday 20th January

Interims: Antofagasta (ANTO), BHP Grp (BHP),

Finals: None declared

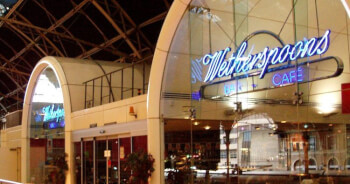

Trading Updates: Burberry Grp (BRBY), CMC Markets (CMCX), Diploma (DPLM), Dixons Carphone (DC.), WH Smith (SMWH), JD Wetherspoon (JDW),

AGMs: Diploma (DPLM), Prairie Mining (PDZ), Topps Tiles (TPT), WH Smith (SMWH), Sabien Technology (SNT) General Meeting,

Research Tree Comment:

Just how bad has it been for JD Wetherspoon (JDW) over the lockdowns? Way back at the end of August, when he rated the pubs group shares as a Buy, analyst Nishant Choudhary at AlphaValue considered that the group was better placed to cope with the headwinds. Its shares were then 1024p each, they have since risen to steady out at above 1110p. This day’s Trading Update will cover the group’s Q2 business report.

Thursday 21st January

Interims: None declared

Finals: None declared

Trading Updates: AJ Bell (AJB), Close Brothers Grp (CBG), Countryside Properties (CSP), Daily Mail and General Tst (DMGT), Energean (ENOG), Entain (ENT), Headlam Grp (HEAD), Hyve Grp (HYVE), Luceco (LUCE),

AGMs: Brandshield Systems (BRSD), Grafton Grp (GFTU), Kenmare Resources (KMR), Melrose Industries (MRO), Mineral & Financial Invs (MAFL),

Research Tree Comment:

This day will see the Luceco (LUCE) group declare its 2020 full year Trading Update. Liberum’s analysts are keen upon the shares of this wiring, lighting and power products group. Considering that it has both quality and stability, the brokers see solid growth ahead, together with a reset in margin targets. It is also looking for mergers and acquisition opportunities to accelerate the group’s next phase of growth.

Friday 22nd January

Interims: None declared

Finals: None declared

Trading Updates: Computercenter (CCC), Epwin Grp (EPWN), Medica Grp (MGP), SimplyBiz Grp (SBIZ), Strix Grp (KETL), The Mission Grp (TMG),

AGMs: Character Grp (CCT), Ironveld (IRON), Salt Lake Potash (SO4),

Research Tree Comment:

Analyst Dr Michael Green at Align Research considers the stock of Ironveld (IRON) to be ‘in play’. He suggests that the recent financing deal will ‘unlock tremendous value at a world-class high purity iron, vanadium and titanium project in the Bushveld.’ He has put out a Conviction Buy target of 3.26p on the iron ore group’s shares.

However, SP Angel has a different view concluding that ‘sometimes a company should wake up and smell the coffee. Mining juniors need to park stalled projects till conditions improve while working on more viable projects. We are not saying their High Purity Iron project will never be developed as we expect vanadium prices to rise on strong demand for ferro-vanadium for steel and for vanadium for Vanadium Redox Flow Batteries but the project may need significantly better conditions for financing and development.’

Zeus Capital in a recent 17-page report on the Strix Group (KETL) commented upon the kettle safety control products group’s good Q3 trading declaration on its Capital Markets Day. The group, which is seeking to double its revenues over the next five years, primarily through organic growth, is continuing to grow its market share in kettle controls. The broker considers ‘that the group’s current valuation is underpinned by longer term aspirations and that the share ratings they currently trade on does not look expensive when factoring in the potential growth from the business as it diversifies.’

The Pre-Close Trading Update due to be announced on this day will cover the full year to end December. It will, hopefully, confirm a very good outcome to the last year, while also declaring that current year prospects are even more optimistic.