See what's trending this week...

Companies: BHRD, CRTA, G4M, IQE, NXT, NEXN, PLUS, SDG, SPE, VEC

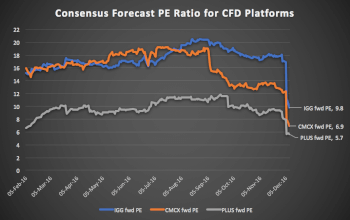

Plus500 (PLUS)

Upgrades driven by strong client growth | Liberum, 3 Jan

Paid Access

"Plus500's trading update this morning indicated that Q4 was an exceptionally strong period for customer acquisition. Consequently, we upgrade our Sterling EPS forecasts by 2%, 15% and 20% in 2017, 2018 and 2019, respectively. Our forecasts reflect stronger customer acquisition through our forecast horizon offset to some extent by lower ARPU, as a result of the ESMA leverage limits likely to come into force. Our new TP of 1,232p (previous: 1,069p) offers potential upside of 21% and an ETR of 28%. Valuation remains compelling, at 8.2x CY18 EPS falling to 8.1x and a yield of +7%. BUY."

IQE (IQE)

VCSEL growth underpins revenue upgrade | Edison, 2 Jan

Free Access

"IQE’s pre-close trading update noted that management expects FY17 revenues to be ahead of market expectations. Noting that the upgrade is driven by delivery of volume epitaxy on a programme that we infer is the new iPhone X, a programme which will continue throughout FY18, we raise our revenue estimates for both FY17 and FY18, but keep EPS numbers unchanged as the proportion of licence revenues in the mix is lower.

Management expects volume VCSEL ramp-up during H217 to result in photonics revenues approximately doubling for FY17 as a whole. Our estimates model photonics revenues remaining at H217 levels throughout FY18. Management expects wireless revenues to be broadly flat year-on-year, with favourable FX rates balancing an inventory reduction. Our estimates model growth from this segment in FY18. IQE expects the increase in wafer sales to drive an expansion of wafer margins in FY17, an effect which we model as continuing through FY18. We revise our group revenue estimates from £145.3m to £150.1m for FY17 and from £160.3m to £165.2m for FY18. We also increase the FY17 cash tax payment by £4.2m to reflect the settlement of a prior year tax liability."

Taptica International (TAP)

Fast forward for video DSP acquisition | finnCap, 4 Jan

Paid Access

"Taptica management has made rapid progress with its consolidation of the Tremor Video DSP business bought in August, completing it ahead of schedule. Strengthened management with new targets, budgets and controls have paid immediate dividends; achieving profitability in Q4 rather than FY 2018. Alongside continuing strong performance in the core Mobile Advertising business, this will see a significant uplift in margins, profit and cash flow for FY 2017. We, therefore, lift our FY 2017 earnings expectations and target price from 500p to 550p.

Today's trading update flags much higher margins from the Tremor Video DSP acquisition, leaving adj. EBITDA ahead of market expectations. We, therefore, raise our FY 2017 forecast from $28.9m to $33.0m. We also note revenue is expected to be “broadly in line”, suggesting some of the acquired business has been cut in the accelerated restructuring and consolidation (presumably low-margin sales) and in response, we adjust our group revenue forecast from $216.5m to $210.6m. This has a follow-on effect on our FY 2018 sales expectations; however, with the higher margins being delivered, our EBITDA forecast for the current year is unchanged. The additional profit should also see much reduced net debt at the year-end."

NEXT (NXT)

January Trading Statements | Whitman Howard, 2 Jan

Paid Access

"Next (NXT LN, 4525p, Sell, TP 3700p) presents its Christmas trading update tomorrow. It is traditionally the first to report and gives some indication on the overall Christmas out-turn. At its 1st Nov 3Q trading update, Next guided to 4Q sales - 0.3% (Next Retail and Directory together). Additionally, it will provide its first detailed guidance for the year to Jan 2019. Currently, the market is looking for PBT to decrease modestly c3%. 2017/18 midpoint PBT guidance currently stands at £717m.

Our sense based on channel check pre and post-Christmas is that the level of discounting in the High Street, in general, has been below last year, probably aided by cold weather and conservative buying patterns."

Gear4music (G4M)

Jingle bells | Edison, 5 Jan

Free Access

"Gear4music (G4M) has fulfilled the strong expectations of its four-month Christmas trading period. Revenue growth of 42% is consistent with H1 and is in line with expectations, both in the UK and faster-growing international markets. This means that the online model continues to take share, achieving growth far ahead of consumer fundamentals and building on its market-leading position. We retain our forecast and reiterate our valuation stance, which sees upside based on the rate of development of international markets."

Sopheon (SPE)

Trading update and customer event feedback | Progressive Equity Research, 4 Jan

Free Access

"Sopheon has today published an upbeat trading update. We make no changes to estimates at this stage but will look to revisit forecasts once more detail is available. Separately, we had the privilege of attending a recent Sopheon user forum in Stuttgart. The event provided a rare insight into the Group’s relationships with customers, and gave us a significant degree of reassurance around the product’s reach, the roadmap, and the level of reliance placed upon it by a global group of blue-chip clients."

Walker Greenbank (WGB)

Trading in line with reduced forecasts; Anstey defers £0.4m profit to Q1 | N+1 Singer, 4 Jan

Paid Access

"Walker Greenbank has confirmed that repairs to the Anstey factory printing machine that was affected by the fire 4 weeks ago are progressing, and it will be up and running again in early Q1 FY19. Insurance will cover the repair/replacement costs, and there will be no loss of profit (just a deferral from Q4 into Q1). The deferred printing revenue is expected to be of the order £1m and the profit shift will be about £0.4m. We have altered our forecasts accordingly, from £12.8m to £12.4m in Jan18 and from £13.5m to £13.9m in Jan19. The fact there is no further update on trading indicates performance since the warning 8 weeks ago has been in line with downgraded guidance. Given where the share price has dropped to after a 40% fall to 140p (vs 12% downgrade), the P/E is now sitting at just 9x. This looks to be significantly oversold and so today’s news ought to be well received and see the shares regain some ground. The FY pre-close will provide more details on subsequent UK and overseas trading in 4 weeks time."

Wandisco (WAND)

Record contract win | Edison, 3 Jan

Free Access

"WANdisco’s $4.3m contract win with a major financial institution is the company’s largest to date and should leave our FY17 bookings and revenue estimates well underpinned. The deal, which was delivered via the IBM OEM partnership, also helps put into context the rationale for the recent fundraise to support a faster roll-out of the OEM strategy. We expect an acceleration in commercial momentum from here.

The $4.3m win is the second $4m+ deal signed via the IBM OEM partnership in the financial services sector during FY17. We understand that WANdisco has had a longstanding dialogue with the customer, but the IBM relationship was key to securing a deployment of this magnitude. The client will use the Big Replicate/Fusion platform to seamlessly replicate data between primary and disaster recovery sites across both big data and cloud applications."

Be Heard Group (BHRD)

Revenues ahead but costs timing mismatch | N+1 Singer, 4 Jan

Paid Access

"Be Heard has issued its January trading update indicating organic revenue growth of 24% for 2017. This implies a c5% beat. Given the recent win rate management had expected this to turn out even more strongly but timing factors mean that these revenues will fall into 2018. Building out resource to support this very fast growth rate has however taken its toll in December and led to a mismatch between revenue and costs. While we expect to reduce our forecast EBITDA for 2017 we do not expect to make any changes to our 2018 assumptions given the client win momentum and healthy visibility. The Company has also announced board changes. Executive Chairman Peter Scott becomes CEO, NED David Morrison becomes non-executive Chairman and the Company intends to split the CFO/COO roles once they have recruited a new CFO (Robin Price to retain COO role). While in the short term there will be some disappointment on 2017 profitability the underlying factor is strong growth (something which agency groups do struggle with in terms of cost planning when growth rates are very high) and from this perspective, this demonstrates that the strategy fundamentals are sound in our view."

Vectura Group (VEC)

Trading and strategy update | N+1 Singer, 4 Jan

Paid Access

"This morning’s update highlights an in-line performance of key revenue drivers, but an expected £5m negative top line impact from currency. In addition, Vectura has taken the decision to partner its proprietary VR475 (EU) and VR647 (US) programmes, in line with our expectations. FY2018 R&D guidance has been lowered, with our £65m forecast remaining within the range. Finally, Mundipharma has terminated development of the VR2076 pMDI triple therapy, which we did not include in our estimates. Overall a broadly in-line update. We note the significant share price rally since our upgrade to Buy on 10th November at 90p."