An extract from Northland Capital's AIM Journal - January

Companies: ASC, FEVR, GWPRF, PAYS, SXX, WTG

Second-half boost to AIM trading

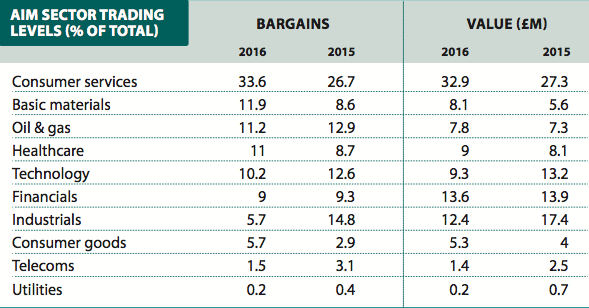

AIM performed strongly last year and trading levels also picked up in the second half.

Last year’s EU referendum appears to have sparked an upturn in trading on the junior market. The average daily trade value and average daily number of bargains were both higher in 2016 than 2015.

Trading in the first half of 2016 was behind the levels in the first half of the previous year but in the second half of 2016 each month’s trading was higher than the same month in 2015 – both in terms of number of trades and value. The average daily value of trades for the whole year was £128.4m, against £121.9m in 2015, while the average daily number of bargains was 24,593, compared with 22,809 last year.

These figures tend to get adjusted. The 2015 numbers are slightly higher than the original figures in the December 2015 AIM statistics, but any changes should not be substantial.

One of the biggest changes is the decline in trading in industrials. However, this is mainly attributable to the support- services sector, which included online payments business Paysafe in 2015. In the second half of the year Paysafe was generally the second most traded company every month after ASOS but it moved to the Main Market in early 2016.

The improvement in trading levels is more impressive when the loss of Paysafe, which was generating around 10% of trading on AIM in the later months of 2015, is taken into account. In 2017, the cancellation of the AIM quotation of GW Pharmaceuticals will have less of an effect because it accounted for around 2% of the value of trades in December.

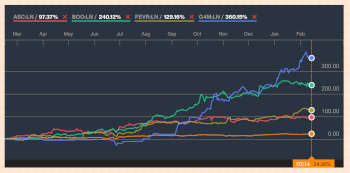

Consumer services became even more dominant last year. ASOS continues to be the most traded share on AIM and rival online fashion retailer boohoo.com recovered from its depressed levels in 2015 on the back of increased investor interest.

Mixer drinks supplier Fevertree Drinks goes from strength to strength and this is the main reason why the consumer goods sector has gone from 2.9% to 5.7% of bargains and from 4% to 5.3% in terms of value.

The beverages sub-sector has gone from one-third to nearly 50% of the total value of consumer goods trading, while the share of the number of bargains has doubled from 28.6% to 57.3%. In December 2016, Fevertree accounted for more than 90% of bargains in the beverages sub-sector, which is higher than in December 2015. The number of trades in the other beverages companies slipped slightly.

Mining

Basic materials, which is predominantly mining, has gone from seventh in terms of bargains to the second most traded sector in 2016. In value terms, the sector has moved from seventh to fifth.

This is consistent with the fact that there are a significant number of small mining companies on AIM. The value traded last year was a larger percentage than the share of the total value of AIM, which has risen since 2015. There is undoubtedly an upturn in interest in mining and exploration companies based on optimism about commodity prices.

It is not just small mining companies that have attracted attention. Sirius Minerals is a large mining company and it has become one of the most traded companies on AIM, helped by the securing of the finance it requires to develop its mine. The number of trades more than doubled year on year in December and the value was seven times the level in 2015.

In contrast, the oil and gas sector continues to decline in importance even though the oil price has started to recover.

The decline in the technology sector appears to be in part because of the decline in trading in Watchstone, formerly Quindell, which was exacerbated in value terms by the sharp decline in its market capitalisation.

.png)