Search our extensive database for professional

equity research & media

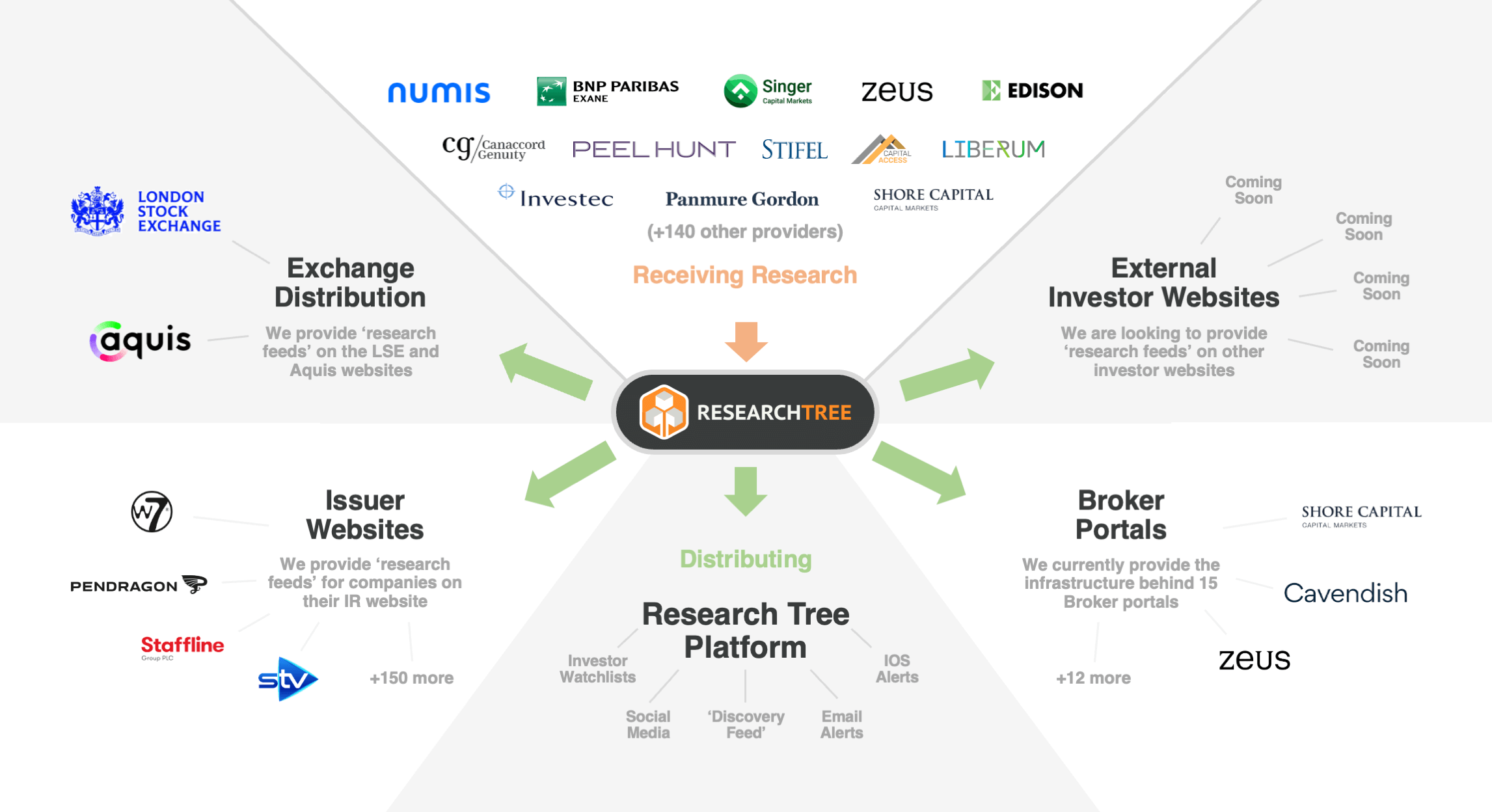

Providers on Research Tree include:

Research Tree

The home of professional equity research

At Research Tree, we democratise access to equity research for investors and companies. Our platform aggregates professional research reports from various analysts, providing valuable insights for informed investment decisions.

Research Tree Platform Features

Explore all the features we offer investors on Research Tree below

Build Watchlists

Create personalised watchlists to track your favourite equities and stay updated on their performance, in one centralised dashboard.

Set-Up Alerts

Set up custom email alerts to receive timely updates and notifications about significant market movements.

Generate Ideas

With access to a wide range of providers creating research on sector and thematic notes, uncover unique investment opportunities and innovative ideas.

Discover Our B2B Solutions

Research Feeds

Increase the accessibility, distribution, and visibility of professional equity research on your company website

View more

Provider Portals

Seamlessly present your equity research in a ‘one- stop destination’ for investors – whilst maintaining a fully compliant process.

View more

Research Distribution

Let us help distribute your professional equity research through our online ecosystem.

View more

Fireside Webinars

Keep investors informed and engaged online via one of Research Tree's 'Fireside Webinars'.

View more

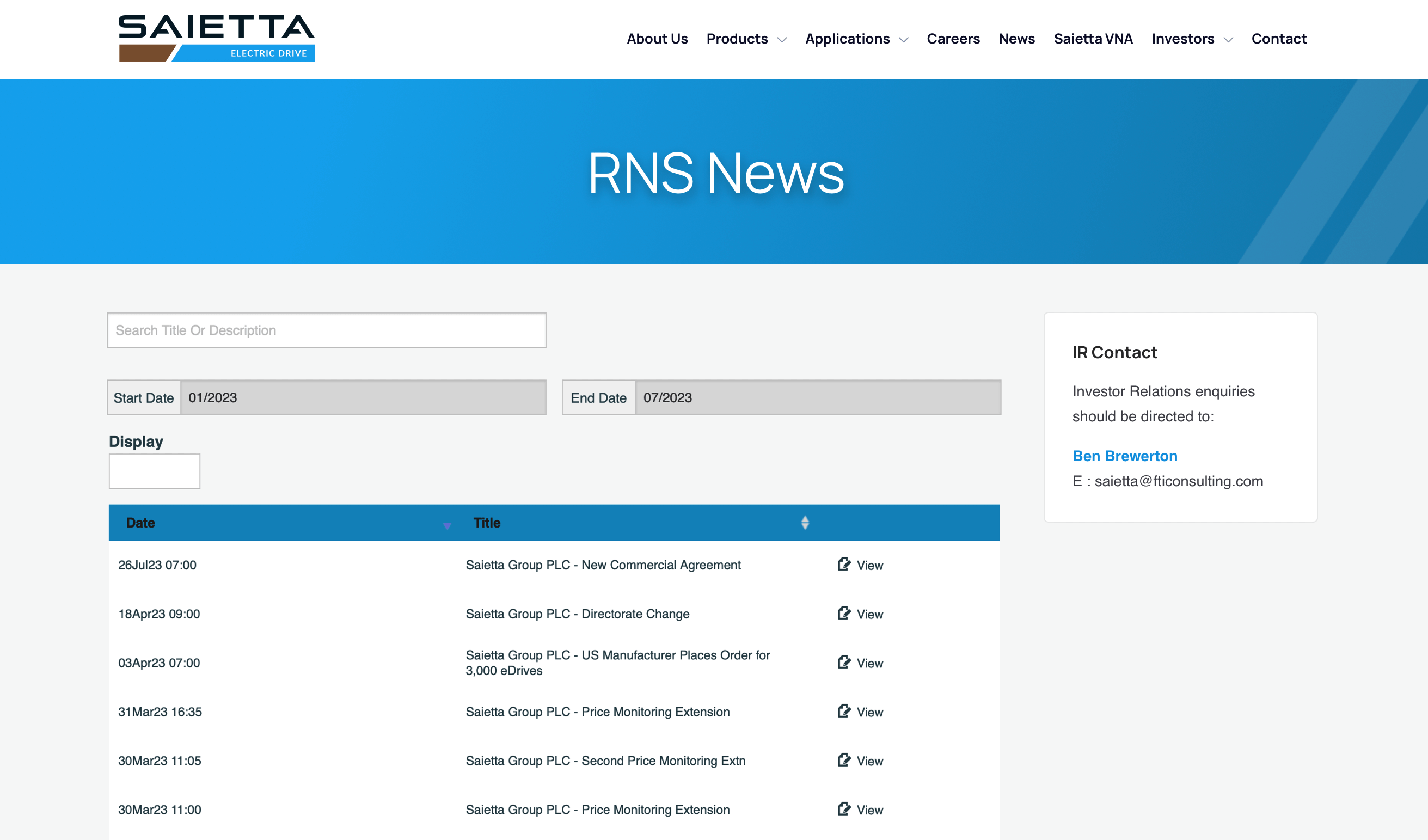

Embedded RNS Feeds

Enhance the reach, dissemination, and prominence of your firm's Regulatory News Service bulletins on your website.

View more

DealBridge

DealBridge enables brokers to manage wallcrossing, bookbuilding, and allocation efficiently while ensuring compliance.

Coming Soon