Tees Valley Lithium: Lower CAPEX, Higher Uptime, Stronger Market Outlook

The FEED study has reduced projected CAPEX to

Independent analysis by

HIGHLIGHTS

· CAPEX reduced to

· Plant availability increased by 5% to 90%, with no increase in operating costs, driving stronger profitability

· NPV of

· First production on target for early 2028, aligning with rising lithium prices and surging EV and ESS demand

· Train 1 production of 25,000 tonnes per annum set to supply 2.5% of

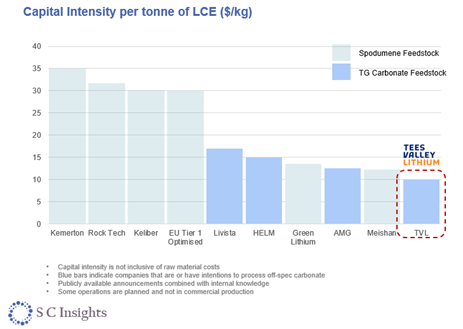

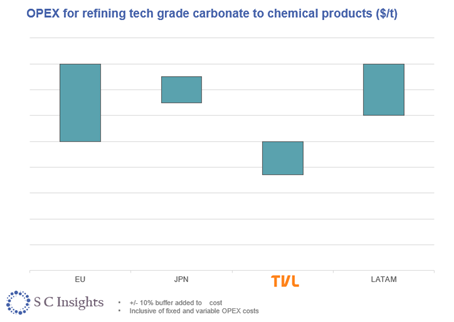

· CAPEX and OPEX costs independently validated by SC Insights as expected to be lowest in

FEED study by Wave and Veolia reducing Capex and optimising process route

The Train 1 Front-End Engineering Design (FEED) study is progressing well, with TVL working in close partnership with engineering partners

The modularised approach has improved schedule efficiency and reduced the capital expenditure for Train 1 to

Process route design modifications have been made to accommodate a broader range of feedstock specifications, including the ability to incorporate recycled lithium inputs, supporting both circular economy principles and customer ESG objectives.

SC Insights confirms TVL as

Independent analysis by SC Insights (Lithium Battery Supply Chain Experts) confirms that TVL is expected to be the lowest-cost lithium hydroxide refinery in

SC Insights further forecasts that TVL's first commercial production of battery-grade lithium hydroxide in early 2028 will coincide with the next expected upturn in the lithium pricing cycle.

With European demand for battery-grade lithium projected to reach 1 million tonnes per annum, Train 1 is expected to supply approximately 2.5% of this market, delivering directly into a European customer base increasingly focused on sourcing local, traceable, and low-carbon supply.

The development of further trains at TVL represents the opportunity to significantly expand production capacity over time, strengthening the

Alkemy Chairman

"Lithium battery supply chain experts SC Insights has confirmed that TVL is expected to be

It has also confirmed that there is strong growing market demand for locally processed battery grade lithium in

As we close in on

SC Insights Managing Director

"We're pleased to continue working with Tees Valley Lithium as an independent advisor, providing detailed market and competitor benchmarking to assess the project's position within a rapidly evolving lithium industry.

Our analysis draws on the latest cost, price, and demand data, and indicates that TVL is expected to be one of the lowest-cost lithium hydroxide refineries in

While market dynamics will continue to evolve, the combination of modular design, strategic location, and feedstock flexibility places TVL in a strong position to benefit from the next phase of market growth as demand for locally refined battery-grade lithium accelerates."

Further information

For further information, please visit Alkemy's website: www.alkemycapital.co.uk or TVL's website www.teesvalleylithium.co.uk.

-Ends-

|

|

Tel: 0207 317 0636 |

|

|

Tel: 0203 829 5000 |

ABOUT US

Forward Looking Statements

This news release contains forward‐looking information. The statements are based on reasonable assumptions and expectations of management and Alkemy provides no assurance that actual events will meet management's expectations. In certain cases, forward‐looking information may be identified by such terms as "anticipates", "believes", "could", "estimates", "expects", "may", "shall", "will", or "would". Although Alkemy believes the expectations expressed in such forward‐looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those projected. In addition, factors that could cause actual events to differ materially from the forward-looking information stated herein include changes in market conditions, changes in metal prices, general economic and political conditions, environmental risks, and community and non-governmental actions. Such factors will also affect whether Alkemy will ultimately receive the benefits anticipated pursuant to relevant agreements. This list is not exhaustive of the factors that may affect any of the forward‐looking statements. These and other factors should be considered carefully and readers should not place undue reliance on forward-looking information.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the