("

Interim Results for six-month period ending

Highlights from the period and events following the period end include:

· Leadership:

· Battery Grade Lithium: in January, CTL proved its ability to deliver battery-grade lithium from its own Laguna Verde brine, validating its direct lithium extraction (DLE) processes and exceeding international standards for battery-grade purity.

· Resource: CTL's JORC resource at Laguna Verde has now increased to 1.63Mt of lithium carbonate equivalent (LCE)

· Fundraise: in February and March, a

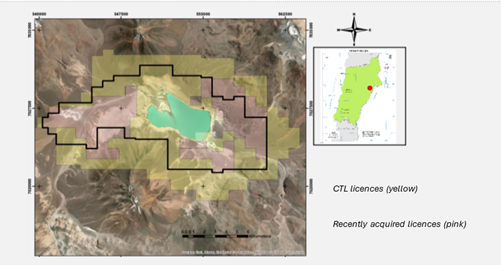

· Licence Expansion: after the period end, CTL has acquired 30 additional licences at Laguna Verde increasing the Group's mining licence coverage of the Government's special lithium operating contract (CEOL) polygon area to over 97%, underscoring its dominant position in the basin and significantly enhancing CTL's candidacy to be awarded a CEOL.

· Loan Notes: after the period end, the Loan Notes issued in

· Cost discipline: the focus to cut costs has shown favourable results in the first half of the year and remains as an ongoing priority.

· Board restructure: post period end, four directors stepped down from the Board in August as a result of operational and financial restructuring; a new Jersey-resident director is expected to be appointed soon.

"I am very pleased to have joined the Company at such an exciting time, with the CEOL application running and the pre-feasibility study in development. All the work undertaken in the past years on exploration, piloting and modelling has positioned us uniquely to become the next lithium producer in a prime jurisdiction such as

The first half of the year came with the disappointment of not being admitted into the CEOL´s streamlined process for Laguna Verde, but with the recent acquisition of the Minergy licenses and an ownership of more than 97% of the mining property within the Government´s polygon area, we are now front runners for a new streamlined process, which should be opened in the coming months.

I would like to thank our investors for their ongoing support, and especially to those who have participated in our recent fundraise, completed in late August, for continuing to believe in our story and potential. We look forward to the coming months with confidence and excitement on what´s to come, and will keep you appraised with regular updates along the way"

CHAIRMAN'S REVIEW

In what has undoubtedly become a pivotal phase for

So far this year we have: reshaped our leadership, strengthening our presence in

Leadership

· On

He spent the seven years up to 2024 at the largest lithium producer in the world, Albemarle, with the latter three years as their country manager in

· In August, after the period end, as part of a wider operational and financial restructuring initiative the Board was reshaped.

Battery-Grade Lithium Carbonate

· In January, we achieved a significant milestone by proving our capacity to produce battery-grade lithium carbonate from our brine. Our sampling produced a 99.78% purity exceeding the Chinese industry benchmark of 99.6%. The next phase will focus on scaling up production to supply potential strategic partners and off-takers for product testing.

Laguna Verde

· The Laguna Verde salar has been designated as a priority for lithium development by the Chilean Government and in January we submitted our application to enter a streamlined process toward CEOL award. Although our application was compelling and strengthened further by letters of support in favour of

· The Government is also required to engage in a consultation process with the indigenous communities which have traditional interests at Laguna Verde. That process commenced in late July, and we understand it should be completed by the end of October.

· In January, we were also pleased to announce a new JORC-compliant resource estimate at Laguna Verde, prepared by

Viento Andino and Arenas Blancas - Exploration Upside

· No activity has been undertaken at Viento Andino (formerly

· We have also chosen to retain licence positions at Arenas Blancas (

Capital Markets & ASX Listing

·

· In February and

· Post period end, in August,

Financial Update

· In the first half of the year the Group recorded an operating loss of

· Finance charges in the period of

· Exploration and evaluation assets increased slightly to

Outlook

The Board remains confident in

· Advance into a streamlined CEOL process at Laguna Verde

· Complete the PFS at Laguna Verde and begin work on preparing a definitive feasibility study and EIA

· Advance discussions with potential strategic partners.

· Scale up production of battery-grade lithium carbonate for validation by off-takers.

· Continue proactive engagement with indigenous communities and stakeholders.

On behalf of the Board, I would like to thank our investors, partners, and the

______________________

INTERIM FINANCIAL RESULTS

Condensed Consolidated Statement of Comprehensive Income

|

|

|

Note |

Unaudited |

Reviewed |

|

|

|

|

|

£ |

£ |

|

|

|

|

|

|

|

|

|

Income |

|

|

- |

- |

|

|

Administrative costs |

|

3 |

(1,161,410) |

(2,226,790) |

|

|

Operating loss |

|

|

(1,161,410) |

(2,226,790) |

|

|

|

|

|

|

|

|

|

Finance costs |

|

4 |

(884,847) |

- |

|

|

Foreign exchange on financing transactions |

|

5 |

856,161 |

- |

|

|

Loss before tax |

|

|

(1,190,096) |

(2,226,790) |

|

|

|

|

|

|

|

|

|

Income tax |

|

7 |

|

- |

|

|

Loss for the period after tax |

|

|

(1,190,096) |

(2,226,790) |

|

|

|

|

|

|

|

|

|

Other comprehensive (loss) / income : |

|

|

|

|

|

|

Exchange differences arising on translation of functional currencies |

|

(1,206,844) |

(906,194) |

||

|

Total comprehensive loss for the period |

|

|

(2,396,940) |

(3,132,984) |

|

|

|

|

|

|

|

|

|

Loss per share basic (post consolidated basis) |

|

8 |

(0.012) |

(0.031) |

|

The accompanying notes are an integral part of these unaudited condensed consolidated interim financial statements.

Condensed Consolidated Statement of Financial Position

|

|

|

Unaudited |

Audited |

|

|

Note |

£ |

£ |

|

|

|

|

|

|

Exploration and evaluation assets |

9 |

32,776,060 |

32,583,274 |

|

Non-current assets |

|

32,776,060 |

32,583,274 |

|

|

|

|

|

|

Cash and cash equivalents |

|

143,225 |

134,248 |

|

Trade and other receivables |

10 |

91,996 |

161,492 |

|

Current assets |

|

235,221 |

295,740 |

|

|

|

|

|

|

Trade and other payables |

12 |

(301,653) |

(471,672) |

|

Loans notes |

13 |

(2,198,169) |

(2,185,135) |

|

Deferred consideration |

14 |

(1,623,504) |

(1,686,408) |

|

Provisions and accruals |

12 |

(967,924) |

(770,342) |

|

Current liabilities |

|

(5,091,250) |

(5,113,557) |

|

|

|

|

|

|

Deferred consideration |

14 |

(13,294,815) |

(13,815,221) |

|

Non-current liabilities |

|

(13,294,815) |

(13,815,221) |

|

|

|

|

|

|

Net assets |

|

14,625,216 |

13,950,236 |

|

|

|

|

|

|

Share capital |

|

30,532,549 |

28,443,989 |

|

Capital reserve |

|

(77,237) |

(77,237) |

|

Share based payment reserve |

11 |

7,852,934 |

6,869,574 |

|

Foreign exchange reserve |

|

(3,802,432) |

(2,595,588) |

|

Accumulated losses |

|

(19,880,598) |

(18,690,502) |

|

|

|

|

|

|

Equity and reserves |

|

14,625,216 |

13,950,236 |

The accompanying notes are an integral part of these consolidated financial statements.

These financial statements were approved and authorised for issue by the Board of directors on

Condensed Consolidated Statement of Changes in Equity

|

|

Share capital |

Capital reserve |

Share based payment reserve |

Foreign exchange reserve |

Accumulated losses |

Total |

|

|

£ |

£ |

£ |

£ |

£ |

£ |

|

|

|

|

|

|

|

|

|

At |

26,310,625 |

(77,237) |

5,713,259 |

(705,375) |

(11,448,282) |

19,792,990 |

|

|

|

|

|

|

|

|

|

Loss for the period |

- |

- |

- |

|

(2,226,790) |

(2,226,790) |

|

Other comprehensive income |

- |

- |

- |

(906,194) |

- |

(906,194) |

|

Total comprehensive loss |

- |

- |

- |

(906,194) |

(2,226,790) |

(3,132,984) |

|

|

|

|

|

|

|

|

|

Share options and warrants |

- |

- |

704,548 |

- |

- |

704,548 |

|

|

26,310,625 |

(77,237) |

6,417,807 |

(1,611,569) |

(13,675,072) |

17,364,554 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At |

28,443,989 |

(77,237) |

6,869,574 |

(2,595,588) |

(18,690,502) |

13,950,236 |

|

|

|

|

|

|

|

|

|

Loss for the period |

- |

- |

- |

- |

(1,190,096) |

(1,190,096) |

|

Other comprehensive income |

- |

- |

- |

(1,206,844) |

- |

(1,206,844) |

|

Total comprehensive loss |

- |

- |

- |

(1,206,844) |

(1,190,096) |

(2,396,940) |

|

|

|

|

|

|

|

|

|

Issue of share capital |

2,297,840 |

- |

- |

- |

- |

2,297,840 |

|

Share options and warrants |

(209,280) |

- |

983,360 |

- |

- |

774,080 |

|

|

2,088,560 |

- |

983,360 |

- |

- |

3,071,920 |

|

|

|

|

|

|

|

|

|

|

30,532,549 |

(77,237) |

7,852,934 |

(3,802,432) |

(19,880,598) |

14,625,216 |

The accompanying notes are an integral part of these consolidated financial statements.

These financial statements were approved and authorised for issue by the Board of directors on

Condensed Consolidated Statement of Consolidated Cash Flows

|

|

|

Unaudited |

Reviewed |

|

|

Note |

£ |

£ |

|

|

|

|

|

|

Loss after tax for the period |

|

(1,190,096) |

(2,226,790) |

|

Non-cash items: |

|

|

|

|

Fair value of loan note warrants |

|

376,820 |

86,387 |

|

Fair value recognition of share options and warrants |

|

- |

- |

|

Movement in trade and other receivables |

|

70,634 |

397,320 |

|

Movement in payables, provisions and accruals |

|

(677,272) |

707,691 |

|

Finance costs |

|

884,847 |

- |

|

Net cash used in operating activities |

|

(535,067) |

(1,035,392) |

|

Expenditure on exploration and evaluation assets |

|

(935,912) |

(4,800,040) |

|

Net cash used in investing activities |

|

(935,912) |

(4,800,040) |

|

|

|

|

|

|

Proceeds from issue of ordinary shares |

|

2,297,840 |

- |

|

Finance costs |

|

- |

- |

|

Net cash generated from financing activities |

|

2,297,840 |

- |

|

|

|

|

|

|

Net cash flow |

|

826,861 |

(5,835,432) |

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents brought forward |

|

134,247 |

6,202,028 |

|

Net cash flow |

|

826,861 |

(5,835,432) |

|

Effect of exchange rate changes |

|

(817,883) |

(330,620) |

|

Cash and cash equivalents carried forward |

|

143,225 |

35,976 |

The accompanying notes are an integral part of these interim unaudited condensed consolidated financial statements.

Notes to the Financial Statements

1. GENERAL INFORMATION

CleanTech Lithium Plc ("CTL Plc", or the "Company")

The condensed consolidated interim financial statements of CleanTech Lithium Plc for the first six months ended 30 June 2025 were approved for issue on 26 September 2025.

CleanTech Lithium Plc was incorporated and registered as a private company, initially with the name

On 14 February 2022, a share-for-share exchange between the shareholders of CleanTech Lithium Ltd (CTL Ltd, or the

In the year ended 2024, CleanTech Lithium Chile SpA, a company with registered number, RUT 77.905.882-4, was incorporated to serve as holding company for the Chilean entities. During the year, the debt and equity interests held by CTL Ltd in each of the Chilean subsidiaries was transferred to CleanTech Chile SpA and CleanTech Chile SpA issued an equal value of debt and equity as consideration to CleanTech Lithium Limited, such that the transaction had a neutral economic effect for the group.

2. BASIS OF PREPARATION

The condensed consolidated interim financial statements for the Group have been prepared in accordance IAS 34 'Interim Financial Reporting' per the

The amounts in this document are presented in British Pounds (GBP), unless noted otherwise. Due to rounding, numbers presented throughout these condensed consolidated Interim financial statements may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures.

A summary of the material accounting policies can be found in the Company's consolidated financial statements for the year ended 31 December 2024, on pages 48 to 50. The accounting policies used to prepare these condensed consolidated interim financial statements are consistent with those. Furthermore, there are no new standards or interpretations applicable from 1 January 2025 which have a significant impact on these condensed consolidated interim financial statements.

Significant accounting judgments, estimates and assumptions

In preparing this interim financial report, it has been necessary to make judgments, estimates and assumptions to form the basis of presentation, recognition and measurement of the Group's assets, liabilities, items of income statements, accompanying disclosures and the disclosure of contingent liabilities. Uncertainty about these assumptions and estimates could result in outcomes that require a material adjustment to the carrying amount of assets or liabilities affected in future periods.

The significant judgments, estimates and assumptions made when applying the Group's accounting policies are the same as those applied to the consolidated financial statements for the year ended 31 December 2024, with the exception of the judgement relating to deferred consideration which arose on the acquisition of the LV licences, details of which are set out in Note 14. The significant judgment in assessing the exploration and evaluation assets for the existence of indicators of impairment at the reporting date, which are set out in note 9.

The judgement relating to the recoverability of the Chilean VAT is as disclosed in note 10.

Going Concern

The Group is in a pre-revenue phase of development and until its transition to revenue generation and profitability the Group will be required to rely on externally sourced funding to continue as a going concern, the Board recognises this condition may indicate the existence of material uncertainties, which may cast significant doubt regarding the Group's ability to continue as a going concern. Notwithstanding, the Directors have a demonstrated record of successfully raising capital raising for projects and ventures of this nature and are confident in being able to secure the funding needed for the Group to deliver on its commitments and continue as a going concern.

3. ADMINISTRATION EXPENSES

Administration expenses in the six months to 30 June 2025 totaled £1.2 million (H1 2024 £2.2 million), reflecting cash costs of £1.4 million (H1 2024 2.5 million) off set by non-cash costs and unrealised foreign exchange gains of £0.2 million (H1 2024 £0.2 million).

Of the non-cash costs, £0.1 million relates to the fair value of options and warrants (H1 2024 £0.1 million) and £0.4 million reflects the unwinding of the discount on the deferred consideration (H1 2024 £nil). These have been off-set by the unrealised gain on translation of the deferred consideration of £0.7 million (H1 2024: £0.3 million).

Of the £1.3million in cash costs, approximately £0.4 million relates to directors and staff costs (H1 2024: £0.5 million), £0.1 million relates to promotion, public and investor relations and travel (H1 2024: £0.4 million), £0.7 million relates to legal and professional support including listing and compliance, audit and insurance costs (H1 2024: £0.8 million), and the balance of £0.1 million comprises a variety of other and general administrative costs (H1 2024: £0.2 million).

4. FINANCE COST

The finance charge in the period of £0.9 million reflects the unwinding of deferred consideration discount of £0.8 million (H1 2024: £nil) and the finance costs associated with the loan notes issued in June 2024 £0.1 million (H1 2024 nil). Both charges are non-cash in nature.

5. FOREIGN EXCHANGE ON FINANCING TRANSACTIONS

The foreign exchange on financing transactions reflects the translation exchange gain of £0.9 million on the USD $ denominated buy out of the LV licences.

6. SEGMENTAL INFORMATION

The Group operates in a single business segment, being the exploration and evaluation of mineral properties, activities which are undertaken in

7. INCOME TAX

The accrued income tax expense continues to be £nil as the Group remains in a loss-making position. No deferred tax asset is recognised on these losses due to the uncertainty over the timing of future profits and gains.

8. LOSS PER SHARE

The calculation of basic loss per ordinary share is based on the loss after tax and on the weighted average number of ordinary shares in issue during the period.

A diluted loss per share assumes conversion of all potentially dilutive Ordinary Shares arising from the share schemes. Potential ordinary shares resulting from the exercise of warrants and options have an anti-dilutive effect due to the Group being in a loss position. As a result, diluted loss per share is disclosed as the same value as basic loss per share.

|

|

|

Unaudited 30-Jun-2025 |

Reviewed 30-Jun-2024 |

|

|

Basic and diluted loss per share |

|

£ |

£ |

|

|

Loss after taxation |

|

(1,190,096) |

(2,226,790) |

|

|

Basic weighted average number of ordinary shares (millions) |

|

96.35 |

72.58 |

|

|

Basic loss per share (GBP £) |

|

(0.012) |

(0.031) |

|

In November 2024, a share consolidation was completed resulting in the doubling of the nominal price per ordinary share (from 1p to 2p) and a halving of the number of shares in issue. Although the share consolidation occurred after 30 June 2024, the basic weighted average number of ordinary shares in the comparative period in the table above is shown on a post consolidated basis for like-for-like comparison purposes.

9. EXPLORATION AND EVALUATION ASSETS

Expenses incurred to date by the Chilean entities on feasibility studies, mineral exploration and delineation were capitalised as "exploration and evaluation assets" within "non-current assets" in accordance with the Group's accounting policy.

|

Exploration and evaluation assets |

Unaudited six months ended 30-Jun-2024 |

Audited Year ended 31-Dec-24 |

|

|

£ |

£ |

|

|

|

|

|

Opening balance |

32,583,274 |

13,710,413 |

|

Fair value of licence acquisitions |

- |

15,278,742 |

|

Additions |

967,957 |

5,599,236 |

|

Impairments |

- |

(480,483) |

|

Effect of foreign exchange translations |

(775,171) |

(1,524,637) |

|

Closing balance |

32,776,060 |

32,583,274 |

Of the £0.97 million additions in the period, approximately £0.39 million related to pre-feasibility costs for the Laguna Verde project, £0.24 million to mining licences costs, £0.19 million relates to communities and other support costs, capitalised people costs account for £0.12 million, and non-cash fair value costs associated with share options accounts for the remainder.

The fair value of licence acquisitions in 2024 reflects the present value of deferred consideration for licences acquired under the LV Purchase Agreement (refer Note 14), of which approximately £1.0 million has been paid.

Impairment assessments

The Directors assess for impairment when facts and circumstances suggest that the carrying amount of an exploration & evaluation asset (E&E) may exceed its recoverable amount. In making this assessment, the Directors have regard to the facts and circumstances noted in IFRS 6 paragraph 20. In performing their assessment of each of these factors, at 30 June 2024, the Directors have:

· reviewed the time period that the Group has the right to explore the area and noted no instances of expiration, or licences that are expected to expire in the near future and not be renewed;

· determined that further E&E expenditure is either budgeted or planned for all licences;

· not decided to discontinue exploration activity due to there being a lack of quantifiable mineral resource; and

· not identified any instances where sufficient data exists to indicate that there are licences where the E&E spend is unlikely to be recovered from successful development or sale.

Based on the above assessment, the Directors are not aware of any facts or circumstances that would suggest the carrying amount of the E&E asset may exceed its recoverable amount. Consequently, the Directors do not consider there is any indication of impairment.

Furthermore, in 2024, the DLE pilot plant was commissioned, consequently the Directors considered whether expenditure relating to the DLE pilot plant should be reclassified as tangible assets in 2024 and concluded that the Pilot Plant remains in a testing stage of its development.

10. TRADE AND OTHER RECEIVABLES

|

|

Unaudited as at 30-Jun-25 |

Audited |

|

|

£ |

£ |

|

|

|

|

|

Prepayments and deposits |

55,834 |

125,058 |

|

VAT |

25,038 |

21,038 |

|

Other receivables |

11,124 |

15,396 |

|

Total |

91,996 |

161,492 |

Prepayments and deposits largely reflect prepaid insurance and other commercial subscriptions which renew variously and annually as well as office rental deposit amounts paid.

Although VAT shows a balance of approximately £25k at 30 June 2025, at that date approximately £1.9 million in Chilean input VAT is not shown in the table above (approximately 2024: £1.8 million). Although the Chilean input VAT is expected to be eligible for refund in future, due to the uncertainty over the timing of future production and revenues, which would trigger the Group's eligibility to recover that VAT, the Directors have made full provision against this same amount. Accordingly, approximately £0.1 million provision has been reflected in the income statement for the period ended 30 June 2025 (refer Note 3).

Other receivables comprise multiple smaller working capital balances in

11. SHARE BASED PAYMENTS

|

|

Unaudited Six months ended |

Audited Year ended |

|

|

30-Jun-25 |

31-Dec-24 |

|

|

# |

# |

|

|

|

|

|

Outstanding at start of period |

19,446,461 |

17,181,344 |

|

Warrants granted |

16,398,534 |

3,147,614 |

|

Warrants and Share Options: expired, relinquished or revoked |

(900,003) |

(332,497) |

|

Outstanding at end of period |

34,494,992 |

19,996,461 |

All options and warrants are granted in Company's name. Share options granted have a weighted average exercise price of 96 pence and warrants have a weighted average exercise price of 35 pence.

The fair value of each option granted in the period was estimated on the grant date using the Black Scholes option pricing model. The following assumptions have been used:

Weighted average fair value of call option per share £0.85

Weighted average share price at grant date £1.03

Weighted average exercise price £1.02

Average expected volatility at grant dates 109.1%

Vesting period 5.0 years from vesting

Average risk-free interest rate (based on government bonds) 4.1%

The total share option fair value charge during the six months to 30 June 2025 is £146k (2024 £198k), of which approximately £183k has been recorded in the income statement as a non-cash employee expense; the balance has been recorded within E&E.

The total warrant shares fair value charge during the six months to 30 June 2025 was approximately £837k (2024: £506k).

As noted, these fair value estimates derived thorough Black-Scholes modelling and Monte Carlo simulations are non-cash accounting entries.

12. PAYABLES, PROVISIONS AND ACCRUALS

|

|

Unaudited |

Audited |

|

|

30-Jun-20254 |

31-Dec-24 |

|

|

£ |

£ |

|

|

|

|

|

Trade payables |

(262,185) |

(471,672) |

|

Provisions |

(92,918) |

(95,182) |

|

Other taxes and social security |

(39,467) |

(69,880) |

|

Accruals |

(875,007) |

(605,280) |

|

Total |

(1,269,577) |

(1,242,014) |

Trade and other payables include routine trade creditors.

Other taxes and social security balances largely relate to people-related costs and taxes balances at the period end. Accruals include routine accruals for professional services rendered not invoiced at period end.

13. LOAN NOTES

On 30 June 2024 the Company executed a GBP £ loan note instrument and an AUD $ loan note instrument pursuant to which it issued loan notes to subscribers ('Original Loan Notes') to raise A$3.995 million, approximately £2.1 million, to finance working capital and costs associated with ASX admission. In addition, the Original Loan Note holders were granted with a total of 2,190,091 warrants (on a post consolidated basis), valued at approximately GBP £506k at the date of grant.

After the period end, and further to the passing of relevant resolutions at the general meeting on 29 August 2025, both the AUD $ and GBP £ loan notes were restructured. The outstanding principal, fees and premiums were consolidated, at a £ equivalent value of approximately £3.07 million and restructured into AUD and GBP Convertible Loan Notes ('CLNs').

The CLNs have a maturity date of 30 June 2026, carry a 12% premium payable on redemption, the security provisions instantiated for the Original Loan Notes have been applied to the CLNs and the holders of those notes have the right to convert their outstanding balance, including any premium, into newly issued ordinary shares at a conversion price of 6 pence per share. In addition, the warrants which were attached to the Original Loan Notes, were cancelled and regranted with an exercise price of A$0.176 (in the case of the AUD CLNs) and £0.086 (in the case of the GBP CLNs).

The commissions payable on the Original Loan Notes have been amortised in full to the income statement at 30 June 2025, and the fair value of warrants attaching to the Original Loan Notes, of £506k, have been recognised within the share based payment equity reserve.

14. DEFERRED CONSIDERATION

Laguna Verde Option buy-out

On 19 April 2024, CleanTech Laguna Verde SpA, a wholly owned Chilean subsidiary of CleanTech Lithium Plc, entered into a sale and purchase agreement (LV Purchase Agreement) to acquire 100% legal and beneficial interest in the mining licences historically held by CleanTech under option under the terms of the LV Option Agreement. The LV Purchase Agreement had the effect of terminating the LV Option Agreement.

Pursuant to the LV Purchase Agreement the consideration payable comprises fixed payments totaling US$10.5 million, which are scheduled to occur at various annual and semi-annual milestone periods over a period of up to 5 years from the date of the LV Purchase Agreement, and two deferred payments, totaling US$24.5 million, scheduled to occur upon sold production reaching 10k tonnes of LCE and 35k tonnes of LCE respectively or on the 10th anniversary of the date of the LV Purchase Agreement, whichever is the earlier.

The carrying value for the LV licences acquired pursuant to the LV Purchase Agreement, has been designated as an asset acquisition in accordance with the Group accounting policy and assigned a fair value in accordance with the principles of the UK IASs. Similarly, the Group has assigned a fair value to the deferred consideration associated with the acquisition which is allocated between current and non-current liabilities.

In assessing the appropriate basis on which to determine the fair value of the non-current component of the deferred consideration, the Directors have used a discount rate of 8% which they believe is reflective of the factors that market participants would consider in the pricing of such a liability as well as the currency in which the cashflows are denominated. This is consistent with the requirements of IFRS 13 - Fair Value Measurement.

As described above, the two final payments of the deferred consideration, totaling USD$24.5m, are required to be made upon achieving certain production milestones, but in any event, are required to be made within 10 years of execution of the LV Purchase Agreement. Due to the uncertainties surrounding the timing of achieving the production milestones, the Directors have assumed that the remaining two payments will be made on the 10th anniversary of signing the LV Purchase Agreement.

|

|

Unaudited at 30-Jun-25 |

Audited at 31-Dec-24 |

|

|

£ |

£ |

|

|

|

|

|

Deferred consideration, current |

1,623,504 |

1,686,408 |

|

Deferred consideration, non-current |

13,294,815 |

13,815,221 |

|

Total |

14,918,319 |

15,501,629 |

15. SUBSEQUENT EVENTS

Important matters and events which have occurred after the period end are outlined in the Chairman's review.

**ENDS**

The information communicated within this announcement is deemed to constitute inside information as stipulated under the Market Abuse Regulations (EU) No 596/2014 which is part of UK law by virtue of the European Union (Withdrawal) Act 2018. Upon publication of this announcement, this inside information is now considered to be in the public domain. The person who arranged for the release of this announcement on behalf of the Company was Steve Kesler, Director and Chairman.

|

|

For further information contact: |

|

|

|

|

|

CleanTech Lithium PLC |

|

|

|

|

|

Ignacio Mehech/Gordon Stein/Nick Baxter |

Office: +44 (0) 1534 668 321 Mobile: +44 (0) 7494 630 360 Chile office: +562-32239222 |

|

|

|

|

Beaumont Cornish Limited (Nominated Adviser) Roland Cornish/Asia Szusciak |

+44 (0) 20 7628 3396 |

|

|

|

|

Fox-Davies Capital Limited (Broker) Daniel Fox-Davies |

+44 (0) 20 3884 8450 |

|

|

|

|

|

|||

Beaumont Cornish Limited ("Beaumont Cornish") is the Company's Nominated Adviser and is authorised and regulated by the FCA. Beaumont Cornish's responsibilities as the Company's Nominated Adviser, including a responsibility to advise and guide the Company on its responsibilities under the AIM Rules for Companies and AIM Rules for Nominated Advisers, are owed solely to the London Stock Exchange. Beaumont Cornish is not acting for and will not be responsible to any other persons for providing protections afforded to customers of Beaumont Cornish nor for advising them in relation to the proposed arrangements described in this announcement or any matter referred to in it.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.