CORNISH METALS COMPLETES AN UPDATED PEA OF THE SOUTH CROFTY CRITICAL MINERAL PROJECT WITH AN NPV OF

Since the highly successful

While on-site construction is already underway, the team rigorously validated key assumptions, optimised project parameters, and further refined cost estimates, significantly advancing and de-risking multiple elements of the project design and execution plan.

This updated PEA, constrained by the current Mineral Resource, which was reported in accordance with National Instrument 43-101 ("NI 43-101") with an effective date of

This Study is constrained by the current NI 43-101 Mineral Resource, supporting a 14-year LOM. Importantly, the South Crofty Mineral Resource remains open at depth, along strike and within the current mine envelope. On final investment decision, subject to funding, the Company will re-commence underground resource conversion and expansion drilling in parallel with mine construction and development - simultaneously driving growth and delivery. Over the last 25 years in operation, South Crofty has consistently replaced mined tonnes to extend its life of mine and the Company is targeting a continuation of this trend.

"The project continues to be supported by robust economics with an increased NPV and a short payback period of only 3.3 years.

"Additionally, the upside potential through further Mineral Resource expansion is material, as evidenced by the mine's historical record of consistently replacing mined tonnes and adding to the resource base, a trend that we expect will be replicated once we are in a position to start an underground near-mine drilling programme on commencement of underground development. The programme is structured to build on historical resource replacement and de-risk the mine plan aiming at accelerated resource growth targeting defined in-mine exploration zones to expand inventory and extend mine life. We believe that the current South Crofty Mineral Resource, which constrains the current study's 14-year mine life, is only a small deposit within a much broader tin system in the South Crofty mining permission area that will support a multigenerational asset, as it was once before.

"South Crofty was the last mine in the region to close, and we are proud to be on the cusp of making it the first to re-open, producing tin, a critical mineral that is essential to the green economy. The project is effectively already in construction with major works underway including the shaft and pump station refurbishment, construction of the workshop and stores building, process plant site excavation and critical site utilities. Key long-lead equipment has been ordered and locked in, including the production and service winders and other important systems. We are deploying best practice initiatives including real-time monitoring for safer operations, productivity enhancement, equipment availability, and continuous optimisation, and we are also designing operational buffers to maximise flexibility and uptime. We have a comprehensive development plan for South Crofty and the backing of the community and government.

"South Crofty remains a flagship project within the

"We look forward to restarting production and bringing significant value to

Highlights

Ø Reinforced leadership team delivering global best practice

· Newly appointed General Manager and

· Top-tier third party consultants have independently verified all project parameters-from technical design to real time cost estimation-ensuring rigour, transparency, and execution confidence

Ø Solid project economics and cash generation

·

·

· Capital payback period of 3.3 years after-tax

· Cumulative after-tax cash flow of approximately

· Average annual after-tax cash flow of approximately

· Average annual EBITDA of

Ø A low-cost, high-grade, responsible tin operation with strong ESG credentials

· Lowest quartile producer - Average AISC of approximately

· Average annual tin production of approximately 4,700 tonnes for years two through six (equivalent to approximately 1.6% of global mined tin production)

· Average pre-concentrated head grade of 2.11% tin in years two through six, upgraded from an average mined grade of 1.05% tin

· Low impact underground operation with no surface tailings disposal

· Use of 100% renewable electricity supply with renewable power generation optionality

· Potential to directly employ over 300 people and create up to 1,000 indirect jobs

Ø Sizeable Exploration Target potential

· Near mine Exploration Target points to potential additional mineralisation of 6 to 13 million tonnes ("Mt"), at a tin grade of 0.5% to 1.8%

· South Crofty has a record of consistently replacing mined tonnes to extend its life of mine and the Company is targeting a continuation of this trend

· The Company has good visibility on higher grade extensions that can allow a further optimised mine plan in due course subject to exploration drilling success

· The Company has developed a resource drilling programme that is planned to commence with the start of underground development and continue alongside production

· Further growth opportunities from longer term exploration within the South Crofty mining permission area and within

Ø Well supported project

· Support from local communities and government, and

· Permitted project with existing mine infrastructure, mining permission through to 2071 and full planning permission to construct the processing plant to recover tin concentrate

A Technical Report prepared in accordance with NI 43-101 will be filed on SEDAR+ within 45 days of this announcement.

|

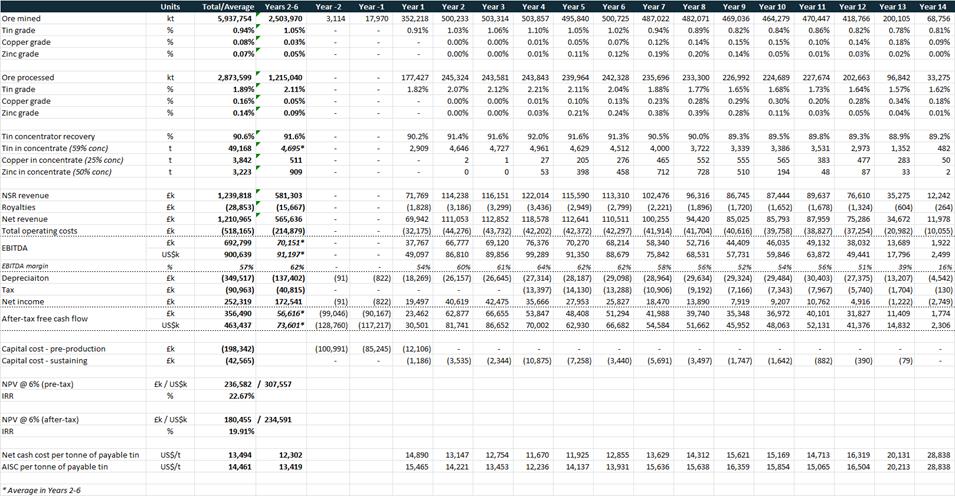

Summary Operating & Financial Metrics |

|

|

|

Operations |

Mine throughput |

500 ktpa |

|

|

Processed throughput (post pre-concentration) |

250 ktpa |

|

|

LOM |

14 years |

|

|

Total LOM tonnes mined |

5,938 kt |

|

|

Average mined tin grade |

0.94% |

|

|

Contained tin |

55,982 t |

|

|

Total LOM concentrator tonnes processed |

2,874 kt |

|

|

Average processed tin grade |

1.89% |

|

|

Average tin recovery |

87.8% |

|

|

Total LOM tin produced |

49,168t |

|

|

Total LOM copper produced |

3,842 t |

|

|

Total LOM zinc produced |

3,223 t |

|

|

Years 2-6 average annual tin production |

4,695 t |

|

Capital costs |

Pre-production |

|

|

|

Post-production sustaining |

|

|

Operating costs |

Average net cash cost in years 2-6 |

|

|

|

Average LOM net cash cost |

|

|

|

Average AISC in years 2-6 |

|

|

|

Average LOM AISC |

|

|

Economic assumptions |

Tin price |

|

|

GB£:US$ |

1.30 |

|

|

|

25% |

|

|

Financials |

NPV (6% Real) - Pre-tax / After-tax |

|

|

|

IRR - Pre-tax / After-tax |

23% / 20% |

|

|

Capital payback period after-tax |

3.3 years |

|

|

Total LOM net Revenue |

|

|

|

Total LOM EBITDA |

|

|

|

After-tax Free Cash Flow (from start of production) |

|

|

|

Years 2-6 average annual after-tax Free Cash Flow |

|

|

|

Years 2-6 average annual EBITDA / EBITDA margin |

|

Table 1: South Crofty operating and economic summary

Notes:

- NPV effective as at

- Mine plan and financial modelling include Inferred Mineral Resources.

The evaluation at this level of study includes Indicated and Inferred blocks and consequently it is not possible to define a Mineral Reserve. This study is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have economic considerations applied that would enable them to be categorised as Mineral Reserves. There is no certainty that this study will be realised.

Capital and Operating Costs

The pre-production capital cost of the South Crofty project commencing from

|

|

(£ million) |

% |

|

Mine development and pre-production |

48.8 |

25% |

|

Process plant |

51.7 |

26% |

|

Site development and ancillary facilities |

4.0 |

2% |

|

Other surface infrastructure |

7.4 |

4% |

|

Tailings management |

10.0 |

5% |

|

Owners cost |

39.2 |

20% |

|

Indirects |

19.9 |

10% |

|

Contingency |

17.3 |

9% |

|

Total pre-production capital |

198.3 |

100% |

Table 2: South Crofty pre-production capital costs (

The pre-production capital estimate increased from the 2024 PEA estimate of

The South Crofty underground mining operation is estimated to have a low total unit operating cost, averaging approximately

|

|

Unit Cost (£/t) |

Total LOM Cost (£ million) |

% |

|

Mining & hoisting |

52.6 |

313.4 |

60% |

|

Processing |

16.0 |

95.5 |

18% |

|

Pumping and water treatment |

6.4 |

38.2 |

7% |

|

G&A, including closure cost |

12.5 |

74.2 |

14% |

|

Total |

87.5 |

521.3 |

100% |

Table 3: South Crofty operating costs

Average LOM net unit cash costs, inclusive of treatment charges and by-product credits from copper and zinc are estimated to be

Figure 1: South Crofty expected to be a lowest quartile cost tin producer (2030 net cash cost of production).

Source:

Cash Flow Generation

South Crofty's estimated low operating costs and a well-supported tin price environment are expected to translate to high margin tin sales and strong cash generation. After-tax free cash flow is estimated to total approximately

Figure 2: South Crofty after-tax free cash flow profile

Sensitivity Analysis

South Crofty project economics are well supported at a range of tin price assumptions and discount rates.

|

After-tax NPV (£ million) |

Commodity Price |

|||||

|

-20% |

-10% |

0% |

+10% |

+20% |

||

|

Discount Rate (Real) |

5% |

71 |

138 |

204 |

269 |

335 |

|

6% |

57 |

119 |

180 |

242 |

304 |

|

|

7% |

43 |

101 |

160 |

218 |

276 |

|

|

8% |

31 |

86 |

140 |

195 |

250 |

|

|

9% |

19 |

71 |

123 |

174 |

226 |

|

Table 4: Metal price and discount rate sensitivity analysis

The base-case tin price of

Figure 3: Pre-tax NPV6% sensitivity analysis to various project parameters

Production Profile

South Crofty's production profile is based on an annual mined throughput of approximately 500,000 tonnes and annual processing of approximately 250,000 tonnes following pre-concentration at an average tin grade of 1.89%. Tin in concentrate production over a 14-year LOM is expected to total slightly more than 49,000 tonnes, averaging approximately 4,700 tonnes of tin in concentrate per year in the first five years post ramp-up (years two through six) (see blue box in Figure 4).

Figure 4: South Crofty indicative production profile

The use of pre-concentration employing the latest X-Ray Transmission ("XRT") ore sorting technologies reduces the volume of material processed and required for backfilling to approximately half of the material mined. The impact to concentrator feed grades is also significant, with LOM processed tin grades averaging 1.89%, approximately double the average mined grade of 0.94% tin. Estimated processed tin grades in years two through six average approximately 2.1%.

Figure 5: South Crofty mined and processed tin grades

Indicative timeline

The pace of activities at South Crofty continues to rise as the newly reinforced leadership team works towards first tin production by mid-2028. Key areas of focus and deliverables are outlined in the indicative timeline below:

Figure 6: Indicative timeline to first tin production

Opportunities

This study is constrained by the current South Crofty Mineral Resource Estimate updated in

Historic production at South Crofty demonstrates consistent discovery of new material and subsequent conversion to Reserves (Figure 7).

In

The Company has developed a resource drilling programme that, subject to funding, is planned to commence with the start of underground development and continue alongside production. The South Crofty mine benefits from being a brownfield operation through access to over 25 years of digitalised exploration, development and production data. The programme will be focused on resource definition and expansion with the aim of replacing mined resources, continuing the resource replacement trend demonstrated through the mine's production history.

The near mine exploration target demonstrates the potential to maintain a stable and higher rate of production beyond the sixth year of production, as well as an extended mine life well in excess of the study's constrained 14 years. The Company is also assessing the potential for increased throughput, with further growth opportunities from longer term exploration activities within

The Study's production profile for South Crofty indicates total tin production of slightly above 49,000 tonnes over a 14-year mine life, averaging approximately 4,700 tonnes of tin per year in the first five years post ramp-up (years two to six) with a declining trend in later years. The production profile is constrained by the current South Crofty Mineral Resource as last updated in

The near mine Exploration Target points to potential additional mineralisation at South Crofty and it is management's belief that the production profile in years two through six might be prolonged if the Company replicates its historical record of consistently replacing mined tonnes to extend its life of mine. The Company is also assessing the potential for increased throughput, with further growth opportunities from longer term exploration activities within

Figure 8: South Crofty tin production profile.

Qualified Persons

The Qualified Persons for the updated PEA are Mr

All QPs have reviewed the technical content of this news release for the South Crofty deposit and have approved its dissemination.

A Technical Report disclosing the updated PEA in accordance with the requirements of NI 43-101 will be prepared by AMC on behalf of

This news release has been reviewed and approved by Mr

ABOUT

· is a historical, high-grade, underground tin mine located in

· is permitted to commence underground mining (valid to 2071), construct a new processing facility and for all necessary site infrastructure;

· would be the only primary producer of tin in

· benefits from strong local community, regional and national government support with a growing team of skilled people, local to

ON BEHALF OF THE BOARD OF DIRECTORS

"

CEO and Director

Engage with us directly at our investor hub. Sign up at: https://investors.cornishmetals.com/link/Pm59nP

For additional information please contact:

|

|

|

|

|

|

|

Tel: +1 (604) 200 6664

|

|

(Nominated Adviser & Joint Broker) |

|

Tel: +44 203 470 0470

|

|

|

|

|

|

(Joint Broker) |

|

Tel: +44 207 907 8500

|

|

|

|

|

|

BlytheRay (Financial PR) |

Said Izagaren |

Tel: +44 207 138 3204 |

|

|

|

|

|

|

|

|

Neither the

Caution regarding forward looking statements

This news release may contain certain "forward-looking information" and "forward-looking statements" (collectively, "forward-looking statements"). Forward-looking statements include predictions, projections, outlook, guidance, estimates and forecasts and other statements regarding future plans, the realisation, cost, timing and extent of mineral resource or mineral reserve estimates, estimation of commodity prices, currency exchange rate fluctuations, estimated future exploration expenditures, costs and timing of the development of new deposits, success of exploration activities, permitting time lines, requirements for additional capital and the Company's ability to obtain financing when required and on terms acceptable to the Company, future or estimated mine life and other activities or achievements of

Forward-looking statements are subject to risks and uncertainties that may cause actual results to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to receipt of regulatory approvals, risks related to general economic and market conditions; risks related to the availability of financing; the timing and content of upcoming work programmes; actual results of proposed exploration activities; possible variations in Mineral Resources or grade; projected dates to commence mining operations; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes, title disputes, claims and limitations on insurance coverage and other risks of the mining industry; changes in national and local government regulation of mining operations, tax rules and regulations. The list is not exhaustive of the factors that may affect Cornish's forward-looking statements.

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by the Company to constitute inside information pursuant to Article 7 of EU Regulation 596/2014 as it forms part of

Appendix 1 - South Crofty summary LOM operating and financial model

[1] The potential quantity and average grade of the near mine Exploration Target is conceptual in nature and is an approximation. There is insufficient data to estimate a Mineral Resource in the area considered and it is uncertain if further exploration will result in the definition of a Mineral Resource.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the