Option to Acquire 100% of the

Building a high-grade gold portfolio in

OVERVIEW

· LOI to acquire 100% of the 6,656.2 hectares high grade

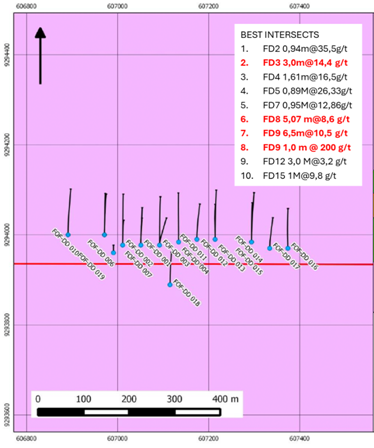

· Over 2,800m of historical drilling completed with intercepts including:

o 3.0m @14.4g/t

o 6.5m @ 10.5g/t

o 5.07m @ 8.6 g/t and

o 1.0m @ 200.0 g/t

· Initial JORC (2004) Inferred resource of 130,000 oz Au from 2.1Mt @ 2g/t, independently estimated in 2010

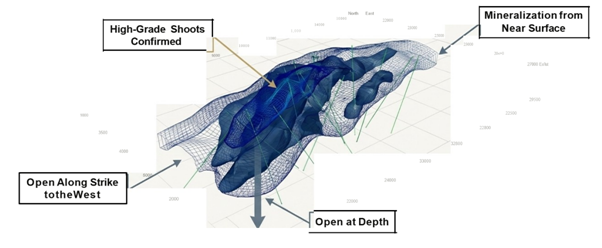

· Identified gold mineralisation extends from near surface to depths of c.150m and over a c.400m strike length

· Data indicates that the identified mineralisation, where the initial resource is located, represents a small part of a much larger system

· Mapping and geophysics indicate that the mineralised structure continues for at least 500m west of the current drilling, beyond the defined 400m resource strike length

· Acquisition comprises structured staged cash and shares payment based on work commitments aligned with exploration success, together with a

"Having signed the LOI, we intend to engage drilling contractors immediately to undertake a low-cost, high impact, 2,000m drill programme to test extensions at the initial Molly 1 target, which will generate additional targets and provide the basis for the next phase of exploration. The deal structure importantly provides us with a stage-gated and highly cost-effective framework to gain control of a gold asset with fantastic potential.

"We also expect our first phase drill results from Paranaíta later this month, which will be used to update the resource estimate and better quantify that project's potential.

"Our team's deep knowledge of

DETAILS

The 6,656.2 hectares

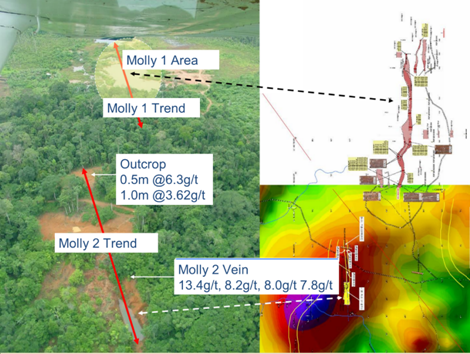

Molly lies within a proven corridor of hard-rock gold mineralisation that demonstrates the district's capacity to host large, economically viable deposits. The primary target is Molly 1, where high-grade quartz veins were historically mined to depths of up to 30m. Geologically, it is hosted within Paleoproterozoic Parauari granites, a recognised host for major gold deposits in the Tapajós. A dominant east-west-striking quartz vein, ranging from 0.5m to 3m in width, forms the high-grade core of the system. This is surrounded by a classic epithermal alteration halo, including potassic, phyllic, and argillic assemblages, which significantly expands the overall exploration target.

A 2,857m 19 hole diamond drilling programme tested the down-dip extensions of the quartz vein system beneath historical artisanal workings and intersected high-grade, hydrothermally brecciated, sulphide-rich quartz veins, confirming the presence of a robust high-grade, near-surface epithermal primary gold system at shallow depths: Grades included 3.0m @ 14.4g/t, 5.07m @ 8.6g/t, 6.5m @ 10.5g/t and 1m @ 200 g/t.

|

A JORC-compliant Inferred Mineral Resource of approximately 130,000 ounces of gold has been defined using a 0.5 g/t Au cut-off, providing a solid foundation for future growth. This initial resource, estimated in 2010 by

|

Source: Independent technical report on Sao Domingos gold project, prepared

Geophysical data indicates that the identified mineralisation where the initial resource is located represents only part of a much larger system, with a well-defined structural corridor extending more than 500m to the west. This highlights strong potential for significant resource expansion.

Assay results from drilling validate the high-grade nature of the system. Statistical analysis of 180 mineralised samples returned a maximum raw value of 32.99 g/t gold, demonstrating the presence of locally very high-grade zones within the broader mineralised structure. These results support the potential for both grade and tonnage growth with further drilling.

A three-dimensional geological and mineralisation model shows that gold mineralisation extends from near surface to depths of approximately 150m over a strike length of around 400m. The system remains open both at depth and along strike, particularly to the west, where drilling has not yet tested the interpreted continuation of the structure.

Ground-based spectral induced polarisation (IP) and magnetic surveys have revealed a strong structural trend linking the Molly 1 prospect with the Molly 2 area to the west. Interpretation of these geophysical anomalies suggests that both areas form part of the same mineralised system, offset by later faulting. This significantly increases the size of the exploration target and supports a district-scale geological model.

Mapping and geophysics indicate that the mineralised structure continues for at least 500m west of the current drilling, beyond the defined 400m resource strike length. This untested extension has the potential to more than double the strike extent of known mineralisation, representing a major opportunity for resource growth.

|

The Phase 1 work will focus on step-out drilling to test the western extension identified by geophysics, alongside infill drilling to upgrade the existing Inferred Resource to the Indicated category. Phase 2 aims to define a multi-pit operation, including initial drilling at the Molly 2 prospect, metallurgical test work, and preliminary economic assessments. The Company is funded for both programmes.

TRANSACTION DETAILS

Jangada has signed an LOI for an exclusive option with BGold to acquire a 100% interest in the

Initial Drilling Obligation and Option Right:

Within three (3) months of signing the LOI, Jangada shall complete a minimum of 2,000m of diamond drilling on the Project (the "Initial Program"). Upon timely completion of the Initial Program, Jangada shall have the exclusive right to enter into the Option on the terms set out below (the "Option Terms"), subject to the parties entering into a definitive agreement at that time, but which is expected to be based on the commercial terms outlined below.

Summary of Option Terms:

On execution of definitive agreements:

· Cash payment of

· Issuance of

· Commitment to complete a further 2,500 metres of drilling within 12 months

On first anniversary of signing definitive agreements:

· Cash payment of

· Issuance of

· Completion of an additional 10,000 metres of drilling over the following 12 months and delivery of either:

o An updated JORC-compliant Mineral Resource Estimate, or

o a Preliminary Economic Assessment (PEA)

Resource-based consideration:

· Payment of

· The same per-ounce payment applies to any future resource updates

· Upon payment, the Project will be transferred to a wholly owned subsidiary of Jangada

Royalty:

· BGold will retain a 2.0% NSR on future production

NSR advance:

· If commercial production has not commenced within five years of signing definitive agreements, Jangada will pay an annual NSR advance of

Related Party Transaction

Jangada intends to commence the Initial Program immediately. Alongside, the parties will work to finalise and execute definitive documentation consistent with the LOI, subject to customary regulatory approvals as needed.

**ENDS**

For further information please visit www.jangadamines.com or contact:

|

|

|

|

|

|

Nominated & Financial Adviser |

Tel: +44 (0)20 7409 3494 |

|

|

Broker |

Tel: +44 (0)20 7100 5100 |

About

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the