("

Investment exposure to the highly prospective Las Huaquillas gold, copper and silver project in

The investment is being made by way of a subscription for a total of 5,000,000 common shares at

1 19.1% remains subject to TSX-V approval

Fidelity's flagship asset, the

Project Highlights

· Historical resource (non-NI 43-101 compliant2) of 6.57 Mt grading 2.12 g/t Au and 25.2 g/t Ag, for a total of 446,000 oz gold and 5.3 million oz silver

· The Epithermal gold-silver system at Los Socavones is open along strike and at depth

· Two confirmed porphyry systems - Cementerio and

· Extensive historical work, including soil geochemistry, geophysics, and more than 5.7 km of diamond drilling across 26 holes, as well as 1.2 km of underground development on three levels

· Five mineralised zones defined to date, encompassing multiple styles of mineralisation - epithermal gold-silver, porphyry copper-gold, and associated polymetallic systems

· Significant historic intercepts include:

67 m (≈ 53 m true width) @ 2.7 g/t Au and 15.3 g/t Ag (LH97-08, Los Socavones)

99 m @ 0.47 % Cu, 0.11 g/t Au and 4.5 g/t Ag (LH97-04, Cementerio)

69 m @ 0.32 % Cu, 0.45 g/t Au and 3.0 g/t Ag (LH97-17,

The NI 43-101 Technical Report (

Fidelity intends to use the net proceeds of its private placement to advance its Peruvian exploration and community relation programmes, and for corporate working capital purposes. Fidelity is advancing a near-term exploration programme at Las Huaquillas that involves:

· Renewal of the mining land use agreement with the landowners

· Access to the Adit for sampling, assays, and verification of historical geological data, with grades in Adit S1 ranging from 15 Au-g/t to 70 Au-g/t, including mapping

· Conducting bulk industrial sampling with over 1 ton per sample

· Approval for production with mining permits allowing up to 350 tons per day (tpd)

· Evidence that Fidelity has obtained community acceptance for the Project and mining activities in the area

· Drill permits - potential to be approved within months (subject to standard Peruvian procedures)

Fidelity's Executive Chairman is

"It's rare to find opportunities with pre-money market valuations around CA$2 million which provide meaningful exposure to such large-scale copper-gold-silver epithermal and porphyry systems in proven regional settings. The opportunity for Fidelity - and therefore

2Note: The historical resource estimate was prepared by Gariepy & Vachon (1999) for

Enquiries:

|

|

+44 (0)20 7981 2576

|

|

|

+44 (0)20 7628 3396 |

|

|

+44 (0)207 432 0501 |

|

|

IR.MetalsOne@vigoconsulting.com +44 (0)20 7390 0230

|

|

|

+1 604 366 6277 |

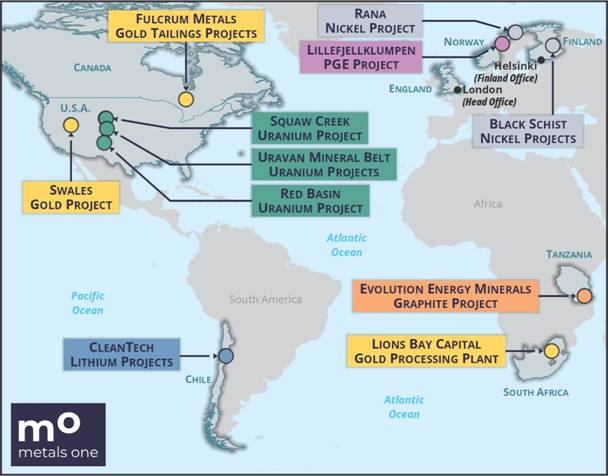

About

Map of

Follow us on social media:

LinkedIn: https://www.linkedin.com/company/metals-one-plc/

X: https://x.com/metals_one_PLC

Subscribe to our news alert service on the Investors page of our website at: https://metals-one.com

About Fidelity Minerals Corp.

Fidelity Minerals Corp. has assembled a portfolio of high-quality mining assets and is targeting large scale copper and gold and aims to delineate major deposits on these properties that could attract the interest of mid-tier and major mining companies. The company is focused on progressing its most advanced project, Las Huaquillas, which is a gold, copper and silver in

Market Abuse Regulation (MAR) Disclosure

The information set out below is provided in accordance with the requirements of Article 19(3) of the Market Abuse Regulations (EU) No. 596/2014 which forms part of

Nominated Adviser

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the