The information contained within this announcement is deemed to constitute inside information as stipulated under the retained EU law version of the Market Abuse Regulation (EU) No. 596/2014 (the "

('

Maiden JORC Mineral Resource Estimate for MB01 South

of 870,000oz at 1.09g/t Au

Highlights

· Independent consultant

· The MRE extends over a strike length of approximately 900m, a width of up to 700m and down to a maximum depth of 340m. It has significantly exceeded the upper range of the JORC Exploration Target range for MB01-S and is also higher grade.

· The JORC Exploration Target* for the yet to be drilled MB01-N zone, which lies approximately 700m to the northeast of MB01-S, has a range of

· Importantly, both the MB01-S MRE and MB01-N Exploration Target remain open in all directions and at depth and the next work programme is currently being finalised with the Company's earn-in partner,

· The Company believes there is excellent potential to significantly increase the size of the Resource, and that the maiden MRE alone, subject to further work and economics, could form the backbone of a low strip ratio open pit mine.

Chief Executive Officer of

"The next steps are being actively considered and will be finalised with our partner

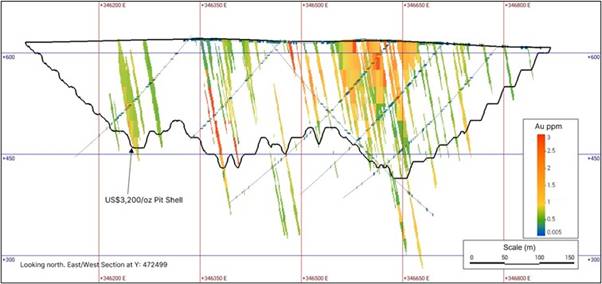

Figure 1. Cross section (looking north) through the MRE model for the MB01-S zone, showing drill holes and mineralised domains. Blocks within the model are constrained by a

Further Details

MB01-S Mineral Resource Estimate

A maiden JORC MRE for the MB01-S zone has been prepared by Forge and is presented in Table 1. The estimate is based on a total of 7,848 samples, collected from 2,778m of trenching (from six trenches) and 6,828m of diamond drilling (from 24 holes) completed during the Company's maiden drilling programme at Mbe. The estimate has delivered a total Resource of 24.8Mt at a grade of 1.09g/t for 870,000oz contained gold Au, based on a 0.40g/t Au lower cut-off grade and within a

The MRE replaces the

Table 1. JORC MRE for the MB01-S zone

|

JORC Classification |

Oxidation Level |

Gross |

Net Attributable (90%) |

||||

|

Tonnage |

Grade (g/t) |

Total Contained Gold (oz) |

Tonnage |

Grade (g/t) |

Total Contained Gold (oz) |

||

|

Inferred |

Oxide |

2,400,000 |

0.91 |

70,000 |

2,160,000 |

0.91 |

63,000 |

|

Fresh |

22,400,000 |

1.10 |

800,000 |

20,160,000 |

1.10 |

720,000 |

|

|

Total |

24,800,000 |

1.09 |

870,000 |

22,320,000 |

1.09 |

783,000 |

|

Notes:

· Effective date of the Mineral Resource is

· The Resource has been estimated by Mr.

· The Mineral Resource Estimate is based on a total of 7,848 samples, collected from 2,778m of trenching and 6,828m of diamond drilling.

· Gold grades are estimated using Ordinary Kriging within hard-boundary mineralisation wireframes, based on length-weighted composited assay data and variogram models developed for the principal mineralised domains.

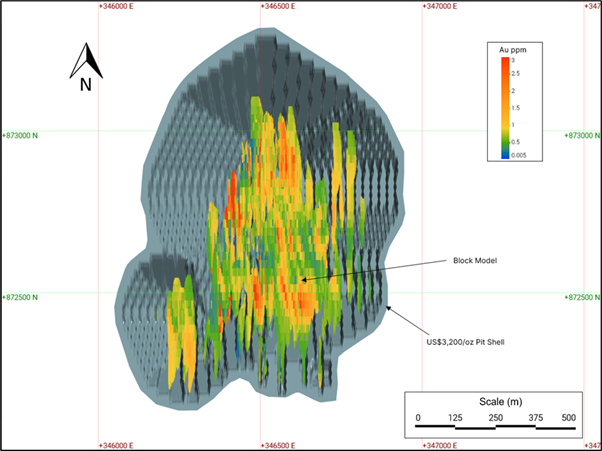

· The Mineral Resource extends over a strike length of approximately 900m, up to 700m width and to a maximum depth of 340m. To define the blocks with reasonable prospects of eventual economic extraction (RPEE) as required under the JORC Code (2012 Edition), the estimate has been constrained within a Lerchs-Grossman optimised pit shell generated in Datamine NPVS, using a gold price of

· The Mineral Resource has been reported above a cut-off grade of 0.40g/t Au and filtered by the pit shell constraint.

· The Resource Estimate is shown on a gross (100%) basis. After the on-going restructuring process (announcement dated

· All figures are rounded to reflect the relative accuracy of the estimate. Differences may occur due to rounding.

· Mineral Resources are not Mineral Reserves and have not demonstrated economic viability. Further exploration, sampling, and economic studies are required before any potential conversion to Ore Reserves can be considered.

· A site visit to the

Preliminary pit shell modelling indicates that the current conceptual open-pit outline at MB01-S extends to the western edge of the modelled mineralisation and overlaps areas of existing community infrastructure, some of which are regarded as culturally and socially sensitive, and their presence will require formal heritage and community consultation. They may influence future project design, disturbance limits, and permitting outcomes. No environmental or social impact studies have yet been undertaken.

The grade-tonnage sensitivity analysis in Table 2 demonstrates the robustness of the MRE across a range of cut-off grades between 0.2g/t and 0.6g/t Au. Contained metal varies only modestly, indicating that the deposit is not overly sensitive to cut-off grade selection. Resource pit optimisation was also undertaken using a gold price of

Table 2. Grade tonnage sensitivity for MB01-S zone MRE

|

Cut-off Grade (Au ppm) |

Tonnes |

|

Contained Metal (Au troy oz) |

|

0.6 |

20,400,000 |

1.21 |

790,000 |

|

0.5 |

23,400,000 |

1.12 |

850,000 |

|

0.4 |

24,800,000 |

1.09 |

870,000 |

|

0.3 |

25,300,000 |

1.07 |

870,000 |

|

0.2 |

25,400,000 |

1.07 |

870,000 |

Note:

· All figures are rounded to reflect the relative accuracy of the estimate. Differences may occur due to rounding.

· The grade-tonnage sensitivity information is presented for illustrative purposes only and does not constitute a separate Mineral Resource estimate.

Figure 2. Plan view of Resource

MB01-N JORC Exploration Target*

At MB01-N, the JORC Exploration Target range published in

It presents significant upside to the MB01-S MRE given its close (700m) proximity but will require drilling to convert it to a JORC Resources category.

Table 2. Exploration Target* for the MB01-N zone

|

|

|

|

|

15,000,000 - 20,000,000 |

0.77 - 0.94 |

370,000 - 605,000 |

*The potential quality and grade of the Exploration Target are conceptual in nature. There has been insufficient exploration to estimate a Mineral Resource, and there is no certainty that further exploration work will result in the determination of a Mineral Resource.

Notes:

· The target has been delineated based on a dataset comprising 2,409 samples collected from 4,318m of trenching.

· The Exploration Target was generated by constructing three-dimensional wireframe models representing interpreted mineralised bodies. Extrapolation is limited to 200m along strike, consistent with observed mineralised trends, and extended to a vertical depth of 200m below current surface topography.

· Oxidation modelling was not incorporated into this phase of work. As such, the impact of oxidation on grade distribution remains a source of uncertainty.

· A lower cut-off grade of 0.30g/t Au was applied to define mineralised blocks considered within the target. The grade range has been determined by applying a ±10% variation around the calculated mean grade above the selected cut-off.

· Tonnage estimates are derived from the modelled tonnage ±15%.

· A mean bulk density of 2.7t/m³ has been applied within the mineralised domains.

· All figures are rounded to reflect the inherent uncertainty and relative accuracy of the estimate.

· Infill drilling is recommended to advance the understanding of mineralisation continuity and grade distribution.

· The Exploration Target estimate has been prepared by Mr

The next work programme at Mbe is currently being finalised with the Company's earn-in partner,

Further information can be found in the Mbe JORC Table 1 disclosure on the following page of the Company's website: https://orioleresources.com/projects/mbe/

Competent Persons Statement

The information in this announcement that relates to the Mineral Resource Estimate and the Exploration Target is based on data compiled by Mr.

The technical information in this release that relates to Exploration Results and any planned exploration programme has been compiled by

Enquiries:

|

|

Tel: +44 (0)23 8065 1649 |

|

|

|

|

|

|

|

|

Tel: +44 (0)20 7409 3494 |

|

|

|

|

|

Tel: +44 (0)20 3934 6630 |

|

|

Glossary and Abbreviations

|

2025 Explroation Target |

Exploration Target published in July2025 for the MB01 prospect, comprising the MB01-N and MB01-S sub-prospects |

|

Au |

Gold |

|

Company |

|

|

Forge |

|

|

g/t |

Grammes per tonne |

|

JORC |

|

|

JORC Code |

2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves |

|

km |

Kilometre |

|

km2 |

Square kilometre |

|

Mbe |

Mbe orogenic gold project |

|

m |

Metres |

|

MRE |

Mineral Resource Estimate |

|

Mt |

Million tonnes |

|

|

|

|

oz |

Troy ounce of gold |

|

Project |

Mbe orogenic gold project |

|

t/m3 |

Tonnes per cubic metre |

Notes to Editors:

At its district scale Central Licence Package, the Company has identified multi-kilometre long gold anomalies including at its flagship Mbe project. At Mbe, the Company has published a JORC Inferred MRE of 870,000oz at 1.09g/t Au for the MB01-S zone, and an Exploration Target range of

The Company has also reported a Resource of 460,000oz contained gold at 2.06g/t Au in the JORC Indicated and Inferred categories at its 90% owned Bibemi project, where it has applied for an exploitation licence.

At the Senala gold project in

For further information please visit www.orioleresources.com, @OrioleResources on X

Background on Mbe

Mbe, with a licence area of 312km2, is an orogenic gold project located within the broader 2,266km2 'Eastern CLP' package of five contiguous gold focused exploration licences in the

At the 3km long MB01 prospect, increased dilation at the sites of structural intersections (steeply dipping NNE and NNW trending shear structures) is believed to have resulted in enhanced levels of gold deposition at the northern target, MB01-N, and the southern target, MB01-S. Gold mineralisation at these targets comprises high-grade, sulphide- and telluride-rich quartz veins, veinlets and breccias within wider envelopes of pervasive, lower-grade gold mineralisation.

After highly encouraging results from infill soil sampling, rock-chip sampling, and trench sampling, a fully funded maiden drilling programme commenced at the MB01-S target in late

In

[1] Oriole is currently undertaking a restructuring process that, once completed, will see it increase its holding from 80% to a 90% interest in the Project (announcement dated

[2] The potential quality and grade of the Exploration Target are conceptual in nature. There has been insufficient exploration to estimate a Mineral Resource, and there is no certainty that further exploration work will result in the determination of a Mineral Resource.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the