("Oscillate" or the "Company")

Conditional Sale and Purchase Agreement to acquire

Senior Management Appointment

Highlights

-

Acquisition of

Kalahari Copper Limited will establish the Company as a large landholder in two emerging copper belts, subject to licence renewal: theKaoko Basin inNamibia and the Kalahari Copper Belt inBotswana - Acquisition gives Serval the opportunity to explore extensive areas of highly prospective terrain in emerging exploration districts, adjacent to significant recent discoveries, in line with the Company's ambition to become a mid-cap copper and future-metals development group

-

Namibia andBotswana both rank highly in the Fraser Institute Investment Attractiveness Index (compared withinAfrica ) - Completion of the acquisition is expected to occur, subject to all conditions being met, simultaneously with the Company's proposed listing on AIM, subject to regulatory approvals

-

Mr

Andrew Benitz to join the Board as a Non-Executive Director upon completion -

Mr

Richard James joins the Company with immediate effect as Chief Financial Officer

The Directors consider that completion of the Acquisition Agreement will establish the Company with a significant exploration position in two emerging copper belts in

CEO,

"We are delighted to have finalised this agreement to acquire Kalahari Copper as we see exceptional value in their portfolio of exploration assets in the Kaoko Belt in

Copper already underpins society in a myriad of ways, but it also plays a fundamental role in the green energy transition, national security and the rapidly expanding digital economy. Our strategy is to identify significant deposits of sustainable copper and associated metals, such as silver, that can address the predicted shortfalls, given the expected upcoming constraints on global supply. As we prepare for our proposed Admission to the AIM market, our ambition is to become a pre-eminent investment vehicle for the

Finally, I am delighted to confirm that

Strategic Rationale for the Acquisition Agreement

The conditional acquisition of Kalahari Copper will provide the Company with a substantial landholding across two emerging copper provinces in

- provide geographic and geological diversification across two high-quality and stable African jurisdictions with supportive mining policies, as well as the exploration project in Côte d'Ivoire;

- create a portfolio of early-stage exploration projects;

- establish the foundation for a potential mid-cap copper and future-metals development group; and

- position the Company to attract a broader investor base.

About the

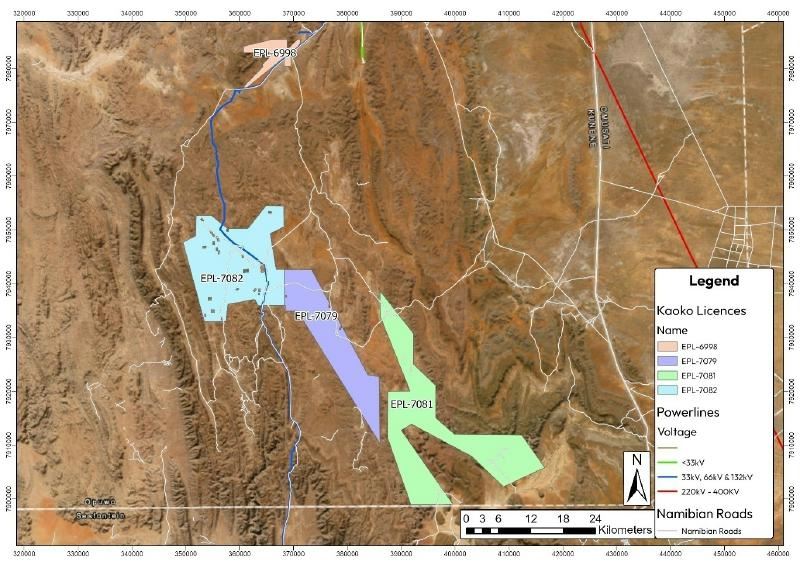

The conditional Acquisition Agreement will give the Company a 100% ownership of four prospective copper and silver exploration tenements in a highly prospective geological terrane, assuming that the applications for three of those licences are renewed.

Completion of the acquisition of the four licences would establish the Company as a large acreage holder in the

Kalahari Copper has completed more than 9,000 metres of drilling over a series of campaigns to date, with multiple intersections demonstrating Cu and Ag mineralisation on multiple prospects, occurring from surface, providing immediate targets for further definition, with the potential to delineate a maiden resource in due course.

Location of Kalahari Copper licences in the

Note: Licences EPL-6998, EPL-7081 and EPL-7082 are in the process of being renewed and are subject to approval.

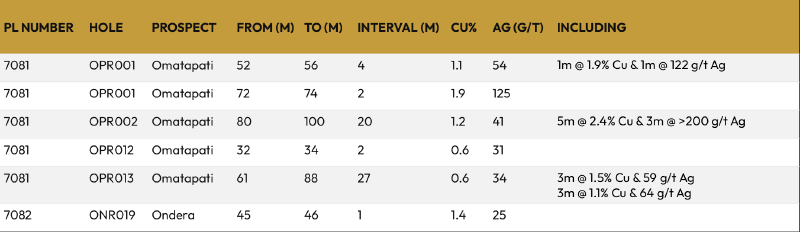

The table below summarises selected drill intersections from the 2024 and 2025 campaigns.

About the

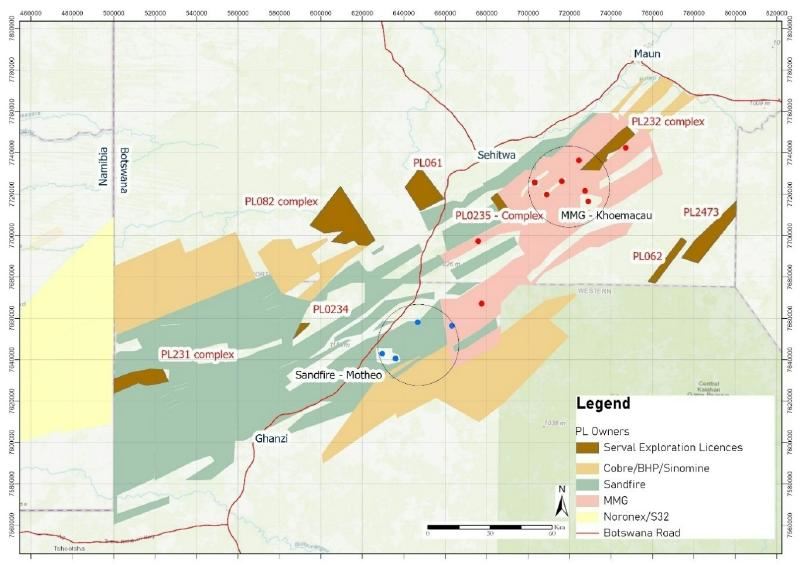

Completion of the conditional Acquisition Agreement will give the Company a 100% ownership of 17 prospective copper and silver exploration tenements, covering an area of 1,453km

2

, assuming that all applications are transferred.

Completion of the acquisition would establish the Company as a large acreage holder in the KCB

, which is considered to be one of the world's most prospective areas for new sediment-hosted copper discoveries by the

The region recently became home to two major copper operations, namely Khoemacau (bought by MMG Limited for

Within the KCB licences, the Company will target unexplored basin margins and strike extension of known deposits with what the Company believes to be ideal geological positions for sedimentary copper. The PL85 licence, which is located in the Bushman Lineament and not shown in the map below, is also adjacent to the previously producing Kopano copper mine in this region.

Location of Kalahari Copper licences in the KCB:

Summary of the Key Terms of the Acquisition Agreement

The consideration to be paid by the Company for all of the shares in Kalahari Copper is the aggregate of:

- cash consideration of £2 million and a sum equal to the cash balance of Kalahari Copper and its subsidiaries in excess of a threshold. The parties may agree to defer the £2 million payment whereupon interest at the rate of 15% per annum or 2% per month will accrue, depending on the reason for the deferral). Where such payment is deferred, the Seller will have the right to convert these into Ordinary Shares in the Company at any time using the lower of a 30 trading day volume-weighted average price (" VWAP ") and the placing price at the time of the Company's admission to AIM, subject to a floor of a 15% discount to the 30 trading day VWAP;

- the issue to the Seller of such number of new Ordinary Shares in the capital of Oscillate which will constitute 30% of the Company's issued share capital on admission to trading on AIM (being the " Consideration Shares ") subject to a minimum raise on Admission to AIM raising gross proceeds (other than from persons connected to the Seller) of at least £5,000,000 and disregarding shares, if any, issued to raise proceeds in excess of the minimum fundraise. These consideration shares will be subject to a lock-in agreement in accordance with AIM Rule 7 for 12 months from completion of the Acquisition Agreement;

-

up to six further milestone payments, three each for both the

Botswana and the Namibian projects, of £1.5 million in cash each, due on a per country basis upon each of an initial Maiden JORC Report, first publication of a Pre-Feasibility Study and a first Final Investment Decision (in aggregate a maximum of up to £9.0 million); and

- the Company has also agreed to grant the Seller a net smelter royalty of 1.9% of copper sold which was produced from any of the Namibian or Botswanan Licences.

The Company has agreed that it will grant two options to the Seller, each over 3% of the capital of the Company at Admission (assuming the minimum raise and disregarding shares issued in excess of the minimum raise). The first option for 3% is at par value and has a term of three years from completion of the Acquisition. The second option is for 3% also at par value and has a term of five years from completion of the Acquisition and is exercisable only following the publication of the first Maiden JORC Report of Measured and Indicated Resources produced on any of the Namibian licences.

In the event the minimum raise is not achieved, or is only achieved with investment from the Seller, the Seller will also have an anti-dilution option entitling it to subscribe for shares at par value to maintain its pro rata holding on Admission until such time as the minimum raise is achieved.

The Company has agreed to grant the Seller the right to participate in future share issues on the same terms as any investors to maintain its percentage shareholding in the Company.

In addition, Oscillate has granted the Seller the right to nominate up to two members of the board of directors of the Company ("

Board

"), dependent on the percentage of shares held at that time by the Seller and its majority shareholders. In accordance with this right, the Seller has indicated that it intends to nominate Mr

The Company has agreed to pay deferred consideration to the Seller in an amount equal to 10% of the proceeds of any sale in the event that a licence or a subsidiary of Kalahari Copper is on sold within five years.

The Seller is also entitled to deferred consideration equal to 80% of the net proceeds of a contingent fee that may become payable to Kalahari Copper in the future by

Completion of the Acquisition is conditional among others things on:

-

the completion of a reorganisation by Kalahari Copper to introduce the Seller as the holding Company of the group and to transfer non-core subsidiaries, in each case on terms acceptable to the Company by

6 March 2026 or such later date as may be agreed ; - the issue of customary legal opinions as required by the AIM Rules in respect of Kalahari Copper, its subsidiaries and their Licences in a form satisfactory to the Company;

- delivery of customary documents including a relationship agreement between the Seller and the Company;

-

the

Takeover Panel agreeing, subject to the passing of a resolution by independent shareholders to waive the obligation on the Seller to make a general offer to shareholders under Rule 9 of the Takeover Code which could otherwise arise on the issue of shares and subscription for shares pursuant to the Transaction ; - the receipt of such local consents as required;

- the passing at a general meeting of the Company of the resolutions to approve any other matters such as the authority to allot the Consideration Shares;

- the fundraising associated with Admission (the " Fundraising ") raising cash, in aggregate, of not less than £5,000,000 with the Fundraising or such lower amount as agreed between the Seller and the Company; and

- Admission to AIM becoming effective,

subject to the waiver of such condition by the relevant party, where applicable.

Both the Seller and Oscillate have given the other certain warranties and certain indemnities, subject to certain limitations in the case of the Seller. Both parties have also given certain undertakings as to the conduct of their respective businesses pending completion.

Board and Senior Management Changes

In accordance with their right to appoint up to two directors to the Board of the Company, the Seller will nominate

As part of the corporate development of the Company in advance of its proposed Admission to the AIM market,

The Directors of the Company accept responsibility for the contents of this announcement.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) 596/2014 AS IT FORMS PART OF

Enquiries:

|

|

Company |

|

+ 44 (0) 7711 313 019 |

|

|

IR |

|

+44 (0) 7876 796 629 |

|

|

PR |

|

+44 (0) 20 7920 3150

|

|

|

Aquis Corporate Adviser |

|

+44 (0) 20 7469 0930 |

|

SP Angel

|

Broker |

|

+44 (0) 20 3470 0470 |

About Serval Resources

Serval Resources is focused on unlocking value across a high-potential portfolio to become a leading mid-cap copper and future metals explorer and developer.

By securing exploration and development assets in the upcoming copper belts of

These regions remain relatively under-explored in contrast to their high potential. Serval will look to apply modern and rigorous exploration techniques, as well as the depth of experience of its management team, in order to systematically evaluate, secure and develop prospective opportunities to the benefit of all its stakeholders.

Serval Resources is a brand operated by

For further information, visit:

|

26 02 09 SPA to acquire Kalahari Copper - FINAL |

4304475_1.png |

4304475_2.jpeg |

4304475_0.jpeg |