NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY IN OR INTO

|

FOR IMMEDIATE RELEASE |

|

("Panther" or the "Company")

(Incorporated in the

Half Yearly Financial Report

For the six months ended

Chairman's Statement

I am pleased to present the Chairman's Statement for

Strategic Developments- Winston Project Advancement

On

To strengthen our expertise in this area, we appointed Mr Kerem Usenmez to the Company's

Demonstrating strong confidence in the Company's future prospects, both myself and Chief Executive Officer

Operational Activities- Obonga and

Throughout the period, we have maintained our focus on our highly prospective Obonga and

We were pleased to extend the

At

The five hole (1,558m), Phase 1 Diamond Drilling Programme assay results, reported between

Panther continues to nurture our important relationships with First Nation stakeholders, local community and governmental relations, to maintain the Company's standing as an active explorer dedicated to make a positive impact for all concerned.

In corporate activities, Panther raised

The Board is focussed on continuing to execute our strategy and to strengthen our position as we advance three distinct opportunities which each benefit from

• Winston: Near-development stage with existing infrastructure and feasibility study.

• Obonga: Early-stage exploration with multiple VMS discoveries and PGE potential.

•

The Winston project provides huge potential for Panther with access to a potential near-term production opportunity with existing infrastructure including power lines, plant site, and underground development. Whilst the

The Board and I are extremely pleased with the strategic and operational developments during 2025 to date, and I would like to thank everyone involved for their hard work and dedication.

Executive Chairman

INTERIM MANAGEMENT REPORT FOR THE SIX MONTHS ENDED

Operational Highlights

Key operational milestones achieved during the six-month reporting period to

Obonga Project Background

· Total Area: 291 km2

· Prospective for: Base Metals (Copper, Zinc, Lead, Nickel) and

· Significant Neighbours: Mattabi Mine (Glencore) and Sturgeon Lake VMS Camp to west, Lac des Iles Mine (Impala Canada) to south.

· Potential:

The Obonga Project is Panther's flagship project, which has advanced from a greenfield regional data-based target area, through proof of concept to drilling success and base metal VMS and graphite discoveries. The project covers 90% (291 km2) of the district scale Obonga Greenstone Belt in northwest

Panther has achieved significant milestones through successful drilling campaigns at Obonga's Wishbone prospect, revealing a substantial Volcanogenic Massive Sulphide system. The Wishbone discovery, a first of its kind on the Obonga Greenstone Belt, is characterised by impressive drill hole intercepts, including 27.3m of massive sulphide and 51m of sulphide-dominated mineralisation.

Further drilling in late 2022 reaffirmed the potential, with intersections such as 3.6m @ 3.9% Zn, including 2m @ 6.8% Zn & 4.3 g/t Ag, indicating proximity to metal-fertile fluid flow. The discovery of the Wishbone VMS system is pivotal, boding well for the existence of additional VMS bodies in the vicinity, given their tendency to occur in clusters.

The Survey and Awkward targets have also benefitted from preliminary drilling, confirming VMS style mineralisation at Survey with a 29m wide intercept of cyclical semi-massive and disseminated sulphide, with graphite discovered at Awkward. This, coupled with the Wishbone discovery, solidifies the Obonga Greenstone Belt's status as a new emerging VMS Camp.

The Obonga Greenstone Belt, with its emerging VMS Camp status, is strategically positioned close to national railroad transport links and the industrial port city of

The presence of significant gold occurrences, base metals, and promising exploration results in the Obonga Greenstone Belt contribute to its appeal as a potential mining district. This strategic positioning makes it an attractive prospect for future resource development and exploration.

On

The Awkward magmatic feeder conduit target at Obonga is focused on a nickel-copper-platinum-palladium discovery, the significant pathfinders in the Awkward area continue to gain traction within the industry.

Under the Amending Agreement the exploration commitment is now spread over five years; whilst the original net smelter return royalty is replaced with a gross revenue royalty equal to 1.5% of the gross value of the sale proceeds actually received by the royalty payor from activity carried out on the Property. In connection with the signing of the Amending Agreement Panther issued 42,070 new ordinary shares (the "Consideration Shares") with a value of Canadian

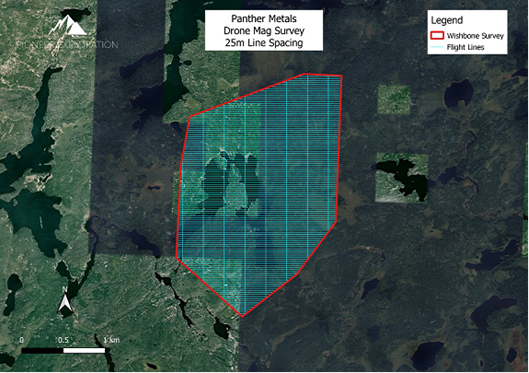

On

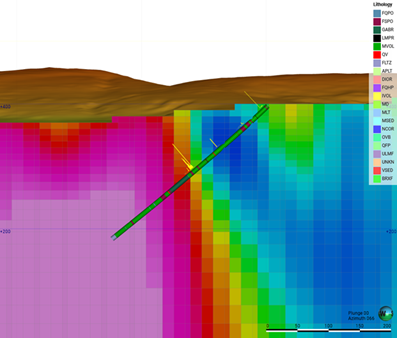

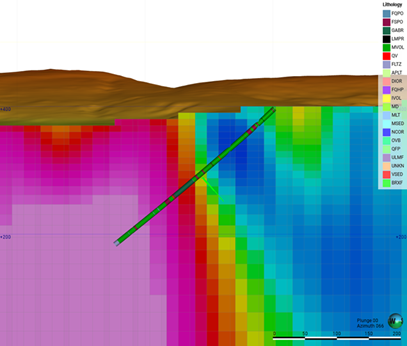

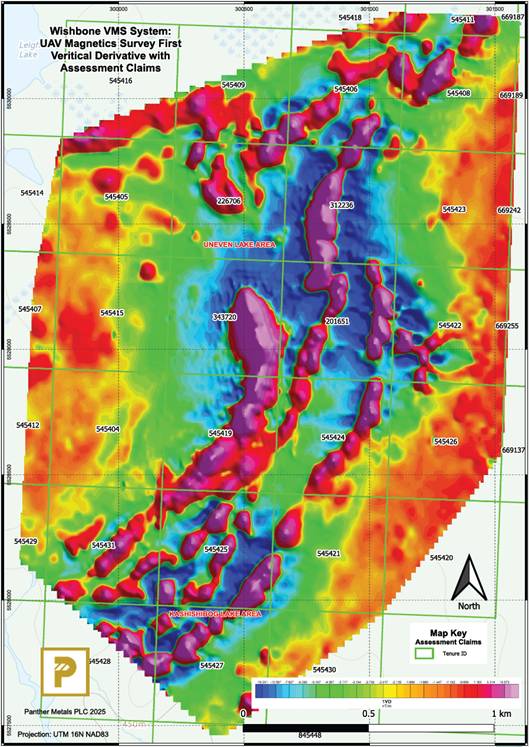

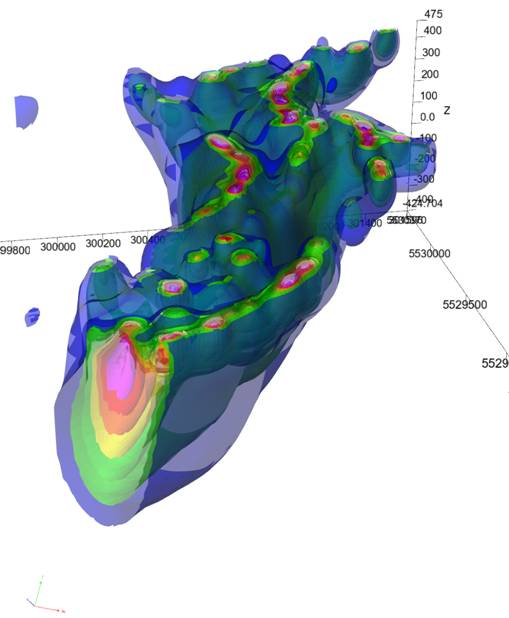

The deliverables of the high-resolution magnetics surveys and their data products, including six processed data products and associated maps (Figure 2) as well as the 3D inversion model (Figure 3) helped to refine planned drill hole orientations to target high grade base metal zones at depth, as well as providing inputs and informing the mineral system modelling for the Wishbone Prospect.

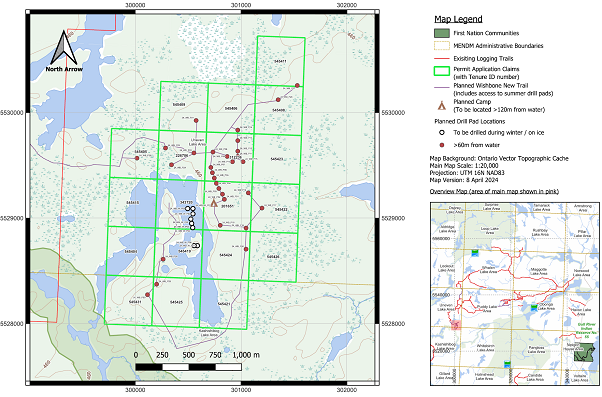

The Wishbone VMS system is covered by Exploration Permit PR-24-000022 which is valid through

Table 1: Wishbone Prospect UAV Magnetic Survey Details

|

UAV Magnetics Survey Rational |

Survey Equipment |

Survey Size |

Flight Line Azimuth (degrees) |

Survey Data Products |

|

Targeting VMS style base metal mineralisation at depth.

3D Inversion modelling will facilitate drill hole orientation planning to target the expected high base metal grade parts of the targeted VMS systems. |

Unmanned Airborne magnetometer survey system incorporating:

Base station magnetometer GSM-19W Overhauser

Airborne magnetometer Gem Systems GSMP-35U potassium vapor magnetometer & ancillary electronics. |

25m line & 250m tie line spacing Total line kilometres: 190.11 km |

090° |

· Final Total Magnetic Intensity

· First Vertical derivative

· Second Vertical Derivative

· Horizontal Derivative

· Analytic Signal

· Tilt Derivative

· 3D Inversion Models

|

Figure 1: Wishbone Magnetics Survey Area with 25m Spaced E-W Flight lines and 250m Spaced N-S Tie Lines

Figure 2: Wishbone First Vertical Derivative Magnetics Survey Map

Figure 3: Oblique View of the 3D Wishbone Magnetic Inversion Model That Will Inform the Next Round of Drilling

Figure 4: Wishbone Exploration Permit Planned Drill Pads and Access

Post period end, on

Awkward is a PGE, Ni and Cu magmatic sulphide prospective conduit and layered mafic intrusive target. The target comprises a highly anomalous geophysical target comprising a coincident magnetic remnant low and electromagnetic conductor. Historical surface sampling in the target area returned anomalous palladium (Pd) and platinum (Pt) up to a reported 1.23 g/t Pd+Pt and historical drilling on the periphery of the target intersected

As part of the ongoing assessment of the Awkward Target Panther sourced and acquired the historical drill core from three drill holes (PL-13-01, PL-13-02 and PL-13-03) drilled by Navigator Minerals during 2013 for further investigation and reanalysis.

The drill core was re-examined and re-assayed in conjunction with specialists from the

Specifically, the Awkward intrusion shares many of these characteristics with the intrusion that hosts Impala's 3 Moz Lac des Iles PGE mine located 85 km to the south. The drill core includes two types of rock that are very prospective for this mineralisation, both of which have never been seen at surface at Awkward and never analysed for PGEs:

1) Varitextured, "marble cake" gabbro that bears a visual similarity to one of the main ore-hosting horizons at the Lac des Iles mine, and

2) Massive sulphide rip-up clasts that may represent remobilisation from a magma conduit or other massive sulphide horizon within the intrusion.

Twenty drill core samples were selected for submittal to sample preparation at the OGS laboratory in

The samples represent intersections from drill holes PL-13-01 and PL-13-03, with selected assay results set out in Table 2.

The assay results are deemed highly encouraging for the presence of potentially economic concentrations of nickel and platinum group elements in a layered intrusive and feeder conduit. Moreover, the Company has noted similarities with the Mount Keith Deposit Type. The

A review of historical information relating to the Awkward area notes that Newmont identified the potential for around 1 billion tonnes at between 0.19-0.2% Ni in the area in 1967. Whilst the Company has yet to locate the supporting technical evidence, this observation supports the potential for

Previous geophysical modelling undertaken by Panther interpreted the course of the magmatic feeder conduit based on Maxwell Plate Modelling of the regional electromagnetic ('EM') geophysical data. The modelling established 20 conductive plates which outline four distinct conductive lineations or 'Trends' which are interpreted to relate to sulphide bearing magmatic conduits and graphite.

Panther's 2022 diamond drilling programme tested three of the 20 conductive plates (three holes totalling 243m drilled) with hole BBR22_AW-P1-1 intersecting 27.2 m @ 2.25 % Total Graphitic Carbon ('TGC') from 12m downhole in 'Trend 3'. Whilst this drilling did not interest the targeted massive sulphide bearing pipe, it was deemed very positive as the graphite is interpreted to have resulted from the high heat flow associated with a proximal magmatic conduit. The remainder of the conductive plates are as yet untested and Panther is currently designing follow-up work at Awkward which will be outlined in due course.

Table 2: Summary of Drill Core Assay Results

|

Hole ID |

Sample ID |

From (m) |

To (m) |

Interval (m) |

Ni (%) |

Pt (g/t) |

Pd (g/t) |

Ag (g/t) |

Cu (ppm) |

|

PL-13-01 |

25-NMPL-001 |

34.55 |

35.25 |

0.7 |

0.05 |

0.01 |

0.01 |

0.27 |

285 |

|

PL-13-01 |

25-NMPL-002 |

49.20 |

50.00 |

0.8 |

0.01 |

|

0.00 |

0.02 |

7 |

|

PL-13-01 |

25-NMPL-003 |

63.65 |

64.40 |

0.75 |

0.11 |

0.02 |

0.04 |

0.32 |

599 |

|

PL-13-01 |

25-NMPL-004 |

158.00 |

159.50 |

1.5 |

0.16 |

0.04 |

0.04 |

0.74 |

1,180 |

|

PL-13-01 |

25-NMPL-005 |

159.50 |

161.00 |

1.5 |

0.21 |

0.03 |

0.05 |

1.21 |

1,420 |

|

PL-13-01 |

25-NMPL-006 |

161.00 |

162.50 |

1.5 |

0.41 |

0.14 |

0.11 |

1.67 |

2,520 |

|

PL-13-01 |

25-NMPL-007 |

162.50 |

164.00 |

1.5 |

0.39 |

0.09 |

0.11 |

1.72 |

2,690 |

|

PL-13-01 |

25-NMPL-008 |

164.00 |

165.50 |

1.5 |

0.21 |

0.05 |

0.06 |

1.05 |

1,435 |

|

PL-13-03 |

25-NMPL-009 |

57.10 |

57.70 |

0.6 |

0.08 |

0.01 |

0.01 |

1.09 |

1,250 |

|

PL-13-03 |

25-NMPL-010 |

171.40 |

171.85 |

0.45 |

0.89 |

|

0.02 |

1.71 |

3,550 |

|

PL-13-03 |

25-NMPL-011 |

173.65 |

174.50 |

0.85 |

1.07 |

0.01 |

0.04 |

1.28 |

2,290 |

|

PL-13-03 |

25-NMPL-012 |

213.00 |

213.35 |

0.35 |

0.13 |

|

0.00 |

0.45 |

809 |

|

PL-13-03 |

25-NMPL-013 |

233.00 |

233.35 |

0.35 |

0.81 |

|

0.02 |

0.42 |

337 |

|

PL-13-03 |

25-NMPL-014 |

246.40 |

247.40 |

1 |

0.84 |

|

0.04 |

1.33 |

723 |

|

PL-13-03 |

25-NMPL-015 |

247.40 |

248.25 |

0.85 |

0.41 |

0.01 |

0.01 |

2.18 |

4,200 |

|

PL-13-03 |

25-NMPL-016 |

255.00 |

256.50 |

1.5 |

0.18 |

0.01 |

0.01 |

0.81 |

1,255 |

|

PL-13-03 |

25-NMPL-017 |

288.00 |

289.25 |

1.25 |

0.21 |

|

0.02 |

1.13 |

2,020 |

|

PL-13-03 |

25-NMPL-018 |

289.25 |

290.50 |

1.25 |

0.18 |

|

0.01 |

0.97 |

1,640 |

|

PL-13-03 |

25-NMPL-019 |

290.50 |

291.75 |

1.25 |

0.29 |

0.01 |

0.01 |

0.74 |

1,400 |

|

PL-13-03 |

25-NMPL-020 |

291.75 |

293.00 |

1.25 |

0.23 |

0.01 |

0.02 |

1.03 |

1,520 |

(Drill hole locations: PL-13-01 UTM16N 312165E 5536265N, PL-13-03: UTM16N 312348E 5537443N)

Dotted Lake Project Background: Critical Mineral Potential

· Total Area: 36.9 km2

· Prospective for: Base Metals (Nickel, Cobalt, Copper, Zinc) and

· Significant Neighbours: Barrick Gold (

The Dotted Lake Project encompasses a substantial 36.9 km² (Figure 3) within the North Limb of the Schreiber-Helmo Greenstone Belt, situated 16 km north of Barrick Gold's Hemlo Gold Mine which has produced over 22 Moz of gold over 30 years to date and 9 km from GT Resources recent discovery at

Panther acquired 100% of the Dotted Lake Project in July 2020. An airborne magnetic and electromagnetic geophysical survey was flown in

Figure 5: Location of the

The 'Phase 1 Diamond Drilling Programme' was conducted in 2024, the five drill holes, totalling 1,559m drilled, were undertaken utilising a single sled mounted diamond wire line NQ2 diameter core drilling rig operated by

Table 3: Dotted Lake Phase 1 Diamond Drilling Programme Hole Summary

|

Drillhole ID |

Easting |

Northing |

Elevation |

Azimuth |

Dip |

Hole Depth |

Start |

Finish |

|

DL24-001 |

589,455 |

5,416,139 |

397 |

330 |

45 |

330 |

|

|

|

DL24-002 |

590,435 |

5,416,233 |

387 |

154 |

55 |

328 |

|

|

|

DL24-003 |

590,102 |

5,416,175 |

383 |

160 |

54 |

330 |

|

|

|

DL24-004 |

592,745 |

5,416,939 |

391 |

160 |

45 |

248 |

|

|

|

DL24-005 |

592,347 |

5,417,309 |

408 |

180 |

45 |

326 |

|

|

Note: Coordinate projection stated as

Figure 6: Detailed Core Logging,

The Dotted

· Nickel, Chromium, PGE:

§ Over 214 m of open-ended nickel-bearing ultramafic intrusive intersected in hole DL24-002, with 129m intersected in DL24-003 and 94m intersected in DL24-004.

§ Grades up to 0.25% Ni highlighting the scale and consistency of the intrusive system.

§ Ultramafic layering confirmed by cyclical 5m wide banding of elevated chromite grading up to 6.65 %, 0.1 g/t Platinum & 0.24 g/t Palladium.

· Zinc:

§ DL24-001 intersected wide predominantly seafloor volcano-sedimentary derived packages prospective for hosting VMS mineralisation, with

· 5.5m @ 1.21 % Zn from 155.3m, including

· 2.7m @ 2.42% Zn from 155.3m and

· 1.0m @ 3.8% Zn from 155.3m

· Gold:

§ PM21-DL-001: nine separate gold intervals grading up to 2.57g/t Au (2021 drill hole)

§ DL24-001: three separate gold intervals grading up to 1.55 g/t Au

§ DL24-005: three anomalous intervals grading up to 1.63 g/t Au

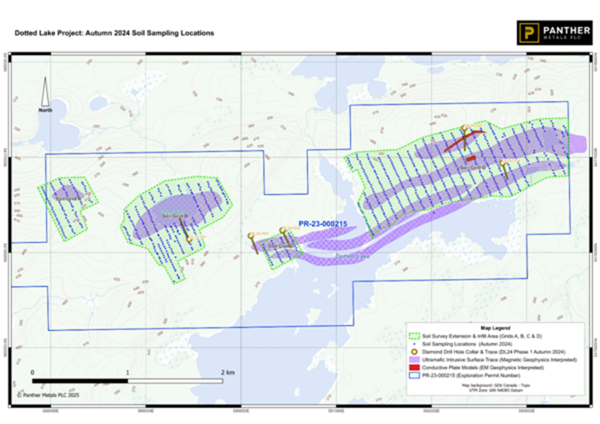

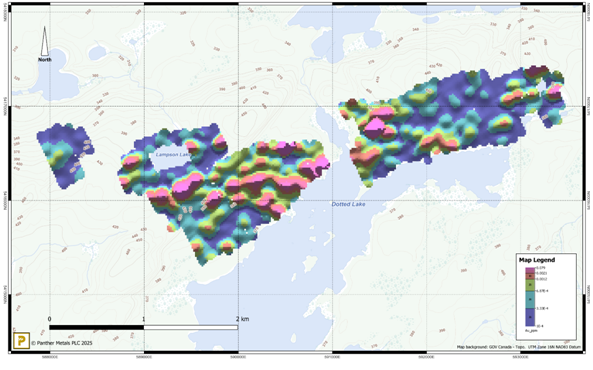

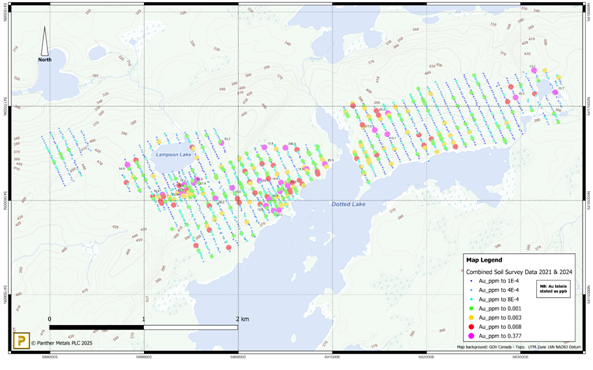

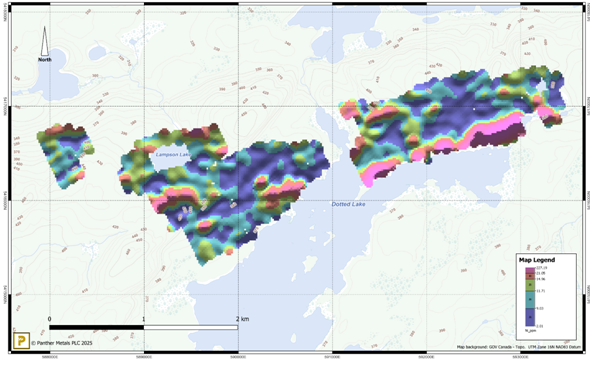

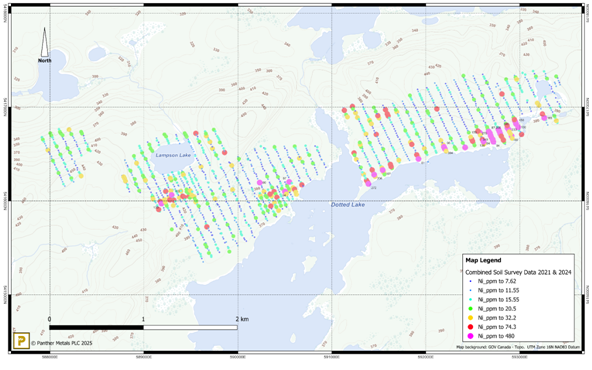

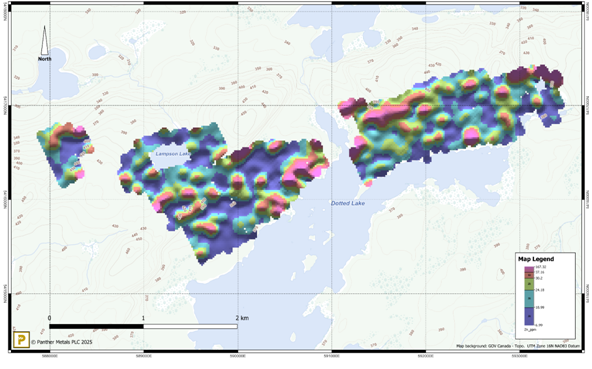

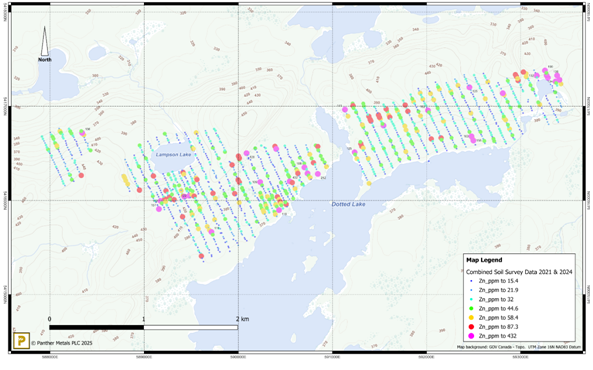

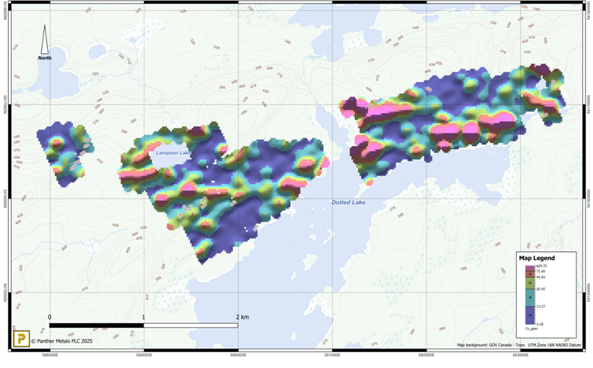

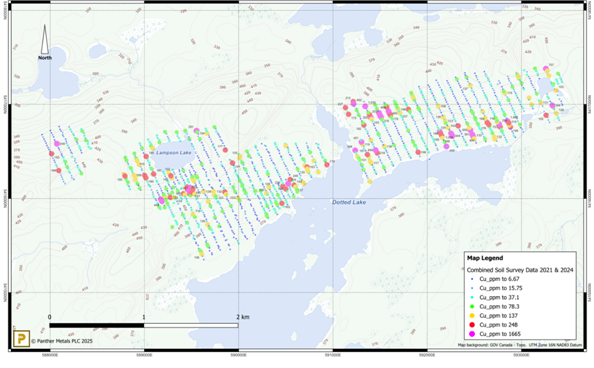

On

The soil assays returned standout multi-element critical mineral geochemical anomalies closely linked and coincident with geophysical anomalies and the recent Phase 1 Diamond Drilling target areas.

Highly anomalous soil assays ranged up to 1,665 ppm copper, 480 ppm nickel, 62 ppm cobalt, 190 ppm zinc, 0.99 ppm silver and 377 ppb gold (Table 4).

The results delineated multiple new target areas around

Table 4: Highest Three Soil Assay Results for Selected Elements

|

Selected Element |

Lower Limit of Detection |

1st Highest |

2nd Highest |

3rd Highest |

|

Copper (Cu) |

0.01 ppm |

1,665 ppm |

1,030 ppm |

1,005 ppm |

|

|

0.04 ppm |

480 ppm |

456 ppm |

394 ppm |

|

Cobalt (Co) |

0.001 ppm |

62 ppm |

61 ppm |

49 ppm |

|

Zinc (Zn) |

0.1 ppm |

190 ppm |

157 ppm |

157 ppm |

|

|

0.001 ppm |

0.99 ppm |

0.56 ppm |

0.50 ppm |

|

Gold (Au) |

0.2 ppb |

377 ppb |

42.2 ppb |

30.6 ppb |

Table notes: Soil assay results by ALS Laboratories analytical method ME-MS41L. Limit of detection (LOD) = lower limit of stated method. ppm = parts per million. ppb = parts per billion. 1 ppm = 1,000 ppb. Results subject to rounding.

The Soil Survey work was supported by the Ontario Junior Exploration Program ("OJEP"), a provincial government grant to help junior companies finance early exploration projects. OJEP covers 50% of eligible costs for approved programmes, with the agreed contribution to Panther for this work totalling Canadian

On the

|

|

|

|

Figure 7: Dotted Lake Project 2024 Soil Sampling Grids and Interpreted Ultramafic Bodies

|

|

|

(> 10 ppb Au Labels) |

Figure 8: Structurally Controlled Gold Trends Merge South of

|

|

|

(> 100 ppm Ni Labels) |

Figure 9: Significant Nickel Anomalies Trend Right Across the Survey Area

|

|

|

(> 50 ppm Zn Labels) |

Figure 10: Anomalous Zinc Trend Exceeds 3.5km In North of Survey Area

|

|

|

(> 100 ppm Cu Labels) |

Figure 11: Distinct Copper Anomalies Correlate with Multielement Anomalies Including Nickel and Zinc

The assay results from the Dotted

The first batch of drill core sample assay results were announced on

The subsequent three batches of drill core assay results were received and reported during the month of

The final, Batch 4, drill core assays were reported

A summary of the drilling hole findings is provided below.

Drill Hole DL24-001

· DL24-001 intersected predominantly seafloor volcano-sedimentary derived metavolcanic packages. Ultramafic intrusions were not intersected, with these bodies interpreted from the magnetisation vector inversion ("MVI") Magnetic Susceptibility Model to be possibly located at a greater depth below

· Multi-element analysis of drill hole assay results show strong correlation between gold, silver, copper, lead, zinc and barium indicating the mineralisation is linked to a volcanic-associated submarine hydrothermal system as associated with a metamorphosed VMS style of mineralisation.

· The Zinc intersections in DL24-001 are located 1.2km south-west of the Fairservice Zinc Showing where high-grade zinc (12% Zn with 2.2 g/t Au) is considered to represent remobilised and metamorphosed VMS mineralisation. The large, metamorphosed VMS-style Geco deposit, located 30km north of Dotted Lake near

· Significant downhole zinc intersections:

o 5.5m @ 1.21 % Zn from 155.3m including

§ 2.7m @ 2.42% Zn from 155.3m and

§ 1.0m @ 3.8% Zn from 155.3m (Figure 2)

· Zinc and gold are closely associated together in DL24-001 and also correlate well with conventional magnetic inversion domain boundaries in the magnetic susceptibility model (Figure 12).

· Gold intersections in DL24-001 correlate with an open-ended 750m long gold in-soil anomaly, offset from the western end of the 1.2km gold in soil anomaly which extends westwards from the Panther 2021 drill hole which intersected over 9 separate gold intervals grading up to 2.57g/t Au3, and from trench Tr-10-4 which returned gold samples up to 18.9g/t Au.

· Significant downhole gold intersections:

o 0.5m @ 1.15 g/t Au from 11.8m;

o 4.5m @ 0.64g/t Au from 156.3m, including

§ 0.9m @ 1.55g/t Au, 1.4g/t Ag & 2.08% Zn from 156.3m (Figure 2); and

o 1.0m @ 0.53 g/t Au & 1.24 g/t Ag from 105.0m.

Drill Hole DL24-002

Assay results for DL24-002 show a 214.7m wide open-ended zone of intrusive ultramafic derived magnesium (Mg) rich serpentinite grading up to 21.7% Mg, which is mineralised with the platinum group elements ("PGE"), platinum (Pt) and palladium (Pd), nickel (Ni), chromium (Cr) and silver (Ag), between 113.3m downhole to end of hole at 328m.

· The DL24-002 Ni and Cr assay result grade variations show layering with three distinct higher grade zones within the bottom 112m of the hole as well as overlimit Cr. As hole DL24-002 was ended inside the intrusive, the prospect of strengthening grade-layering with depth is considered strong.

· DL24-002 intersected downhole 214.7m wide open-ended zone of Mg-rich serpentinite intrusive from 113.3m to end of hole at 328m, with higher grade layering including:

o 0.7m @ 0.07 % Ni, 0.06 g/t Pt, 0.14 g/t Pd, 5.47 % Cr & 9.2 % Mg from 113.4m.

o 4.0m @ 0.13 % Ni, 0.02 g/t Pt, 0.04 g/t Pd, 0.91 % Cr & 17.2 % Mg from 169.0m.

o 36.3m @ 0.13 % Ni, 0.01 g/t Pt, 0.02 g/t Pd, 0.43 % Cr & 18.8 % Mg from 216.0m.

o 7.5m @ 0.20 % Ni, 0.02 g/t Pt, 0.04 g/t Pd, 0.49 % Cr & 20.0 % Mg from 258.5m.

o 12.0m @ 0.18 % Ni, 0.01 g/t Pt, 0.02 g/t Pd, 0.63 % Cr & 19.7 % Mg from 304.0m.

· Three samples returned intersections with overlimit chromium (>1% Cr) which were subsequently reanalysed using the ore grade 'OG62' overlimit assay method for high grade chromium, returning 0.7 m @ 5.47% Cr, 1.0m @ 1.44% Cr & 1.0m @ 1.37 % Cr.

Drill Hole DL24-003

· Diamond drill hole DL24-003 downhole intersection:

o 129.0m @ 0.09 % Ni, 0.01 g/t Pt, 0.02 g/t Pd, 0.37 % Cr & 14.4 % Mg from 172.0m, including:

§ 32.4m @ 0.12 % Ni, 0.01 g/t Pt, 0.03 g/t Pd, 0.59 % Cr & 17.1 % Mg from 221.0m;

§ 6.0m @ 0.13 % Ni, 0.02 g/t Pt, 0.05 g/t Pd, 0.67 % Cr & 13.7 % Mg from 254.0m; and

§ 23.0m @ 0.11 % Ni, 0.01 g/t Pt, 0.02 g/t Pd, 0.24 % Cr & 16.1 % Mg from 274.0m

o Six samples returned intersections with chromium (>1% Cr) of 1.29%, 1.38%, 1.45%, 1.52%, 1.62% (all 1m wide) and 6.65% (0.5m wide).

Drill Hole DL24-004

· Diamond drill hole DL24-004 downhole intersections:

o 94.4m @ 0.12 % Ni, 0.01 g/t Pt, 0.02 g/t Pd, 0.46 % Cr & 17.7 % Mg from 152.6m, including:

§ 4.6m @ 0.17 % Ni, 0.03 g/t Pt, 0.09 g/t Pd, 1.13 % Cr & 20.1 % Mg from 196.7m

§ 7.0m @ 0.15 % Ni, 0.02 g/t Pt, 0.04 g/t Pd, 0.46 % Cr & 18.7 % Mg from 233.0m

o Five samples returned intersections with chromium (>1% Cr) of 1.14% (1.0m wide), 1.24% (1.0m wide), 1.37% (0.8m wide), 1.61% (0.5m wide) and 1.89% (0.6m wide).

Drill Hole DL24-005

· DL24-005 did not intersect ultramafic intrusive however the bottom 12m of the hole show a 10 fold increase in average Cr levels (ranging up to 0.72% Cr) suggesting the bottom of the hole is in the vicinity of the ultramafic alteration halo.

· Gold intersection:

o 0.4m @ 1.625 g/t Au from 123.5m

· Distinct intervals with elevated Fe content (ranging 14-19% Fe) display correlation with low-level but elevated Cu ranging up to 0.36% Cu.

|

A: |

|

B: |

|

Figure 12: DL24-001 Drill Hole Lithology over Conventional Magnetic Inversion Magnetic Susceptibility Model, with: (A) Gold Intersections; (B) Zinc Assay Traces. Gold and zinc mineralisation display good correlation with conventional magnetic inversion domain boundaries. |

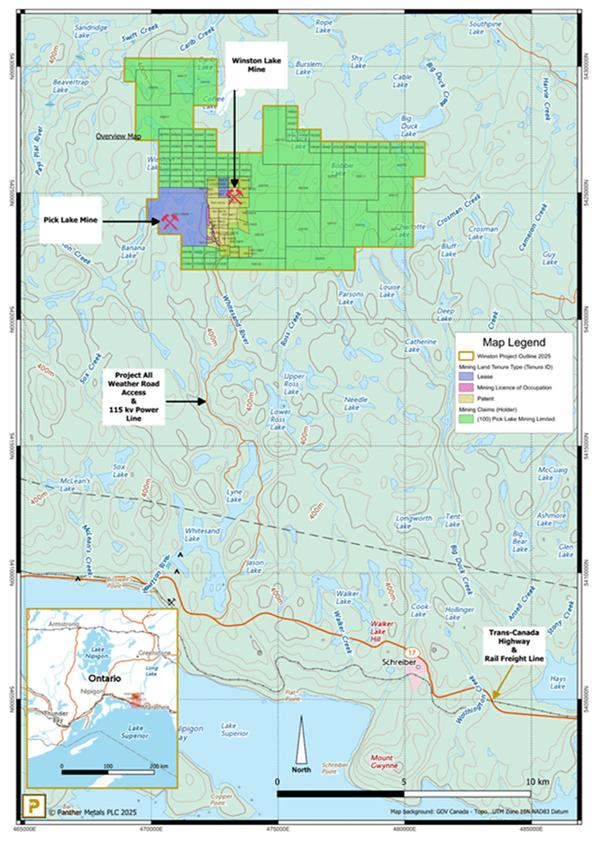

· Total Area: 60.41km2

· Prospective for: Base Metals (Zinc, Copper, Cobalt, Gallium and Indium) and

Panther signed two option agreements (the "Option Agreements"), announced

The Option Agreements signed with First Quantum, the

Based on an underground mining Feasibility Study published in 2021 the

The Winston tailings storage facility provides the potential for reprocessing historical mine tailings, unlocking residual contained metal value and contributing to the long-term environmental rehabilitation of the site.

The 2021 feasibility study positions the project in the lowest quartile of operating costs globally, with a projected initial mine life of 8.5 years. Panther plans to build on the resources, to increase reserves and extend the mine life utilising the Company's strong local exploration network and leveraging institutional, governmental and critical mineral programme support.

Winston Key Highlights

·

· NPV8%:

· IRR: 26% pre-tax

· EBITDA:

· CAPEX:

· OPEX:

· LOM: Initial 8.5 year life of mine, with 3.5 year pay-back period. Strong potential to increase LOM.

· Producing an average 33.40ktpa contained zinc,1.3ktpa contained copper, 698oz recovered gold and 90.8koz recovered silver (after ramp-up), from an onsite processing facility with an annualised 326ktpa capacity.

· The unit pricing for copper, gold and silver, concentrate payable percentages and exchange rates, are positively different from 2021 in today's dollars, providing scope for additional value uplift.

· High-Grade Mineral Resource

· Indicated Resource of 2.07 Million Tonnes @ 18% Zinc

· Volcanogenic Massive Sulphide mineralisation well understood by Panther.

· Positive Upside

· Panther plans to build value through extending the mine life utilising the Company's strong local exploration network and leveraging institutional, governmental and critical mineral programme support.

· No name discussions in

· Strong prospects to increase Mineral Resources and Mineral Reserves through exploration down-dip and along strike of the current Resources.

· Zinc and Copper deemed Critical Minerals in

· Positive First Nation engagement.

· Strong Institutional and Governmental support for future financing options.

· Existing historical tailings storage facility offers potential for near-term cash-flow subject to further studies.

Figure 13: Location of the

Figure 14:

In relation to advancing the

On 19 June 2025, Panther announced a collaboration with Fulcrum to investigate the potential commercialisation of the historical mine processing tailings storage facility located on the Winston Project.

Post period end, on 15 July 2025 the Company further announced the commencement of a tailings sampling programme at the Winston Project. The tailings focussed work forms part of the Company's strategy to unlock the value from the Winston Project's historical mine site while contributing positively to local environmental outcomes. The Winston Lake Mine was operational from 1988 to 1998, producing approximately 3.3 million tonnes of ore and yielding zinc, copper, silver, and gold. Based on historic processing recoveries it is believed that a significant quantity of valuable material was not captured and remains in the tailing storage facility.

The tailings focussed programme, and associated follow-on work, includes:

· collection of representative samples from the historical tailings storage facility;

· undertake tailings Mineral Resource estimate with initial metals recovery test work;

· assess the financial potential of tailings reprocessing to enhance project economics;

· evaluate the opportunity to add to the operational life of the Winston Project;

· quantify the potential for resource growth based on historical recovery rates; and

· support future environmental remediation by reducing the long-term footprint of legacy tailings.

Assay results from the tailings sampling were announced on 31 July 2025. These exceeded Panther's expectations returning high grade gold (Au), gallium (Ga), silver (Ag), zinc (Zn), copper (Cu) and cobalt (Co), strongly supporting further sampling and metallurgical testwork to determine the most economic and environmentally sensitive route for extracting the precious metals and other critical minerals from the TSF.

· Tailings samples return assay results of up to:

o 0.814 g/t Au

o 21.9 g/t Ag

o 2.20% Zn

o 0.20 % Cu

o 496 ppm Co

o 122 ppm Ga

In addition, a rock sample from a historical massive sulphide dump at the Pick Lake deposit located circa 1.4km west of the TSF yielded 25.3% Zn, 3.0% Cu, 0.55g/t Au. 119 g/t Ag, 388 ppm Co and 26.2 ppm Ga which points to the future potential offered by the strong exploration targets in the Pick Lake area.

The Company further announced on 1 September 2025 that it had formally commenced the application for the Recovery of Minerals Permit as part of a series of workstreams to quantify, evaluate and permit the contained high-grade gold, gallium, silver, zinc, copper and cobalt and other recoverable minerals located within the historic

A Recovery Permit allows its holder to recover minerals from tailings or other mine waste materials at a given location without having first obtained an exploration permit or a filed Mine Closure Plan. If the tailings or other mine waste materials are located on crown land, the holder can also recover minerals and exploit them commercially without a mining claim or mining lease.

Corporate and Financial Highlights

Share Issues and Director Dealings

Placing

On 20 January 2025, the Company announced the completion of a conditional placing of 910,000 ordinary shares of no par value (the "Placing Shares") at a price of 50 pence per Placing Share (the "Placing Price") in a placing (the "Placing"), raising gross proceeds of £455,000. Each Placing Share was issued with one warrant attached entitling the holder to subscribe for one new ordinary share at a price of 75 pence (the "Warrants"). The Warrants have a life of 36 months from the date of Admission on 28 February 2025. Following Admission on 28 February 2025, the Company's total issued share capital consisted of 5,189,080 Ordinary Shares.

Debt Capitalisation

On 12 March 2025, the Company announced that it had agreed terms to capitalise its only outstanding debt facilities, comprising the £150,000 of unsecured convertible loan notes announced 20 November 2023, which carry an interest rate of 15%. The Company settled this liability by the issue of new ordinary shares with warrants attached, on the same economic terms as the most recent placing announced on 20 January 2025.

The Company allotted, issued and admitted to trading a combined total of 362,250 shares at an issue price 50p (the "Settlement Shares") and delivered 362,250 warrants with an exercise price of 75p to the former holders of the loan notes. The warrants have a life of 3 years and be subject to an "accelerator" requiring the warrants to be exercised should the Panther share price exceed £1.50 at any time over a period of 20 trading days following the date of the issue of the warrants. The shares were admitted on 8 April 2025.

Warrant Issue

On 24 June 2025, the Company announced it had received notice of exercise of a total of 106,666 warrants with an exercise price of 75p per share, raising £80,000 for the Company. The Company made applications for 106,666 new Ordinary Shares to be admitted to listing and Admission took place on 30 June 2025.

Director Purchase in Market

On 25 June 2025, the Company that on 24 June 2025 Kerry Hazelwood, a PCA of the Chief Executive Officer,

Director Direct Subscription

On 30 June 2025, the Company announced that Executive Chairman,

On 2 April 2025, the Company announced that at its General Meeting of the Company, all resolutions were duly passed. On 30 June 2025, the Company announced the results of its AGM in which all of the resolutions were passed successfully.

Held for Sale Investment - Fulcrum Sale

On 8 April 2025, the Company announced that it had sold a total of 7,625,122 ordinary shares of nominal value 1 pence each in the capital of Fulcrum Metals plc ("Fulcrum") (the "Ordinary Shares") on 7 April 2025, at a price of 3.5 pence per Ordinary Share, for an aggregate amount of £266,879.27 (net of fees and expenses). The Fulcrum sale constituted a disposal of Panther's remaining holding in Fulcrum.

Advisory Board

On 18 June 2025, the Company announced the appointment of

On 23 July 2025, the Company announced the appointment of Mr Kerem Usenmez MSc.

Bitcoin Acquisition

On 23 June 2025, the Company announced the successful opening of a Bitcoin Treasury account CoinCorner Ltd based in the

Exploration Agreements

Obonga Amendment

On 3 April 2025, the Company announced the amendment and extension to the purchase agreement (the "Amending Agreement") with Broken Rock Resources Ltd ("Broken Rock") over the Obonga Project ("Obonga" or the "Property"), which covers over 90% of the Obonga Greenstone Belt, in

Under the Amending Agreement the exploration commitment is now spread over five years; whilst the original net smelter return royalty is replaced with a gross revenue royalty equal to 1.5% of the gross value of the sale proceeds received by the royalty payor from activity carried out on the Property.

In connection with the signing of the Amending Agreement Panther allotted and issued 42,070 new ordinary shares (the "Consideration Shares") with a value of Canadian $30,000 to Broken Rock (based on the mid-market closing price of Panther's ordinary shares on 27 March 2025 and an exchange rate of CAD$1.85 to £1.00.

The Consideration Shares were credited as fully paid and rank pari passu in all respects with the existing Ordinary Shares in the share capital of the Company, including the right to receive all dividends and other distributions declared, made, or paid on or in respect of such shares after the date of issue of the Consideration Shares. The shares were admitted on 8 April 2025

Winston

On 17 June 2025, the Company announced the signing of two option and purchase agreements (the "Agreements") to create the Winston Project, a polymetallic high-grade zinc, copper and precious metal volcanogenic massive sulphide ("VMS") property comprising a critical mineral mine redevelopment and resource building exploration opportunity (the "Project"), located 50 km east of

The Agreements signed with First Quantum Minerals Ltd ("First Quantum"), the

The 2021 Feasibility Study for the mine redevelopment expected to generate average life of mine ("LOM") annual EBITDA of C$67.64 million (M) and have a pre-tax NPV(8%) of C$ 175.8 M and IRR of 26%, with further strong exploration potential for defining additional Mineral Resources and Mineral Reserves from the two main deposits as well as additional near-mine VMS exploration targets.

Panther's Winston Project is underpinned by two separate purchase option agreements which will upon exercise consolidate the mining claims, leases and mineral assets into a single 100% owned property.

1. First Quantum Minerals Option to Purchase Winston Lake Property

The First Quantum option to purchase agreement affords Panther the Option to purchase, all right, title and interest in, the Winston Lake Property and patented land leases. The agreement includes an initial due diligence period in which Panther has the right to conduct agreed exploration work.

In the initial 12-month due diligence period Panther has the right to all project data and to conduct an agreed exploration programme on the First Quantum property, in return for a C$100,000 payment. Prior to the expiration of the due diligence period, Panther may extend the period for a further 12 months up to three times (for a total maximum due diligence period of 48 months) by making payments of C$50,000 per extension.

Upon Panther exercising the purchase option, First Quantum will be granted a 2% net smelter return ("NSR") royalty (the "Royalty") over the Winston Lake Property, with Panther having the right to purchase back half (50%) of the Royalty for a payment of C$3,000,000. Upon exercise Panther will be required to replace First Quantum's outstanding letter of credit for C$4,000,000 (or such greater amount as may be in place as of the completion date), currently issued in favour of the Ministry of Northern Development and Mines.

2. Frontier Energy Option and Sale and Purchase Agreement for the Pick Lake Mining Ltd Property

The terms of the Frontier Energy Option and Sale and Purchase Agreement comprise an Option Period running to 15 October 2025. An Option payment of 100,000 Australian dollars (A$), with additional A$30,000 per month, payable on the first business day in each month thereafter and ending on 15th October 2025, the payments in each case offset against the total purchase price of A$2,750,000, when the Option is exercised. Panther is entitled to exercise the Option at any time during the Option Period.

The

Financial Review

The Group has reported an unaudited loss for the six months ended 30 June 2025 of £1,068,265 (six months ended 30 June 2024 - loss £967,902). The basic and diluted earnings per share for the period was -20.99 pence and -20.99 pence respectively (six months ended 30 June 2024 - basic and diluted earnings of -25.59 pence and -25.59 pence respectively).

The key performance indicators are set out below:

|

|

At 30-Jun-25 |

At 30-Jun-24 |

At 31-Dec-24 |

|

|

(unaudited) |

(unaudited) |

(audited) |

|

|

£ |

£ |

£ |

|

|

|

|

|

|

Net asset value |

2,074,738 |

3,005,768 |

2,111,196 |

The Directors are required to provide an Interim Management Report in accordance with the Financial Conduct Authorities ("

The following statement of the Principal Risks and Uncertainties, the Related Party Transactions, the Statement of Directors' Responsibilities and the Operational and Financial Review constitute the Interim Management Report of the Company for the six months ended 30 June 2025.

Principal Risks and Uncertainties

The principal risks and uncertainties of the Company are detailed on page 28 of the Company's most recent Annual Report for the year ended 31 December 2024 which can be found on the Company's website at www.panthermetals.co.uk. The principal risks and uncertainties facing the Company remain unchanged from those disclosed in the Annual Report for the year ended 31 December 2024, and the Board are of the opinion that they will continue to remain unchanged for the forthcoming six-month period.

The principal risks and uncertainties facing the Company are as follows:

• adverse foreign exchange fluctuations;

• if the Group is unable to raise additional capital when needed or on suitable terms it could force a delay, reduce or eliminate its exploration development and production plans and efforts; and

• there are significant risks associated with any discovery and the ability of the Company to then generate any operational cashflows.

Related Party Transactions

There have been no material changes to the related party transactions described in the Annual Report that could influence the financial position or performance of the Company.

Going Concern

As at 30 June 2025, the Group had total cash reserves of £27,293 (31 December 2024: £17,536). The Directors are aware of the reliance on fundraising within the next 12 months having reviewed the Group's working capital forecasts. Directors believe that the Group is well placed to manage its business risks successfully, providing future fundraisings are successful. The interim financial statements have been prepared on a going concern basis and do not include adjustments that would result if the Group was unable to continue in operation. As a junior exploration company, the Directors are aware that the Company must go to the marketplace to raise funds in the next 12 months to meet its investment and exploration plans and to maintain its listing status.

For and on behalf of the Board of Directors

Chief Executive Officer

24 September 2025

STATEMENT OF DIRECTORS' RESPONSIBILITY FOR THE HALF YEARLY REPORT FOR THE SIX MONTHS ENDED 30 JUNE 2025

The Directors confirm to the best of their knowledge:

· the interim financial statements have been prepared in accordance with International Accounting Standard 34, Interim Financial Reporting, as adopted by the EU;

· the interim financial statements give a true and fair view of the assets and liabilities, financial position and the loss of the Group;

· the interim report includes a fair review of the information required by DTR 4.2.7R of the Disclosure and Transparency Rules, being an indication of important events that have occurred during the first six months of the financial year and their impact on the interim financial information, and a fair description of the principal risks and uncertainties for the remaining six months of the year; and

· the interim financial information includes a fair review of the information required by DTR 4.2.8R of the Disclosure and Transparency Rules, being information required on related party transactions.

For and on behalf of the Board of Directors

Chief Executive Officer

24 September 2025

CONSOLIDATED CONDENSED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHS ENDED 30 JUNE 2025

|

|

Notes |

Period ended 30 June 2025 £ |

Period ended 30 June 2024 £ |

|

|

|

Unaudited |

Unaudited |

|

Revenue |

|

- |

- |

|

|

|

|

|

|

Cost of sales |

|

- |

- |

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

- |

- |

|

|

|

|

|

|

Administrative expenses |

|

(525,871) |

(393,724) |

|

Share-based payment (charge)/ credit |

7 |

(167,466) |

(41,725) |

|

Realised and unrealised gains/losses on investments held for sale |

2 |

(365,738) |

(531,821) |

|

|

|

|

|

|

Operating loss |

|

(1,059,075) |

(967,270) |

|

|

|

|

|

|

Finance costs |

|

(9,190) |

(632) |

|

|

|

|

|

|

|

|

|

|

|

Profit/ (loss) before taxation |

|

(1,068,265) |

(967,902) |

|

|

|

|

|

|

Taxation |

|

- |

- |

|

|

|

|

|

|

Profit/(loss) for the period |

|

(1,068,265) |

(967,902) |

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income |

|

- |

- |

|

|

|

|

|

|

Total comprehensive profit/ (loss) for the period |

|

(1,068,265) |

(967,902) |

|

|

|

|

|

|

|

|

|

|

|

Profit/ (loss) attributable to: |

|

|

|

|

Equity holders of the company: |

|

(1,068,265) |

(967,902) |

|

|

|

|

|

|

|

|

(1,068,265) |

(967,902) |

|

|

|

|

|

|

|

|

|

|

|

Basic earnings/ (loss) per share (pence) |

3 |

(20.99)p |

(25.59)p |

|

Diluted earnings/ (loss) per share (pence) |

3 |

(20.99)p |

(25.59)p |

|

|

|

|

|

|

|

Notes |

As at 30 June 2025 £ |

As at 30 June 2024 £ |

As at 31 December 2024 £ |

|

|

|

Unaudited |

Unaudited |

Audited |

|

Non-current assets |

|

|

|

|

|

Exploration and evaluation assets |

|

2,464,568 |

1,979,125 |

2,281,726 |

|

Bitcoin Treasury Intangible |

1.3 |

52,010 |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-current assets |

|

2,516,578 |

1,979,125 |

2,281,726 |

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

Investments Held for Sale |

2 |

- |

1,371,868 |

631,270 |

|

Receivables |

|

45,991 |

139,057 |

104,795 |

|

Cash at bank and in hand |

|

27,293 |

236,958 |

17,536 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets |

|

73,284 |

1,747,883 |

753,601 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

2,589,862 |

3,727,008 |

3,035,327 |

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

Trade and other payables |

|

(366,441) |

(153,948) |

(613,916) |

|

Loan Notes |

4 |

- |

(406,500) |

(172,500) |

|

|

|

|

|

|

|

Total Current Liabilities |

|

(366,441) |

(560,448) |

(786,416) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net current assets/(liabilities) |

|

(293,157) |

1,187,435 |

(32,815) |

|

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

Provision for deferred consideration |

5 |

(148,683) |

(160,792) |

(137,715) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

(515,124) |

(721,240) |

(924,131) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets |

|

2,074,738 |

3,005,768 |

2,111,196 |

|

|

|

|

|

|

|

Capital and reserves |

|

|

|

|

|

Called up share capital |

6 |

7,808,682 |

6,705,665 |

6,944,341 |

|

Share-based payment reserve |

7 |

735,206 |

632,822 |

567,740 |

|

Retained losses |

|

(6,469,150) |

(4,332,719) |

(5,400,885) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total equity |

|

2,074,738 |

3,005,768 |

2,111,196 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes |

As at 30 June 2025 £ |

As at 30 June 2024 £ |

As at 31 December 2024 £ |

|

|

|

Unaudited |

Unaudited |

Audited |

|

Cash flows from operating activities |

|

|

|

|

|

Operating Loss |

|

(1,059,075) |

(967,270) |

(2,206,568) |

|

Adjusted for: |

|

|

|

|

|

Share-based payment charge |

|

167,466 |

41,725 |

152,991 |

|

Loss on termination of exploration projects |

|

- |

- |

180,462 |

|

Realised and unrealised gains/losses on investments held for sale |

|

365,738 |

531,821 |

1,051,189 |

|

Foreign exchange |

|

79,859 |

41,973 |

111,818 |

|

(Increase)/decrease in receivables |

|

63,094 |

(80,779) |

(46,516) |

|

Increase/(decrease) in payables |

|

(296,586) |

13,508 |

465,083 |

|

|

|

|

|

|

|

Net cash (used in)/generated from operating activities |

|

(679,504) |

(419,022) |

(291,541) |

|

|

|

|

|

|

|

Investing activities |

|

|

|

|

|

Proceeds from the sale of held for sale investments |

2 |

266,879 |

356,701 |

570,548 |

|

Cash spent on exploration activities |

|

(223,767) |

(81,841) |

(702,591) |

|

Purchase of Bitcoin |

1.3 |

(52,010) |

- |

- |

|

|

|

|

|

|

|

Net cash (used in)/ generated from investing activities |

|

(8,898) |

274,860 |

(132,043) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Financing activities |

|

|

|

|

|

Proceeds from issuing shares |

6 |

587,000 |

315,000 |

375,000 |

|

Proceed from conversion of warrants |

6 |

80,000 |

- |

- |

|

OJEP funding |

1.3 |

31,159 |

- |

- |

|

|

|

|

|

|

|

Net cash generated from financing activities |

|

698,159 |

315,000 |

375,000 |

|

|

|

|

|

|

|

Net increase/ (decrease) in cash and cash equivalents |

|

9,757 |

170,838 |

(48,584) |

|

|

|

|

|

|

|

Cash and cash equivalents at beginning of period |

|

17,536 |

66,120 |

66,120 |

|

|

|

|

|

|

|

Cash and cash equivalents at end of period |

|

27,293 |

236,958 |

17,536 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Group |

Notes |

Share capital £ |

Share based payment reserve £ |

Retained losses £ |

Total £ |

|

|

|

|

|

|

|

|

Balance at 1 January 2024 |

|

6,330,665 |

591,097 |

(3,364,817) |

3,556,945 |

|

|

|

|

|

|

|

|

Loss for the year |

|

- |

- |

(2,212,416) |

(2,212,416) |

|

|

|

|

|

|

|

|

Total comprehensive loss for the year |

|

- |

- |

(2,212,416) |

(2,212,416) |

|

|

|

|

|

|

|

|

Transactions with the owners of the company |

|

|

|

|

|

|

Shares issued |

6 |

375,000 |

- |

- |

375,000 |

|

Conversion of convertible loan notes |

|

238,676 |

- |

- |

238,676 |

|

|

|

|

|

|

|

|

Other transactions |

|

|

|

|

|

|

Options issued |

7 |

- |

47,232 |

- |

47,232 |

|

Warrants issued |

7 |

- |

105,759 |

- |

105,759 |

|

Warrants forfeited |

7 |

- |

(176,348) |

176,348 |

- |

|

|

|

|

|

|

|

|

Balance at 31 December 2024 |

|

6,944,341 |

567,740 |

(5,400,885) |

2,111,196 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at 1 January 2025 |

|

6,944,341 |

567,740 |

(5,400,885) |

2,111,196 |

|

|

|

|

|

|

|

|

Loss for the year |

|

- |

- |

(1,068,265) |

(1,068,265) |

|

|

|

|

|

|

|

|

Total comprehensive loss for the year |

|

- |

- |

(1,068,265) |

(1,068,265) |

|

|

|

|

|

|

|

|

Transactions with the owners of the company |

|

|

|

|

|

|

Shares issued |

6 |

455,000 |

- |

- |

455,000 |

|

Debt capitalised |

6 |

181,125 |

- |

- |

181,125 |

|

Obonga extension shares |

6 |

16,216 |

- |

- |

16,216 |

|

Warrant Conversion |

6 |

80,000 |

- |

- |

80,000 |

|

Director Subscription |

6 |

132,000 |

- |

- |

132,000 |

|

|

|

|

|

|

|

|

|

|

864,341 |

- |

- |

864,341 |

|

Other transactions |

|

|

|

|

|

|

Options issued/charged |

7 |

- |

23,616 |

- |

23,616 |

|

Warrants issued/charged (net of exercise) |

7 |

- |

143,850 |

- |

143,850 |

|

|

|

|

|

|

|

|

Balance at 30 June 2025 |

|

7,808,682 |

735,206 |

(6,469,150) |

2,074,738 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTES TO THE UNAUDITED CONDENSED INTERIM FINANCIAL STATEMENTS

FOR THE SIX-MONTH PERIOD ENDED 30 JUNE 2025

1 Accounting policies

1.1. Half-yearly report

This interim financial information for the six months ended 30 June 2025 and 30 June 2024 is unaudited and does not constitute statutory financial statements within the meaning of the Companies Act 1982 (Isle of Man). The interim financial information was approved by the Board of Directors on 18 September 2025.

The figures for the year ended 31 December 2024 have been extracted from the statutory financial statements which have been prepared in accordance with UK adopted International Accounting Standards ("IFRS") and which have been reported on by the Company's auditor. The auditor's report on those financial statements was unqualified.

The condensed interim financial statements have not been reviewed by the Company's auditor.

1.2. Basis of accounting

The condensed interim financial information has been prepared in accordance with the requirements of IAS 34 "Interim Financial Reporting".

The interim financial information does not include all notes of the type normally included in the annual financial report and therefore cannot be expected to provide as full an understanding of the financial performance, financial position and financing and investing activities of the group as the full financial report.

The financial information has been prepared on the historical cost basis. The accounting policies and methods of computation adopted in the Company's preparation of the condensed interim financial information are consistent with those adopted and disclosed in the financial statements for the year ended 31 December 2024 and those expected to be used for the year ending 31 December 2025.

The Company will report again in full for the year ending 31 December 2025.

1.3. Accounting policies

The accounting policies are unchanged from those used in the last published annual financial statements for the year ended 31 December 2024. The Company has accounted for the OJEP funding in accordance with IAS 20 Accounting for Government Grants and Disclosure of Government Assistance by offsetting the £31,160 received against the related Dotted Lake exploration asset. The Company has accounted for the £52,010 of Bitcoin Treasury held at 30 June 2025 in accordance with IAS 38 Intangible Assets. The majority of the Bitcoin Treasury was disposed of after the period end. As at 24 September 2025, the Company holds Bitcoin with a value of £457. The Company has no immediate intention to buy Bitcoin.

2 Investments Held for Sale

|

|

|

£ |

|

Net book value |

|

|

|

At 1 January 2025 |

|

631,270 |

|

Disposals in the period |

|

(590,947) |

|

Fair value loss of investment held for sale |

|

(40,323) |

|

|

|

|

|

At 30 June 2025 |

|

- |

|

|

|

|

On 8 April 2025 the Company announced that it sold its remaining holdings in Fulcrum a total of 7,625,122 ordinary shares of nominal value 1 pence each in the capital of Fulcrum Metals plc on 7 April 2025, at a price of 3.5 pence per ordinary share, for an aggregate amount of £266,879 (net of fees and expenses).

3. 2025 Loss per share

The basic loss per ordinary share reflecting for the interim period to 30 June 2025 is -20.99 (2024 -25.59) pence and has been calculated by dividing the loss for the period by the weighted average number of ordinary shares in issue of 5,087,019. There are 2,586,492 potentially issuable shares all of which relate to share options issued to Directors and professional advisers under option, options issued as part of acquisitions and warrants issued as part of placings (see note 7). The weighted average number of potential ordinary shares in issue is 7,673,511 shares. Based on the losses made in the period which are, the diluted loss per share is anti-dilutive and therefore has been kept the same as the basic loss per share of -20.99 (2024 -25.59) pence per share.

4. Convertible Loan Note and Loan Notes

|

|

|

As at 30 June 2025 £ |

As at 30 June 2024 £ |

As at 31 December 2024 £ |

|

Current Liabilities payable within 1 year |

|

|

|

|

|

Amount due to Convertible Loan Note Holders (Aug 2023) |

|

- |

234,000 |

- |

|

Amount due to Loan Note Holders (November 2023) |

|

- |

172,500 |

172,500 |

|

|

|

|

|

|

|

|

|

- |

406,500 |

172,500 |

|

|

|

|

|

|

|

|

|

|

|

|

On 12 March 2025 the Company announced it had agreed terms to capitalise its only outstanding debt facilities, comprising the £150,000 of unsecured convertible loan notes announced 20 November 2023, which carry an interest rate of 15% by the issue of new ordinary shares with warrants attached as set out in note 6.

5. Provision for Deferred Consideration

|

|

|

As at 30 June 2025 £ |

As at 30 June 2024 £ |

As at 31 December 2024 £ |

|

Current Liabilities payable within 1 year |

|

|

|

|

|

Amount due to Broken Rock |

|

16,053 |

17,346 |

16,653 |

|

Amount due to Aki Siltamaki |

|

- |

5,782 |

- |

|

Amount due to Frontier Energy |

|

58,800 |

- |

- |

|

Amount due to Douglas Kakeeway and John Ternowesky |

|

- |

8,673 |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

74,853 |

31,801 |

16,653 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Current Liabilities |

|

|

|

|

|

Amounts due to Broken Rock |

|

148,683 |

160,792 |

137,715 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

223,536 |

192,593 |

154,368 |

|

|

|

|

|

|

On 3 April 2025 the Company announced the amendment and extension to the purchase agreement allows for an additional year to meet the exploration commitment at Obonga and so an additional CAD$30,000 payment will be due to Broken Rock in August 2026 with the final payment due in August 2027.

In November 2021, the Company agreed a deal with Aki Siltamaki to take an option on four further properties on the Obonga greenstone belt to supplement its landholding in the area. The headline consideration was CAD$30,000 upfront and an ongoing payment of CAD $10,000 per year for the three consecutive years of the agreement and the final payment of CAD $200,000. The final payment is contingent on success in the ground.

In relation to the Company's interest in Winston and the Frontier Energy Option and Sale and Purchase Agreement for the Pick Lake Mining Ltd Property, the terms agreement comprise an Option Period running to 15 October 2025. An Option payment of 100,000 Australian dollars (A$), with additional A$30,000 per month, payable on the first business day in each month thereafter and ending on 15th October 2025, the payments in each case offset against the total purchase price of A$2,750,000, when the Option is exercised. Panther is entitled to exercise the Option at any time during the Option Period.

A deferred consideration liability has been recognised as there are no conditions attached to these payments. The amounts payable over time have been discounted to present value. Each period the liability is increased by the interest rate used in the discounting calculation with subsequent increases expensed to finance costs.

No payments have yet been made in the six months to 30 June 2025 (2024: £nil). £565 was recognised in finance costs (2024: £632).

6. Share capital

|

|

Number of new Ordinary shares |

Share Capital |

|

|

No |

£ |

|

Allotted, issued and fully paid: |

|

|

|

As at 1 January 2025 |

4,279,080 |

6,944,341 |

|

|

|

|

|

Placing- January 2025 |

910,000 |

455,000 |

|

Capitalisation of debt facility- March 25 |

362,250 |

181,125 |

|

Obonga extension consideration shares- April 2025 |

42,070 |

16,216 |

|

Warrant Conversion- June 2025 |

106,666 |

80,000 |

|

Director Subscription- June 2025 |

191,304 |

132,000 |

|

|

|

|

|

|

|

|

|

As at 30 June 2025 |

5,891,370 |

7,808,682 |

|

|

|

|

|

|

|

|

On 20 January 2025 the Company announced the completion of a conditional placing, confirming it has placed 910,000 ordinary shares of no-par value at a price of 50 pence raising gross proceeds of £455,000. Each share was issued with one warrant attached entitling the holder to subscribe for one new ordinary share at a price of 75 pence. The warrants have a life of 36 months from the date of Admission. Admission took place on 28 February 2025.

On 12 March 2025 the Company announced it had agreed terms to capitalise its only outstanding debt facilities, comprising the £150,000 of unsecured convertible loan notes announced 20 November 2023, which carry an interest rate of 15%. The Company settled this liability by the issue of new ordinary shares with warrants attached, a combined total of 362,250 shares at an issue price 50p and delivered 362,250 warrants with an exercise price of 75p to the former holders of the loan notes. The warrants have a life of 3 years and be subject to an "accelerator" requiring the warrants to be exercised should the Panther share price exceed £1.50 at any time over a period of 20 trading days following the date of the issue of the warrants.

On 3 April 2025 the Company announced an Amending Agreement on the Obonga project extending the existing agreement for a further 12 months and meaning that the exploration commitment is now spread over five years; whilst the original net smelter return royalty is replaced with a gross revenue royalty equal to 1.5% of the gross value of the sale proceeds actually received by the royalty payer from activity carried out on the Property. In connection with the signing of the Amending Agreement the Company allotted and issued 42,070 new ordinary shares with a value of Canadian $30,000 to Broken Rock based on the mid-market closing price of Panther's ordinary shares on 27 March 2025 and an exchange rate of CAD$1.85 to £1.00.

On 24 June 2025 the Company announced it had received notice of exercise of a total of 106,666 warrants with an exercise price of 75p per share, raising £80,000 for the Company. Admission took place on 30 June 2025.

On 30 June 2025 the Company announced that Executive Chairman, Nicholas O'Reilly, and Chief Executive Officer, Darren Hazelwood, have undertaken a direct share subscription with the Company for a total of £132,000 at the market mid-price of 69p. Mr Hazelwood subscribed for a total of 155,072 new shares for a consideration of £107,000, taking his and Mrs Hazelwood's total holding to 7.32% of the issued share capital in the Company. Mr O'Reilly subscribed for a total of 36,232 new shares for a consideration of £25,000, taking his total holding to 113,305 Ordinary Shares equivalent to 1.92% of the issued share capital in the Company.

7. Share based payment transactions- Equity settled share based payments

Options issued, cancelled and outstanding at 30 June 2025

In relation to the Placing announced on 23 May 2024 each Placing Share was issued with one warrant attached entitling the holder to subscribe for one new ordinary share at a price of 7.5 pence with a life of 36 months from the date of Admission.

In relation to the conditional placing announced on 20 January 2025, each Placing share was issued with one warrant attached entitling the holder to subscribe for one new ordinary share at a price of 75 pence. The warrants have a life of 36 months from the date of Admission. Admission took place on 28 February 2025. On 24 June 2025 the Company announced it had received notice of exercise of a total of 106,666 warrants with an exercise price of 75p per share, raising £80,000 for the Company. The Company made applications for 106,666 new Ordinary Shares to be admitted to listing and admission took place on 30 June 2025.

On 12 March 2025 the Company announced it had agreed terms to capitalise its only outstanding debt facilities, comprising the £150,000 of unsecured convertible loan notes announced 20 November 2023, which carry an interest rate of 15%. The Company settled this liability by the issue of new ordinary shares with warrants attached, a combined total of 362,250 shares at an issue price 50p (the "Settlement Shares") and delivered 362,250 warrants with an exercise price of 75p to the former holders of the loan notes. The warrants have a life of 3 years and be subject to an "accelerator" requiring the warrants to be exercised should the Panther share price exceed £1.50 at any time over a period of 20 trading days following the date of the issue of the warrants.

Options and warrants issued, cancelled and outstanding at the period end

|

|

1 Jan 2025 |

|

|

At 30 June 2025 |

Weighted average exercise |

|

|

No of options |

Issued |

Exercised |

No of options |

price (£) |

|

Obonga options |

20,000 |

- |

- |

20,000 |

3.25 |

|

Management options |

184,000 |

- |

- |

184,000 |

3.75 |

|

Placing Warrants- Aug 2022 |

834,909 |

- |

|

834,909 |

2.13 |

|

Management Options- November 2023 |

48,000 |

- |

- |

48,000 |

1.50 |

|

Placing warrants- May 2024 |

333,333 |

- |

- |

333,333 |

1.88 |

|

Placing warrants- January 2025 |

- |

910,000 |

(106,000) |

804,000 |

0.75 |

|

Debt capitalisation warrants March 2025 |

- |

362,250 |

- |

362,250 |

0.75 |

|

|

|

|

|

|

|

|

|

1,420,242 |

1,272,250 |

(106,000) |

2,692,492 |

14.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Options and warrants outstanding and exercisable at the interim period end

|

|

Vested and exercisable |

Exercise price (£) |

Weighted average contractual life |

Expiry date |

|

|

|

|

(years) |

|

|

Obonga options |

20,000 |

3.25 |

1.09 |

2 August 2026 |

|

Management options- August 2021 |

184,000 |

3.75 |

1.15 |

22 August 2026 |

|

Placing Warrants- August 2022 |

834,909 |

2.13 |

0.13 |

18 August 2025 |

|

Management Options- November 2023 |

48,000 |

1.50 |

3.34 |

1 November 2028 |

|

Placing warrants- May 2024 |

333,333 |

1.88 |

1.90 |

23 May 2027 |

|

Placing warrants- January 2025 |

910,000 |

0.75 |

2.67 |

28 February 2028 |

|

Debt capitalisation warrants- March 2025 |

362,250 |

0.75 |

2.78 |

12 March 2028 |

|

|

|

|

|

|

A Black-Scholes model has been used to determine the fair value of the share options and warrants on the date of grant. The model assesses several factors in calculating the fair value. These include the market price on the date of grant, the exercise price of the share options, the expected share price volatility of the Company's share price, the expected life of the options, the risk-free rate of interest and the expected level of dividends in future periods.

For those options granted where IFRS 2 "Share-Based Payment" is applicable, the fair values were calculated using the Black-Scholes model. The inputs into the model were as follows:

|

Date of grant |

Risk free rate |

Share price volatility |

Expected life |

Share price at grant date |

|

|

|

|

|

|

|

Obonga options- August 2021 |

0.66% |

55% |

5 years |

0.1363 |

|

Management options- August 2021 |

0.77% |

55% |

5 years |

0.1175 |

|

Placing Warrants- August 2022 |

3.67% |

54% |

3 years |

0.0535 |

|

Management Options- November 2023 |

5.49% |

43% |

5 years |

0.0340 |

|

Placing warrants- May 2024 |

4.31% |

55% |

3 years |

0.4075 |

|

Placing warrants- January 2025 |

3.97% |

57% |

3 years |

0.4900 |

|

Debt capitalisation warrants- March 2025 |

3.90% |

57% |

3 years |

0.3850 |

|

|

|

|

|

|

The total charge to the consolidated statement of comprehensive income for the period to 30 June 2025 was £167,466 (2024: charge of £41,725).

8 Subsequent events

Bitcoin Treasury Disposal

During the post period end in July and August 2025, the Company sold the majority of its Bitcoin holdings to meet certain supplier liabilities. As at 24 September 2025, the Company holds Bitcoin with a value of £457. The Company has no immediate intention to buy Bitcoin.

August 2022 Warrants Expiry

On 18 August 2025, 834,909 warrants relating to the warrants issued alongside the placing in August 2022 expired.

END

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.