Q3 2025 Activities Report

For the Quarter ending

Highlights

● Total Recordable Injury Frequency Rate (TRIFR) decrease to 1.95 from 2.02 at the end of

● Group gold production of 59,857 ounces (oz) (Q2 2025: 75,962oz) as expected due to first full Quarter of stockpile processing at Mako and the impact of rainy season at both sites

● All-In Sustaining Costs (AISC) of

● Quarterly gold sales of 63,483oz at an average realised price of

● Quarterly capital expenditure (excluding exploration) of

● Quarterly operating cash flow generation of

● Net cash of

● Unaudited EBITDA of

● Further progress at Bantaco with infill-drilling at Bantaco South Prospect confirming the continuity of the mineralisation along strike and down dip

● Updated Mineral Resource Estimate (MRE) at the

● Positive government engagement in

● Group production in line with original guidance, at lower end. Year-end guidance narrowed to 275-285 koz from 275-300 koz reflecting a combination of increased guidance at Mako and lower guidance at Syama; Group AISC revised to

o Syama production guidance revised to 177-183 koz (from 195-210 koz) consisting of 37-40 koz oxide and 140-143 koz sulphide; Syama AISC revised to

o Mako guidance increased to 98-102 koz (from 80-90 koz), Mako AISC is maintained at

● Capital expenditure guidance (

Note: Unless otherwise stated, all dollar figures are

"2025 continues to be a transformational year across the business as we optimize our producing assets and execute on building a diverse Africa-focused gold producer.

In Mali we have made key management changes at both Syama and in

Elsewhere in the Company we have made great progress on the

Elsewhere in Côte d'Ivoire, exploration activities at the

It has been a stable Quarter on the operational front; the lower production is in line with management expectations reflecting the rainy season and the transition to stockpile processing at Mako. Mako has continued to show strong performance with the first full Quarter of stockpile processing exceeding expectations. At Syama we continued to experience supply chain issues which have had a meaningful impact on gold production so far in 2025. While we are cautiously optimistic that we are addressing these issues, at this stage the situation in

Following the performance this quarter, we have updated guidance for both assets while maintaining our original Group production guidance, narrowed to 275-285 koz - we currently expect to be at the lower end of this range. At Mako, we have increased guidance to 98-102koz (from 80-90 koz). At Syama, we have revised guidance to 177-183 koz (from 195-210 koz).

Although Mako and Syama continue to demonstrate strong cost discipline, we have revised Group AISC to

I remain very pleased with the strong cash flow generation across the business with the net cash position increasing by

Moving into final quarter of 2025, I am confident of a stable end to the year and that the Company is well-positioned for positive performance in 2026. The Company's strong cash flow will be used to drive key strategic initiatives that ultimately create value for all stakeholders."

Webcast and Conference Call

Resolute will host a conference call for investors, analysts, and media on

Conference Call:

Webcast registration link: https://brrmedia.news/RSGQ3_2025

Those wishing to ask questions as part of the Q&A should use the conference call facility (please join five minutes prior to the start time).

Conference call details:

|

Dial in number(s) |

Australia Toll Free: 1 800 681 584 South |

|

Password (if prompted) |

Quote Resolute Mining Q3 when prompted by the operator |

A presentation, to accompany the call, will be available for download on the Company's website: https://www.rml.com.au/investors/presentations/.

Group Operations Overview

|

Group Summary |

Units |

September |

June |

September |

Nine Months |

Nine Months |

|

Mining |

|

|

|

|

|

|

|

Ore Mined |

t |

672,177 |

1,374,517 |

1,368,297 |

3,392,489 |

4,691,145 |

|

Mined Grade |

g/t |

2.10 |

2.03 |

2.06 |

2.02 |

2.10 |

|

Processing |

|

|

|

|

|

|

|

Ore Processed |

t |

1,520,742 |

1,557,787 |

1,529,134 |

4,628,717 |

4,505,571 |

|

Processed Grade |

g/t |

1.48 |

1.82 |

2.00 |

1.70 |

2.05 |

|

Recovery |

% |

82 |

84 |

85 |

83 |

86 |

|

Gold Poured |

oz |

59,857 |

75,962 |

85,043 |

211,318 |

252,182 |

|

Sales |

|

|

|

|

|

|

|

Gold Sold |

oz |

63,483 |

80,797 |

95,242 |

208,603 |

252,563 |

|

Average Realised Price |

$/oz |

3,404 |

3,261 |

2,493 |

3,175 |

2,292 |

|

Financials |

|

|

|

|

|

|

|

Total Capital Expenditure |

$m |

26.6 |

17.6 |

26.6 |

68.9 |

71.0 |

|

|

$m |

(136.6) |

(110.4) |

(145.6) |

(136.6) |

(145.6) |

|

AISC |

$/oz |

2,205 |

1,668 |

1,452 |

1,834 |

1,444 |

Table 1: Resolute Group Operational Performance Summary

During the Quarter, Resolute processed over 1.52Mt across

Environmental and Social Update

Resolute's TRIFR as of

During the Quarter, Resolute advanced preparations for new mandatory climate-related disclosures in accordance with the Australian Sustainability Reporting Standards (ASRS), which includes the drafting of its inaugural FY25 Climate Report. Resolute's climate-related disclosures and GHG emissions inventory will be subject to independent limited assurance.

Resolute continues to strengthen its conformance to the Global Industry Standard on Tailings Management (GISTM) with the preparation of a costed work plan to achieve full conformance at each of its operations. In Q3 Resolute's nominated Senior Independent Technical Reviewer (SITR) returned to Syama for the conduct of their annual safety inspection of the company's existing tailings storage facilities, including the review of plans for a new facility. In Q4 the SITR is scheduled to visit Mako.

Mali

Syama Operations

Syama gold production for the Quarter was 39,918oz at an AISC of

|

Summary |

Units |

September |

June |

September |

Nine Months |

Nine Months |

|

|

Mining |

Sulphide |

|

|

|

|

|

|

|

Ore Mined |

t |

490,154 |

447,538 |

554,221 |

1,450,177 |

1,837,719 |

|

|

Mined Grade |

g/t |

2.25 |

2.44 |

2.50 |

2.38 |

2.58 |

|

|

Oxide |

|

|

|

|

|

|

|

|

Ore Mined |

t |

182,023 |

286,431 |

111,098 |

700,299 |

557,954 |

|

|

Mined Grade |

g/t |

1.70 |

1.35 |

1.40 |

1.46 |

1.58 |

|

|

Processing |

Sulphide |

|

|

|

|

|

|

|

Ore Processed |

t |

614,262 |

576,049 |

622,620 |

1,777,320 |

1,743,624 |

|

|

Processed Grade |

g/t |

2.08 |

2.22 |

2.63 |

2.22 |

2.68 |

|

|

Recovery |

% |

75 |

76 |

78 |

76 |

79 |

|

|

Gold Poured |

oz |

31,833 |

31,461 |

42,878 |

99,438 |

119,515 |

|

|

Gold Sold |

oz |

37,419 |

32,767 |

47,776 |

100,919 |

119,784 |

|

|

Oxide |

|

|

|

|

|

|

|

|

Ore Processed |

t |

349,494 |

395,432 |

352,933 |

1,174,109 |

1,105,208 |

|

|

Processed Grade |

g/t |

0.91 |

0.95 |

1.06 |

0.97 |

1.23 |

|

|

Recovery |

% |

79 |

81 |

84 |

82 |

84 |

|

|

Gold Poured |

oz |

8,085 |

9,563 |

10,113 |

29,740 |

37,535 |

|

|

Gold Sold |

oz |

8,085 |

9,563 |

10,113 |

29,740 |

37,535 |

|

|

Cost |

Syama combined |

|

|

|

|

|

|

|

Total Capital Expenditure |

$m |

26.0 |

16.6 |

22.6 |

42.5 |

39.6 |

|

|

AISC |

$/oz |

2,358 |

2,134 |

1,533 |

2,092 |

1,487 |

|

Table 2: Syama Production and Cost Summary

At the Syama sulphide operation, while underground ore production improved from the previous Quarter despite continuing explosives supply chain disruption, overall production was lower than expected targets considering the rainy season impact. During the Quarter additional explosives suppliers, products and new supply routes have been established to continue to reduce the impact on production in Q4. Mined grades were lower than expected as lower-grade upper levels were mined to realign the cave in the future and maximise ore recovery on lower levels.

The head grade for Q3 was lower than expected due to the lower ore grades from the underground. Blending of lower-grade stockpiles was required to offset lower production during the Quarter but saw a strong finish with consistent improvement in daily ore production. In Q4, head grades and mined tonnes are expected to increase benefitting from operational changes made during the Quarter as well as increased stocks of explosives.

Oxide mining and production was lower than the prior Quarter as head grades continue to be driven by processing lower grade stockpiles. This is expected to continue for the remainder of the year with high grades from the Tabakoroni pit blended into the oxide plant.

With explosive supply chain issues easing, Q4 production is expected to be higher than Q3 driven by higher grades from the underground mine offset by a scheduled eight-day mill and roaster maintenance shutdown. Due to the continued impact of explosives on mining in Q3, guidance has been revised at Syama across both the sulphide and oxide operations. Syama production guidance has been revised lower to 177-183 koz (from 195-210 koz) consisting of 37-40 koz at the oxide operation and 140-143 koz at the sulphide operation. We expect a stronger end to the year on the back of an operational restructure that took place during the Quarter to expedite delivery of efficiency improvements and further cost reductions.

In Q3 the AISC increased slightly to

Capital expenditure was

The SSCP is progressing on time and budget with certain sections accelerated to realise early benefits to operations. The project has no lost time injuries (LTIs) after approximately 921,000 person-hours worked until the end of

The capital expenditure on the SSCP in Q3 was

In Q3 two additional tanks in the existing CCIL circuit were commissioned and are in operation. These have increased the CCIL residence time and will provide a beneficial uplift to recoveries in the sulphide CCIL circuit. The pebble crushing circuit was completed during the Quarter with commissioning underway in Q4. Once commissioned the pebble crusher will improve operational flexibility to the oxide circuit and, once the SSCP is fully commissioned, increased efficiency to sulphide milling.

Construction of the flotation circuit is nearing completion. Commissioning has been rescheduled to

Figure 1: (L) CCIL circuit, (R) Pebble Crusher

By the end of Q2 2026 stage 2 - the ball mill, Secondary Crushing circuit and roaster upgrade - will be completed and commissioned. From this point onwards 100% of sulphide material (c. 1.6-1.8 Mtpa) will be able to be processed through the SSCP circuit.

Figure 2: Secondary Crushing and Ball Mill Areas

As per Figure 3, overall completion of the SSCP remains on track and on budget. Full commissioning is due by end of Q2 2026 followed by a ramp-up from Q3 2026.

Figure 3: SSCP Timeline

As the SSCP ramps up from Q3 2026 the expectation is for Syama gold production to increase to an annual run rate in excess of that originally guided for 2025. Based on current operating models, production levels would remain in this range as processing of high-grade material from

Mali Exploration

The focus of exploration activities at Syama in 2025 has been to drill-test priority oxide targets within the granted Exploitation Permits to determine viability for feeding the oxide plant in the near-future.

Drilling has commenced on the Zozani prospect which was identified in 2024. The strong gold price now makes this prospect more attractive and additional drilling will be undertaken to increase the outlined resources and update the mining studies.

Government Update

Resolute continues to engage with the

Resolute remains committed to working constructively with the Malian Government to create long-term value at Syama for all stakeholders.

Senegal

Mako Operations

Mako gold production for the Quarter was 19,939 oz at an AISC of

|

Summary |

Units |

September |

June |

September |

Nine Months |

Nine Months |

|

Mining |

|

|

|

|

|

|

|

Ore Mined |

t |

- |

630,549 |

702,978 |

1,242,013 |

2,295,472 |

|

Mined Grade |

g/t |

- |

2.05 |

1.82 |

1.91 |

1.85 |

|

Processing |

|

|

|

|

|

|

|

Ore Processed |

t |

556,986 |

586,307 |

553,581 |

1,677,288 |

1,656,739 |

|

Processed Grade |

g/t |

1.18 |

2.00 |

1.89 |

1.66 |

1.92 |

|

Recovery |

% |

91 |

93 |

93 |

92 |

93 |

|

Gold Poured |

oz |

19,939 |

34,938 |

32,052 |

82,140 |

95,132 |

|

Gold Sold |

oz |

17,979 |

38,467 |

37,353 |

77,944 |

95,244 |

|

Financials |

|

|

|

|

|

|

|

Total Capital Expenditure |

$m |

0.6 |

1.0 |

4.0 |

2.6 |

12.4 |

|

AISC |

$/oz |

1,415 |

972 |

1,125 |

1,180 |

1,212 |

Table 3: Mako Production and Cost Summary

Q3 was the first full Quarter of stockpile processing at

Stockpile processing will continue to the end of 2027. The target is for ore to be available before the end of 2027 from either the Bantaco or Tomboronkoto deposits.

As expected, AISC increased to

Capital expenditure for the Quarter of

Tomboronkoto and Bantaco are two potential satellite deposits that Resolute is advancing in order to extend the life of the

The current combined Mineral Resource Estimates of Tomboronkoto and Bantaco contain over 600koz of gold, with possibilities of expansion based on ongoing exploration results. At this stage Resolute believes the MLEP has the potential to provide another five to 10 years of mining activities in

Tomboronkoto

During Q3 the ESIA report for the

Community engagement activities and detailed survey activities commenced in relation to the resettlement of Tomboronkoto village. In parallel, formal EIA studies are in progress for the expansion of the existing

Resolute is confident of the potential to mine the Tomboronkoto satellite deposit from 2028 but notes the dependence on permitting and government approvals.

Figure 4: Approximate Timeline for Tomboronkoto

Bantaco

Figure 5: Bantaco Prospect Locations

In Q3 the main activities included infill drilling at the Bantaco South prospect, progression of technical studies and community engagement activities. Permitting is expected to commence in H1 2026 and the project remains on track for mining activities to commence prior to the end of 2027.

Figure 6: Approximate Timeline for Bantaco

Senegal Exploration

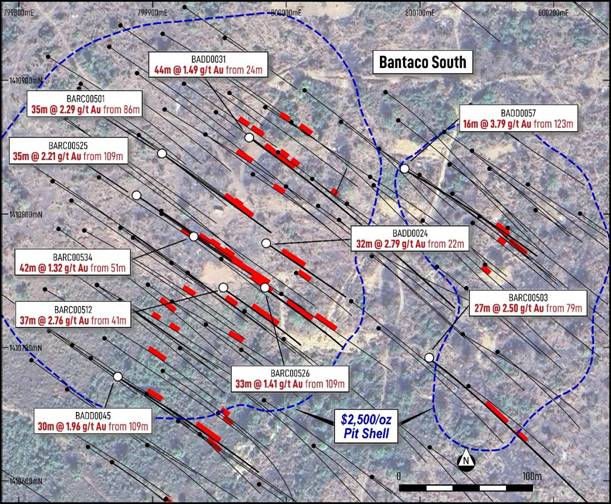

During Q3, the focus was infill drilling at Bantaco South and West Prospects, which along with Tomboronkoto, make up the key satellite deposits that could extend the mine life at Mako.

To date drilling activities have concentrated on the Bantaco West and Bantaco South prospects which have Inferred Mineral Resource Estimates of 5.8Mt grading 0.97 g/t Au for 179koz, and 2.2Mt grading 1.2g/t Au for 87koz both (at 0.5g/t cut-off grade) respectively.

In Q3 infill drilling at Bantaco South was aimed at upgrading the Inferred Mineral Resources to the Indicated category. A total of 5,180m of diamond drilling and 10,957m of RC drilling was completed at Bantaco South.

The infill drilling at 25m spacing has been successful in confirming the continuity of the mineralisation along strike and down dip. Select results from the infill drilling are as follows;

BADD0024 - 32m @ 2.79g/t from 22.00m

BADD0031 - 44m @ 1.49g/t from 24.00m

BADD0045 - 30m @ 1.96g/t from 109.00m

BADD0057 - 16m @ 3.79g/t from 123.00m

BARC00501 - 35m @ 2.29g/t from 86.00m

BARC00503 - 27m @ 2.50g/t from 79.00m

BARC00512 - 37m @ 2.76g/t from 41.00m

BARC00525 - 35m @ 2.21g/t from 109.00m

BARC00526 - 33m @ 1.41g/t from 30.00m

BARC00534 - 42m @ 1.32g/t from 51.00m

After the drilling program at Bantaco South was completed the drill rigs moved to Bantaco West to upgrade and extend the Mineral Resources announced on 24 July. During Q3 a total of 1,960m of diamond drilling and 7,695m of RC drilling was completed at Bantaco West.

Early results from Bantaco West are encouraging with better results including;

BARC00600 - 32m @ 1.89g/t from 32.00m

BARC00623 - 12m @ 4.13g/t from 20.00m

A full list of the significant intersections from Bantaco South since those published on

Figure 7: Bantaco South drill location plan

Exploration for Q4 at Bantaco will focus on continuing the infill and extensional drilling at Bantaco West. Resolute believes the Bantaco West prospect has strong potential to increase the current inferred Mineral Resource of 179 koz which was announced on

The drilling will test for extensions down dip and along strike to the north-east across the highway shown on Figure 8.

An updated MRE for Bantaco South and Bantaco West is targeted for Q1 2026.

Figure 8: Bantaco West drill location plan

Côte d'Ivoire

The government maintains strong commitment to execution of the

Work on updating the DFS continued during the Quarter led by Lycopodium. These workstreams include:

● Optimising pit designs at a gold price assumption of

● Review and finalisation of the processing circuit to accommodate the revised mine schedule

● Refresh of capital and operating cost estimates

● Study on incorporation of back-up power supply to complement grid power

● Key environmental and social work streams including government engagement, community consultation and land acquisition planning.

All workstreams for Doropo are on track as per Figure 9. The updated DFS, is targeted for Q4 this year along with an updated Ore Reserve. Consultants have been engaged for the preparatory planning phase for RAP work. Resolute has been involved in numerous community engagement meetings which have been well received.

Figure 9: Doropo Project Timeline

Financing discussions are ongoing with various options being explored including traditional project finance, bank finance and alternative funding options. We expect this process to accelerate upon the completion of the optimised DFS, and receipt of the exploitation permits.

Doropo Permit Update

Presidential election activities have slowed the processing of our application and Resolute continues to await approval of the Exploitation Permit by the

Doropo Mineral Resource Update

During the Quarter optimisations of the Resource were completed, increasing the Doropo MRE to 4.4 Moz of contained gold with 84% of contained ounces in the Measured and Indicated resource category. Most of the Mineral Resources are within 150m of surface and the larger deposits (Kilosegui and Souwa) remain open along strike and at depth.

|

|

Doropo Mineral Resource Estimate |

|||||

|

|

(0.3g/t Au cut-off, |

(0.3g/t Au cut-off, |

||||

|

Classification |

Tonnes |

Grade (g/t Au) |

Ounces (Au) |

Tonnes |

Grade (g/t Au) |

Ounces (Au) |

|

Measured |

1,550,000 |

1.57 |

78,000 |

1,510,000 |

1.60 |

77,000 |

|

Indicated |

95,200,000 |

1.18 |

3,601,000 |

75,340,000 |

1.25 |

3,027,000 |

|

Inferred |

17,440,000 |

1.21 |

680,000 |

7,370,000 |

1.23 |

292,000 |

|

Total |

114,190,000 |

1.19 |

4,360,000 |

84,220,000 |

1.25 |

3,396,000 |

Table 4: Doropo Mineral Resource Estimate Comparison

Resolute anticipates that, based on the plant capacity outlined in the 2024 DFS, the increase in Mineral Resources will extend the mine life by at least five years beyond the original 10-year plan.

Côte d'Ivoire Exploration

Resolute acquired the

Over

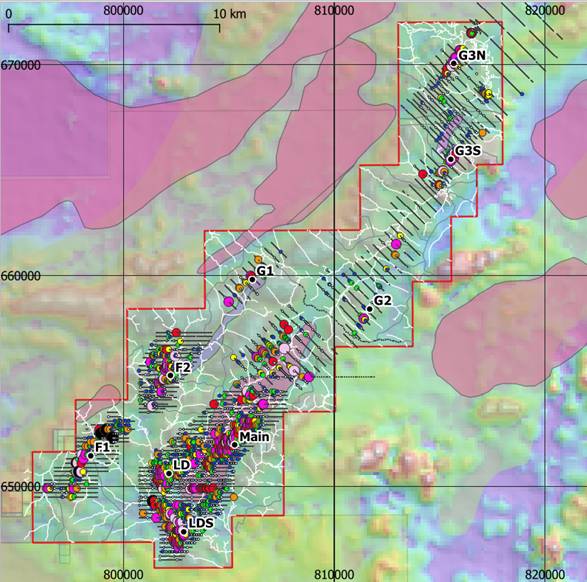

Figure 10: Permit and Prospect Locations at the

During the Q3 geochemical surveys were undertaken on the Kona Permit and the Farako-Nafana Permit to refine the gold targets outlined previously.

The Farako-Nafana permit is located along strike to the south from the recently discovered high grade gold prospects at the Awale-Newmont JV. Resolute sees potential for similar high-grade gold targets on the 100% held Farako-Nafana permit.

The Farako-Nafana permit is completely untested. Drilling has not been conducted here by any previous company. A first stage RC program of 10,000m has been proposed to cover the four best gold targets on the permit. A drilling company has been engaged, and the program is planned to commence in early

Surface geochemistry and mapping is underway on the Kona permit to identify additional resources to add to the two Kona resources which are wholly located on the Kona Permit. Drilling targets have been generated and there is proposals for 15,000m of RC and diamond drilling on the Kona Permit and the Windou permit to the south. This proposed program is due to commence in early

The drill programs on Kona and Windou are planned to add ounces to the current Mineral Resource inventory at Kona of 2 Moz at 0.9 g/t Au

The La Debo project is in the south of Côte d'Ivoire, approximately 280 km west of

In 2016, an initial Preliminary Economic Assessment established a NI 43-101 compliant Inferred Mineral Resource of 400 koz at a grade of 1.3 g/t Au (at 0.3 g/t cut-off). After subsequent deeper Diamond drilling in 2022, the resource was increased but was not reported as NI 43-101 compliant.

Resolute commenced drilling at La Debo in

Drilling continued throughout 2025 with a total of 10,037m of RC drilling and 6,600m diamond drilling completed by Resolute to date. The drilling program was completed in

The drilling from the G3S prospect was very encouraging with excellent down dip intersections along the entire strike length of the deposit.

An extensive auger drilling program has been completed over the south-western half of the La Debo permit to define targets where surface geochemistry is erratic. This program has confirmed a strong gold anomaly at the G1 prospect area which will be RC drill tested in late 2025.

Figure 11: Resolute's Projects in

Figure 12:

In October Resolute was granted two additional exploration permits, Gagnoa and Soubre, situated to the south of the

Financial Highlights and Balance Sheet Activities

Year-to-Date Cash and Bullion Movements (US$ million)

*Included in Operating Cash flows are

Figure 13: YTD 2025 Cash and Bullion Movements

Quarterly Cash and Bullion Movements (US$ million)

*Included in Operating Cash flows are

Figure 14: Q3 2025 Cash and Bullion Movements

In Q3 gold sales of 63,482 oz were achieved at an average realised gold price of

The VAT paid in Q3 in

Unaudited EBITDA for the nine months ending

Exploration Expenditure

Exploration spend year-to-date is

Net Cash Summary

Net cash at

Total borrowings at

Resolute continues to explore various options with respect to the financing of the development of the

Post-Quarter Activities

As noted on

Resolute holds 31,450,000 common shares in Loncor that are valued at approximately

|

|

Authorised by Mr

Contact

|

Resolute Corporate Development and Investor Relations Manager Matthias.otoolehowes@resolutemining.com +44 203 3017 620

|

Public Relations +44 207 920 3150

+44 20 3753 3040

+44 20 7236 1010 |

|

|

About Resolute

Resolute is an African-focused gold miner with more than 30 years of experience as an explorer, developer and operator. Throughout its history the Company has produced more than 9 million ounces of gold from ten gold mines. The Company is now entering a growth phase through the development of the Doropo project in Côte d'Ivoire which will supplement the existing production from the Syama mine in

Through all its activities, sustainability is the core value at Resolute. This means that protecting the environment, providing a safe and productive working environment for employees, uplifting host communities, and practicing good corporate governance are non-negotiable priorities. Resolute's commitment to sustainability and good corporate citizenship has been cemented through its adoption of and adherence to the Responsible Gold Mining Principles (RGMPs). This framework, which sets out clear expectations for consumers, investors, and the gold supply chain as to what constitutes responsible gold mining, is an initiative of the

Appendix

September 2025 Quarter Production and Costs (unaudited)

|

September 2025 - Quarter to date |

Units |

Syama Sulphide |

Syama Oxide |

Syama |

Mako |

Group |

|

|

|

UG Lateral Development |

m |

580 |

- |

580 |

- |

580 |

|

|

|

UG Vertical Development |

m |

17 |

- |

17 |

- |

17 |

|

|

|

Total UG Development |

m |

597 |

- |

597 |

- |

597 |

|

|

|

UG Ore Mined |

t |

490,154 |

- |

490,154 |

- |

490,154 |

|

|

|

UG Grade Mined |

g/t |

2.25 |

- |

2.25 |

- |

2.25 |

|

|

|

OP Operating Waste |

BCM |

- |

1,301,480 |

1,301,480 |

- |

1,301,480 |

|

|

|

OP Ore Mined |

BCM |

- |

88,327 |

88,327 |

- |

88,327 |

|

|

|

OP Grade Mined |

g/t |

- |

1.70 |

2.10 |

- |

2.10 |

|

|

|

Total Ore Mined |

t |

490,154 |

182,023 |

672,177 |

- |

672,177 |

|

|

|

Total Tonnes Processed |

t |

614,262 |

349,494 |

963,756 |

556,986 |

1,520,742 |

|

|

|

Grade Processed |

g/t |

2.08 |

0.91 |

1.66 |

1.18 |

1.48 |

|

|

|

Recovery |

% |

75 |

79 |

76 |

91 |

82 |

|

|

|

Gold Recovered |

oz |

30,915 |

8,042 |

38,957 |

19,256 |

58,213 |

|

|

|

Gold in Circuit Drawdown/(Addition) |

oz |

918 |

43 |

961 |

683 |

1,644 |

|

|

|

Gold Produced (Poured) |

oz |

31,833 |

8,085 |

39,918 |

19,939 |

59,857 |

|

|

|

|

oz |

5,586 |

- |

5,586 |

(1,960) |

3,626 |

|

|

|

Gold Sold |

oz |

37,419 |

8,085 |

45,504 |

17,979 |

63,483 |

|

|

|

Achieved Gold Price |

$/oz |

- |

- |

- |

- |

3,404 |

|

|

|

Cost Summary |

|

|

|

|

|

|

|

|

|

Mining |

$/oz |

466 |

1,041 |

583 |

194 |

453 |

|

|

|

Processing |

$/oz |

711 |

1,335 |

838 |

705 |

794 |

|

|

|

Site Administration |

$/oz |

211 |

464 |

262 |

184 |

236 |

|

|

|

Site Operating Costs |

$/oz |

1,388 |

2,840 |

1,682 |

1,083 |

1,483 |

|

|

|

Royalties |

$/oz |

464 |

476 |

466 |

170 |

370 |

|

|

|

By-Product Credits + Corp Admin |

$/oz |

(4) |

(4) |

(4) |

- |

155 |

|

|

|

Total Cash Operating Costs |

$/oz |

1,848 |

3,312 |

2,145 |

1,253 |

2,008 |

|

|

|

Sustaining Capital + Others |

$/oz |

212 |

46 |

179 |

29 |

129 |

|

|

|

Inventory Adjustments |

$/oz |

243 |

(782) |

35 |

134 |

68 |

|

|

|

All-In Sustaining Cost (AISC) |

$/oz |

2,303 |

2,576 |

2,358 |

1,415 |

2,205 |

|

Appendix

Year-to-date 2025 Production and Costs (unaudited)

|

September 2025 - Year to date |

Units |

Syama Sulphide |

Syama Oxide |

Syama Total |

Mako |

Group |

|

|

|

|

||||||||

|

UG Lateral Development |

m |

3,080 |

- |

3,080 |

- |

3,080 |

|

|

|

UG Vertical Development |

m |

73 |

- |

73 |

- |

73 |

|

|

|

Total UG Development |

m |

3,153 |

- |

3,153 |

- |

3,153 |

|

|

|

UG Ore Mined |

t |

1,450,177 |

- |

1,450,177 |

- |

1,450,177 |

|

|

|

UG Grade Mined |

g/t |

2.38 |

- |

2.38 |

- |

2.38 |

|

|

|

OP Operating Waste |

BCM |

- |

4,415,307 |

4,415,307 |

566,066 |

4,981,373 |

|

|

|

OP Ore Mined |

BCM |

- |

374,067 |

374,067 |

448,893 |

822,960 |

|

|

|

OP Grade Mined |

g/t |

- |

1.46 |

1.46 |

1.91 |

1.70 |

|

|

|

Total Ore Mined |

t |

1,450,177 |

700,299 |

2,150,476 |

1,242,013 |

3,392,489 |

|

|

|

Total Tonnes Processed |

t |

1,777,320 |

1,174,109 |

2,951,429 |

1,677,288 |

4,628,717 |

|

|

|

Grade Processed |

g/t |

2.22 |

0.97 |

1.72 |

1.66 |

1.70 |

|

|

|

Recovery |

% |

76 |

82 |

78 |

92 |

83 |

|

|

|

Gold Recovered |

oz |

96,183 |

29,920 |

126,103 |

82,305 |

208,408 |

|

|

|

Gold in Circuit Drawdown/(Addition) |

oz |

3,255 |

(180) |

3,075 |

(165) |

2,910 |

|

|

|

Gold Produced (Poured) |

oz |

99,438 |

29,740 |

129,178 |

82,140 |

211,318 |

|

|

|

Gold Bullion in Metal Account Movement (Increase)/Decrease |

oz |

1,481 |

- |

1,481 |

(4,196) |

(2,715) |

|

|

|

Gold Sold |

oz |

100,919 |

29,740 |

130,659 |

77,944 |

208,603 |

|

|

|

Achieved Gold Price |

$/oz |

- |

- |

- |

- |

3,175 |

|

|

|

Cost Summary |

|

|

|

|

|

|

|

|

|

Mining |

$/oz |

509 |

710 |

556 |

256 |

439 |

|

|

|

Processing |

$/oz |

658 |

1,066 |

752 |

481 |

647 |

|

|

|

Site Administration |

$/oz |

179 |

369 |

222 |

144 |

192 |

|

|

|

Site Operating Costs |

$/oz |

1,346 |

2,145 |

1,530 |

881 |

1,278 |

|

|

|

Royalties |

$/oz |

373 |

365 |

371 |

169 |

295 |

|

|

|

By-Product Credits + Corp Admin |

$/oz |

(4) |

(4) |

(4) |

- |

93 |

|

|

|

Total Cash Operating Costs |

$/oz |

1,715 |

2,506 |

1,897 |

1,050 |

1,666 |

|

|

|

Sustaining Capital + Others |

$/oz |

146 |

371 |

198 |

32 |

133 |

|

|

|

Inventory Adjustments |

$/oz |

99 |

(345) |

(3) |

98 |

35 |

|

|

|

All-In Sustaining Cost (AISC) |

$/oz |

1,960 |

2,532 |

2,092 |

1,180 |

1,834 |

|

ASX Listing Rule 5.23 Mineral Resources

This announcement contains estimates of Resolute's mineral resources. The information in this Quarterly report that relates to the mineral resources of Resolute has been extracted from reports entitled 'Ore Reserves and Mineral Resource Statement' announced on 11 March 2025 and is available to view on Resolute's website (www.rml.com.au) and www.asx.com (Resolute Announcement).

For the purposes of ASX Listing Rule 5.23, Resolute confirms that it is not aware of any new information or data that materially affects the information included in the Resolute Announcement and, in relation to the estimates of Resolute's ore reserves and mineral resources, that all material assumptions and technical parameters underpinning the estimates in the Resolute Announcement continue to apply and have not materially changed. Resolute confirms that the form and context in which the Competent Person's findings are presented have not been materially modified from that announcement.

ASX Listing Rule 5.19 Production Targets

The information in this announcement that relates to production targets of Resolute has been extracted from the report entitled 'Q4 2024 Activities Report and 2025 Guidance' announced on 30 January 2025 and are available to view on the Company's website (www.rml.com.au) and www.asx.com (Resolute Production Announcement).

For the purposes of ASX Listing Rule 5.19, Resolute confirms that all material assumptions underpinning the production target, or the forecast financial information derived from the production target, in the Resolute Production Announcement continue to apply and have not materially changed.

Cautionary Statement about Forward-Looking Statements

This announcement contains certain "forward-looking statements" including statements regarding our intent, belief, or current expectations with respect to Resolute's business and operations, market conditions, results of operations and financial condition, and risk management practices. The words "likely", "expect", "aim", "should", "could", "may", "anticipate", "predict", "believe", "plan", "forecast" and other similar expressions are intended to identify forward-looking statements. Indications of, and guidance on, future earnings, anticipated production, life of mine and financial position and performance are also forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Resolute's actual results, performance and achievements or industry results to differ materially from any future results, performance or achievements, or industry results, expressed or implied by these forward-looking statements. Relevant factors may include (but are not limited to) changes in commodity prices, foreign exchange fluctuations and general economic conditions, increased costs and demand for production inputs, the speculative nature of exploration and project development, including the risks of obtaining necessary licences and permits and diminishing quantities or grades of reserves, political and social risks, changes to the regulatory framework within which Resolute operates or may in the future operate, environmental conditions including extreme weather conditions, recruitment and retention of personnel, industrial relations issues and litigation.

Forward-looking statements are based on Resolute's good faith assumptions as to the financial, market, regulatory and other relevant environments that will exist and affect Resolute's business and operations in the future. Resolute does not give any assurance that the assumptions will prove to be correct. There may be other factors that could cause actual results or events not to be as anticipated, and many events are beyond the reasonable control of Resolute. Readers are cautioned not to place undue reliance on forward-looking statements, particularly in the significantly volatile and uncertain current economic climate. Forward-looking statements in this document speak only at the date of issue. Except as required by applicable laws or regulations, Resolute does not undertake any obligation to publicly update or revise any of the forward-looking statements or to advise of any change in assumptions on which any such statement is based. Except for statutory liability which cannot be excluded, each of Resolute, its officers, employees and advisors expressly disclaim any responsibility for the accuracy or completeness of the material contained in these forward-looking statements and excludes all liability whatsoever (including in negligence) for any loss or damage which may be suffered by any person as a consequence of any information in forward-looking statements or any error or omission.

Competent Persons Statement

The information in this report that relates to the Exploration Results, Mineral Resources and Ore Reserves is based on information compiled by Mr Bruce Mowat, a member of The Australian Institute of Geoscientists. Mr Bruce Mowat has more than 15 years' experience relevant to the styles of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person, as defined in the 2012 Edition of the "Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves" (the JORC Code). Mr Bruce Mowat is a full-time employee of the Resolute Mining Limited Group and holds equity securities in the Company. He has consented to the inclusion of the matters in this report based on his information in the form and context in which it appears. This information was prepared and disclosed under the JORC Code 2012 except where otherwise noted.

Appendix 2.Recent drilling results

Bantaco, Senegal

|

Hole_ID |

North (WGS) |

East (WGS) |

RL (m) |

Dip |

Azi (WGS) |

EOH (m) |

From (m) |

To (m) |

Width (m) |

Au (g/t) |

|

BADD0022 |

1415324 |

794256 |

118 |

-51 |

134 |

290 |

232 |

245 |

13 |

1.57 |

|

BADD0024 |

1410778 |

799985 |

140 |

-51 |

123 |

111 |

22 |

54 |

32 |

2.79 |

|

BADD0026 |

1410734 |

799915 |

133 |

-52 |

120 |

178 |

78 |

97 |

19 |

0.95 |

|

BADD0028 |

1410682 |

799908 |

132 |

-51 |

125 |

161 |

84 |

96 |

12 |

1.97 |

|

BADD0030 |

1410793 |

800141 |

128 |

-51 |

127 |

224 |

36 |

46 |

10 |

4.56 |

|

BADD0031 |

1410857 |

799972 |

141 |

-53 |

125 |

311 |

24 |

68 |

44 |

1.49 |

|

BADD0032 |

1410893 |

800015 |

136 |

-53 |

127 |

238 |

177 |

180 |

3 |

11.03 |

|

BADD0038 |

1410746 |

799859 |

139 |

-50 |

122 |

182 |

72 |

82 |

10 |

1.67 |

|

BADD0038 |

1410746 |

799859 |

139 |

-50 |

122 |

182 |

95 |

107 |

12 |

1.82 |

|

BADD0041 |

1410878 |

799910 |

145 |

-51 |

123 |

157 |

101 |

123 |

22 |

1.8 |

|

BADD0042 |

1410763 |

799915 |

144 |

-52 |

124 |

140 |

79 |

95 |

16 |

1.18 |

|

BADD0043 |

1410846 |

799995 |

141 |

-51 |

128 |

158 |

1 |

13 |

12 |

1.49 |

|

BADD0043 |

1410846 |

799995 |

141 |

-51 |

128 |

158 |

18 |

29 |

11 |

1.38 |

|

BADD0044 |

1410880 |

799985 |

137 |

-50 |

124 |

153 |

19 |

32 |

13 |

2.1 |

|

BADD0045 |

1410678 |

799874 |

134 |

-52 |

123 |

188 |

109 |

139 |

30 |

1.96 |

|

BADD0050 |

1410827 |

799860 |

148 |

-52 |

125 |

240 |

117 |

130 |

13 |

2.4 |

|

BADD0051 |

1410788 |

799830 |

150 |

-52 |

124 |

245 |

49 |

52 |

3 |

5.51 |

|

BADD0051 |

1410788 |

799830 |

150 |

-52 |

124 |

245 |

151 |

173 |

22 |

0.9 |

|

BADD0053 |

1410743 |

799820 |

143 |

-53 |

120 |

239 |

146 |

169 |

23 |

1 |

|

BADD0055 |

1410787 |

799849 |

149 |

-50 |

124 |

205 |

136 |

152 |

16 |

1.69 |

|

BADD0057 |

1410834 |

800088 |

128 |

-51 |

118 |

176 |

123 |

139 |

16 |

3.79 |

|

BARC00484 |

1410613 |

799870 |

135 |

-50 |

125 |

186 |

69 |

84 |

15 |

1.8 |

|

BARC00494 |

1410579 |

800022 |

132 |

-49 |

125 |

147 |

49 |

52 |

3 |

6.52 |

|

BARC00501 |

1410845 |

799907 |

147 |

-51 |

125 |

144 |

86 |

121 |

35 |

2.29 |

|

BARC00503 |

1410692 |

800107 |

129 |

-52 |

125 |

204 |

79 |

106 |

27 |

2.5 |

|

BARC00503 |

1410692 |

800107 |

129 |

-52 |

125 |

204 |

117 |

129 |

12 |

1.3 |

|

BARC00507 |

1410665 |

799896 |

132 |

-50 |

125 |

156 |

83 |

100 |

17 |

1.63 |

|

BARC00510 |

1410869 |

800005 |

139 |

-49 |

125 |

160 |

10 |

26 |

16 |

1.43 |

|

BARC00512 |

1410745 |

799953 |

142 |

-50 |

125 |

114 |

41 |

78 |

37 |

2.76 |

|

BARC00514 |

1410706 |

799864 |

136 |

-51 |

125 |

174 |

148 |

157 |

9 |

2.88 |

|

BARC00515 |

1410829 |

800101 |

126 |

-48 |

125 |

150 |

101 |

118 |

17 |

1.54 |

|

BARC00516 |

1410724 |

799805 |

142 |

-52 |

124 |

173 |

157 |

173 |

16 |

2.05 |

|

BARC00525 |

1410814 |

799888 |

148 |

-51 |

125 |

170 |

87 |

103 |

16 |

1.66 |

|

BARC00525 |

1410814 |

799888 |

148 |

-51 |

125 |

170 |

109 |

144 |

35 |

2.21 |

|

BARC00526 |

1410745 |

799984 |

137 |

-49 |

125 |

102 |

30 |

63 |

33 |

1.41 |

|

BARC00527 |

1410802 |

799907 |

150 |

-50 |

125 |

94 |

65 |

76 |

11 |

2.47 |

|

BARC00527 |

1410802 |

799907 |

150 |

-50 |

125 |

94 |

82 |

94 |

12 |

1.89 |

|

BARC00527A |

1410800 |

799907 |

147 |

-51 |

125 |

162 |

97 |

112 |

15 |

1.98 |

|

BARC00534 |

1410783 |

799931 |

146 |

-48 |

126 |

138 |

51 |

93 |

42 |

1.32 |

|

BARC00538 |

1410876 |

799948 |

144 |

-50 |

125 |

120 |

66 |

89 |

23 |

1.18 |

|

BARC00539 |

1410898 |

799924 |

144 |

-50 |

125 |

132 |

76 |

90 |

14 |

2.39 |

|

BARC00539 |

1410898 |

799924 |

144 |

-50 |

125 |

132 |

94 |

111 |

17 |

1.64 |

|

BARC00543 |

1410859 |

799890 |

147 |

-51 |

125 |

144 |

124 |

133 |

9 |

2.92 |

|

BARC00544 |

1410798 |

800146 |

128 |

-49 |

126 |

150 |

21 |

38 |

17 |

1.78 |

|

BARC00545 |

1410829 |

799976 |

142 |

-51 |

125 |

120 |

28 |

43 |

15 |

1.81 |

|

BARC00548 |

1410755 |

800008 |

139 |

-52 |

125 |

80 |

1 |

19 |

18 |

2.5 |

|

BARC00550 |

1410826 |

800020 |

141 |

-52 |

125 |

60 |

27 |

36 |

9 |

2.22 |

|

BARC00554 |

1410795 |

800103 |

125 |

-49 |

125 |

132 |

77 |

86 |

9 |

2.87 |

|

BARC00557 |

1410740 |

799997 |

137 |

-50 |

125 |

156 |

47 |

76 |

29 |

1.6 |

|

BARC00558 |

1410766 |

799952 |

143 |

-52 |

125 |

150 |

41 |

70 |

29 |

1.58 |

|

BARC00573 |

1414174 |

792865 |

106 |

-52 |

130 |

114 |

1 |

13 |

12 |

1.52 |

|

BARC00573 |

1414174 |

792865 |

106 |

-52 |

130 |

114 |

64 |

72 |

8 |

2.78 |

|

BARC00575 |

1414200 |

792876 |

109 |

-50 |

130 |

126 |

56 |

68 |

12 |

1.86 |

|

BARC00578 |

1414263 |

792854 |

110 |

-50 |

130 |

126 |

71 |

105 |

34 |

1.16 |

|

BARC00581 |

1414266 |

792883 |

111 |

-50 |

130 |

132 |

44 |

62 |

18 |

1.41 |

|

BARC00582 |

1414234 |

792794 |

108 |

-50 |

130 |

187 |

135 |

141 |

6 |

3.03 |

|

BARC00585 |

1414165 |

792853 |

105 |

-50 |

130 |

108 |

2 |

17 |

15 |

1.28 |

|

BARC00585 |

1414165 |

792853 |

105 |

-50 |

130 |

108 |

72 |

93 |

21 |

1.11 |

|

BARC00600 |

1415035 |

794300 |

131 |

-50 |

130 |

84 |

32 |

64 |

32 |

1.89 |

|

BARC00604 |

1415123 |

794312 |

131 |

-51 |

130 |

90 |

28 |

51 |

23 |

0.7 |

|

BARC00611 |

1414970 |

794294 |

131 |

-52 |

130 |

72 |

8 |

19 |

11 |

2.22 |

|

BARC00614 |

1414892 |

794192 |

135 |

-51 |

130 |

114 |

47 |

64 |

17 |

1.24 |

|

BARC00618 |

1414882 |

794178 |

136 |

-50 |

130 |

120 |

57 |

78 |

21 |

1.15 |

|

BARC00620 |

1414706 |

794112 |

164 |

-51 |

130 |

84 |

18 |

33 |

15 |

1.08 |

|

BARC00623 |

1414732 |

794113 |

168 |

-53 |

130 |

120 |

20 |

32 |

12 |

4.13 |

|

BARC00640 |

1414816 |

794162 |

157 |

-51 |

130 |

114 |

38 |

50 |

12 |

1.48 |

Notes to Accompany Table:

• Grid coordinates are WGS84 Zone 28 North

• RC intervals are sampled every 1m by dry riffle splitting or scoop to provide a 2-3kg sample

• Diamond core are sampled every 1m by cutting the core in half to provide a 2-4kg sample

• Cut-off grade for reporting of intercepts is >0.5g/t Au with a maximum of 3m consecutive internal dilution included within the intercept; only intercepts >=3m and >15 gram x metres are reported

• Samples are analysed for gold by MSA Labs CPA-Au1 500g sample gamma ray analysis by photon assay instrument.

Bantaco

Section 1 Sampling Techniques and Data

|

CRITERIA |

JORC CODE EXPLANATION |

COMMENTARY |

|

|

|

Sampling techniques |

● Nature and quality of sampling (e.g. cut channels, random chips, or specific specialised industry standard measurement tools appropriate to the minerals under investigation, such as down hole gamma sondes, or handheld XRF instruments, etc.). These examples should not be taken as limiting the broad meaning of sampling. ● Include reference to measures taken to ensure sample representivity and the appropriate calibration of any measurement tools or systems used. ● Aspects of the determination of mineralisation that are Material to the Public Report. ● In cases where 'industry standard' work has been done this would be relatively simple (e.g. 'reverse circulation drilling was used to obtain 1 m samples from which 3 kg was pulverised to produce a 30 g charge for fire assay'). In other cases more explanation may be required, such as where there is coarse gold that has inherent sampling problems. Unusual commodities or mineralisation types (e.g. submarine nodules) may warrant disclosure of detailed information. |

Diamond core has been geologically logged and sampled to geological contacts with nominal sample lengths between 0.3m and 4.5m (most commonly 1m). Core selected for assay is systematically cut lengthwise into half core by diamond blade rock saw, numbered and bagged before dispatch to the laboratory for analysis. All core is photographed, wet and dry. Reverse circulation chips are geologically logged and sampled on regular lengths of 1m. Chip material selected for assay is systematically divided to a 1/8 proportion using a rotary splitter attached to the cyclone sample recovery system, numbered and bagged before dispatch to the laboratory for analysis.

|

||

|

Drilling techniques |

● Drill type (e.g. core, reverse circulation, open-hole hammer, rotary air blast, auger, Bangka, sonic, etc.) and details (e.g. core diameter, triple or standard tube, depth of diamond tails, face-sampling bit or other type, whether core is oriented and if so, by what method, etc.). |

Reverse Circulation drilling with 4" or 4.5" hammer and 4" rod string to target depth. |

||

|

Drill sample recovery |

● Method of recording and assessing core and chip sample recoveries and results assessed. ● Measures taken to maximise sample recovery and ensure representative nature of the samples. ● Whether a relationship exists between sample recovery and grade and whether sample bias may have occurred due to preferential loss/gain of fine/coarse material. |

RC recoveries are monitored by chip sample weight recording. Sample weights have been analysed for cyclicity with no relationship between sample weight and depth noted. |

||

|

Logging |

● Whether core and chip samples have been geologically and geotechnically logged to a level of detail to support appropriate Mineral Resource estimation, mining studies and metallurgical studies. ● Whether logging is qualitative or quantitative in nature. Core (or costean, channel, etc.) photography. ● The total length and percentage of the relevant intersections logged. |

Reverse circulation chip samples have been geologically logged to a level of detail to support appropriate classification and reporting of a Mineral Resource. Total length of DD logged is 2,100m. Total length of RC logged is 37,360m. |

||

|

Sub-sampling techniques and sample preparation |

● If core, whether cut or sawn and whether quarter, half or all core taken. ● If non-core, whether riffled, tube sampled, rotary split, etc. and whether sampled wet or dry. ● For all sample types, the nature, quality and appropriateness of the sample preparation technique. ● Quality control procedures adopted for all sub-sampling stages to maximise representivity of samples. ● Measures taken to ensure that the sampling is representative of the in situ material collected, including for instance results for field duplicate/second-half sampling. ● Whether sample sizes are appropriate to the grain size of the material being sampled. |

RC samples representing a 1/8 split are taken directly from the rig mounted cyclone by rotary splitter, sample weight is recorded, sample is bagged in pre numbered plastic and sample tickets are inserted and bag is sealed for transport to preparation facility. Generally, one of each of the two control samples (blank or CRM standard) is inserted into the sample stream every tenth sample. An industry standard, documented process of sample mark-up, core splitting, bagging and ticketing and recording is in place at the Mako site. All samples were submitted to external certified analytical laboratory, MSA Bamako. The 3kg sample were considered appropriate sample size for PhotonAssay analysis. MSA prepares the sample by weighing, drying, and crushing the entire sample to >70% passing 2mm, then into jarred up for PhotonAssay. |

||

|

Quality of assay data and laboratory tests |

● The nature, quality and appropriateness of the assaying and laboratory procedures used and whether the technique is considered partial or total. ● For geophysical tools, spectrometers, handheld XRF instruments, etc., the parameters used in determining the analysis including instrument make and model, reading times, calibrations factors applied and their derivation, etc. ● Nature of quality control procedures adopted (e.g. standards, blanks, duplicates, external laboratory checks) and whether acceptable levels of accuracy (i.e. lack of bias) and precision have been established. |

QAQC consisted of standards, blanks and laboratory duplicates (both coarse and pulp). The QAQC sample results showed acceptable levels of accuracy and precision. The assay data is considered to be suitable for Mineral Resource estimation. |

||

|

Verification of sampling and assaying |

● The verification of significant intersections by either independent or alternative company personnel. ● The use of twinned holes. ● Documentation of primary data, data entry procedures, data verification, data storage (physical and electronic) protocols. ● Discuss any adjustment to assay data. |

Drill hole assay result data has been checked against the original hardcopy laboratory assay reports for a representative number of holes. Below detection limit values (negatives) have been replaced by background values. Un-sampled intervals have been retained as un-sampled (null or blank). All of these intervals occur within the waste domain and have no material impact on the estimate. |

||

|

Location of data points |

● Accuracy and quality of surveys used to locate drill holes (collar and down-hole surveys), trenches, mine workings and other locations used in Mineral Resource estimation. ● Specification of the grid system used. ● Quality and adequacy of topographic control. |

Downhole surveys were undertaken by the drilling contractor using a Reflex DeviGyro tool with a reading taken every 3m downhole. Grid system is based on the UTM28N grid on the WGS84 ellipsoid. Survey heights are based on PRS097 (with independent checks on AusPos) and are orthometric (i.e. msl). A topographic surface with 1m resolution has been generated from a Lidar survey of the area. |

||

|

Data spacing and distribution |

● Data spacing for reporting of Exploration Results. ● Whether the data spacing and distribution is sufficient to establish the degree of geological and grade continuity appropriate for the Mineral Resource and Ore Reserve estimation procedure(s) and classifications applied. ● Whether sample compositing has been applied. |

There is no Resource estimate on the various prospects to date

|

||

|

Orientation of data in relation to geological structure |

● Whether the orientation of sampling achieves unbiased sampling of possible structures and the extent to which this is known, considering the deposit type. ● If the relationship between the drilling orientation and the orientation of key mineralised structures is considered to have introduced a sampling bias, this should be assessed and reported if material. |

Drilling primarily targeted shears within volcanics and metasediments. The drilling orientation is adequate for a non-biased assessment of the orebody with respect to interpreted structures and interpreted controls on mineralisation. |

||

|

Sample security |

● The measures taken to ensure sample security. |

|

||

|

Audits or reviews |

● The results of any audits or reviews of sampling techniques and data. |

The competent person audited the sample preparation laboratory in 2024. No material issues were found. |

||

Section 2 Reporting of Exploration Results

|

CRITERIA |

JORC CODE EXPLANATION |

COMMENTARY |

|

|

|

Mineral tenement and land tenure status |

● Type, reference name/number, location and ownership including agreements or material issues with third parties such as joint ventures, partnerships, overriding royalties, native title interests, historical sites, wilderness or national park and environmental settings. ● The security of the tenure held at the time of reporting along with any known impediments to obtaining a licence to operate in the area. |

|

||

|

Exploration done by other parties |

● Acknowledgment and appraisal of exploration by other parties. |

|

||

|

Geology |

● Deposit type, geological setting and style of mineralisation. |

Geometry of the gold mineralisation is generally NNE to NE striking and vertical to steep westerly dipping. The zones vary between 4 and 30m wide. |

||

|

Drill hole Information |

● A summary of all information material to the understanding of the exploration results including a tabulation of the following information for all Material drill holes: o easting and northing of the drill hole collar o elevation or RL (Reduced Level - elevation above sea level in metres) of the drill hole collar o dip and azimuth of the hole o down hole length and interception depth o Whole length. ● If the exclusion of this information is justified on the basis that the information is not Material and this exclusion does not detract from the understanding of the report, the Competent Person should clearly explain why this is |

. Dip is the inclination of the hole from the horizontal. For example, a vertically down drilled hole from the surface is -90°. Azimuth is reported in degrees as the grid direction toward which the hole is drilled. Down hole length of the hole is the distance from the surface to the end of the hole, as measured along the drill trace. Intersection depth is the distance down the hole as measured along the drill trace. Intersection width is the downhole distance of an intersection as measured along the drill trace. Drill hole length is the distance from the surface to the end of the hole, as measured along the drill trace. |

||

|

Data aggregation methods |

● In reporting Exploration Results, weighting averaging techniques, maximum and/or minimum grade truncations (e.g. cutting of high grades) and cut-off grades are usually Material and should be stated. ● Where aggregate intercepts incorporate short lengths of high grade results and longer lengths of low grade results, the procedure used for such aggregation should be stated and some typical examples of such aggregations should be shown in detail. ● The assumptions used for any reporting of metal equivalent values should be clearly stated. |

Top-cuts have not been used in the drill intersections.

The assay intervals are reported as down hole length as the true width variable is not known. Gold assays are rounded to two decimal places. No metal equivalent reporting is used or applied. |

||

|

Relationship between mineralisation widths and intercept lengths |

● These relationships are particularly important in the reporting of Exploration Results. ● If the geometry of the mineralisation with respect to the drill hole angle is known, its nature should be reported. ● If it is not known and only the down hole lengths are reported, there should be a clear statement to this effect (e.g. 'down hole length, true width not known'). |

All drill results are downhole intervals only due to the variable orientation of the mineralisation. |

||

|

Diagrams |

● Appropriate maps and sections (with scales) and tabulations of intercepts should be included for any significant discovery being reported These should include, but not be limited to a plan view of drill hole collar locations and appropriate sectional views. |

|

||

|

Balanced reporting |

● Where comprehensive reporting of all Exploration Results is not practicable, representative reporting of both low and high grades and/or widths should be practiced to avoid misleading reporting of Exploration Results. |

The report is considered balanced and provided in context.

|

||

|

Other substantive exploration data |

● Other exploration data, if meaningful and material, should be reported including (but not limited to): geological observations; geophysical survey results; geochemical survey results; bulk samples - size and method of treatment; metallurgical test results; bulk density, groundwater, geotechnical and rock characteristics; potential deleterious or contaminating substances. |

|

||

|

Further work |

● The nature and scale of planned further work (e.g. tests for lateral extensions or depth extensions or large-scale step-out drilling). ● Diagrams clearly highlighting the areas of possible extensions, including the main geological interpretations and future drilling areas, provided this information is not commercially sensitive. |

|

||

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.