("Switch", "

Completion of pitting and soil sampling at Issia

Highlights:

· Mineral Resources Estimate target area ("MRE 2") pitting and soils sampling complete

· Together with MRE 1, over 400 tonnes of samples collected on schedule and on budget

· Pilot wash plant expected to be on site shortly to complete assaying of samples for tantalum pentoxide (Ta2O5) and associated heavy minerals

· First resource estimate for Issia on track for early 2026

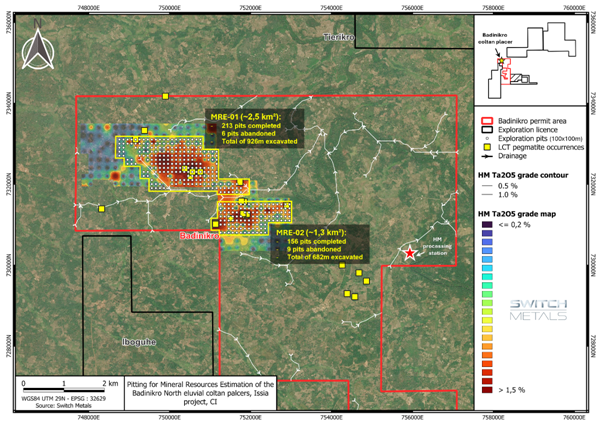

Work on the MRE 2 target area covered an additional 1.3 km2 of exploration alongside the initial MRE 1 target area of 2.5km2. These target areas form part of Permit PR0895 which covers an area of 112 km2 of the 1,015 km2 district-scale

The Company's plan is to define a resource and complete technical and economic studies on the shallow surface coltan placer deposits in the near-term, in parallel with demonstrating further upside potential in the deeper hard rock targets.

Across the MRE 2 target area, 156 resource pits were successfully dug, sampled, mapped, transported and stored ready for further analysis. With the addition of the previously completed MRE 1 work, a total of 369 pits have been dug over a 100 x 100 metre grid spacing, for a cumulative total depth of 1,609 metres. Samples of these holes, with approximately 250kg of representative soil materials each, amount to a total weight of over 400 tonnes which contains various quantities of heavy minerals including tantalum.

Key to the Company's ongoing activities now will be the delivery of the five tonne per hour pilot wash plant, including a scrubber, jig and shaking table which is expected to be on site shortly. Once on site, plant assembly and commissioning will commence immediately.

Once the wash plant is operational, the soil samples will be systematically washed following a strict protocol, to produce a heavy mineral ("HM") sample for each metre. These HM samples will be assayed for tantalum pentoxide (Ta2O5) grade estimation per metre which will feed into the maiden resource model. The processing of these HM samples are expected to follow during October and

The Company's objective remains to determine a first resource estimate at Issia in early 2026. Achieving this milestone will pave the way for technical and economic studies, and the subsequent application for a mining licence over the balance of 2026.

"We continue to be pleased with progress at Issia, with the addition and completion of pitting and sampling on this second target area being another major step. We have come a long way since the start of our first tantalum resource definition programme in May this year, being sufficiently encouraged to expand the initial programme to include the MRE 2 target area.

"I would like to thank our team for their hard work to complete this part of the programme on time and on budget, with no major incidents to report. This additional work should increase the first resource estimate which in turn may enhance the economics of our near-term production plan at the

Figure 1: MRE 1 and MRE 2 target areas for resource definition.

Figure 2: Example of pit hole of 1.25 metres by 80 centimetres and 5 metres depth.

Figure 3: Bulk soil sample bags stored for each hole metre by metre, containing various quantities of heavy minerals and ready for processing using the pilot wash plant.

For further information, please contact:

|

|

Via IFC Advisory |

|

Corporate Finance: Sales:

|

+44 (0) 203 328 5656 |

|

Henry.clarke@oak-securities.com

|

+44 (0) 203 973 3678 |

|

switchmetals@investor-focus.co.uk

|

+44 (0) 203 934 6630 |

About

Its core assets include Issia (Ta + Nb), Bouaké (Ta + Nb + REE) and Tiassalé (Li) projects. Issia is the current focus for the Company as it exhibits potential for early cash flow through ethical tantalum production from shallow coltan placer deposits with significant scale-up potential (from both placers and hard rock pegmatites).

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the