Interim Results

HIGHLIGHTS

Six months to

· Pre-Feasibility Study published on

·

· 23.6% pre-tax Internal Rate of Return ('IRR'), post-tax 19.8%.

· Life of Mine ('LOM') free cash flow post-tax of

· C1 cash operating cost of

· 5 year payback period from start of production for Phase 1 of the planned phased project.

· Maiden Ore Reserve of

· Phase 1: Forecast 18,000 tonnes per annum ('tpa') of LHM

· Phase 2: Forecast peak production of 35,100 tpa LHM, effectively doubling capacity within Phase 1 project footprint.

· Advanced environmental licencing and permitting, with updates to the spatial planning process submitted to Landesdirektion Sachsen.

· LOI signed with solar development company Solar-Bau to explore the option for long term clean power offtake.

· Strong statement of support for the Project from the Saxony Government following EU's publication of its first round of strategic projects under the CRMA.

· Awarded new exploration license at Liebenau to complete almost 13,000 Ha coverage around the Project area of development.

· Completed

Post period end to

· Ongoing development of geometallurgical model.

· Ongoing testwork programme to optimise lithium recovery in beneficiation stage.

· Initial testwork commenced on option to use a tunnel kiln in calcination process.

· Public consultation underway on Spatial Planning Application.

· MoU signed with local "green" cement company to explore potential uses for various waste streams.

· Continue to strengthen German team with appointment of new permitting manager.

Investor hub presentation

Investors are invited to register and submit questions via the "Interim Results Webinar -

Make sure you're registered to the webinar to receive an email notification when the Q&A is published.

For further information visit www.zinnwaldlithium.com or contact:

|

|

|

|

|

|

(Nominated Adviser) |

+44 (0) 20 3328 5656 |

|

|

Oberon Capital Ltd (Broker) |

+44 (0) 20 3179 5300 |

|

|

(Financial PR) |

zinnwald@stbridespartners.co.uk

|

Notes

AIM quoted

CHAIRMAN'S STATEMENT

I am pleased to report on

The publication of our Pre-Feasibility Study ('PFS') in March marked a major milestone. It confirmed the compelling economics of the

Notably, the PFS also confirmed the Project's potential to support the electrification of over one million electric vehicles ('EVs') per year, underscoring its relevance as one of

Since then, we have remained focused on optimising and de-risking the Project further and were, therefore, pleased to complete a

With funding in place, work continues to advance across several key fronts. On the permitting side, we are progressing with the Environmental and Social Impact Assessment and the associated regulatory processes. Concurrently, we are progressing various technical workstreams, advancing negotiations to secure access to land required for infrastructure development, and expanding the team to ensure we have the necessary skills and expertise to take the Project through its next critical phases.

Given that sustainability is central to our development strategy, we are proactively engaging with stakeholders to ensure transparency and build a strong social licence to operate as we advance through permitting and development. As part of this commitment, we recognise our responsibility to support the local economy while safeguarding the region's quality of life. Accordingly, our development plans prioritise minimal surface disruption through an underground mine design and the construction of a proposed 9km underground tunnel, eliminating the need for surface transport and significantly reducing traffic, noise, and environmental impact.

Our low-energy, low-waste processing flowsheet further reinforces the Project's commitment to sustainability, as do our plans to integrate renewable power solutions over the life of the operation. We are actively exploring the latter option in partnership with Solar-Bau, a specialist solar development company. Importantly, although the second planned phase targets production exceeding 35,000 tonnes of LiOH annually, all operations will remain within the original Phase 1 footprint.

The Company continues to maintain its extremely disciplined approach to expenditure and cash management and as such is well funded through its ongoing work into 2026, with cash of

In closing, I would like to thank our shareholders, employees, partners, and the local communities for their continued support and engagement. With a robust technical foundation, strong strategic alignment, and a clear path forward, I am confident that

Non-Executive Chairman

STRATEGIC REPORT

Operational Review

The first half of 2025 saw

PRE-FEASIBILITY STUDY

In

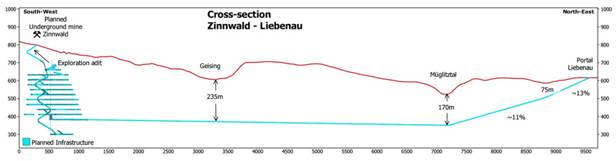

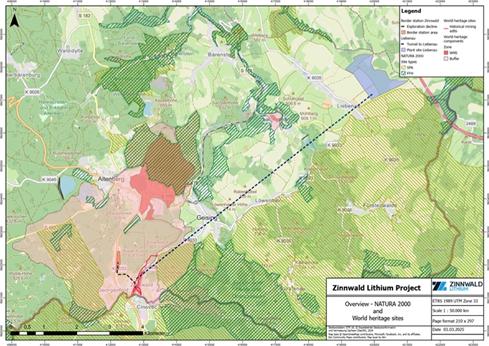

The Project includes an underground mine with associated processing of mined ore to produce battery-grade LHM. Processing including beneficiation, pyrometallurgy and hydrometallurgy will be carried out at an industrial facility to be established near the village of Liebenau. Ore haulage from the mine to the processing facility is via electric conveyor in a 9.1 km tunnel that will be constructed utilising a tunnel boring machine ("TBM") to reduce the Project's impact on local communities.

The Project development concept has been conceived as a multi-stage approach where Phase 1 will establish the necessary infrastructure, develop the mine and deliver approximately 18,000 tonnes of LHM per annum. Phase 2 will double production capacity and sees production peak at approximately 35,100 tonnes LHM per annum utilising the initial mining and tunnel infrastructure and benefiting from economies of scale.

The planned underground mine has been designed as a conventional longhole open stoping operation with paste backfill, utilising regional pillars to mitigate surface subsidence risks. Primary crushing will occur underground before ore is transported through the 9.1 km tunnel via conveyor to the industrial facility.

At the industrial facility ore is initially processed using conventional high intensity wet magnetic separation to recover a zinnwaldite concentrate. Benign quartz sand waste from this stage will either be returned to the mine for use as backfill material underground, stored on the adjacent tailings storage facility or sold to third parties for use in the construction industry.

Subsequent processing stages include calcination of the zinnwaldite concentrate in a rotary kiln, pressure leaching and bicarbonation utilising a proprietary process developed by Metso and subsequent evaporation and crystallisation. The primary end product will be battery grade lithium hydroxide which will be shipped via the nearby autobahn to end-users in the German or EU battery chain. A number of by-products including analcime, calcium silicate, calcium fluoride, calcium carbonate and potassium chloride will also be produced. The process plant is designed to achieve zero liquid discharge.

In Phase 1, the Project will deliver approximately 1.6 million tonnes per annum ('tpa') run of mine (ROM), providing approximately 300,000 tpa zinnwaldite concentrate which will be further processed into approximately 18,000 tpa LHM. Given the scale of the resource and the capacity of the planned processing site, the Project considers expansion through development of Phase 2, doubling capacity and allowing output to peak at approximately 35,100 t/a LHM after allowing for the forecast reduction in feed grade over the LOM. The Project implementation plan envisages the permitting and build-out of Phase 1 to demonstrate the viability of the Project before proceeding with Phase 2, assumed to begin operation in Year 7.

Economic Analysis in the PFS

The economic analysis included in the PFS (summarised below) demonstrates the financial viability of the Project with a pre-tax Net Present Value ("NPV") of

|

PFS Key Financial Model Metrics |

Unit |

Value |

|

Pre-tax NPV (at 8 % discount) |

EUR €m |

3,328 |

|

Pre-tax IRR |

% |

23.6% |

|

Post-tax NPV (at 8 % discount) |

EUR €m |

2,187 |

|

Post-tax IRR |

% |

19.8% |

|

Simple Payback (years post start of production) |

Years |

4.6 |

|

Initial Construction Capital Cost |

EUR €m |

1,048 |

|

Average LOM Unit Operating Costs (pre by-product credits) |

EUR/t LHM |

9,505 |

|

Average LOM Unit Operating Costs (post by-product credits) |

EUR/t LHM |

8,403 |

|

Average LOM Revenue |

EUR €m p.a. |

741 |

|

Average Annual EBITDA with by-products |

EUR €m p.a |

484 |

|

Annual Average LHM Production |

KTonnes per annum |

27 |

|

LiOH Price assumed in model |

EUR/t LHM |

26,288 |

MRE and Reserve

Zinnwald conducted an 84 hole, 27,000m drill programme in 2022-2023 that culminated in an updated Mineral Resource Estimate (MRE) in 2024 (see table below) prepared by Snowden Optiro. The Mineral Resource totals 193.5 Mt at 2,220 ppm Li (429 kt contained lithium metal) in the Measured and Indicated category at a cut-off grade of 1,100 ppm Li. The updated MRE established the Project as the second largest hard rock lithium project in the EU both in terms of resource size and contained lithium content.

As part of the PFS, Snowden Optiro prepared a Mineral Reserve (see table below) estimated using accepted industry practices for underground mines. The identified economic mineralisation was subjected to detailed mine design, scheduling and the development of a cashflow model incorporating technical and economic projections for the mine for the duration of the Reserves case, which is the mining base case. This Maiden Ore Reserve totals

|

Classification |

Tonnes |

Mean Grade |

Contained Metal |

||

|

|

(MT) |

Li (ppm) |

Li2O (ppm) |

Li (Kt) |

LCE (Kt) |

|

Resource ( |

|

|

|

|

|

|

Measured |

36.3 |

2,500 |

5,380 |

91 |

483 |

|

Indicated |

157.2 |

2,150 |

4,630 |

338 |

1,802 |

|

MEASURED + INDICATED TOTAL |

193.5 |

2,220 |

4,780 |

429 |

2,285 |

|

INFERRED TOTAL |

33.3 |

2,140 |

4,610 |

71 |

379 |

|

|

|

|

|

|

|

|

Reserve ( |

|

|

|

|

|

|

Proven |

27.2 |

2,188 |

4,711 |

60 |

317 |

|

Probable |

100.9 |

2,021 |

4,351 |

204 |

1,085 |

|

Total |

128.1 |

2,056 |

4,428 |

263 |

1,402 |

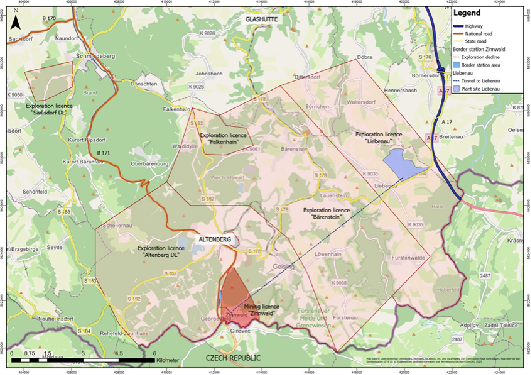

EXPLORATION LICENSES

Whilst the Company's primary focus is on the development of its core Zinnwald Licence, it continues to advance targets on its surrounding 100% owned prospective exploration licence areas. Work on these licences has mainly involved relogging and sampling historical data and core. Furthermore, the Company applied for and received an extension of its Altenberg exploration licence, which is now valid until

In addition, the team is evaluating an extensive historic geological database derived from historical drilling campaigns such as those undertaken by the former Wismut SAG, which has recently been made available to the public. Notably, there is data for over 900 drill holes of various depths within the areas of interest to the Company that has the potential to provide valuable geological and geotechnical information relevant to its licenses and site location options.

New Liebenau Exploration license

On

The Liebenau Licence adds a substantial land area to the mineral exploration titles of the Company in the region that now stands at combined 12,933 ha (see Table and Map below). Exploration activities on these licenses have the potential to further expand the Company's lithium resources which could ultimately contribute to production. The location of the Liebenau Licence is based on the boundaries of previously granted exploration licences and takes into account the findings of extensive exploration work by the state geological institutions of the former GDR and the data obtained therein. These indicate that granite- and greisen-associated Li-Sn-W mineralisation extend into the proposed exploration area.

|

License |

No |

Interest |

Category |

Licence expiry date |

License area (m²) |

|

Zinnwald |

2960 |

100% |

Mining |

|

2,564,800 |

|

Falkenhain |

1686 |

100% |

Exploration |

|

2,957,000 |

|

Altenberg |

1698 |

100% |

Exploration |

|

42,252,700 |

|

Sadisdorf |

1706 |

100% |

Exploration |

|

2,249,000 |

|

Bärenstein |

1713 |

100% |

Exploration |

|

49,339,000 |

|

Liebenau |

1733 |

100% |

Exploration |

|

29,970,000 |

|

Total |

|

|

|

|

129,332,500 |

Map of Licence Areas

|

|

FUNDRAISE

On

The Company's immediate use of the net proceeds of the fundraise include the following:

· Permitting: continue to advance the ongoing permitting process and work required for the Environmental and Social Impact Assessment;

· Project derisking: advance areas identified in the PFS regarding opportunities to de-risk and optimise the Project, including process testwork and further sources of financing including grant funding;

· Property: continue negotiations with the City of Altenberg and landowners identified at Liebenau to secure options over the land required for the Project;

· Project team: continue to build out the Project team in

· Working capital and general corporate purposes.

PERMITTING AND COMMUNITY MATTERS

Permitting / ESIA

The Project will be permitted under German

The Project has also commenced its work to produce an Environmental and Social Impact Assessment that will meet both the requirements for permitting under German Federal law as well as being completed to a level suitable for the purposes of seeking finance from International Financing Institutions, who are signatories to the Equator Principles 4 (and related standards). As part of this work, the Project is finalising for publication in English and German its ESIA Scoping Study, Stakeholder Engagement Plan, Land Acquisition and Compensation Framework and Grievance Mechanism. The Project will then hold public consultation meetings with local stakeholders to finalise these items ahead of the full ESIA.

Spatial Planning

In 2025, the Project has finalised its Spatial Planning application documents, which is reviewed by the Landesdirektion Sachsen ("LDS"). In February, the updated draft Spatial Planning application was submitted for initial review by LDS. The Company received its initial feedback in April and subsequently provided LDS with further documentation, including certain documents translated into Czech. In June, the LDS published its statement declaring formal commencement of the Spatial Planning Procedure. This includes a public statement and presentation on LDS website; request for comments from 120 legal and NGO bodies potentially impacted; and the public display of documents at 4 Town Halls and in the regional

Local Community Engagement

The Company is well aware that a key part of the Project's development will be to secure the social licence to operate via extensive public participation. The Company recognises the importance of the general public and NGOs in the permitting processes and has committed to proactively engage with all the stakeholders in its projects. In early March, the Company launched its German language local community website at www.lithium-im-erzgebirge.de. This website has extensive detail on the Project and offers a forum for direct engagement, and the Company is encouraged by the traffic on this site. At the end of March, the Project's local MD,

The Project has been designed so as to minimise the impact on local communities, the environment and protected areas in the vicinity (Natura 2000 and UNESCO World Heritage). This has been done despite a generally higher cost. This includes underground mining and continuous backfilling with mined waste, rather than open-pit mining.; ore haulage via a tunnel to be constructed, rather than via truck transport on local roads or overland conveyor; and the selection of an area of ground adjacent to the

The Project falls entirely within the municipality of Altenberg that covers an area of 145.8 km2 and had a total population of 7,851 as of 2023. The largest towns and villages most directly impacted will be Zinnwald (2023 population of 377), Altenberg (2023 population 1,968) and Liebenau (2023 population 389). The proposed process plant site is located to the north of the village of Liebenau, where the terrain rises gradually to the south and creates a natural barrier between the village and the plant site. The total above ground area required for the Project is 121 ha, comprising 6 ha at the Zinnwald border station and 115 ha at Liebenau.

Local Government engagement

In April, the Saxon Minister for Economics, Dr

The Saxon Prime Minister and the Minister of Economics have also sent a joint letter to the Federal Minister of Economics Berlin expressing the importance of the Project to Saxony and requesting Federal support.

Solar power opportunity

In 2025, the Company has signed a letter of intent ('LOI') with P+S Projektentwicklung Solar-Bau GmbH ('Solar-Bau') to explore the purchase of solar-generated power. Solar-Bau, a solar development company, plans to establish several solar power generation facilities near the Project. This partnership has the potential to reduce the Project's environmental impact by using solar energy close to its source, thereby reducing energy transfer losses and infrastructure costs, while providing

EUROPEAN UNION AND

Critical Raw Materials Act ("CRMA")

On

While the Company is disappointed to not have been selected as a "strategic" project, it notes that this designation does not itself bestow any specific advantage in terms of funding or specific quantifiable assistance with, or acceleration of, established permitting and project approval timelines. The Company will reassess whether to apply for "strategic" status as and when the next stage of applications is called for, which is believed to be later in 2025.

Saxony Government

In immediate response to the CRMA's decision, on

"Especially in light of increasing international tensions, reducing raw material dependence is crucial for

Minister Panter also emphasised the importance of international investment in large-scale projects such as

The Minister further confirmed that the Saxon Government will actively support the Project and has designated it a high priority. This commitment is formally acknowledged in the coalition agreement between the CDU and SPD in the

Temporary Crisis and Transition Framework ('TCTF')

In 2024 the Company applied for public grant funding under the Federal Government's TCTF programme to support the "Resilience and Sustainability of the Battery Cell Manufacturing Ecosystem" in

If the application is ultimately successful, any funding would be provided 70% by the Federal State Government and 30% by the State of Saxony. On

Post Balance Sheet events to 25 September 2025

The Project has continued to advance the Project on a number of fronts including work on various of the optimisation recommendations included in the PFS to be completed ahead of starting the work on the DFS.

Geology

The Project is further developing its geometallurgical model and has completed the further work on mineral characterization, which will serve as the basis for selection of the variability testwork programme. Furthermore, the Project has also started the automated mineralogy works on zinnwaldite/Li-mica in tailings and feed samples, which will provide further insights into potentially non-recoverable lithium bearing minerals in the run-of-mine material. Additionally, the Project has completed the installation works for its hydrogeological monitoring, including measuring points in and around the proposed Zinnwald mine site. The Project has also completed a LIDAR drone survey at the Liebenau site, which will be used to integrate the plant and TSF into a 3D model for visualization purposes.

Processing Testwork

In the area of mineral processing, the Project is progressing further testwork to optimise and de-risk elements of the flow sheet that will underpin the definitive operating criteria in the DFS. This includes in the mineral processing area to assess the potential to further improve the lithium recovery level in the concentrator, as well as testing the potential to use a tunnel kiln rather than a rotary kiln in the calcination stage. This has the potential to reduce both capital and operating costs in this area as well as simplifying materials handling.

Permitting and ESIA

As noted above, the Spatial Planning application process is in the public consultation phase with the results from LDS targeted for Q4 2025. The Project also intends to commence its public consultation process around its ESIA in Q4 2025.

LOI with local

The Project has signed a non-binding, non-exclusive Memorandum of Understanding ("MoU") with

Brokers

The Company has elected to go forward with a single broker for the time being and

Lithium Market in 2025

The first half of 2025 saw a continuation of the weakness in the lithium price from 2024 with prices for battery grade lithium products below

Outlook

The PFS has demonstrated the size, long mine life and robust economics of the Project and its relevance to the long-term development of the German and EU battery chain. The Company will continue to advance the technical development work required ahead of commencing the DFS. The Company will also continue its work on the permitting and ESIA process and ensuring its social license to operate with the local community, supported by its strong relationship with the local government in Saxony. Alongside this, the Company will continue to advance its long term financing strategy including discussions with potential financing partners.

Financial Review

Notwithstanding that the Company is a

The Group is still at an exploration and development stage and not yet producing minerals, which would generate commercial income. The Group is not expected to report overall profits until it is able to profitably commercialise its

During the period, the Group made a loss before taxation of

The Total Net Assets of the Group increased to

On behalf of the board

CFO and Director

The technical information relating to geology, the Mineral Resource and Reserve Statements and disclosure on other Project matters, particularly the Flowsheet, has been extracted and summarised from the Company's Pre-Feasibility Study Ni 43-101 report. The executive summary of this report was published on

INTERIM CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FR THE SIX MONTHS ENDED

|

|

|

Unaudited |

Unaudited |

|

|

Notes |

€ |

€ |

|

Continuing operations |

|

|

|

|

Administrative expenses |

|

(1,285,304) |

(1,231,500) |

|

Other operating income |

5 |

31,983 |

68,415 |

|

Share based payments charge |

13 |

(380,545) |

(304,818) |

|

|

|

|

|

|

Operating Loss |

4 |

(1,633,866) |

(1,467,903) |

|

|

|

|

|

|

Finance income |

6 |

23,682 |

241,332 |

|

|

|

|

|

|

Loss before taxation |

|

(1,610,184) |

(1,226,571) |

|

Tax on loss |

|

(6,501) |

- |

|

|

|

|

|

|

Loss for the financial period |

|

(1,616,685) |

(1,226,571) |

|

Other Comprehensive loss |

|

(33) |

- |

|

|

|

|

|

|

Total comprehensive loss for the period |

|

(1,616,718) |

(1,226,571) |

|

|

|

|

|

|

|

|

|

|

|

Earnings per share from continuing operations attributable to the owners of the parent company |

7 |

|

|

|

Basic (cents per share) |

|

(0.33) |

(0.25) |

Total loss and comprehensive loss for the year is attributable to the owners of the parent company.

INTERIM CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT

|

|

|

Unaudited |

Unaudited |

Audited |

|

|

Notes |

€ |

€ |

€ |

|

Non-current assets |

|

|

|

|

|

Intangible Assets |

8 |

36,758,607 |

30,617,235 |

34,202,236 |

|

Property, plant and equipment |

9 |

409,446 |

413,768 |

430,752 |

|

Right of Use Assets |

10 |

220,035 |

220,035 |

279,566 |

|

|

|

|

|

|

|

|

|

37,388,088 |

31,251,038 |

34,912,554 |

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

Trade and other receivables |

11 |

281,410 |

409,378 |

371,142 |

|

Right of Use Assets |

10 |

- |

120,049 |

- |

|

Cash and cash equivalents |

|

4,667,416 |

9,287,751 |

5,216,085 |

|

|

|

|

|

|

|

|

|

4,948,826 |

9,817,178 |

5,587,227 |

|

|

|

|

|

|

|

Total Assets |

|

42,336,914 |

41,068,216 |

40,499,781 |

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

Trade and other payables |

12 |

(311,744) |

(492,325) |

(1,106,584) |

|

Lease Liabilities < 1 year |

10 |

(120,693) |

(116,612) |

(118,652) |

|

|

|

|

|

|

|

|

|

(432,437) |

(608,937) |

(1,225,236) |

|

|

|

|

|

|

|

Net current assets |

|

4,516,389 |

9,208,241 |

4,361,991 |

|

|

|

|

|

|

|

Non-current Liabilities |

|

|

|

|

|

Deferred tax liability |

|

(1,382,868) |

(1,382,868) |

(1,382,868) |

|

Lease Liabilities > 1 year |

10 |

(103,798) |

(224,490) |

(164,687) |

|

|

|

|

|

|

|

|

|

(1,486,666) |

(1,607,358) |

(1,547,555) |

|

|

|

|

|

|

|

Total liabilities |

|

(1,919,103) |

(2,216,295) |

(2,772,791) |

|

|

|

|

|

|

|

Net Assets |

|

40,417,811 |

38,851,921 |

37,726,990 |

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

Share capital |

14 |

6,167,588 |

5,377,253 |

5,377,253 |

|

Share premium |

|

42,613,014 |

39,476,355 |

39,476,355 |

|

Other reserves |

|

2,684,362 |

2,042,106 |

2,303,850 |

|

Retained losses |

|

(11,047,153) |

(8,043,793) |

(9,430,468) |

|

|

|

|

|

|

|

Total equity |

|

40,417,811 |

38,851,921 |

37,726,990 |

|

|

|

|

|

|

INTERIM CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHS ENDED

|

|

|

Share Capital |

Share premium account |

Other reserves |

Retained losses |

Total |

|

|

|

€ |

€ |

€ |

€ |

€ |

|

Balance at |

|

5,377,253 |

39,476,355 |

2,303,850 |

(9,430,468) |

37,726,990 |

|

|

|

|

|

|

|

|

|

Six months ended |

|

|

|

|

|

|

|

Loss and total other comprehensive loss for the period |

|

- |

- |

- |

(1,616,685) |

(1,616,685) |

|

Currency translation difference |

|

- |

- |

(33) |

- |

(33) |

|

|

|

|

|

|

|

|

|

Total comprehensive loss for the period |

|

- |

- |

(33) |

(1,616,685) |

(1,616,718) |

|

|

|

|

|

|

|

|

|

Issue of share capital |

|

790,335 |

3,161,343 |

- |

- |

3,951,678 |

|

Share issue costs |

|

- |

(24,684) |

- |

- |

(24,684) |

|

Credit to equity for equity settled share-based payments |

|

- |

- |

380,545 |

- |

380,545 |

|

|

|

|

|

|

|

|

|

Total transactions with owners directly in equity |

|

790,335 |

3,136,659 |

380,545 |

- |

4,307,539 |

|

|

|

|

|

|

|

|

|

Balance at |

|

6,167,588 |

42,613,014 |

2,684,362 |

(11,047,153) |

40,417,811 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Capital |

Share premium account |

Other reserves |

Retained losses |

Total |

|

|

|

€ |

€ |

€ |

€ |

€ |

|

Balance at |

|

5,365,379 |

39,403,810 |

1,896,531 |

(6,817,222) |

39,848,498 |

|

|

|

|

|

|

|

|

|

Six months ended |

|

|

|

|

|

|

|

Loss and total other comprehensive loss for the period |

|

- |

- |

- |

(1,226,571) |

(1,226,571) |

|

Currency translation difference |

|

- |

- |

38 |

- |

38 |

|

|

|

|

|

|

|

|

|

Total comprehensive loss for the period |

|

- |

- |

38 |

(1,226,571) |

(1,226,533) |

|

|

|

|

|

|

|

|

|

Issue of share capital |

|

11,874 |

72,545 |

- |

- |

84,419 |

|

Credit to equity for equity settled share-based payments |

|

- |

- |

145,537 |

- |

145,537 |

|

|

|

|

|

|

|

|

|

Total transactions with owners recognised directly in equity |

|

11,874 |

72,545 |

145,537 |

- |

229,956 |

|

|

|

|

|

|

|

|

|

Balance at |

|

5,377,253 |

39,476,355 |

2,042,106 |

(8,043,793) |

38,851,921 |

|

|

|

|

|

|

|

|

INTERIM CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHS ENDED

|

|

|

Unaudited |

Unaudited |

||

|

|

Notes |

|

|

|

|

|

Cash flows from operating activities |

|

|

|

|

|

|

Cash used in operations |

15 |

|

(1,868,585) |

|

(2,154,765) |

|

|

|

|

|

|

|

|

Net cash outflow from operating activities |

|

|

(1,868,585) |

|

(2,154,765) |

|

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

|

Exploration expenditure |

|

(2,557,424) |

|

(2,955,592) |

|

|

Purchase of property, plant and equipment |

|

(11,086) |

|

(80,385) |

|

|

Proceeds from sale of tangible assets |

|

840 |

|

- |

|

|

Interest received |

|

23,682 |

|

241,332 |

|

|

|

|

|

|

|

|

|

Net cash used in investing activities |

|

|

(2,543,988) |

|

(2,794,645) |

|

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

|

Proceeds from the issue of shares |

|

3,926,994 |

|

- |

|

|

Lease payments |

|

(63,090) |

|

(69,030) |

|

|

|

|

|

|

|

|

|

Net cash generated from / (used in) financing activities |

|

|

3,863,904 |

|

(69,030) |

|

|

|

|

|

|

|

|

Net decrease in cash and cash equivalents |

|

|

(548,669) |

|

(5,018,440) |

|

|

|

|

|

|

|

|

Cash and cash equivalents at beginning of period |

|

|

5,216,085 |

|

14,306,191 |

|

|

|

|

|

|

|

|

Cash and cash equivalents at end of period |

|

|

4,667,416 |

|

9,287,751 |

|

|

|

|

|

|

|

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED

Accounting Policies

Company Information

The group consists of

|

|

Registered office |

Nature of business |

Class of shares held |

Direct holding |

Indirect holding |

|

|

|

Exploration |

Ordinary |

100.0% |

- |

|

|

|

Exploration |

Ordinary |

- |

100.0% |

|

Zinnwald Lithium Services GmbH |

|

Leasing |

Ordinary |

- |

100.0% |

The registered office address of both

The business office address of both

1.1 Basis of preparation

These unaudited interim condensed consolidated financial statements have been prepared under the historical cost convention and in accordance with the AIM Rules for Companies. As permitted, the Company has chosen not to adopt IAS 34 "Interim Financial Statements" in preparing this interim financial information. The unaudited interim condensed financial statements should be read in conjunction with the annual report and financial statements for the year ended

The unaudited interim condensed consolidated financial statements do not constitute statutory financial statements within the meaning of the Companies Act 2006. They have been prepared on a going concern basis in accordance with the recognition and measurement criteria of

The same accounting policies, presentation and methods of computation are followed in these unaudited interim condensed financial statements as were applied in the preparation of the audited financial statements for the year ended

The financial statements are prepared in euros, which is the functional currency of the Company and the Group's presentation currency, since the majority of its expenditure, including funding provided to ZLG and ZLSG, is denominated in this currency. Monetary amounts in these financial statements are rounded to the nearest €.

The € to GBP exchange rate used for translation as at

1.2 Basis of consolidation

The consolidated financial statements incorporate those of

All intra-group transactions, balances and unrealised gains on transactions between group companies are eliminated on consolidation.

Subsidiaries are fully consolidated from the date on which control is transferred to the group. They are deconsolidated from the date on which control ceases.

1.3 Going concern

At the time of approving the financial statements, the directors have a reasonable expectation that the Group has adequate resources to continue in operational existence for the foreseeable future. The Company had a cash balance of

1.4 Intangible assets

Capitalised Exploration and Evaluation costs

Exploration and evaluation assets are capitalised as Intangible Assets and represent the costs incurred on the exploration and evaluation of potential mineral resources. They include direct costs (such as permitting costs, drilling, assays and flowsheet testwork done by consulting engineers), licence payments and fixed salary/consultant costs, capitalised in accordance with IFRS 6 "Exploration for and Evaluation of Mineral Resources". Exploration and Evaluation assets are initially measured at historic cost. Exploration and Evaluation Costs are assessed for indicators of impairment in accordance with IFRS 6 when facts and circumstances suggest that the carrying amount of an asset may exceed its recoverable amount. Any impairment is recognised directly in profit or loss.

1.5 Property, plant and equipment

Property, plant and equipment are initially measured at cost and subsequently measured at cost, net of depreciation and any impairment losses.

Depreciation is recognised so as to write off the cost or valuation of assets less their residual values over their useful lives on the following bases:

Leasehold land and buildings No depreciation is charged on these balances

Plant and equipment 25% on cost

Fixtures and fittings 25% on cost

Computers 25% on cost

Motor vehicles 16.7% on cost for new vehicles, 33.3% on cost for second-hand vehicles

Low-value assets 100% on cost on acquisition for items valued at less than

The gain or loss arising on the disposal of an asset is determined as the difference between the sale proceeds and the carrying value of the asset and is recognised in the income statement.

1.6 Impairment of non-current assets

At each reporting period end date, the group reviews the carrying amounts of its tangible and intangible assets to determine whether there is any indication that those assets have suffered an impairment loss. If any such indication exists, the recoverable amount of the asset is estimated in order to determine the extent of the impairment loss (if any). Where it is not possible to estimate the recoverable amount of an individual asset, the group estimates the recoverable amount of the cash-generating unit to which the asset belongs.

Intangible assets not yet ready to use and not yet subject to amortisation are reviewed for impairment whenever events or circumstances indicate that the carrying value may not be recoverable.

Recoverable amount is the higher of fair value less costs to sell and value in use. In assessing value in use, the estimated future cash flows are discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset for which the estimates of future cash flows have not been adjusted.

If the recoverable amount of an asset (or cash-generating unit) is estimated to be less than its carrying amount, the carrying amount of the asset (or cash-generating unit) is reduced to its recoverable amount. An impairment loss is recognised immediately in profit or loss, unless the relevant asset is carried at a revalued amount, in which case the impairment loss is treated as a revaluation decrease.

1.7 Cash and cash equivalents

Cash and cash equivalents include cash in hand and deposits held at call with banks with a maturity date of less than 30 days.

1.8 Right of Use Assets and Lease Liabilities

All leases are accounted for by recognising a right-of-use assets due to a lease liability except for:

· Lease of low value assets; and

· Leases with duration of 12 months or less

The Group reviews its contracts and agreements on an annual basis for the impact of IFRS 16. The Group has such short duration leases and lease payments are charged to the income statement with the exception of the Group's lease for the Freiberg office and core shed, which expired in April 2024 and have been replaced by new office leases in Dresden and Core Shed in Altenberg that both started on 1 May 2024.

Lease liabilities are measured at the present value of the contractual payments due to the lessor over the lease term, with the discount rate determined by reference to the rate inherent in the lease unless (as is typically the case) this is not readily determinable, in which case the group's incremental borrowing rate on commencement of the lease is used. Variable lease payments are only included in the measurement of the lease liability if they depend on an index or rate. In such cases, the initial measurement of the lease liability assumes the variable element will remain unchanged throughout the lease term. Other variable lease payments are expensed in the period to which they relate.

On initial recognition, the carrying value of the lease liability also includes:

· amounts expected to be payable under any residual value guarantee;

· the exercise price of any purchase option granted in favour of the group if it is reasonably certain to assess that option;

· any penalties payable for terminating the lease, if the term of the lease has been estimated on the basis of termination option being exercised.

Right of use assets are initially measured at the amount of the lease liability, reduced for any lease incentives received, and increased for:

· lease payments made at or before commencement of the lease;

· initial direct costs incurred; and

· the amount of any provision recognised where the group is contractually required to dismantle, remove or restore the leased asset

Subsequent to initial measurement lease liabilities increase as a result of interest charged at a constant rate on the balance outstanding and are reduced for lease payments made. Right-of-use assets are amortised on a straight-line basis over the remaining term of the lease or over the remaining economic life of the asset if, rarely, this is judged to be shorter than the lease term.

2 Judgements and key sources of estimation uncertainty

In the application of the accounting policies, the directors are required to make judgements, estimates and assumptions about the carrying amount of assets and liabilities that are not readily apparent from other sources. The estimates and associated assumptions are based on historical experience and other factors that are considered to be relevant. Actual results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognised in the period in which the estimate is revised where the revision affects only that period, or in the period of the revision and future periods where the revision affects both current and future periods.

Critical judgements

The following judgements and estimates have had the most significant effect on amounts recognised in the financial statements.

Share-based payments

Estimating fair value for share based payment transactions requires determination of the most appropriate valuation model, which depends on the terms and conditions of the grant. This estimate also requires determination of the most appropriate inputs to the valuation model including the expected life of the share option or appreciation right, volatility and dividend yield and making assumptions about them. For the measurement of the fair value of equity settled transactions with employees at the grant date, the Group and Company use the Black Scholes model.

Impairment of Capitalised Exploration Costs

Group capitalised exploration costs had a carrying value as at 30 June 2025 of €36,758,607 (31 December 2024: €34,202,236), which solely relate to the Zinnwald Lithium Project, Management tests annually whether capitalised exploration costs have a carrying value in accordance with the accounting policy stated in note 1.6. Each exploration project is subject to a review either by a consultant or an appropriately experienced Director to determine if the exploration results returned to date warrant further exploration expenditure and have the potential to result in an economic discovery. This review takes into consideration long-term metal prices, anticipated resource volumes and grades, permitting and infrastructure as well as the likelihood of on-going funding from joint venture partners. In the event that a project does not represent an economic exploration target and results indicate that there is no additional upside, or that future funding from joint venture partners is unlikely, a decision will be made to discontinue exploration.

In

3 Segmental reporting

The Group operates solely in the

|

|

|

|

Total |

|

|

2025 |

2025 |

2025 |

|

|

€ |

€ |

€ |

|

|

|

|

|

|

Administrative expenses |

(408,321) |

(856,352) |

(1,264,673) |

|

Share based payment charge |

- |

(380,545) |

(380,545) |

|

Loss on foreign exchange |

(1,542) |

(17,846) |

(19,388) |

|

Other operating income |

21,201 |

10,782 |

31,983 |

|

Finance income |

7,661 |

16,021 |

23,682 |

|

Interest Paid |

(1,243) |

- |

(1,243) |

|

Tax |

(6,501) |

- |

(6,501) |

|

|

|

|

|

|

Loss from operations per reportable segment |

(388,745) |

(1,227,940) |

(1,616,685) |

|

|

|

|

|

|

As at 30 June 2025 |

|

|

|

|

Reportable segment assets |

35,328,329 |

7,008,585 |

42,336,914 |

|

Reportable segment liabilities |

1,883,740 |

35,363 |

1,919,103 |

|

|

|

|

|

|

|

|

|

Total |

|

|

2024 |

2024 |

2024 |

|

|

€ |

€ |

€ |

|

|

|

|

|

|

Administrative expenses |

(520,159) |

(808,446) |

(1,328,605) |

|

Share based payment charge |

- |

(304,818) |

(304,818) |

|

Gain on foreign exchange |

- |

99,296 |

99,296 |

|

Other operating income |

68,415 |

- |

68,415 |

|

Finance income |

- |

241,332 |

241,332 |

|

Interest Paid |

(2,191) |

- |

(2,191) |

|

|

|

|

|

|

Loss from operations per reportable segment |

(453,935) |

(772,636) |

(1,226,571) |

|

|

|

|

|

|

As at 30 June 2024 |

|

|

|

|

Reportable segment assets |

30,156,337 |

10,911,880 |

41,068,217 |

|

Reportable segment liabilities |

2,062,391 |

153,905 |

2,216,296 |

|

|

|

|

|

4 Operating loss

|

|

2025 |

2024 |

|

|

€ |

€ |

|

Operating loss for the period is stated after charging / (crediting) |

|

|

|

|

|

|

|

Exchange losses / (gains) |

19,388 |

(99,296) |

|

Depreciation of Right of Use Assets |

59,531 |

66,194 |

|

Depreciation of owned property, plant and equipment |

32,359 |

30,457 |

|

Amortisation of intangible assets |

1,053 |

13,494 |

|

Gain on disposal of fixed assets |

(840) |

- |

|

Share-based payment expense |

380,545 |

304,818 |

|

Operating lease charges |

25,550 |

44,906 |

|

Exploration costs expensed |

316,586 |

423,407 |

|

|

|

|

5 Other operating income

|

|

2025 |

2024 |

|

|

€ |

€ |

|

Other operating income |

31,983 |

68,415 |

|

|

|

|

Other operating income includes income for use of hydrogeological data. Prior period primarily comprised rental and utilities income from sub-lessors at the Group's former offices in Freiberg.

6 Finance income

|

|

2025 |

2024 |

|

|

€ |

€ |

|

Interest income |

|

|

|

Interest on bank deposits |

23,682 |

241,332 |

|

|

|

|

7 Earnings per share

|

|

2025 |

2024 |

|

|

€ |

€ |

|

|

|

|

|

Weighted average number of ordinary shares for basic earnings per share |

477,159,468 |

474,458,825 |

|

|

|

|

|

Effect of dilutive potential ordinary shares |

|

|

|

- Weighted average number of outstanding share options/RSUs and PSUs |

28,907,354 |

22,276,104 |

|

|

|

|

|

Weighted average number of ordinary shares for diluted earnings per share |

506,066,822 |

496,734,929 |

|

|

|

|

|

|

|

|

|

Earnings |

|

|

|

Continuing operations |

(1,616,685) |

(1,226,571) |

|

Loss for the period for continuing operations |

|

|

|

|

|

|

|

Earnings for basic and diluted earnings per share distributable to equity shareholders of the company |

(1,616,685) |

(1,226,571) |

|

|

|

|

|

Earnings per share for continuing operations |

|

|

|

Basic earnings per share |

|

|

|

Basic earnings per share |

(0.33) |

(0.25) |

|

|

|

|

There is no difference between the basic and diluted earnings per share for the period ended 30 June 2025 or 2024 as the effect of the exercise of options would be anti-dilutive.

8 Intangible Assets

|

|

|

|

Total |

|

|

|

|

€ |

|

Cost |

|

|

|

|

At 1 January 2025 |

|

|

34,207,732 |

|

Additions - group funded |

|

|

2,557,424 |

|

|

|

|

|

|

At 30 June 2025 |

|

|

36,765,156 |

|

|

|

|

|

|

Amortisation and impairment |

|

|

|

|

At 1 January 2025 |

|

|

5,496 |

|

Amortisation charged for the period |

|

|

1,053 |

|

|

|

|

|

|

At 30 June 2025 |

|

|

6,549 |

|

|

|

|

|

|

Carrying amount |

|

|

|

|

At 30 June 2025 |

|

|

36,758,607 |

|

|

|

|

|

Intangible assets comprise capitalised exploration and evaluation costs (direct costs, licence fees and fixed salary / consultant costs) of the

9 Property plant and equipment

|

|

Leasehold, land and buildings |

Fixtures, fittings and equipment |

Motor vehicles |

Total |

|

|

€ |

€ |

€ |

€ |

|

Cost |

|

|

|

|

|

At 1 January 2025 |

100,990 |

458,914 |

66,593 |

626,497 |

|

Additions |

8,400 |

2,686 |

- |

11,086 |

|

Disposals |

- |

(840) |

- |

(840) |

|

Exchange adjustments |

- |

(260) |

- |

(260) |

|

|

|

|

|

|

|

At 30 June 2025 |

109,390 |

460,500 |

66,593 |

636,483 |

|

|

|

|

|

|

|

Depreciation and impairment |

|

|

|

|

|

At 1 January 2025 |

- |

151,559 |

44,185 |

195,744 |

|

Depreciation charged for the period |

- |

25,717 |

6,642 |

32,359 |

|

Disposals |

- |

(840) |

- |

(840) |

|

Exchange adjustments |

- |

(226) |

- |

(226) |

|

|

|

|

|

|

|

At 30 June 2025 |

- |

176,210 |

50,827 |

227,037 |

|

|

|

|

|

|

|

Carrying amount |

|

|

|

|

|

At 30 June 2025 |

109,390 |

284,290 |

15,766 |

409,446 |

|

|

|

|

|

|

10 Right of Use Assets and Lease Liabilities

In May 2024, Zinnwald Lithium GmbH entered into two new commercial lease agreements for an office in Dresden and a Core Shed in Altenberg. The duration of both leases are for 3 years and expire in April 2027. The Dresden lease can be renewed for two further 3-year periods in 2027 and 2030. The Altenberg lease can be renewed for a further 3-year period in 2027 and a further 4-year period in 2030. The monthly combined leases instalments are €10,515 per month, fixed for the duration of the leases. The monthly combined leases instalments are €10,515 per month, fixed for the duration of the leases. Movements in the period are shown as follows:

|

|

|

|

Total |

|

|

|

|

€ |

|

Right of Use Asset |

|

|

|

|

At 1 January 2025 |

|

|

279,566 |

|

Depreciation in the period |

|

|

(59,531) |

|

|

|

|

|

|

At 30 June 2025 |

|

|

220,035 |

|

|

|

|

|

|

Lease Liability |

|

|

|

|

At 1 January 2025 |

|

|

283,339 |

|

Interest charged in the period |

|

|

4,242 |

|

Lease payments in the period |

|

|

(63,090) |

|

|

|

|

|

|

At 30 June 2025 |

|

|

224,491 |

|

|

|

|

|

|

- Recognised in short-term payables |

|

|

120,693 |

|

- Recognised in payables > 1 year |

|

|

103,798 |

11 Trade and other receivables

|

|

30 June 2025 |

31 December 2024 |

|

Amounts falling due within one year: |

€ |

€ |

|

Trade Receivables |

2,274 |

439 |

|

Other taxation and social security |

8,025 |

- |

|

Other receivables |

138,807 |

235,344 |

|

Prepayments and accrued income |

132,304 |

135,359 |

|

|

|

|

|

At period end |

281,410 |

371,142 |

|

|

|

|

12 Trade and other payables

|

|

30 June 2025 |

31 December 2024 |

|

Amounts falling due within one year: |

€ |

€ |

|

Trade payables |

105,250 |

343,391 |

|

Other taxation and social security |

- |

61,465 |

|

Other payables |

31,456 |

61,234 |

|

Accruals and deferred income |

175,038 |

640,494 |

|

|

|

|

|

At period end |

311,744 |

1,106,584 |

|

|

|

|

13 Share based payment transactions

|

|

30 June 2025 |

30 June 2024 |

|

Expenses recognised in the period |

€ |

€ |

|

Options issued under the Share Option Plan (2017) |

128,203 |

104,158 |

|

RSUs issued under RSU Scheme (2020) |

192,173 |

151,007 |

|

PSUs issued under PSU Scheme (2020) |

60,169 |

49,653 |

|

|

|

|

|

At period end |

380,545 |

304,818 |

|

|

|

|

Awards made under the various share incentive schemes will be expensed over the relevant vesting periods for each scheme. On 31 January 2025. a total of 3,600,000 Options were granted to employees, consultants and Directors of the Group at a price of 7.50p, together with 2,624,814 RSUs and 694,061 PSUs to the Executive Directors.

Options and PSUs have been expensed based on a Black Scholes calculation using an option life of 5 years and a risk-free interest rate of 3.9%. The Company has used a volatility rate of 64.1% looking back 4 years from the date of grant to account for the material distorting event of the Company's readmission to AIM in October 2020 following its reverse takeover acquisition of the Zinnwald Project. The Company will use a 5 year look back for all future grants going forward.

14 Share Capital

|

|

30 June 2025 |

31 December 2024 |

|

Ordinary share capital |

€ |

€ |

|

Issued and fully paid |

|

|

|

542,354,605 ordinary shares of 1p each (2024: 474,536,675) |

6,167,588 |

5,377,253 |

|

|

|

|

The Group's share capital is issued in GBP £ but is converted into the functional currency of the Group (Euros) at the date of issue of the shares.

|

Reconciliation of movements during the period: |

|

|

|

|

Ordinary Number |

Ordinary Value |

|

|

€ |

€ |

|

Ordinary shares of 1p each |

|

|

|

At 1 January 2025 |

474,536,675 |

5,377,253 |

|

Issue of fully paid shares |

67,817,930 |

790,335 |

|

|

|

|

|

At 30 June 2025 |

542,354,605 |

6,167,588 |

|

|

|

|

15 Cash (used in)/generated from group operations

|

|

2024 |

2024 |

|

|

€ |

€ |

|

Loss for the period after tax |

(1,616,685) |

(1,226,571) |

|

Adjustments for: |

|

|

|

Investment income |

(23,682) |

(241,332) |

|

Lease interest |

4,242 |

2,191 |

|

Gain on disposal of fixed assets |

(840) |

- |

|

Depreciation of Right of Use Assets |

59,531 |

66,194 |

|

Depreciation of property, plant and equipment |

32,359 |

30,457 |

|

Amortisation of Intangible Assets |

1,053 |

13,494 |

|

Equity-settled share-based payment expense |

380,545 |

304,818 |

|

RSUs expensed in previous period |

- |

(74,862) |

|

Movements in working capital: |

|

|

|

Decrease / (Increase) in trade and other receivables |

89,731 |

(52,665) |

|

Decrease in trade and other payables |

(794,839) |

(976,489) |

|

|

|

|

|

Cash used in operations |

(1,868,585) |

(2,154,765) |

|

|

|

|

16 Events after the reporting date

There are no events after the balance sheet date to report.

17 Approval of interim condensed consolidated financial statements

These interim condensed financial statements were approved by the Board of Directors on 25 September 2025.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.