Five companies that have solid management, decent ROIC, and large addressable markets

Companies: DPP, FUL, GYM, CAKE, TRC

At Research Tree, we love roll-out stocks. Whether that's firms that have a proven and successful offering, or those in the process of rolling out their product to new markets. Fundamentally each needs to have three things: Solid management (preferably with experience of roll-outs), decent ROIC (return on invested capital), and large addressable markets!

In this blog, we look at five rocking roll-out stocks that are listed in the UK, mostly on the AIM-market...

1) Patisserie Holdings

My personal favourite of the roll-out stocks is Patisserie Holdings, the company behind the beloved, unashamedly middle-class cake brand, Patisserie Valerie.

CAKE (possibly one of the best tickers you'll come across) has created a hugely successful and scalable cafe concept by focussing on high-quality cakes, coffee, and atmosphere.

Its financials are as impressive as its cakes... this profit-making machine has recently reported its 10% consecutive quarter of growth, boosting profits 20% YoY. Regarding its status as a great roll out, the numbers speak for themselves - it has a return on invested capital of over 50% and a CAPEX unit cost of around £250k, meaning each unit is paid off in just 1.9 years.

Lastly, CAKE is in safe hands with Chairman Luke Johnson, well known from his days at Pizza Express and Strada. Luke has been involved with some of the most successful restaurant chains in the UK in the past few decades.

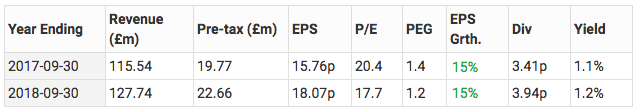

Share price, valuation, and forecasts

CAKE's share price has grown steadily since its mid-2014 IPO, hitting highs of £4 in early 2016. Since then shares have fallen 27% giving the firm a market cap of £306m and a forward P/E of 22.5.

It's forecasting a steady 15% EPS growth in each of the next two years, and a doubling dividend between now and 2018!

2) Fulham Shore

Here's one you might not have heard about, London-based restaurant operator Fulham Shore. This AIM-stock owns and operates two of London's up-and-coming food chains: Franco Manca and the Real Greek. It also runs a Bukowski Grill on a franchise basis.

For those who haven't heard (or visited) any of these, all three (and especially Franco Manca) have cult-like status in London, located at cool pop-up areas in some of London's most affluent areas.

As a roll-out, Fulham Shore is one of the more expensive. It appears to have an particularly high CAPEX per unit that it opens, sitting at c.£800k, and its EBITDA per unit looks to average c.£200k, giving an ROIC (return on invested capital) of 25%. This is probably primarily due to the high-cost locations that it chooses for its restaurants.

As the Naked Fund Manager wrote a few weeks ago, one of the reasons FUL is particularly interesting is due to the management team:

"David Page oversaw much of the Pizza Express growth as CEO and Chairman. He founded the Clapham House Group, owner of GBK and Bombay Bicycle Club. He and his team clearly know how to roll out a winning concept."

Share price and valuation

FUL's share price jumped 200% in the first two months after its listing at the end of 2014 but has since fluctuated between 13 and 23p. It currently sits at around 17p, giving a market cap of a little over £100m on a pretty massive P/E of more than 200x!

Ps... If you visit Brixton Village (Market Row), you can see the original branch of Franco Manca and a Bukowski's right next to each other!

3) Revolution Bars

I hold a long position in RBG

Revolution Bars is a particularly well-followed AIM-listed roll-out stock that operates Revolution (Vodka Revs) and Revolucion De Cuba and is championed by well-known small-cap blogger Paul Scott, amongst others.

RBG is a solid roll-out stock because of its 33% ROIC. Each unit has a CAPEX of around £900k and earns £300k in EBITDA per year on average. This means RBG can pay for a new unit in just three years!

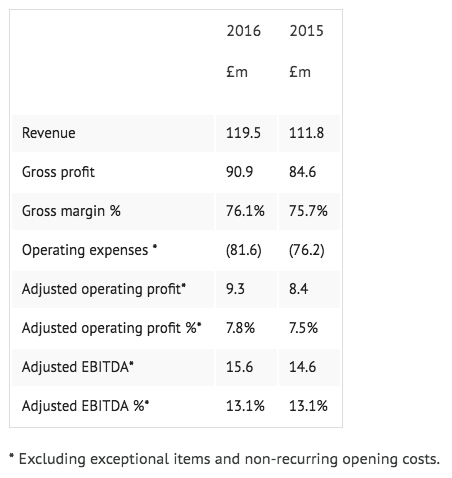

Its financials are also quite impressive, in its most recent full-year results it posted robust growth and came in just ahead of expectations on revenue:

RBG's shares are up 13% since it re-listed in mid-2015, and have gone up 46% since October. It is worth considering that this stock is quite illiquid so fluctuates quite dramatically on an intraday basis.

4) Gym Group

Gym Group is one of the several operators on the lower-end of the gym chain market in the UK, offering a low-cost, stripped down, 24/7 gym that undercuts lots of the competition. It's expanding quickly with an "estate" of 89 gyms at year end and a strategy to open 15-20 new gyms per year.

GYM is very new to the AIM-market, having listed at the end of last year. Since it's 201p IPO, the firm has hit highs of 274 and lows of 165p, but currently, trades on 185p. This gives a market cap of £237M and a forward P/E of about 44x.

Gym Group's roll-out economics are robust, too. It has a CAPEX unit cost of c.£1.5m, but with an annual EBITDA per unit of £500k, it pays off each gym in just three years.

In its most recent full-year results, the firm swung to profit, reporting 22.6% revenue growth, adj EBITDA growth of 33.4% (£22.7m), and pre-tax profit of £8.7m. Membership numbers hit 450k by the end of the year, and have since increased to nearly 500k.

5) DP Poland (Domino's Pizza)

Last but not least, is DP Poland - the Polish listed manifestation of Domino's Pizza. DP Poland is an excellent example of a company taking a proven business model with a well-integrated online offering that is demonstrably popular with customers in the UK and applying it to an under-saturated market.

DP's unit economics are pretty sound - with an estimated CAPEX per unit of around £160k and a modest £60k EBITDA per unit, too. This means DP Poland should repay each unit in just over 2.5 years, giving a strong ROIC of nearly 40%.

Finally, DP has a market cap of £72m and its share price has rocketed 600% since 2014.

When considering the potential of roll-out stocks, investors need to make sure the company has decent management with a proven track record, a nice return on invested capital, and a big enough addressable market to expand in to.