A useful quantitative assessment of the relative potential of each smidcap company...

Companies: TTR, DEBS, ECOR, ELA, FCRM, MAI, NEXN, VEC

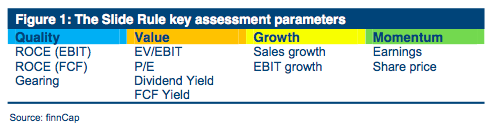

Last month, finnCap published a report called "The Slide Rule" outlining its methodology for simplifying the process to identify the best companies in the small-mid cap sector. Below is an extract from that report.

What is The Slide Rule?

The Slide Rule has been designed to dramatically simplify the identification of the best companies in the UK small/mid-cap sector by making a quantitative assessment of the relative potential of each company. At its core, The Slide Rule aims to identify those companies that create genuine shareholder value through strong returns on capital and solid growth, but also present a value opportunity with the potential tailwind of earnings momentum. Companies are assessed within a Quality, Value, Growth and Momentum (QVGM) framework.

What can The Slide Rule do?

Lots of things. Primarily, rank or screen nearly 500 small/mid-cap companies on 11 key quality, value, growth or momentum metrics, or any blend thereof. We have defined a QVGM-rank for each company based on a proprietary blend of the metrics and, using this, created a ‘Robo Portfolio’ based on the Top 30 companies which we will track over time. We have developed standard screens for 'Undiscovered gems', 'Building momentum' and 'Debt traps'. The Slide Rule could also be used to assess IPOs, look for takeover targets or companies with pension liability issues.

Which companies are included?

The Slide Rule universe includes approximately 500 companies that have proper revenues, profits and cashflows in the £50m-£2bn market cap range. These companies are predominantly in the tech, support services, consumer, media and industrial sectors but there are a smattering of companies in oil, mining and specialty finance sectors as well. The full alphabetical list of companies analysed by The Slide Rule, along with their respective quality, value, growth, momentum and overall QVGM rank, is included at the back of this report.

What are the identified top picks?

Our QVGM portfolio of Top 30 companies for Q1 2017 includes established performers such as boohoo.com, Fevertree and Fulcrum but also more off the beaten track names such as Taptica, Learning Technologies and Stride Gaming.

To read the full report and follow how finnCap's Slide Rule progresses throughout 2017, join Research Tree today. You can get your first month for free using the code RTSIGNUP25.