Interested in high growth pharma and biotech stocks?

Pharmaceutical and biotech stocks are essentially the shares of healthcare companies with a focus on developing, manufacturing and distributing pharmaceutical products, such as drugs, medicines and vaccines.

The biotechnology industry includes businesses that develop drugs and diagnostic technologies for the treatment of diseases and medical conditions. This includes both smaller start-up companies as well as large, well-established corporations that intend to develop a range of drugs and technologies.

Constant scientific and technological advances help generate new and innovative ways to treat and avert diseases, and this has naturally led to the biotech sector in particular presenting exciting opportunities for investors looking for high-growth opportunities.

What drives changes in a pharma or biotech share price?

Investing in pharmaceutical stocks appears to be a widespread trend during periods of economic or political instability, we have further witnesses this on a large scale due to the Covid-19 crisis. Pharma shares have been in particularly high demand simply because they manufacture products and equipment which have been in high global demand.

Indeed, the pandemic has also created massive opportunities for biotechnology companies that are developing treatments and vaccines for the virus.

Whilst during the pandemic we have seen certain vaccines and medicines fast-tracked through production, this is not usually the case for businesses looking to bring a new drug to market. The products these companies work on developing must go through strict, costly, and time-consuming trials before potentially earning approval from a country’s regulatory board. This means that investors may wait for years before knowing whether a drug under development will financially pay off, but equally, if approved the rewards can be high.

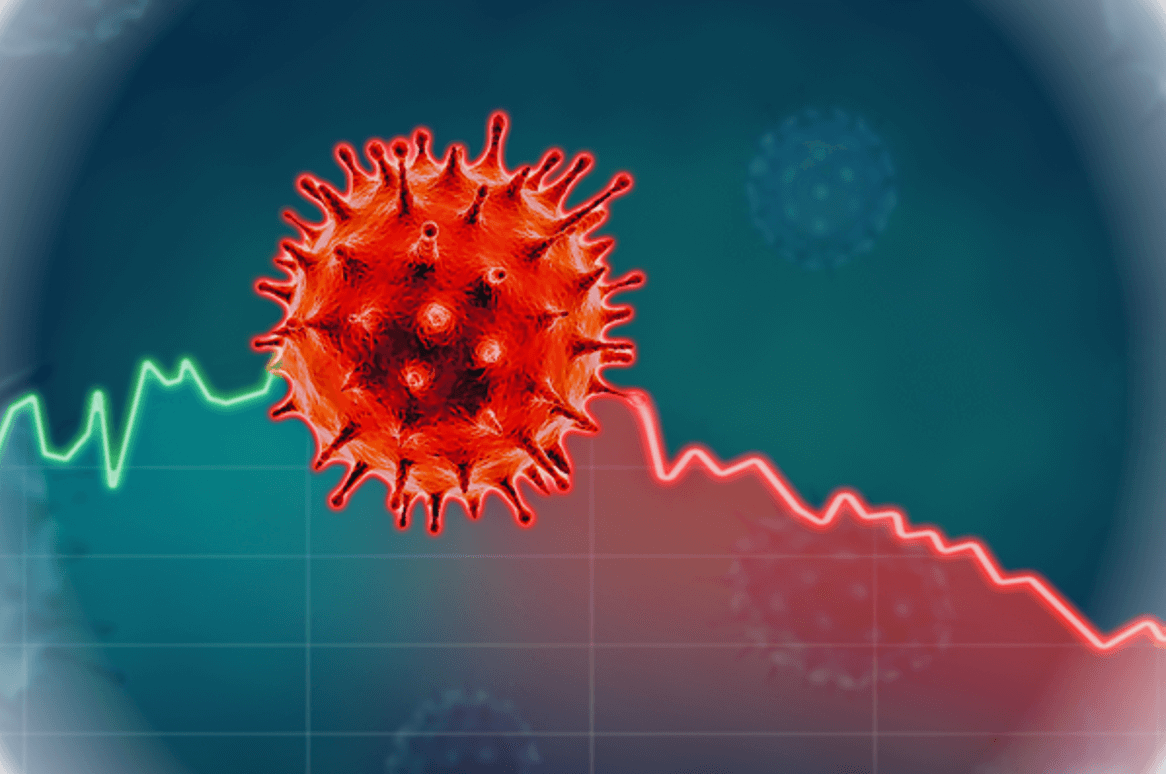

The nature of this industry can lead to sudden sharp increases or decreases in share price, depending on the news a company receives surrounding their developing product.

Pharma and Biotech stocks to watch

Which Pharma and Biotech companies are experiencing high growth? Here is a selection of pharma and biotech stocks that are publically traded. You can read more detailed broker research notes about them here on Research Tree.

We have highlighted below a selection of UK listed pharma and biotech stocks that could be of interest:

e-Therapeutics plc (Market cap: £217m)

e-Therapeutics are an Oxford-based company with a unique and powerful computer-based drug discovery platform, and a specialised approach to network biology.

The platform is able to progress drug discovery programmes through creating computational networks that can precisely represent biological processes. The networks built can be compared and evaluated against a database of roughly 15 million compounds to understand and comprehend novel cellular mechanisms, identify new drug targets, and predict compound activity. The developed platform can identify promising candidates in less time, and at a lower cost, compared to standard and traditional approaches. This can be understood in more detail here on their company website.

Since listing in 2007 the stock is overall down 37%. However, it has performed strongly across the last five years and has increased in value by 458% (21/12/16 - 21/12/21).

If you’re interested in discovering professionally produced broker research on e-Therapeutics then click HERE to view its dedicated page on Research Tree.

Skinbiotherapeutics plc (Market cap: £65m)

SkinBioTherapeutics is focused on targeting five specific skin healthcare sectors; cosmetics skincare, food supplements for the treatment of skin conditions, medical skin care, infection control in both the home and the hospital environment and pharmaceuticals for the prescribed treatment of skin conditions. The business strategy is to eventually partner and out-license its programmes at proof of concept, this can read in more detail here.

The launch of the company’s first product, AxisBiotix-Ps in October, has helped boost the share price up 175% compared to this time last year (21/01/21 - 21/12/21).

If you want to find broker research about Skinbiotherapeutics plc, then click HERE to view its dedicated page on Research Tree. You will be able to see broker research, RNS announcements, videos and podcasts all in one centralised place.

Oxford BioMedica plc (Market cap: £1bn)

Oxford Biomedica is a gene and cell therapy company specialising in the development of gene-based medicines. The company has come under more focus since the pandemic arrived, and has played a leading role in one of the vaccines being developed as explained here. They signed a three-year master supply and development agreement with AstraZeneca for large-scale manufacturing of the adenoviral based COVID-19 vaccine.

Since listing, the stock is down 53% overall. However the company has had a strong run for the past five years, and as such the share price has surged upwards 450% (21/12/16 - 21/12/21).

Want to find out more about Oxford Biomedica? Then click HERE to view its dedicated page on Research Tree, where you can find a mixture of relevant broker research, RNS announcements, videos and podcasts.