KWS is a high-quality company with a strong Balance Sheet, pricing in a lot of growth from current levels.

Companies: Keywords Studios PLC Unsponsored ADR

The Focus Stock this week is Keyword Studios, a high growth company that is both incredibly acquisitive and enjoying robust organic growth. KWS is a quality operator with a strong Balance Sheet that could comfortably carry more debt. Management has a clear strategic direction and operates in a fragmented market.

The shares trade at a premium after a 300% rise over the last 15 months, and as with any growth company, it’s hard to know whether today’s price has got ahead of itself, or that, looking back in a few years time, today’s level will have been a bargain.

Below I briefly outline what the business does, the nature of the market it operates in, and the level of competition it faces. I also run through a valuation exercise to demonstrate what growth the shares are currently pricing in and how acquisitions might affect this.

Keywords Studios

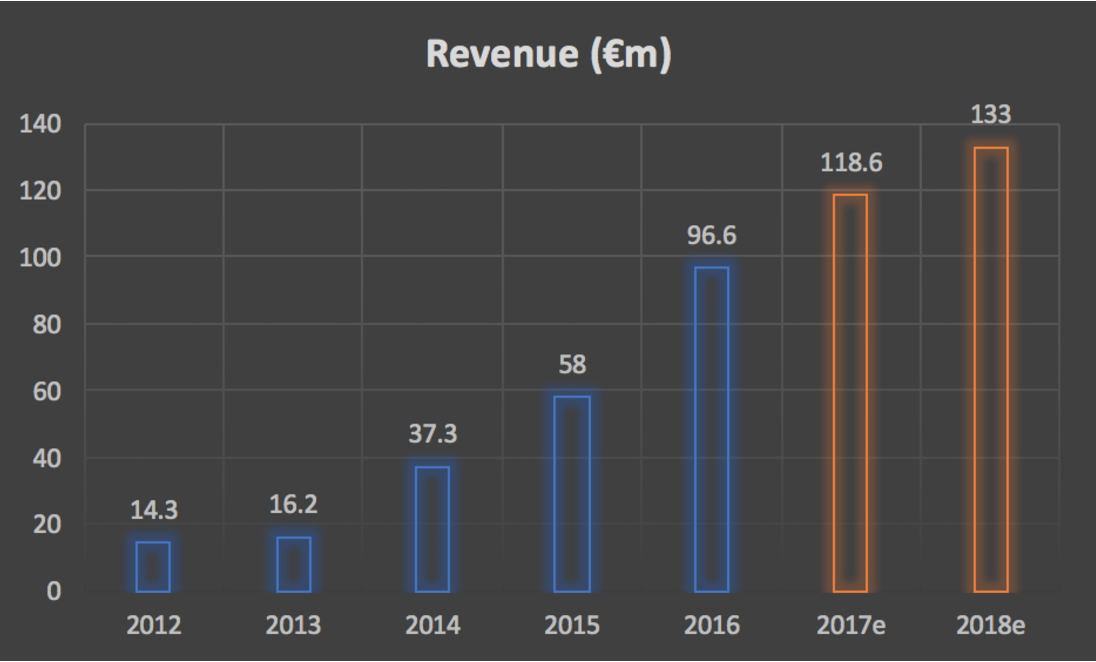

The Group is comprised of six globally managed service lines operating from 27 production studios spread across 16 countries. It has expanded rapidly since IPO, at which time it only had five studios, and has increased its earnings by an impressive 290% over the period and a 62% Revenue CAGR since 2012.

Some stats

Founded: 1998

IPO: July 2013

IPO Price: 145p

Current Price: 718p

Market Cap: £383.7m

Enterprise Value: £380.4m

Revenue: £65.3m

Shares in issue: 54.43m

PE (2017e) vs Sector PE: 37x vs 28x

What does Keywords do?

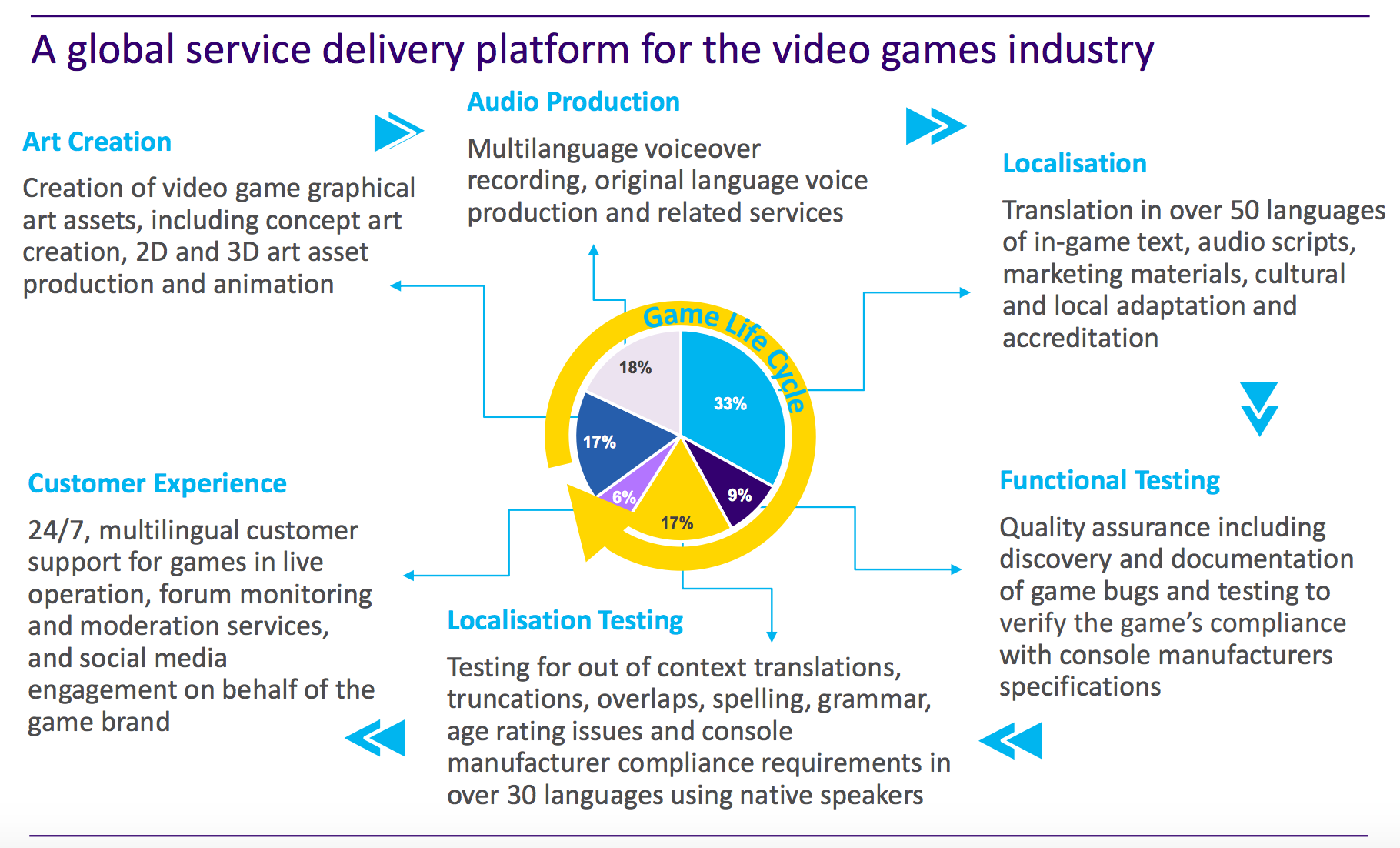

KWS is a provider of services to the major global game developers. It has expanded its offering to cover art creation, audio production, localisation (i.e., language translation), testing and customer experience. There is a useful slide describing its business in the latest presentation last week.

Who are the competitors?

In early 2016 KWS acquired Synthesis, the second biggest company in the market, cementing its position as the dominant business in the industry and taking its market share from 10% to 15%. It is now clearly in a dominant market position:

- In the wider gaming market, it counts 21 of the top 25 companies by revenue as clients.

- In the fast growing Mobile Gaming Developers market, it services 7 of the top 10 companies.

To illustrate the point, below is a list of its primary clients in both verticals, showing its focus on the top end of the market is working well.

The fact that KWS is the biggest operator in the market with a 15% share shows how fragmented the market is. This presents an opportunity for KWS to continue to pick of much smaller competitors at lower multiples to bolster its position and increase the touch points it has with the big spending game developers.

How big is the market?

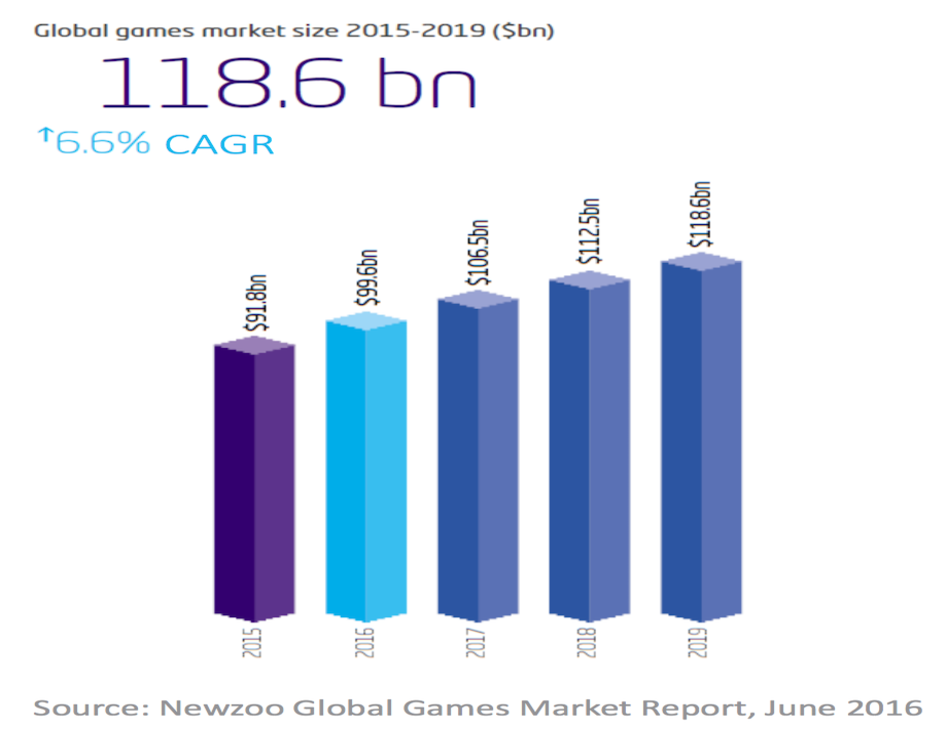

The gaming market is expected to continue to grow over the coming years as games become more complex, with richer environments, greater connectivity and collaboration of users, and new technologies such as VR and AR become the norm.

Newzoo Global Games estimate the size of the market is currently c.$100bn of revenues per annum and will grow to c.$120bn by 2019.

Keywords Management points to a clear demand from the big game developers to increase the amount they outsource to specialist agencies, especially for work elements that are not “core” or IP-related. It appears, therefore, that the addressable opportunity is a growing share of a structurally growing market.

300% recent rise in share price

The shares have been on a tear for the last 15 months, with a 300% rise, as its operations and new acquisitions have outperformed.

The company raised guidance and completed eight acquisitions over 2016, including that of its biggest competitor Synthesis, which has then gone on to perform robustly.

What is the investment rationale?

The primary value proposition of Keyword Studios in my view is that it is building a complete offering for game developers by acquiring the various services from multiple smaller companies in what has been a highly fragmented market. This benefits the developers as it allows them to streamline their business and concentrate their time and effort on the high-value end of the process, i.e., game creation and IP. It makes far more sense for other services down the chain to be housed within a trusted third party, rather than keeping the costs on your Balance Sheet.

The other benefit connected to this is one of efficiency. As mentioned above, the primary services KWS currently offers are art, voice, localisation (i.e., language translation) and functionality testing. These units are far more likely to be fully utilised when working in an agency environment like KWS, rather than having duplication across the game developers. The game developers can then dial up and dial down the costs as needed.

Future growth looks set to continue to be both organic, through increasing cross-selling of KWS’s current offering to its client base, and inorganic. CEO Andrew Day highlighted in the FY Results presentation that the company had extended its borrowing facility and the cash generation of the business certainly gives scope to use debt to acquire further businesses. KWS currently has c.€8m in net cash on the Balance Sheet but could comfortably borrow €30m on current cash generation and more as its capital base increases, while still remaining within around 2x EBITDA.

What are the analysts pricing in for future growth?

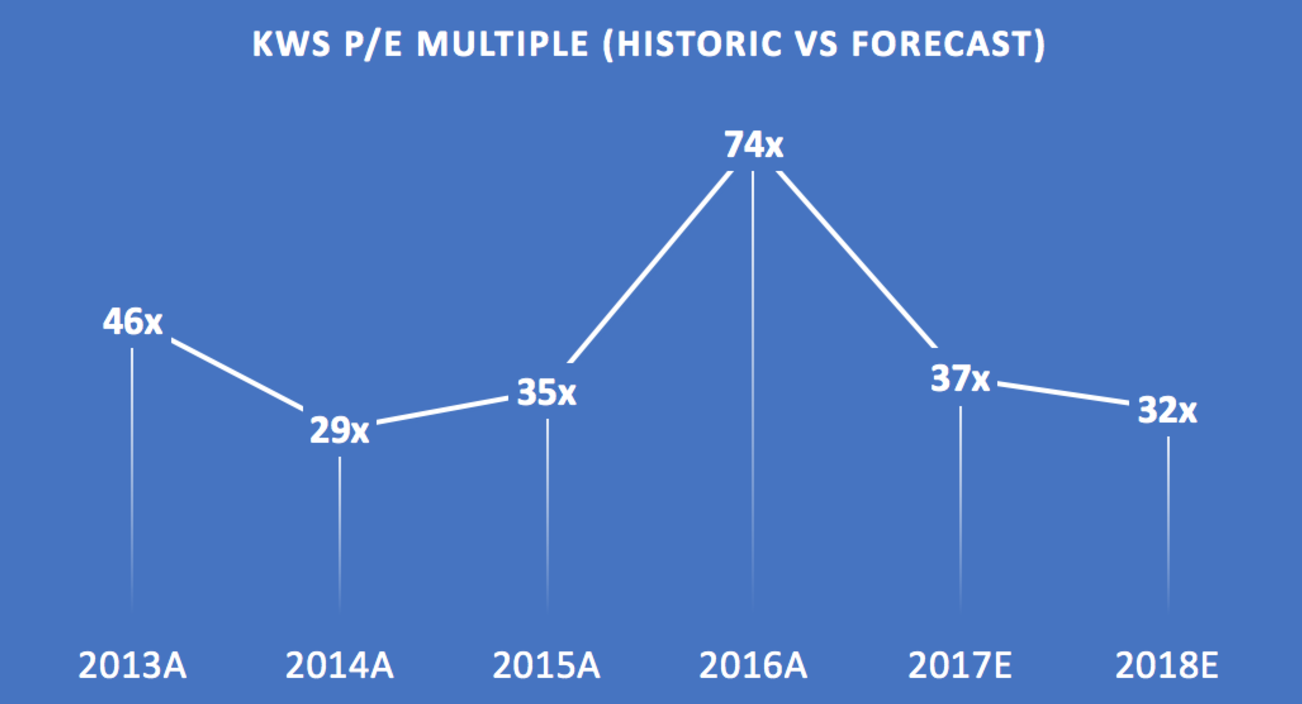

The below graph shows the multiple of earnings the stock was trading at around each FY reporting date since the 2013 list. It also shows what multiple of consensus forecast earnings KWS trades on today based on the consensus figures taken from Stockopedia.

The earnings multiple expansion that occurred in 2016 and early 2017 is clearly shown by the 2016 spike in the above graph. The lower forecasts multiples for 2017 and 2018 are an indication of the level of growth expected by analysts.

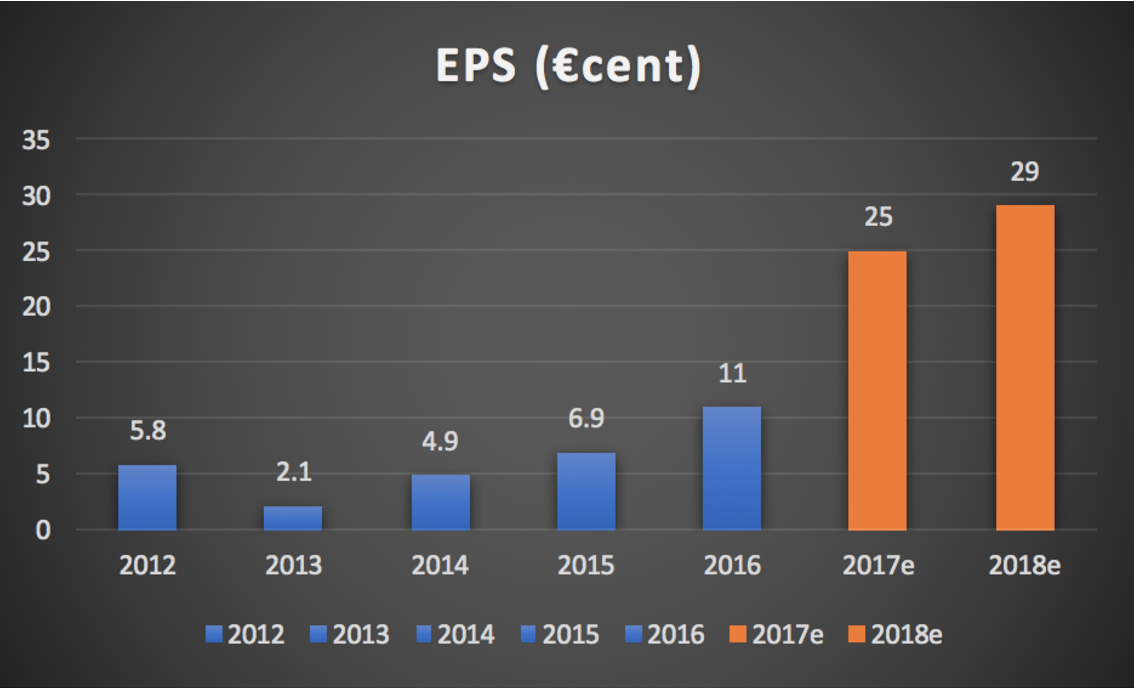

The below shows KWS’s impressive revenue and EPS delivery over the last five years, and the consensus expectations of future growth over the next couple years.

Analysts are expecting KWS to continue growing at a rapid rate. But what is the market discounting?

What is the market pricing discounting?

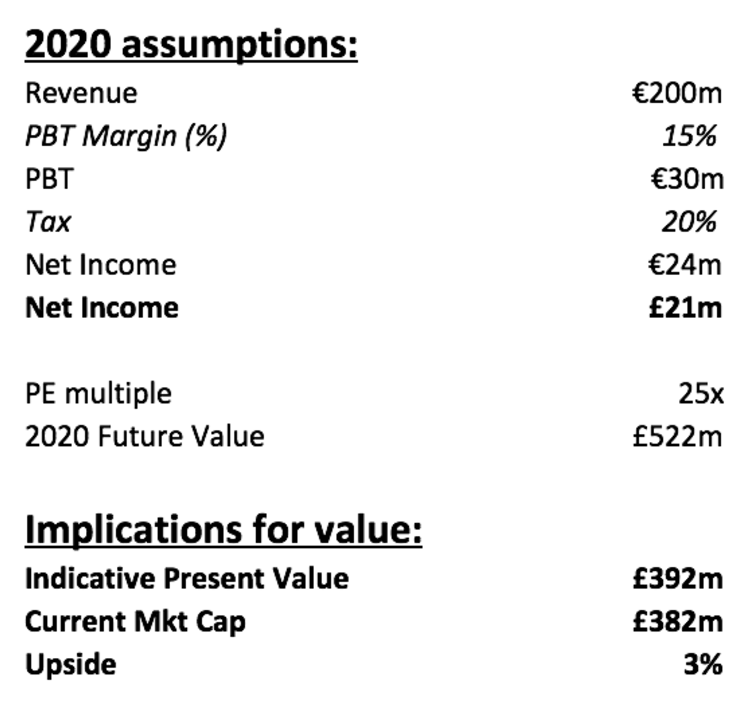

Using a set of pretty uncontroversial assumptions, it becomes apparent that the market is baking in a lot of future growth.

I’ve taken the bullish assumption that revenues reach €200m by 2020. That would imply a 20-25% topline growth over 2019 and 2020 from the €133m baked into consensus forecasts for 2018.

PBT margins are around 15% currently so a €200m revenue in 2020 might lead to a €30m profit before tax. Tax rates are around 20% so under this scenario Net Income would be €24m, or c.£20m.

The Software & IT Services sector trades on a 1-year forecast earnings multiple of around 28x. That’s a high multiple versus the broader market, which trades at just under 20x. If that holds by 2020, then it is reasonable to assume that KWS could be trading at c.25x earnings, especially considering it is currently trading at 34x 2017 forecast earnings and 29x 2018 forecast earnings.

Using a £20m Net Income for 2020 and a 25x PE multiple would put a value of £522m on the business in 2020. Discounting that back to today using a 10% discount factor for the intervening three years gives a value today of £392m, i.e., the current market cap priced into the market.

Conclusion

The above shows the market is already pricing in high growth over the next few years. If revenues double from current levels by 2020 and margins remain steady, and if the market continues to price KWS and its sector on a premium multiple compared to other sectors, then the fair value is close to the current market cap.

This seems like a sensible scenario for the market to price in but it also means, as an investor, you’re already paying for that growth when you buy the shares at current levels.

What about the upside from acquisitions?

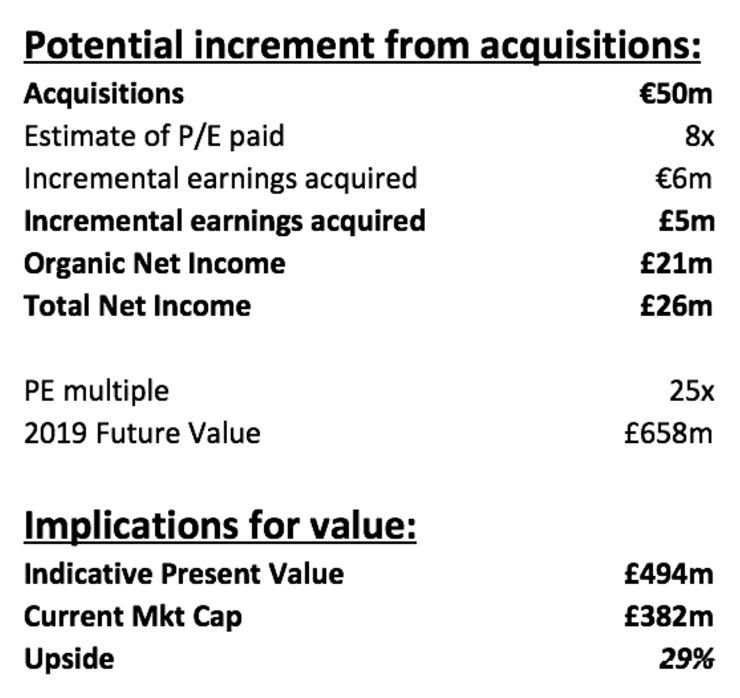

Taking this analysis a step further, Management has highlighted it will be gearing up with its new debt facility to continue its acquisitive trend. The Balance Sheet is currently sitting on a net cash position of c.€8m and could be more efficient by utilising more debt at the low current interest rates.

Edison analyst Dan Ridsdale expects €50m of acquisitions in an excellent note published last week. If we assume the above €200m of revenues is what KWS can achieve organically from here, with increased cross-selling of products and services for example, then there is upside from utilising its Balance Sheet more efficiently to acquire further earnings.

Based on historic PE multiples paid by KWS, 8-10x earnings appears a reasonable assumption of the cost of future acquisitions. If KWS spends €50m over the next few years that would add around £5m of Net Income assuming an average price paid of 8x Net Income. Adding this incremental £5m Net Income to the assumed £20m would result in a future Net Income in 2020 of around £25m, a future value using 25x earnings of £658m and a present value of £494m. That represents a 29% upside to the current market cap.

There is clearly scope to increase value for shareholders via acquisition. If you can pay 8-10x earnings for companies, then plug them into the business and be rewarded with a valuation of 25-30x earnings for the same income, that will not only add value for shareholders, it will also better serve Keyword Studios’ client base, and cement its position as a dominant force in the sector.

However, the fundamental questions that need to be asked to get a proper view of the ultimate value of a business like Keyword Studios:

- How big is the addressable market? And,

- How much of that market can KWS realistically expect to capture?

Once you have a reasonable understanding of those questions, you can begin to calculate the mature value of the business after all the acquisitions, and high organic growth has passed.

One potential constraint to growth would be another consolidating company moving into the market. The result of this would be a reduction in the attainable market for KWS, and an increase in the earnings multiples it would need to pay (above the current 8x-10x) to continue its acquisitions. The other impact of a serious competitor would be an erosion of the current 15% PBT margins.

Overall conclusion

In summary, KWS is clearly a high-quality company. It has a strong Balance Sheet, a clear strategic direction, a fragmented market to grow into, and a structurally growing customer base that is supportive of its business model.

As with any high-growth company, it's hard to know whether the price you pay as an investor is far too high, or that you will look back in a few years time at the growth the company achieved and realise it was actually a bargain.

Keyword Studios is certainly pricing in a lot of growth from current levels, and the above valuation exercise gives an idea of how much. The key, therefore, is to get an appreciation of the ultimate potential for growth and work back from there to reach a view.

-----

Please Note: Nothing in the above article should be treated as advice. I have no holding or beneficial interest in the above company.