Relatively low P/E after considerable earnings growth in a market that could face consolidation

Companies: Nexxen International Ltd.

Ad-Tech has been a sector much in focus recently, with lots of interest from private investors, and some excellent research being published by Analysts.

This week, Panmure Gordon published a bumper report on the sector, as part of its initiation on RhythmOne. According to analyst Jonathan Helliwell, the digital ad market is growing at an impressive 15% per year, but the bulk of this is being absorbed by Google and Facebook.

In this market, he argues that evolution and "intense consolidation" are likely with several factors driving consolidation:

- high fragmentation

- increasing standards

- the need to keep up with Facebook/Google

- increasing funding challenges

- strategic interest from other sectors

- (ad agencies, consultants, IT groups, telcos, publishers, Chinese investors).

With this in mind, we decided to take a further look at another player in the sector, Taptica. It is a company that has enjoyed a spectacular share price growth over the past year after a sequence of earnings upgrades, and one that could be part of any market consolidation that takes place.

Taptica International

Founded: 2011

Taptica International is an American-founded, Israeli-based, UK-listed Ad-Tech Demand-Side Platform.

Well, what does that mean?

Essentially, it's a bit like Google Adwords (Google's primary source of income), but while Adwords is exclusive to Google's network of websites/publishers, TAP's demand-side platform gives advertisers access to 50,000 sources, targetting users based on 1st party data (data from publishers).

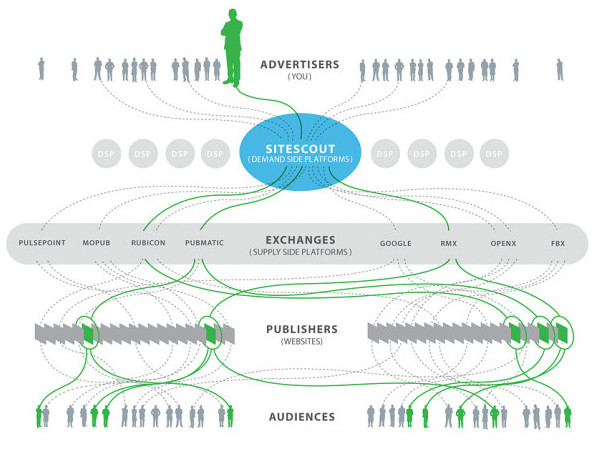

DSPs are basically programmatic marketing platforms that allow advert buyers (read: Marketers) to buy ad space across a huge swath of the internets' publishers/sites, including Google and FBX (Facebook).

This graphic, borrowed from the lovely people at Sitescout (also a DSP), is the best way to explain the difference:

Advertisers use a DSP to pay for ads/remarketing on various Ad Networks. Publisher sites meet those DSPs in the Ad Exchanges and an RTB (Real-Time Bidding) auction/transaction takes place almost instantaneously to determine the most suitable ad/cost for both bidder and seller...

Still not clear?

Have you ever played a smartphone game and an advert pops up, or read an article in a newspaper app and a tailored ad appears mid-article? That's where Taptica comes in. TAP is a mobile-focused platform that has its origins in the Gaming Market (Gaming Apps), but it now offers data-focused marketing services to advertisers across the globe.

The company uses AI (artificial intelligence), Machine Learning, and Big Data to target users with very specific ads suited to them based on a broad range of criteria. It also offers clients (i.e. marketers) a real-time analytics tool to help them not only become aware of unique user behaviours (tracking clicks, installs, and impressions), but also measure the quality of the new users based on demographics, engagement, and how they spend their money.

TAP handles a massive 22bn requests per day in 15 countries. It uses user's data from 17,000 campaigns, 600 clients, and has profiles on 220m users to help target people with effective messaging.

It works with more than 600 advertisers worldwide including Disney, Amazon, Facebook, Twitter, Starbucks, King.com, Lyft, HBO, Sony, Expedia, Zynga, EA, GREE, ngmoco, Hotel Tonight, Playtika and Game Insight, and more than 50,000 supply and publishing partners worldwide.

The Investment Case

Taptica has been gaining lots of attention in the past twelve months after enjoying a stonking 363% rise from its 63p lows last July. In that time, Brokers raised EPS forecasts four times, from 12.72p to 26.71p (an impressive 109% increase).

Despite that, its P/E is still relatively modest for a growing tech company, but this could be because of the uncertainty in earnings that has hampered the Ad-Tech industry in the past, as well as the discount that non-UK companies can sometimes be subject to on the AIM market.

TAP's growth is expected to slowdown after making considerable gains between 2015-16 (+66% revenue, ), falling to +26% in 2017 and +15% in 2018 according to consensus expectations. However, as the company raised forecasts several times in the past year, the upcoming trading update will be watched carefully by investors.

Sector Comparison

As mentioned above, TAP is trading at a slight discount to its peers on a forward P/E 14.4 compared to the sector-wide average of 18.7. This drops to 11x 2017e EPS of 27p, and 10.3x 2018e EPS of 28p.

While its P/E is modest, its PEG ratio is relatively high at 1.81x 2017E, i.e. investors will be paying 1.81x earnings per unit of growth.

It also has a relatively high price-to-book ratio of 5.4x, which is significantly higher than its sector average of 1.69. However, its book value is increasing and its ROE, which should be used to complement P/B ratios, is impressive at 34%:

"Companies with high growth rates are likely to have high P/B ratios. Divergence between the two measures, high P/B with a low ROE, can be a warning signal that shareholder equity is no longer increasing." - Investopedia

Stockopedia's handy relative valuation feature suggests TAP is c.6% undervalued compared to its peers.

*** Investors should be aware that its free float is relatively small at 29m shares (48%), and as its average trade volume is 160k, so its stock price could fluctuate a bit.

Conclusion

All in all, TAP has re-rated in the last year +363%, but this is primarily due to a recovery in earnings, rather than multiple expansion. The 14x reported earnings that it currently trades on is below the 33x that it traded on post-2015 results. In that year, earnings had slumped heavily it shifted emphasis away from the display business towards mobile and social. Looking back to 2014 for normalised level, the stock was still trading at 18x, i.e. above current levels.

Having said that, its shift towards focusing heavily on mobile services follows trends across the internet and it is well positioned to benefit from a growing digital ad market. Its ROE, ROCE, and Operating Margin are all strong compared to the market and its sector, and its current assets of £51m (£21.5m in cash!) easily cover its liabilities of £31.9m, so there are no bankruptcy or dillution risks.

TAP's has an impressive list of clients, impressive return on equity, and has proven itself a serious player in its shifts towards mobile, but the question remains - is there more upside potential after such staggering share price growth? Will TAP be a prime target in any industry consolidation? or will growth continue to slow in an industry being squeezed by the Duopoly of Facebook and Google?