Rising energy costs stifled global productivity but also drove innovation, creating long-term benefits.

I watched a fascinating talk online recently, given by Gervais Williams, the senior fund manager at Miton Group. He gave the presentation at a ShareTalk event in Cardiff last month to promote his new book on The Retreat of Globalisation. He particularly focussed on the flatlining global productivity.

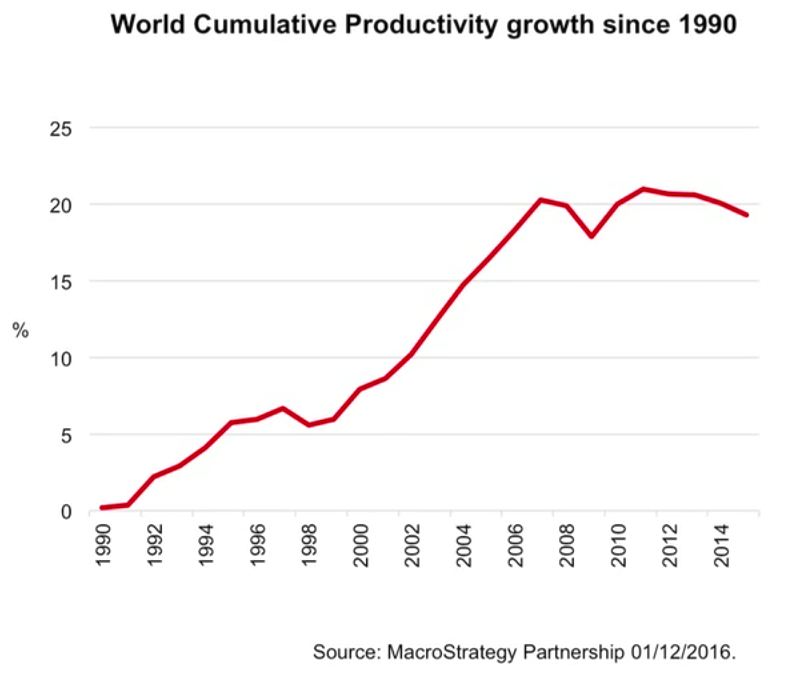

The chart that most stood out for me plotted global productivity over the last 25 years, see below. The interesting takeaway from this graph is that productivity across the globe has flatlined for the last decade.

In this blog, I look into what has caused this flatlining, and why I think we are actually at an inflexion point ahead of another surge in productivity.

Productivity is defined as the ratio of units of output over units of input. As we develop and efficiency improves, the level of output per unit of labour, capex and other costs should increase.

One of the biggest input costs into productivity is the cost of commodities, and a big driver of that is the oil price. Below is a chart showing how the CRB commodities index moved over the last 20 years. The index is a basket of commodities, split roughly 40% energy products, 40% agricultural products and the remainder in metals. It more than doubled from 2002 to around 2013, and this was heavily influenced by oil prices.

What caused oil prices to rise so much?

- Demand from emerging markets increased significantly with Chinese oil consumption nearly trebling from 4.5m bbl/day in 2000 to 12m bbl/day in 2015. Other developing nations like India and Brazil also increased demand materially.

- Supply restraints held back the growth needed to meet demand. Oil majors went through a period of reduced exploration success. Production from maturing basins such as the UK North Sea was not being replaced sufficiently. Geopolitical events disrupted global production, including the Iraq war and its after-effects from 2003, and the Iran nuclear program in 2006.

- Finally, producers had to move to more expensive unconventional oil fields such as the Canadian oil sands and US shale to meet demand. These often had breakeven field economics of $80-100/bbl.

Oil price is set by the marginal barrel, and the above factors drove that marginal barrel up from c.$25 in 2000 to $40 in 2003, and then to c.$110 in 2013.

Energy-related capex rose significantly

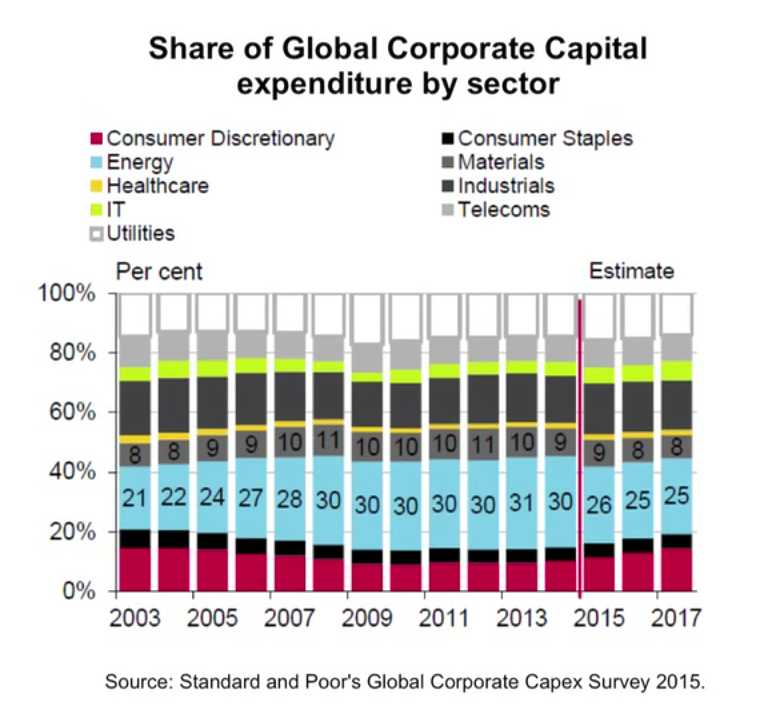

An interesting point from the below graph that I’ve pinched from Gervais’s presentation is that capex in the Energy industry increased from 21% of global capex in 2003 to 31% in 2013. That’s a massive increase which, as I describe further up, was driven by both surging demand from the likes of China and India, and the inability for conventional supply to meet demand. Producers had to exploit higher cost barrels.

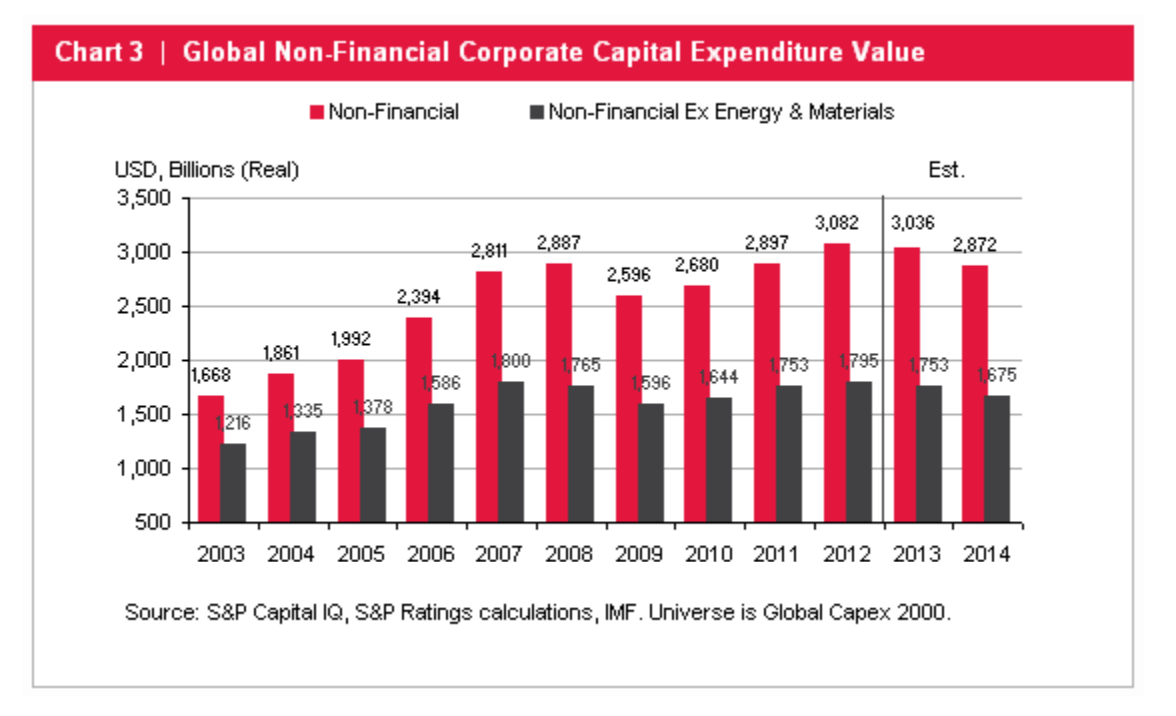

The trend in the growth of capex investment in Energy over the noughties is shown in absolute terms clearly in the below graph taken from the S&P Global Corporate Capital Expenditure Survey 2013.

Did this increase in input prices drive an increase in output value? Not at first...

The next obvious question is whether this increase in Energy-related costs has yielded increased value. The initial result was a transfer of wealth to producers such as the various Opec members, but more importantly, it also created the right environment and economic incentives for innovation in US shale production. This changed everything. US shale producers innovated to the point where they were able to produce economically and scale production remarkably.

Between 2008 and 2014, US crude oil production doubled from 5m bbl/day to an astonishing 10m bbl/day, briefly surpassing Saudi Arabian crude oil production.

Going back to simple demand-supply economics again shows precisely why oil prices dropped so heavily from late 2014:

- US shale production was rampant, Iraq production was increasing with additions from its Kurdistan region, and Iranian production was recovering as sanctions eased.

- Most importantly, Opec, led by the Saudis declared a war for market share on the new upstarts in the US. Saudi Arabia ramped up production to push the price of oil down and drive the higher cost US shale out of the market.

The problem with this is technological innovation continued as established shale producers fought to survive and the breakeven costs per barrel for shale continued to drop. Some shale basins can now produce profitably at $30-40 per barrel. In short, shale production isn’t going anywhere.

Why the flatlined productivity is temporary

Given the cost of Energy over the last decade has significantly increased, and accepting the fact that Energy is such a significant factor in the input costs used to calculate productivity, it is understandable that global productivity has flatlined. The increase in input costs did not yield an increase in output value.

However, the good news is this productivity number masks the actual progress made over the last 10 to 15 years, the fruits of which I believe we will see going forwards. The technological innovation in shale is an example of how economic incentives will drive progress. We now have a global oil production market that can scale up and down far more quickly than before, meaning there should be less price volatility and further innovation should mean the cost of energy will continue to fall.

Many industries have benefitted from the falling cost of energy, not least the chemicals industry where there has been a large increase in the number of chemical plants built in shale producing regions because of the rock-bottom price of natural gas (Henry Hub has fallen from c.$7/mcf in 2007 to $3/mcf today).

The high cost of energy has also driven incredible advancements in the efficiency of solar panels and electric vehicles. Elon Musk announced the launch of his first affordable electric car, the Model 3, and next year will complete the construction of the Gigafactory which will be the largest lithium-ion battery plant in the world, which will have greater output than the rest of the world’s battery plants combined. He may or may not win the battle for the electric car market but either way, the landscape for transport is about to change fundamentally. These advances in solar panel efficiency and electric vehicle technology may have occurred anyway, but the incentive of high oil prices has certainly played its part.

The sharing economy is another reason to be confident about productivity. The level of utilisation of assets is currently inefficient in the extreme. On a personal level, our car is often only driven a couple of times a week. Friends have second properties that are often uninhabited for months at a time. New companies like Uber and AirBnB are altering people’s perceptions of car ownership and property rental. The rising trend of the Sharing Economy is only just beginning, and the result on a macro level will be lower input costs as asset utilisation becomes more efficient.

For these reasons, I would argue that the current stagnant productivity levels are a temporary inflexion point, and we are on the cusp of the next great wave of innovation driven by the changes in transport, a move to decentralised power generation and enhanced utilisation of assets, not to mention AI and self-driving cars...