FTSE 100 company has written off £530m and sacked numerous execs

Companies: BT Group plc

Shares in BT plunged 19% in early trading on Tuesday after the company issued a profit warning and told investors it had written off £530m in its Italian business, considerably more than the £145m expected.

The British telecoms giant has been grappling with an emerging accounting scandal in its Italian operations since October, and the firm has now confirmed that "inappropriate behaviour" was greater than previously identified and its Italian business had overstated earnings for a "number" of years.

"The improper behaviour in our Italian business is an extremely serious matter, and we have taken immediate steps to strengthen the financial processes and controls in that business. We suspended a number of BT Italy's senior management team who have now left the business. We have also appointed a new Chief Executive of BT Italy who will take charge on 1 February 2017...

Further, we are conducting a broader review of financial processes, systems and controls across the Group..."

The review into its Italian operations found "complex" improper transactions had taken place relating to the practice of selling invoices to third parties. The £500m write-off will affect results for the next two years

Additionally, BT gave a bleak update on its outlook for general operations, saying there had been a deterioration in two of its key markets: International corporate and UK public sector. This, combined with the £500m write-off, means operating profit for the year will be £300m lower than previously anticipated (£7.6bn).

Gavin Patterson, Chief Executive BT Group plc, said:

"We are deeply disappointed with the improper practices which we have found in our Italian business. We have undertaken extensive investigations into that business and are committed to ensuring the highest standards across the whole of BT for the benefit of our customers, shareholders, employees and all other stakeholders."

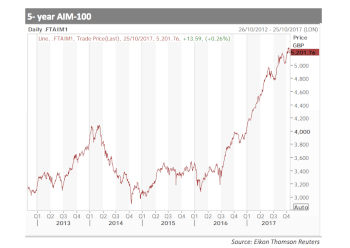

Shares in BT fell 19% as the market opened on Tuesday, wiping c.£7bn off the FTSE 100 giant's market cap.