With the polls closing, what is the City's view on the equities and GBP impact of differing outcomes

Companies: ANTO, AZN, BAB, BBY, BHP, CLLN, FRES, GSK, HLMA, HILS, KIE, RIO, SAB, SHRS, SN/, ULVR

We are only a day away from the election after what can only be described as a raucous campaign with some highly amusing gaffes, a pretty dreadful set of manifestos from both main parties, u-turns from the Tories, pandering to the youth vote by Labour, and a huge narrowing in the polls.

There has also been a brace of devastating terrorist attacks which has served to remind us all of the more important things in life.

Returning to the politics, the narrowing polls has opened up far more options than anyone considered when Theresa May was sailing 20% above Labour in the polls. It is worth thinking about what the markets could do under these scenarios.

How might markets react to a hung parliament?

Panmure Gordon's Chief Economist Simon French sees a hung parliament leading to a stronger pound as the chances of a hard Brexit fall:

"We also expect GBP strength in a hung parliament scenario where, despite the uncertainty, the odds on a softer Brexit and retention of single market membership will be enhanced."

A rising Sterling would surely lead to falling large-caps as the translation impact of dollar-denominated revenues kicks in, reversing the effect we saw post the Brexit vote last year.

Stocks exposed here would be big overseas earners like the Mining giants Fresnillo, Antofagasta, Rio Tinto, and BHP Billiton, Pharma stocks like GlaxoSmithKline, AstraZeneca, and Shire, as well as companies like SABMiller, Unilever, and Smith & Nephew.

On the other hand, The Economist today took the opposite position:

"If the Parliament is closely hung, leaving a second election likely, the pound will surely take a hit; equities too. Uncertainty would mean that overseas investors would be reluctant to commit cash to Britain. "

Here The Economist sees Sterling and equities falling. Admittedly there are competing forces and the currency and equity markets certainly don't always move in lock-step. For this to be the case, the uncertainty around Britain's future would have to significantly outweigh the translation benefits of a great many UK-listed companies that have material international revenues.

What about a stable or increased Tory majority?

The bookies are expecting the Tory majority to be around 70. This is broadly in line with Simon French's base case, where Panmure sees a 60 seat majority resulting in slight weakness in Sterling:

"We anticipate a 60-seat Conservative majority – leading to a slight weakness in Sterling over the near term and a small relief bounce in domestic equities, led by financials."

At the same time, Mr French thinks a larger majority could see a strengthening of GBP:

"We expect Sterling to rally should the Conservatives achieve a larger majority – permitting more wriggle room for the May government with her own party"

A Labour majority could boost equities...or not

The ramifications of a Labour victory on markets are probably the most complex. The increase in spending plans could be a boon for equities as they were in the US when Trump won the election.

Stocks that could benefit here include Carillion, Kier Group, Babcock International, Halma, Balfour Beatty, and Hill & Smith, amongst others.

However, the markets would likely price in a softer Brexit which could lead to a strengthening Sterling and a reversal of the recent bull run for UK equities, as dollar earnings translate into fewer pounds.

Longer term concerns about the direction of the economy, the size of the deficit, and the impairment of Britain's image as "Business friendly" could lead to capital flowing out of the economy, and a greater risk premium to UK Plc. This view is broadly shared by The Economist:

"...most would assume a softer Brexit if Labour wins... That might be good for sterling (which has tended to fall whenever a hard Brexit looks likely).

If, however, Labour was set to push through ... higher corporate taxes, a financial-transaction tax, nationalisation and taxes on executives, then the markets are likely to take alarm."

"The better Labour does (that is, the closer it gets to governing on its own), the more likely it is that sterling and equities will take a hit."

Is the youth vote narrowing?

One last stat, looking at the latest Survation poll, their team have seen a big narrowing in the preference for Labour over Conservative week-on-week.

Last week Survation's poll found Under 25's polled at 60% Labour, 27% Tory. This week it has narrowed to 51% Labour, 39% Tory. That is a huge shift. It may be dodgy sampling and not representative, but it is an interesting data point this close to voting day.

The FT poll of polls above shows how close things are as we head to the ballot box tomorrow.

How has the market reacted to Brexit Vote and previous elections?

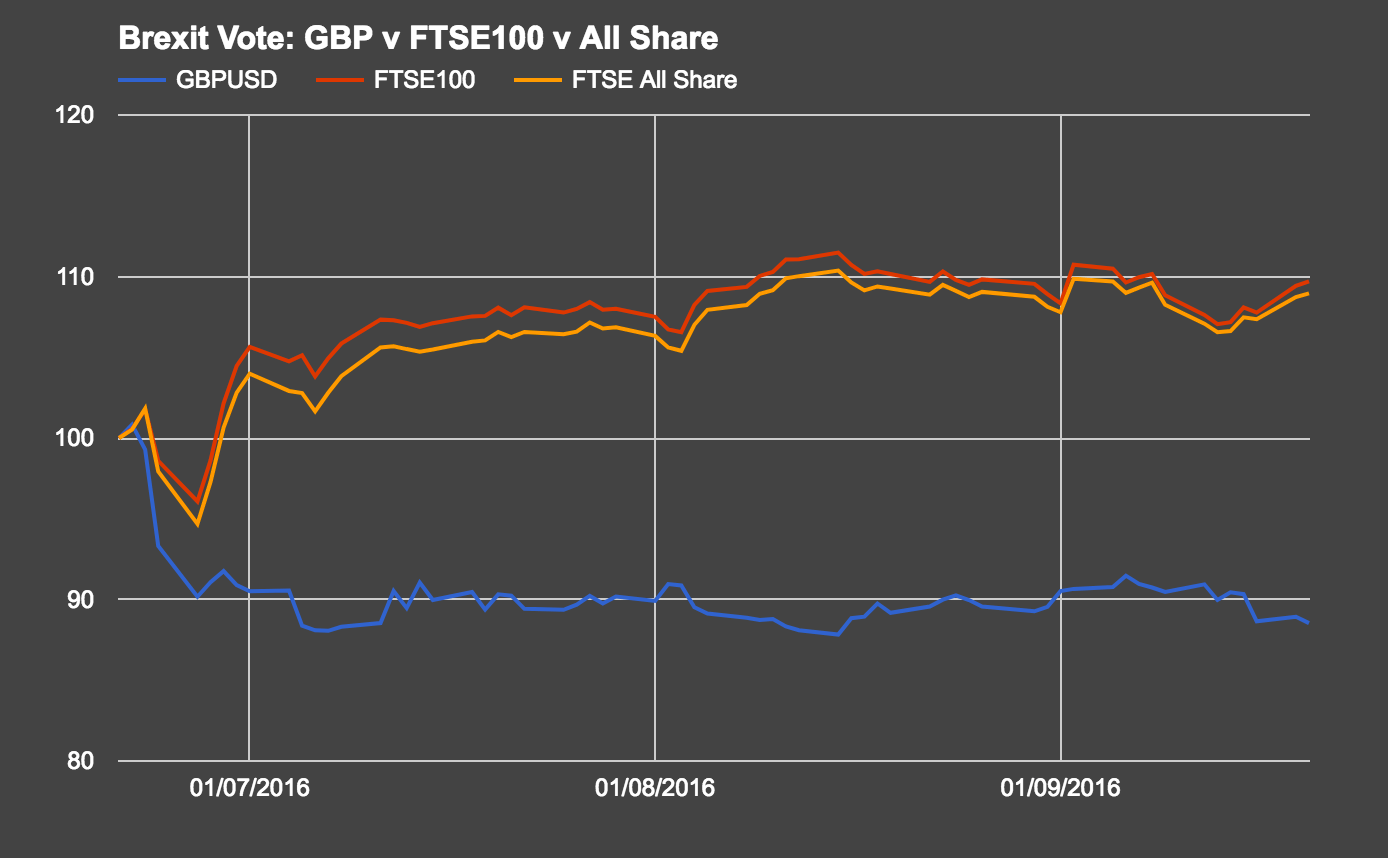

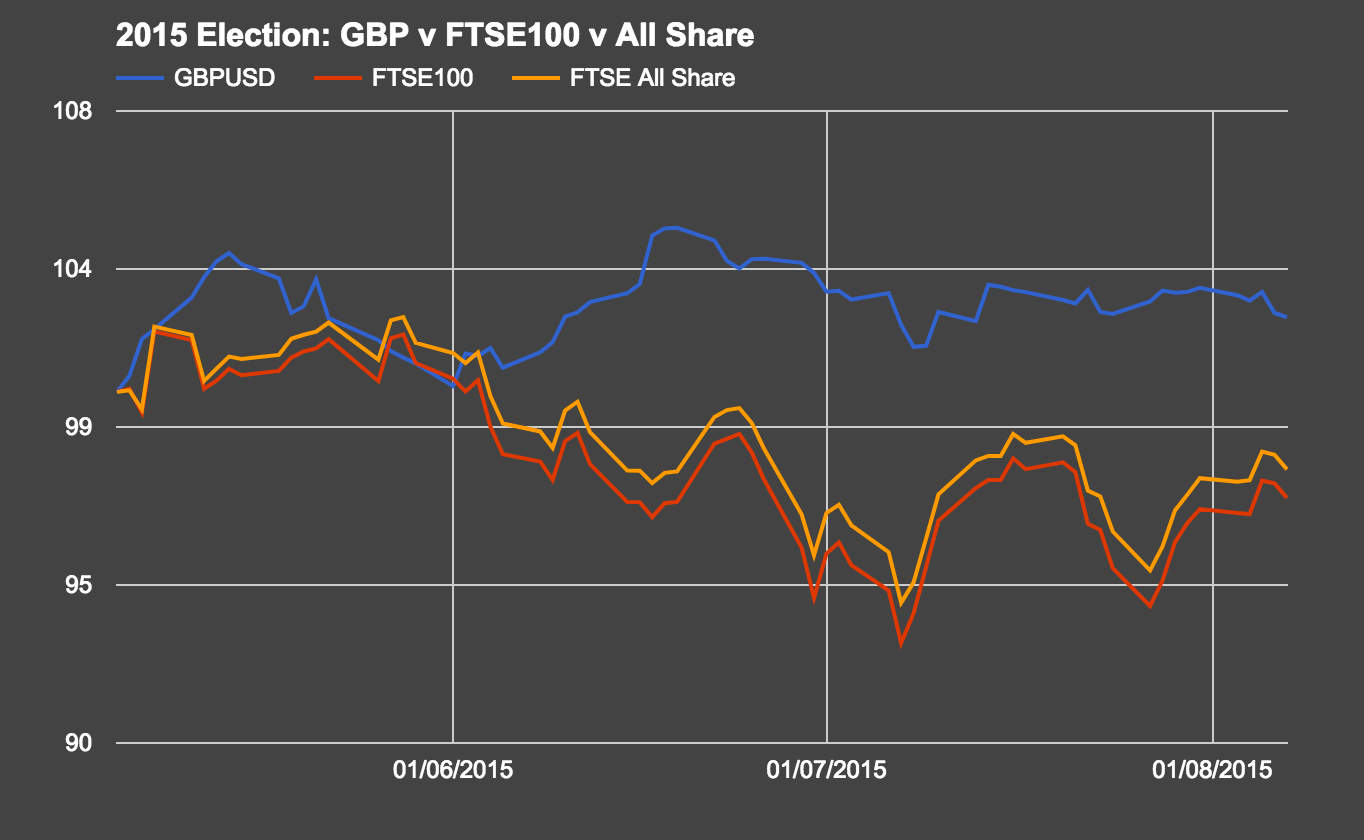

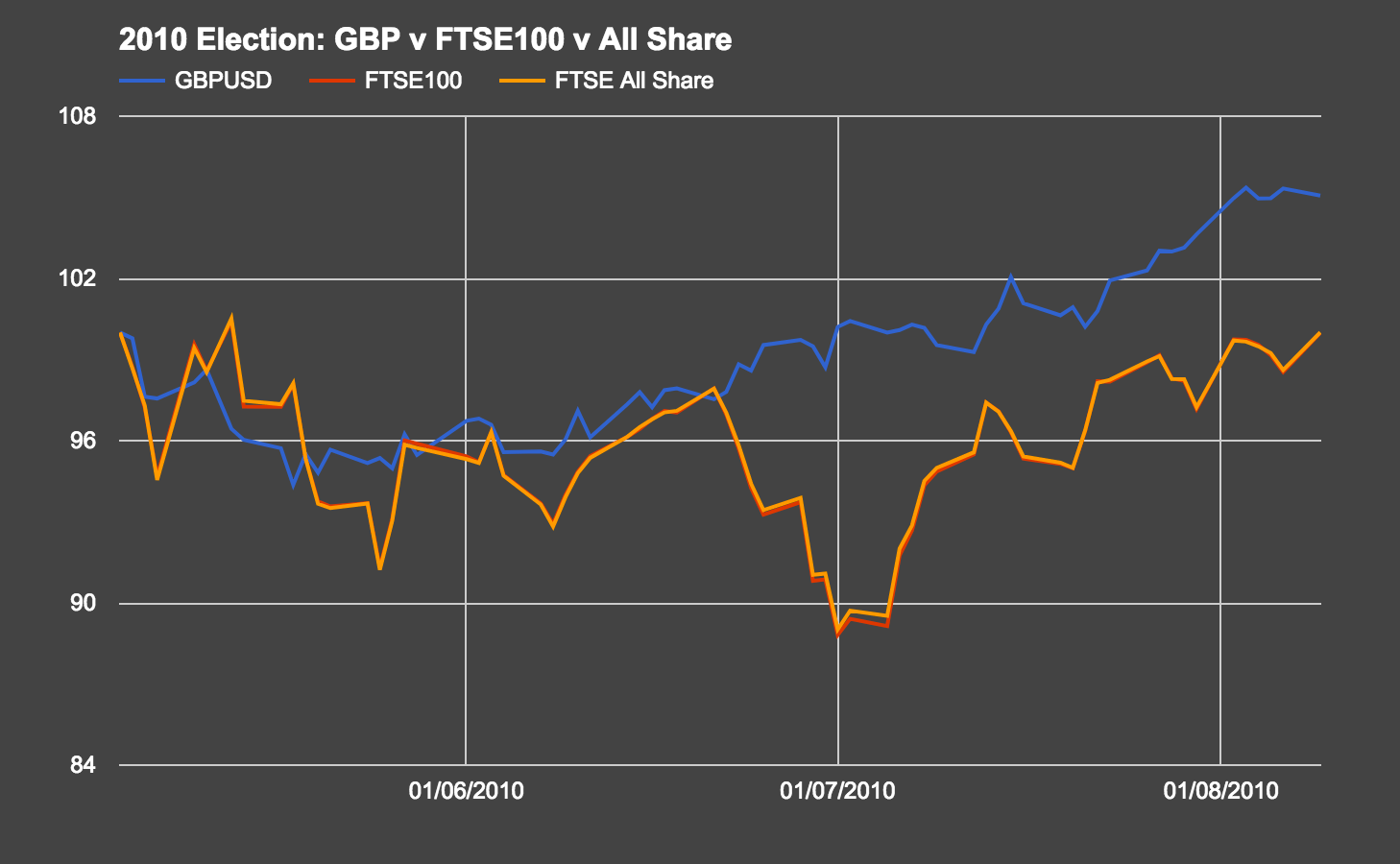

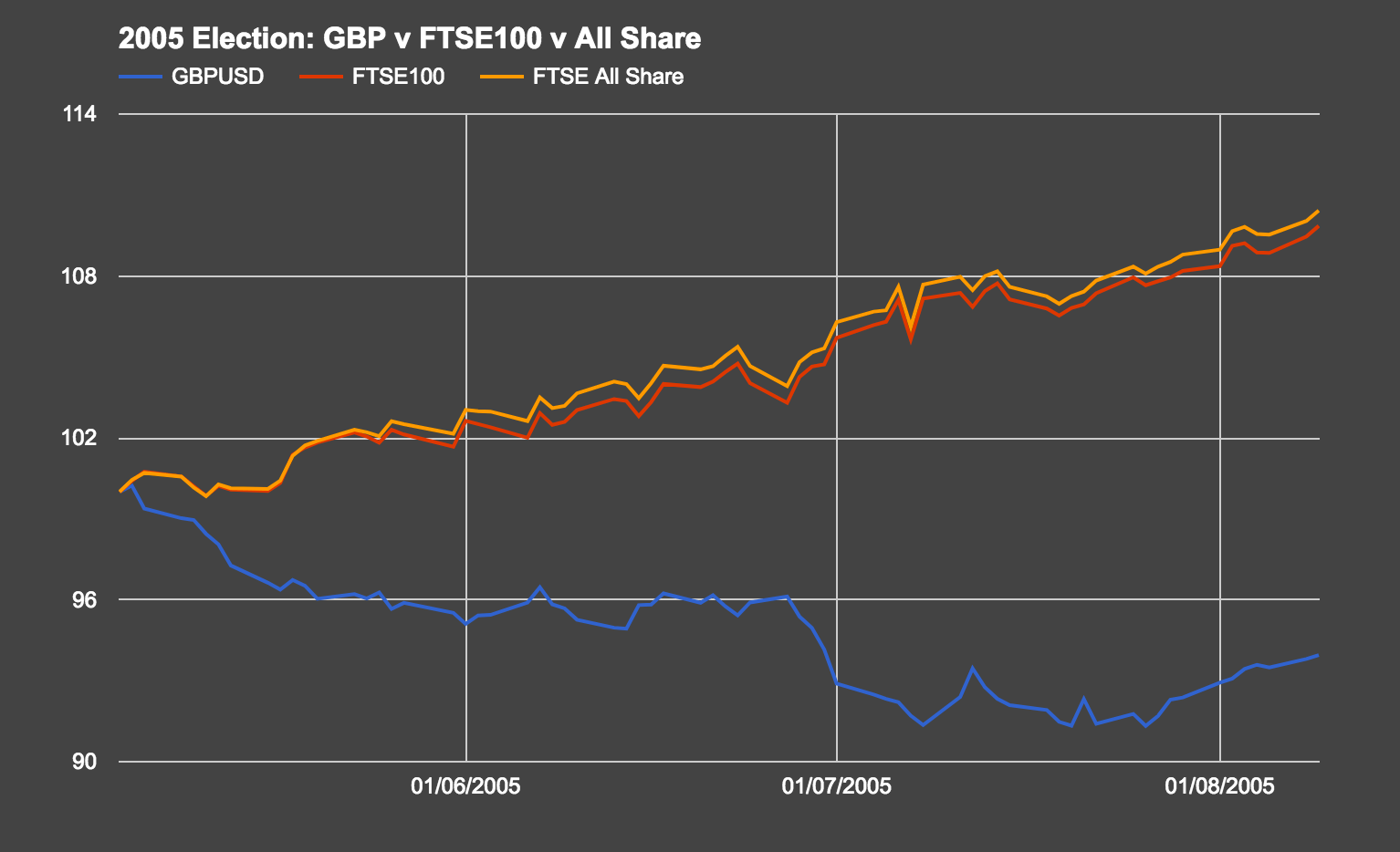

Below I've shown the market reaction of Sterling (USD/GBP), large cap UK equities (FTSE 100) and all UK equities (FTSE All Share) for the 3 months following the Brexit Vote and the 2005/10/15 UK General Elections. The data is indexed to 100 from just before each event took place.

Brexit

Following Brexit, Sterling weakened significantly and UK equities rallied in equal measure, following an initial dip.

2015

The 2015 Election brought little in the way of movement in Sterling and UK Equities trended down a few percent over the following three months.

2010

The 2010 Election brought the Conservatives to power, and after a month of both Sterling and Equities moving sideways, both began an upward trend. This may be a consequence of uncertainty initially, followed by stability through the Coalition Government. Markets (especially Gilts) welcomed the austere tone George Osborne brought after the deficit had grown out of hand.

2005

The halcyon days of the 2005 Election saw Tony Blair and Gordon Brown return to power, with Gordon Brown's unwise words of "Gone are the days of boom and bust" only two years away from coming back to haunt him. Here the returned Labour government saw a weakening pound and an equally offsetting equities market.

_m.png)

.png)