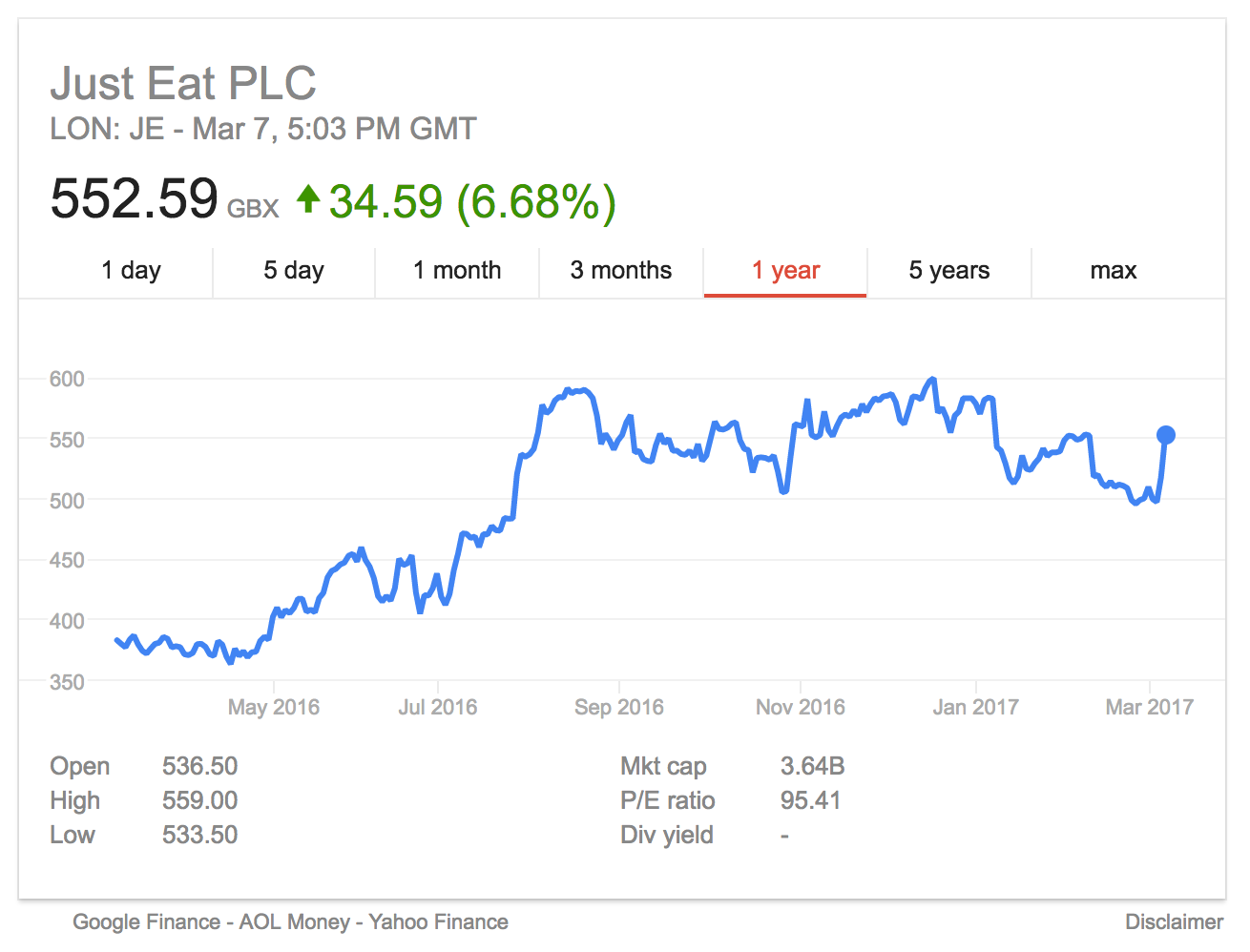

Just Eat expecting further strong growth this year. It is trading on a 2017 forward PE ratio of 33x.

Companies: Just Eat Plc

Just Eat, the dominant online food delivery platform, published another stellar set of Results this morning. It has faced scepticism over the last six months as to it's premium valuation status with shares 15% off their August highs before the market opened this morning. However, the numbers released in today's FY Results are impressive across the board.

Some of the key points in today's announcement:

- Revenues up 52% y-o-y from £248m to £376m, and like-for-like revenues up 46%.

- Underlying EBITDA nearly doubled to £116m with margins increasing 7%!

- PBT went from £35m in 2015 to £91m in 2016.

These are highly impressive figures, supported by encouraging business KPIs... JE processed £2.5bn of orders over the year, up from £1.7bn in 2015. The UK market size is expanding at 8% per annum and Management sees the total market size across all its regions at £23bn today. That puts Just Eat at roughly 10% market share for delivered food.

There has been better than expected success with Just Eat's Orderpad tablet app. Management had targeted 1/3rd of UK orders to be processed through this system by March 2017, but over 2016 the number was over 50%. Success with this app makes restaurants far stickier and less likely to jump to a competitor.

The business is a great example of a solid negative working capital model with cash receipts upfront but partner restaurants being paid fortnightly. This allows Just Eat to organically fund growth.

The recent proposed acquisition of Hungryhouse at what looks like a premium valuation from Delivery Hero shows Just Eat's willingness to take out any serious competition in its markets, even if they are far smaller. The one caveat here is that it is currently sitting with the Competitions Authority.

It seems like the Western World is being carved up between Just Eat, Delivery Hero and Grubhub. In my view, it is unlikely each will be challenged in their strongholds (Just Eat in UK, Delivery Hero in Germany, Grubhub in the US) but each of these markets is growing healthily on an organic basis as consumers continue to switch from telephone to online ordering.

Strong growth guidance - Management has set another target of strong growth over 2017 with expected revenue growth of c.30% to £480-495m and EBITDA growth of 40% to £157-163m.

CEO Paul Buttress, who will be stepping down soon, strikes a confident tone:

"We continue to see strong growth in the UK, adding materially more revenues in absolute terms than the year before. Our international businesses also go from strength to strength; having become profitable in aggregate during the year, they continue to grow rapidly and now represent over one-third of Group revenues."

"Our markets remain relatively under-penetrated, meaning there is considerable runway to generate sustainably profitable growth across the business"

Looking at valuation, unsurprisingly the company trades on a premium rating. Based on 2016 earnings of 12p that were reported this morning Just Eat trades on a 44x PE multiple. Consensus revenues forecasts are consistent with the new guidance for 2017 and the consensus earnings, which should therefore also be consistent, for 2017 is 16.3p. That puts JE. on a forward earnings multiple of 33x.

Shares are up c.7% today as the market welcomed the strong performance and growth prospects.