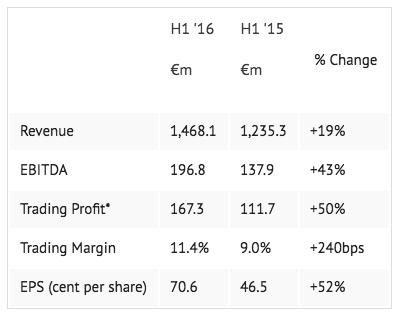

KGP revenue up 19% to €1.47bn, EBITDA up 43%, and profit up 50%

Companies: Kingspan Group Plc

Kingspan Group (LSE: KGP), released record Half-Year Results this morning. The company said that it had continued to deliver increased market penetration worldwide, and was benefitting from acquisitions in the past few years, all of which have bedded in well.

The building materials company recorded its strongest six-month performance ever with revenue up 19% to €1.47bn (€1.24bn H115), profit up 50% to €167.3m, (€111.7m H115), EBITDA up 43% to €196.8m (€137.9m), EPS up 52% to 70.6c (46.5c H115), and posting an interim dividend of 10c per share, an increase of 25% YoY.

According to the announcement, the company saw significant advances in Western Europe and North America in particular, with consistent growth across divisions. Sales in Insulated Panels were up 26% globally, and sales in Insulated Board were up 9%. During the period, the company invested €138m, €55m in capex and €83m in acquisitions.

During the period, the company acquired water tank specialist Tankworks, daylighting business Essman, whilst its subsidiary Joris Ide acquired Euroclad. The combined cost of the acquisitions was €209m, of which €83m was incurred before the period end with €126m payable during H216.

Gene Murtagh, Chief Executive of Kingspan commented:

"These results reflect our strongest ever six month performance, underpinned by solid organic growth and a robust contribution from the Joris Ide and Vicwest businesses acquired last year. The expansion in profit margin has helped deliver a 50% increase in trading profit, and with good order intake momentum in the second quarter continuing into the current trading period, we expect a solid performance in the second half. We continue to acquire complementary businesses, with a total of €83m invested in two businesses in the first half and €126m paid for two further businesses after the period end."