FTSE100 firm to save £300m by the end of 2019, having already saved £650m in past four years

Companies: Pearson PLC

Pearson shares jumped 15% on Friday morning after the FTSE 100 publisher announced that it was looking for ways to save a further £300m by the end of 2019 through restructuring measures. It also announced a modest increase in sales and a mixed picture across its divisions.

The firm said it had begun a "strategic review" of its US publishing arm, citing under competitive pressure and its struggle to keep up with its school business, which is more digitally-focused. The Financial Times reported that the review of the US business had taken analysts by surprise, as it accounts for around 8% of overall sales.

Underlying sales in the first quarter rose 6%, led by growth in higher education courseware and certification in the US, school textbooks in South Africa, and student assessments in the UK. This offset declines in student assessment in the US and Learning Studio - its higher ed learning management system. It also endured declines in the Middle East and India.

READ: Why Pearson was an obvious value trap

Today's news was welcomed by investors ahead of its AGM, but the past few years have been difficult for the London-based firm. It has had several profit warnings and only narrowly achieved its 2016 forecasts after its last restructuring programme, which delivered significant cost savings.

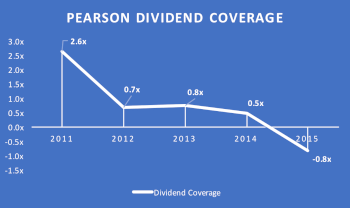

The firm's dividend growth has declined over the previous five years, falling from a 9% increase in 2011 to a 2% increase in 2015. Meanwhile, Return-on-Equity fell from a healthy 15% in 2011 to low single digits and then negative in 2015 as the firm reported a loss.

Its Net Debt remained unchanged YoY at £1.1bn, which the company said reflected strong working capital management and favourable exchange rate movements. This offset a payment for its pension fund liability related to the creation of PRH in 2013.

CEO John Fallon said the company would be leaner and equipped to innovate and win in digital education:

"Though the bulk of our sales come later in the year, our first quarter trading is encouraging and in line with expectations... The measures we are announcing today build on the work completed last year and will allow us to further simplify our portfolio, reduce costs and accelerate our digital transformation."