TRI saw 20% PBT growth and raised dividends by 25%

Companies: Trifast plc

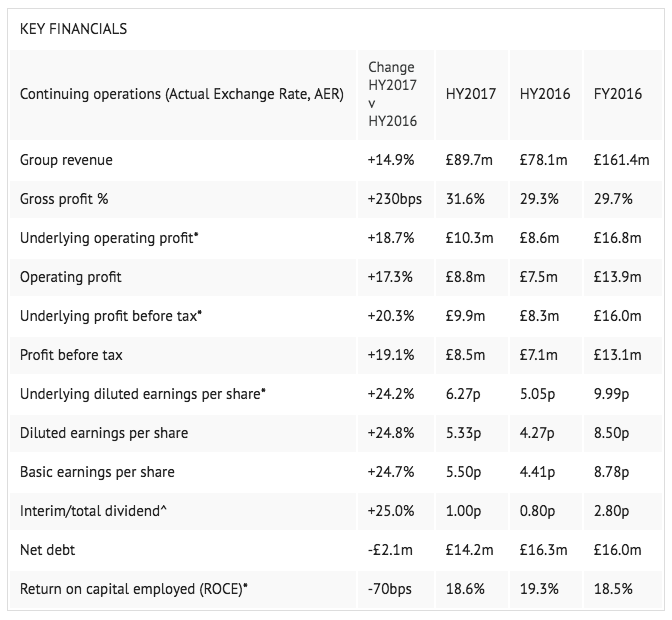

UK engineering firm Trifast Plc (LSE: TRI) has released another record breaking set of figures for the 6 months to 30 September, showing strong underlying trading growth and underlying PBT for the period, up 8% (constant currency) and 20.3% total vs the previous period.

The group's total revenue grew 8% (constant currency) and 14.9% in total, with management attributing the results to its growth strategy that continued to deliver revenue from multinational OEMs (Original Equipment Manufacturers).

Favourable exchange rates helped the group land an additional £1m in underlying PBT, and can be seen in a doubling of the underlying EPS (+24.2%). Due to the increased figures, TRI also raised its interim dividend by 25%, delivering 1p per share back to shareholders.

However, management has confirmed that the business is starting to see some purchase price challenges in the UK business from an ongoing weakness of Sterling vs major currencies:

"...we expect these pressures to increase over time if that weakness persists. However, as an international business with over 70% of our revenue being generated outside of the UK, the Board remains confident we have the flexibility and foresight to meet these challenges head on as and when they arise."

Brokers finnCap, N+1 Singers and Arden Partners put out research reports on the update, with finnCap saying interims had been better than expected, and as a result that it was upgrading EPS forecasts by 3% FY17 and 4.4% FY18:

"Adjusted PBT growth of 20.3% has been driven by a mix of improved gross margins, ongoing operational efficiency gains, the Kuhlmann acquisition and currency benefits.

Our forecast upgrades have further upside potential from acquisitions, which remain a focus of management. The forecast upgrade justifies an increase in our price target from 165p to 176p and we remain Buyers."

N+1 Singer welcomed the announcement, saying had reported another strong performance in H117. N+1 Singers has raised its PBT forecasts by 5% for the full-year 2017, and 7% for the full-year 2018, raising its target price from 170p to 190p:

"The group’s focus on growing its share of business with multinational OEMs helped drive good organic sales growth of 4.5%, ahead of most industrial peers. This was boosted to c.15% sales growth by a six-month contribution from last year’s acquisition and an FX tailwind, which also delivered a 30bp increase in adjusted operating margin to 11.4%."

Arden Partners said it was also raising FY17 earnings forecasts by 5% and maintained its buy stance:

"The group benefits from a broad spread of geographies; over 70%% of FY17 revenues will be generated outside the UK with Continental Europe trading particularly well.

Additionally, the pound depreciation will be positive for exports from UK automotive OEMs, the largest sector exposure domestically. FY17 forecast earnings growth of 16% justifies a mid/upper teens rating..."

Malcolm Diamond, Exec Chairman of Trifast said the period had put the business firmly back on track with expectations, confirming that the board expected it to be another record breaking financial year:

"There are, of course, some macroeconomic factors we cannot fully mitigate, including the ongoing volatility in the foreign currency and raw materials markets, as well as the wider potential implications of Brexit on our business and the UK economy."

The group's share price rose a modest 4% in early trading.