WINE reinstates dividend and points to new low capex strategy bearing fruit

Companies: Naked Wines plc

After September's profit warning today's Half Year Results contain some more encouragement.

Before I dive into the detail I feel it's important to highlight what a good job Majestic and its CEO Rowan Gormley have done putting together an engaging and very transparent set of Results. These announcements are often incredibly dry and hide behind ambiguities and corporate speak. However, this was genuinely an interesting read that left the reader with a clear picture of what Management are working towards, where they've slipped up and how they are measuring progress.

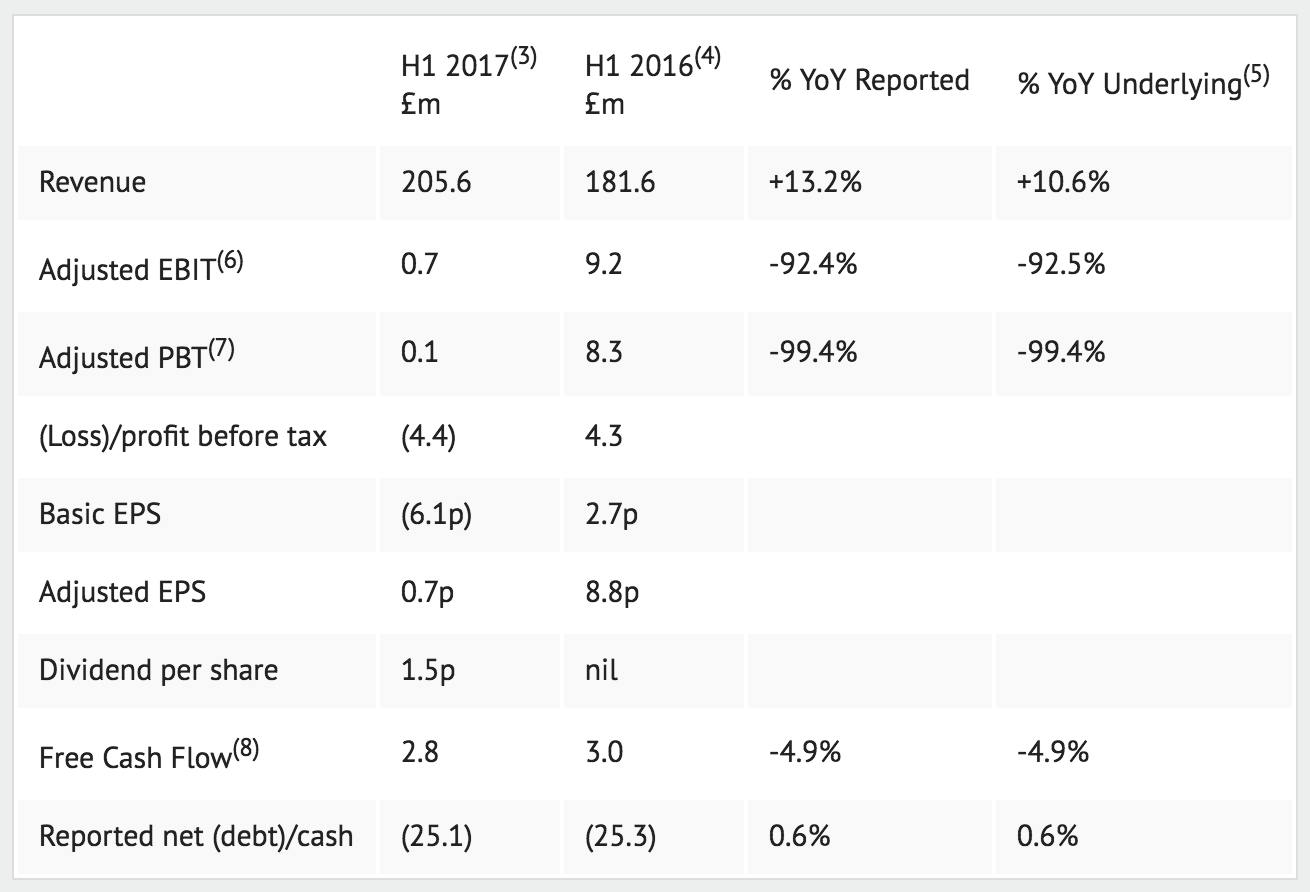

Underlying Revenue rose 10.6% year-on-year, but Basic EPS fell from +2.7p to a loss of (6.1p). That's quite a deviation between top-line and bottom line.

Why the swing to loss is not a concern

The "Why" is helpfully outlined by Mr Gormley. Previous investments were directed towards new branch openings which is CapEx and is hence lobbed on the Balance Sheet.

The new strategy is to increase customer growth and retention with the branches and online real estate it has. This means the cash that was used for fitting out new branches is now being spent on marketing and other customer retention initiatives such as increased staffing which is expensed in the income statement.

Look at free cash flow to confirm this. FCF is only slightly down year-on-year. A sign of confidence from Management is the reinstatement of a 1.5p dividend.

Are the new investment channels working?

It's too early to say today but the KPI's set out by Management are moving in the right direction and seem eminently sensible from our perspective. Customer retention in the main Retail division and the Naked Wines online offering edged up 2.6% and 1.9% respectively. Also, the increased staffing appears to be improving service levels with the number of 5-star reviews marginally up in Retail and 6% up in Naked.

There were disappoint elements, though. Commercial has been disappointing with the Group highlighting:

"Majestic Commercial performance is well short of expectations"

Also, the much flagged direct mail campaign that drove September's profit warning was another source of disappointment:

"...early test results were successful so we decided to ramp up ... Sadly, the roll out did not get anything like the results we saw in the testing ... Could we/should we have tested more cautiously? Unfortunately yes"

The refreshing message here was the honest assessment that pre-campaign testing wasn't sufficient and therefore was misleading. The important point made here was that Majestic has learnt from the mistake making it unlikely it will be repeated.

When deploying a multi-channel marketing campaign there will always be disappointing channels and companies need to test them to know whether there is sufficient ROI to put in more capital. It sounds like Majestic should have adopted a more phased approach but probably not make that mistake again.

Brokers welcome progress but some caution remains

Liberum put out an upbeat report this morning detailing its updated view of the company and highlighting how the "Interims show strategic progress".

Panmure strike a more neutral tone in its report:

"The reinstatement of the interim divi at 1.5p, cash conversion of adj profits ... and good progress in the five KPIs (most notably customer retention) are supportive..."

However:

"...the restoration of the legacy Majestic retail business (still c.90% of the enlarged group’s trading EBIT) to sustained growth, vitality and competitiveness will be highly protracted... Meanwhile, we think that Naked Wines has yet to prove its ability to grow both sales and profits on a sustainable basis".

Shares are up 5% today as investors are encouraged by the operational progress being made. Looking at valuation, EPS forecasts appear to be c.13p for 2017 and c.18p for 2018 as Brokers expect earnings to recover. This puts the current PE ratio at c.24x for 2017 earnings and c. 17x 2018.