The results for the year to July '17 sent shares up 10%.

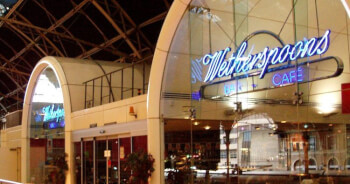

Companies: J D Wetherspoon plc

J D Wetherspoon (LON: JDW) has announced its preliminary results for the year to 30 July 2017 which highlight the strong year acchieved by the Group, boosted by "very strong" sales over the summer holiday period.

Highlights for the year include a revenue increase of 4% to £1.7m and PBT increase of 15% to £76m, after exceptional items. Operating profit also increased 17% to £129m.

Shares in Wetherspoon's jumped 10% with the results.

Executive Chairman Tim Martin, whose holdings in JDW over the last 11 years has increased from 21% to 32% as a results of the company's share buybacks, said a dividend of 12p per share will be issued.

This is the same as FY 16's 12p per share dividend, with the Group holding back on increasing it...

"In view of the high level of capital expenditure and the potential for advantageous investments, the board has decided to maintain the dividend at its current level for the time being."

SInce the year-end, like-for-like sales have increased 6%, and while "this is a positive start" Martin said, although "it is very unlikely to continue for the rest of the year."

The Group's Chairman went on to say:

"Like-for-like sales of around 3-4% will be required in order to match last year's profit before tax."

Martin also went into a lengthy sermon about how Brexit will not impact Wetherspoon's, but more likely its EU suppliers, and how the Group is "extremely confident" it can switch to other suppliers if need be.

JDW currently trades at a PE ratio of 17x versus the industry median of 14x, with a market cap of £1.1bn.